Acetylene Black Market Size, Share & COVID-19 Impact Analysis, By Type (Powder Form and Granular Form), By Application (Adhesives/Sealants/Coatings, Batteries, Rubber, Greases, Cosmetics & Personal Care, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

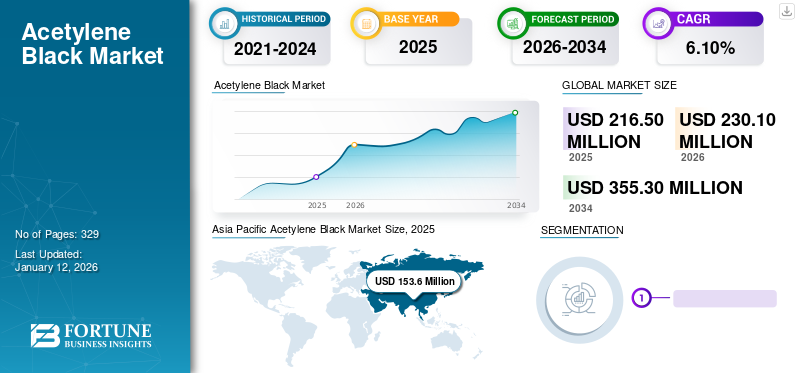

The global acetylene black market size was valued at USD 216.5 million in 2025 and is expected to grow from USD 230.1 million in 2026 to USD 355.3 million by 2034, exhibiting a CAGR of 6.10% during the forecast period. Asia Pacific dominated the acetylene black market with a market share of 71.00% in 2025. Moreover, the acetylene black market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 42.39 million by 2032, driven by growing demand in battery manufacturing, expansion in electronics and automotive sectors, and sustainability trends.

Acetylene black is a type of carbon black that is produced by the decomposition of acetylene gas at high temperatures. It is produced as a fine powder that is black in color and has a high surface area and high electrical conductivity. The superior properties, such as high surface area, high electrical conductivity, and good thermal stability, make it a valuable material in many different industries, particularly in the field of energy storage. Increasing adoption of acetylene black in lithium-ion batteries and the growing automotive industry boost the market growth.

Global Acetylene Black Market Overview

Market Size and Forecast:

- 2025 Market Size: USD 216.5 million

- 2026 Market Size: USD 230.1 million

- 2034 Projected Market Size: USD 355.3 million

- CAGR (2026–2034): 6.10%

Market Share:

- Asia Pacific Market Share (2025): 71.00%

Regional Highlights:

- Asia Pacific: 2025 Market Size: USD 153.6 million

- United States (U.S.): 2032 Market Projection: USD 42.39 million

- Europe: Driven by sustainability regulations and high-performance product demand.

- Americas (Excl. U.S.): Demand driven by battery tech in the U.S. and rubber industries in Latin America.

- Middle East & Africa: Rising demand for energy storage systems due to solar and wind energy adoption.

COVID-19 IMPACT

Supply Chain Disruptions Due to Spread of COVID-19 Resulted in Reduced Demand from End-use Industries

The COVID-19 pandemic had a substantial effect on the market. The pandemic and ensuing lockdown measures put in place by governments all over the world caused decreased demand for rubber goods, disruptions in the global supply chain, and temporary shutdowns of industrial facilities. The product demand from end-use industries was reduced due to supply chain disruptions.

Automotive and rubber manufacturing production declined during COVID-19. Although automotive sales declined during the pandemic, Electric Vehicle (EV) manufacturers witnessed a rise in consumer demand. According to the International Energy Agency (IEA), global electric car sales in 2020 were estimated to be 3.1 million compared to 2.2 million in 2019. Hence, the demand from EV manufacturers was noteworthy. As soon as the EV demand increased, the market witnessed a rising demand.

LATEST TRENDS

Download Free sample to learn more about this report.

Increasing High-performance Rubber Goods to Increase Product Consumption

The need to improve high-performance products' durability, strength, and wear resistance has increased the demand for acetylene black in the rubber industry. In the rubber sector, it is frequently employed as a reinforcing agent. It is used in the production of high-performance rubber goods such as conveyor belts, tires, and industrial hoses due to its superior dispersibility and large surface area.

In rubber formulations, acetylene black frequently takes the place of more conventional carbon black types as channel black and furnace black. The higher purity, better dispersibility, and larger surface area of the product make it ideal over other forms of carbon black. In addition, it is chosen over other types of carbon black for applications such as manufacturing high-performance tires, where its superior rubber reinforcing capabilities can aid in enhancing handling, grip, and performance.

