Acne Treatment Market Size, Share & Industry Analysis, By Product (Retinoids, Antibiotics, Isotretinoin, and Others), By Route of Administration (Oral and Topical), By Age Group (10 to 17 Years, 18 to 44 Years, 45 to 64 Years, and 65 Years & Above), By Distribution Channel (Hospital Pharmacies and Retail & Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

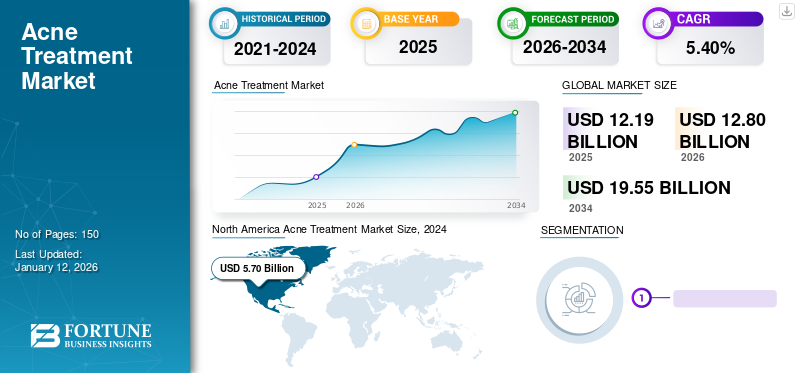

The global acne treatment market size was valued at USD 12.19 billion in 2025. The market is projected to grow from USD 12.80 billion in 2026 to USD 19.55 billion by 2034, exhibiting a CAGR of 5.40% during the forecast period. North America dominated the acne treatment market with a market share of 48.71% in 2025.

Acne is a skin condition that arises when hair follicles get clogged with dead skin cells and oil. This condition is most common among teenagers, although it affects people of all ages. The most common medications are antibiotics, retinoids, and retinoid-like drugs. The treatment of acne depends on the severity of the condition. The treatment span can extend up to several months.

The increasing prevalence of skin disorders is one of the major factors augmenting the demand for acne treatment products globally during the forecast period. For instance, according to the National Center for Biotechnology Information (NCBI), the prevalence of acne affected 9.4% of the global population in 2022. It is the eighth most prevalent disease in the world.

Additionally, the strong focus of key players on launching new and innovative products further supports the market growth. For instance, in October 2023, Crown Therapeutics launched two new PanOxyl products - PanOxyl Adapalene 0.1% Gel and PanOxyl Clarifying Exfoliant to expand its acne treatment portfolio.

The COVID-19 pandemic staggered the growth of drugs used to treat acne due to the reduced number of patients seeking treatment globally in 2020. However, later in 2021, patient visits to hospitals and clinics started increasing as the regulations imposed by governments were relaxed resulting in increasing patient number. Additionally, the increased cases of acne associated with prolonged use of medical face masks also supported the demand for drugs during the pandemic and post-pandemic years.

Global Acne Treatment Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 12.19 billion

- 2026 Market Size: USD 12.80 billion

- 2034 Forecast Market Size: USD 19.55 billion

- CAGR: 5.40% from 2026–2034

Market Share:

- North America dominated the acne treatment market with a 48.71% share in 2025, driven by the increasing prevalence of acne, rising aesthetic concerns among the population, and robust product launches by key companies in the region.

- By product type, the antibiotics segment is expected to retain its largest market share owing to its high treatment efficiency and continuous clinical approvals for new antibiotics-based therapies.

Key Country Highlights:

- United States: Growth driven by strong R&D investments, increasing dermatology consultations, and rising awareness of advanced acne treatment products.

- Europe: Expansion fueled by a growing patient pool, significant product development in dermatology drugs, and increased adoption of advanced treatment solutions.

- China: Rising consumer awareness, growing presence of pharmaceutical companies entering the acne treatment space, and expanding access to OTC skincare products.

- Japan: Market growth supported by increasing skincare concerns among adults and teenagers, coupled with high adoption of innovative topical solutions and aesthetic treatments.

Acne Treatment Market Trends

Growing Clinical Approval of Drugs to Drive Market Growth

Rising prevalence of the condition among teenagers and adults has caught the attention of manufacturers, thereby boosting the demand for medications for acne treatment. Drug development focuses on the challenge of treating acne effectively and safely. For instance, the U.S. Food and Drug Administration (FDA) has given the nod for the new abbreviated drug application for topical retinoid adapalene gel USP 0.3%, manufactured by Alembic Pharmaceuticals for treating acne vulgaris. Similarly, in June 2022, Zydus Lifesciences received the U.S. FDA approval for the marketing of Adapalene and Benzoyl Peroxide topical gel in the U.S. This generic drug is used to treat acne.