DRIVING FACTORS

Increasing Battery Production to Bolster the Product Demand

The increasing adoption of EVs has increased the acetylene carbon demand as it is used in producing lithium-ion batteries. Acetylene black plays a vital role in lithium-ion battery production as it is used as a conductive additive in the anode material to improve conductivity. Several factors have increased the EV demand, such as government policies to incentivize EV ownership, increasing variety of EV models, and the development of charging infrastructure, which has further driven the demand in the automotive industry.

The increasing battery technology has paved the path for acetylene black as it increases the battery's conductivity. This carbon black type has a high degree of graphitization and surface area, which improves the electrical conductivity, further increasing the energy density and enhancing the performance of lithium-ion batteries. The moving trend toward eco-friendly and sustainable transportation solutions such as EVs is anticipated to bolster the demand during the projected period.

Several other batteries, such as lead-acid, alkaline, and zinc-carbon, utilize acetylene black as a conductive additive. Lead-acid batteries are used to store energy generated from solar and wind energy. As the renewable energy trend proceeds, the demand for lead-acid batteries in renewable energy systems will increase and significantly fuel the market growth. Batteries such as zinc-carbon are extensively used for low-drain applications such as toys, remote control devices, flashlights, clocks, and radios. This type of battery is inexpensive and widely available, making production easier and less expensive. Owing to the above-mentioned factors, the increasing battery production is expected to bolster the acetylene carbon black demand.

RESTRAINING FACTORS

Availability of Substitute Products and Fluctuating Raw Material Availability to Dampen the Market Growth

The demand for acetylene black has been hindered due to the availability of substitutes, such as silica, carbon black, graphite, conductive polymers, and metal oxides, as they are used as reinforcing agents, conductive fillers, and colorants in various end-use industries. Emerging material classes, such as conductive polymer, potentially threaten the acetylene black market growth.

Conductive polymer has certain properties that may reduce the product demand. In some applications, conductive polymers are being utilized as a substitute for battery applications. The conductive polymer can be processed more easily than acetylene black to create transparent and flexible coatings, which makes conductive polymers a significant option for OLED displays or flexible electronics. However, acetylene black has several unique properties that have garnered attention due to increasing EV adoption. As conductive polymers are an emerging material class, several properties of conductive polymers are unclassified.

In addition, fluctuating raw material availability and cost are impeding the market growth. The production of the product requires the availability of acetylene gas, which is derived from fossil fuels. Depleting fossil fuel resources has prompted soaring prices and dampened the product’s production cost. However, increasing environmental regulations may hamper industry growth.

SEGMENTATION

By Type Analysis

Powder Form Segment to Hold a Larger Share Due to its Extensive Applications

Based on type, the market is segmented into powder form and granular form. The powder form segment accounted for the largest share of 83.14% in the year 2026. Powdered form is mostly used as a conductive additive in batteries and electronic components and a reinforcing agent in rubber manufacturing. The rise of electric vehicles, renewable energy, and other technologies that require high electrical conductivity are boosting the demand for powdered form. Powdered form can be easily mixed into the material being processed, allowing for consistent dispersion and reinforcing the products. Due to the growing demand from end-use industries, the powder form is expected to be the fastest-growing segment.

Granular form is used in applications where handling and flowability are important parameters, such as in the production of dry cell batteries. Granular form has a small volume and convenient transportation advantages compared to the powder form. The dust pollution is small, which is beneficial to improve the product usage in environmental conditions. The granular form can be metered more accurately in the battery electrode mix and possess certain advantages over the powdered form for specific applications.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Batteries Segment to be the Dominating Application Due to Increasing Adoption of Electric Vehicles

In terms of application, the market is segmented into adhesives/sealants/coatings, batteries, rubber, greases, cosmetics & personal care, and others. The batteries segment accounted for the largest acetylene black market share of 74.19% in 2026. The product consumption is increasing in battery production due to the growing demand for lithium-ion batteries, which are widely used in EVs, energy storage systems, and consumer electronics. The batteries segment is anticipated to be the fastest-growing segment as the trend for advanced and efficient battery technologies continues to grow.