Additionally, in January 2022, GALDERMA announced that it received antitrust clearance from the U.S. authorities and completed the acquisition of ALASTIN Skincare, Inc. to develop innovative and clinically-tested physician-dispensed skincare products.

Download Free sample to learn more about this report.

Acne Treatment Market Growth Factors

Rising Acne Prevalence Globally to Propel Market Growth

Globally, the prevalence of skin conditions has increased significantly. According to the American Association of Dermatology, in 2022, more than 50 million people in the U.S. will suffer from acne. Therefore, the number of patients opting for the treatment is increasing rapidly in developing and developed countries in North America, Europe, and Asia Pacific.

The introduction of various products used for the treatment, such as retinoids, isotretinoids, and antibiotics in oral and topical forms, is increasing awareness about acne products and available treatment options in the global population. Additionally, operating players are undertaking various initiatives to increase acne awareness among the general population. For instance, in June 2021, Dermalogica launched a new campaign to educate people on acne and promote skin acceptance.

Thus, increasing patient awareness is projected to propel market growth.

Launch of Novel Drugs to Propel Growth of the Market

The demand for effective drugs to treat this condition is rising due to the growing prevalence of the condition globally. Thus, the key companies are focusing on introducing novel drugs to meet the demand, which is the key trend for the market growth.

- In October 2023, the U.S. FDA approved IDP-126 (Cabtreo), manufactured by Bausch Health, for the treatment of acne. This is the first and only fixed-dose, triple-combination topical treatment approved for acne.

- In July 2022, Glenmark Pharmaceuticals launched a new acne drug, MINYM gel, in India. This is India’s first topical Minocycline 4% Gel to treat acne.

- In September 2021, Mayne Pharma Group Limited announced the launch of isotretinoin capsules, 10 mg, 20 mg, 30 mg, and 40 mg. In the U.S., isotretinoin capsules are a generic version of ABSORICA indicated to treat severe recalcitrant nodular acne.

- In June 2020, Bausch Health Companies Inc. launched ARAZLO lotion in the U.S. for patients nine years of age and older suffering from acne vulgaris.

- In March 2020, COSMEDIX, a global trailblazer in skincare products, announced the correct rapid relief acne treatment.

Moreover, efficient product marketing to intrigue the target population is another significant factor in increasing market growth. For instance, in March 2020, Derma Group launched a new website for Acne Ultra Clear.

RESTRAINING FACTORS

Side Effects Pertaining to Current Marketed Drugs is Limiting Adoption

Despite the higher prevalence of chronic acne globally, certain factors limit the adoption of acne treatment options. Among them is the side effect associated with drugs. According to the National Center for Biotechnology Information (NCBI), nausea, vomiting, or diarrhea are the most commonly seen side effects of antibiotics and are observed in around 7% of the total patients taking tetracycline and 4% of the patients taking macrolides.

The U.S. Food and Drug Administration (FDA) alerts about the usage of certain Over-the-Counter (OTC) medications that can cause potentially life-threatening allergic reactions or severe irritation. Additionally, antibiotics, such as tetracycline and clindamycin, which are majorly used to treat this condition, may create antibiotic resistance in the patients, which is projected to limit the market growth. For instance, according to the Centers for Disease Control and Prevention (CDC), more than 2.8 million people in the U.S. have observed antibiotic resistance.

Acne Treatment Market Segmentation Analysis

By Product Analysis

High Efficiency for Treatment of Acne to Propel Growth of Antibiotics Segment

The market is divided into antibiotics, retinoids, isotretinoin, and others based on product.

The antibiotics segment led the market accounting for 46.16% market share in 2026. This is attributable to the growing approval of antibiotics for acne treatment, along with their high efficiency in exudate management. Thus, antibiotics dominate the global market and are regarded as the highest shareowner throughout the forecast period. Additionally, several studies have demonstrated the effectiveness of antibiotic treatment for acne. For instance, in March 2023, a study was published by the Yale School of Medicine that demonstrated the effectiveness of different antibiotics and stated which types of these products are more suitable for acne treatment.

The retinoids segment is projected to register a higher CAGR by 2032, owing to the rising prevalence of moderate to severe acne and rising demand for retinoids. For instance, in February 2020, Sun Pharmaceutical Industries Ltd. announced the launch of ABSORICA LD (Isotretinoin) capsules in the U.S. to manage severe recalcitrant nodular acne in patients 12 years of age and older.

To know how our report can help streamline your business, Speak to Analyst

By Route of Administration Analysis

Easy Availability of OTC Topical Products Globally to Dominate Market Share

The market is divided into topical and oral in terms of route of administration.