Followed by the batteries segment, the rubber segment is expected to grow at a high growth rate due to increasing demand for high-performance products that utilize acetylene black as a reinforcing agent. In addition, it is utilized as a reinforcing filler in adhesive, sealant, and coating industries. As the demand for high-performance materials with improved properties increases, the product consumption is projected to grow significantly during the forecast period.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Acetylene Black Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 153.6 million in 2025. A large manufacturing base for lithium-ion battery production in Japan, South Korea, and China is bolstering the product demand in the region. China is the biggest market for lithium-ion batteries as well as for acetylene black. The regional demand for EVs and energy storage systems has caused high market growth. The demand is expected to increase as the region’s focus on innovation and technology for high-performance batteries and advanced materials has increased. In addition, the region is also the largest consumer and producer of natural rubber. The growing automotive industry is expected to increase the product demand in Asia Pacific. The Japan market is projected to reach USD 31.7 million by 2026, the China market is projected to reach USD 107.8 million by 2026, and the India market is projected to reach USD 1.8 million by 2026.

North America

In the Americas, the product demand varies according to sub-regions. In countries such as the U.S. and Canada, the demand is primarily driven by the growth of lithium-ion batteries. In contrast, the rubber manufacturing industry is driving the demand in countries such as Mexico, Brazil, and the rest of Latin America. Additionally, increasing focus on sustainability and environmental regulation drives the eco-friendly and efficient material demand, further surging the product demand. The U.S. market is projected to reach USD 32.5 million by 2026.

Europe

In Europe, the demand for high-performance products and the rising focus on sustainability and environmental regulation drive the market. The region is home to one of the leading automakers such as Germany. The shifting trend toward adopting electric vehicles is further expected to increase the product demand. The increasing environmental regulations drive efficient product demand in France, Italy, and the U.K. The UK market is projected to reach USD 3.5 million by 2026, while the Germany market is projected to reach USD 7.5 million by 2026.

Middle East & Africa

In the Middle East & Africa, the demand is driven by the energy storage solutions and rubber manufacturing industries. In the Middle East, energy storage system solutions demand has increased significantly due to adoption of renewable energy such as wind and solar power.

KEY INDUSTRY PLAYERS

Business Expansion is Strategic Initiative Implemented by Companies

Denka Company Limited, Orion Engineered Carbons, Hexing Chemical Industry, and Jinhua Chemical are some of the key producers operating in the market. Most players are involved in product innovation, capacity improvement, acquisition, and collaborations in the market to meet demand from battery manufacturers and increase the footprint in the global market. The players are also involved in sustainability activities to promote renewable energy and reduce carbon footprint. Whereas some key players focus on incorporating novel technologies to improve efficiency and enhance performance.

For instance, acetylene black offered by Tianjin Yiborui Chemical Co., Ltd. improves the battery's service life and discharge performance as it has a high structure, eliminates harmful side reactions caused by impurities, and reduces the internal resistance of the battery.

LIST OF KEY COMPANIES PROFILED:

- Sun Petrochemicals (India)

- UBIQ TECHNOLOGY CO., LTD. (China)

- Orion Engineered Carbons (Luxembourg)

- Tianjin Yiborui Chemical Co., Ltd. (China)

- Denka Company Limited (Japan)

- Ningxia Jinhua Chemical Co., Ltd. (China)

- Xiahuayuan Xuguang Chemical Co., Ltd (China)

- Hexing Chemical Industry (China)

KEY INDUSTRY DEVELOPMENTS:

- March 2022 - Orion Engineered Carbons announced a plan to build an acetylene-based conductive additives manufacturing plant in the U.S. The company would invest USD 120-140 million for the facility, and the acetylene will be supplied from a neighboring site owned by Equistar Chemicals LP (LyondellBasell subsidiary).

- October 2022- SCG Chemicals Public Company Limited (SCGC) formed a joint venture with Denka Company Limited to operate the acetylene black manufacturing site in Thailand. The facility has a production capacity of 11,000 tons annually.

REPORT COVERAGE

The market research report provides a detailed market analysis and focuses on crucial aspects such as leading companies, types, applications, and products. Also, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends and highlights vital market developments and competitive landscape. In addition to the abovementioned factors, the report encompasses various factors contributing to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 6.10% from 2026-2034 |

|

Segmentation |

By Type, Application, and Geography |

|

By Type |

|

|

By Application |

|

|

By Geography |

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 230.1 million in 2026 and is projected to reach USD 355.3 million by 2034.

In 2025, the market value stood at USD 216.5 million.

Growing at a CAGR of 6.1%, the market will exhibit rapid growth in the forecast period (2026-2034).

The batteries segment is expected to lead the market during the forecast period.

Increasing battery production to bolster the acetylene carbon black demand is the key factor driving the market.

China held the highest share of the market in 2025.

Denka Company Limited, Orion Engineered Carbons, Hexing Chemical Industry, and Jinhua Chemical are the leading players in the market.

Increasing battery production is expected to create new opportunities for the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us