The topical segment dominated the market accounting for 63.42% market share in 2026. and is expected to maintain its dominance across the forecast timeframe. The growth is attributable to the increasing number of companies manufacturing topical solutions for acne treatment. This is attributed to the patient population suffering from the condition, which is primarily intrigued by topical solutions as these products are easily available and comfortable.

- For instance, in October 2022, the new skincare brand AcneSquad introduced a new product range for the treatment of acne. These topical products include toners, tonics, and serums, among others.

The oral segment is anticipated to project a significant CAGR during the forecast period due to an increase in the condition's prevalence and the growing number of product launches. For instance, in January 2019, Almirall, S.A. launched Seysara, the first oral antibiotic that has been specifically developed for use in acne in the U.S.

By Age Group Analysis

Rising Incidence of the Condition among Adults is Attributed to the Dominance of the 18 to 44 Years Segment

The market is fragmented into 10 to 17 years, 18 to 44 years, 45 to 64 years, and 65 years & above, as per age group.

The 18 to 44 years segment is projected to dominate the market with a share of 55.14% in 2026. The dominance is due to increase in the patient population of this particular age group. For instance, according to a study published in June 2023 by the National Center for Biotechnology Information (NCBI), the incidence of adult acne is constantly increasing. Currently, it is estimated that around 40% of the total adult population is affected by acne.

The 10 to 17 years segment is estimated to witness considerable growth across the forecast period owing to the increasing incidence of acne vulgaris amongst the mentioned teenage group.

By Distribution Channel Analysis

Rising Demand for OTC Products to Lead to Retail & Online Pharmacies Segment’s Lucrative Growth Rate

Based on distribution channel, the market is bifurcated into retail & online pharmacies and hospital pharmacies.

In 2026, the retail & online pharmacies segment is projected to lead the market with a 94.19% share. This is due to the increasing number of online portals and websites commercializing acne treatment products, such as Walmart, Amazon, and several others. Moreover, the growing demand for OTC drugs will strongly support the growth of this segment.

The hospital pharmacies segment is estimated to hold a significant share during the forecast period due to an increase in hospital consultations to treat this disease.

REGIONAL INSIGHTS

Based on region, the market is segmented into Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America.

North America Acne Treatment Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 48.71 billion in 2026. The region's dominance is attributable to the increasing prevalence of acne across the region and the rising concerns related to beauty among the population. Thus, major players are introducing new drugs in the North American market. For instance, in November 2021, Sun Pharma launched Winlevi, a cream for the treatment of the condition, in the U.S. Additionally, factors such as a significant rise in the patient population, increasing awareness regarding advanced treatments, and the presence of major brands contributed to the high demand of products leading to the region’s superiority globally. The U.S. market is projected to reach USD 6.05 billion by 2026.

Europe will account for the second most prominent shareholder due to the increasing patient pool in the region, strong investment in R&D for the drugs used for the treatment of dermatology conditions by the major companies, and increased adoption of advanced treatment products. The UK market is projected to reach USD 0.52 billion by 2026, while the Germany market is projected to reach USD 0.61 billion by 2026.

Asia Pacific is estimated to register the highest CAGR due to rising awareness among the population about several drugs combined with the increasing number of companies entering the Asia market. For instance, in July 2022, Sun Pharmaceutical Industries expanded its collaboration with Cassiopea to supply WINLEVI in Australia, Japan, and New Zealand, along with three other countries. The Japan market is projected to reach USD 0.54 billion by 2026, the China market is projected to reach USD 0.63 billion by 2026, and the India market is projected to reach USD 0.67 billion by 2026.

Latin America will witness a significantly stable CAGR during the forecast owing to the rising prevalence of moderate to severe acne in the region and the rising recognition of the treatment.

The Middle East & Africa will occupy a smaller acne treatment market share and register a moderate CAGR since the market is still budding. Additionally, consumers' rising adoption of drugs will lead to growth during the forecast period.

List of Key Companies in Acne Treatment Market

Focus on Inorganic Growth Strategies Propelled Allergan and Botanix Pharmaceuticals to Lead Global Market

The market is characterized by a large number of major players offering various types of drugs. The prominent companies will have a strong revenue position coupled with a diversified product portfolio of acne treatment drugs. These companies have a robust stronghold in the pivotal growth regions, and some dominant players include Allergan, Galderma S.A., and Bausch Health Companies Inc. For instance, In April 2021, Bausch Health Companies Inc. announced significant topline results from its Phase 3 trials for IDP-126 Gel to treat acne vulgaris. Additionally, in December 2022, the same company announced the availability of ARAZLO, a new treatment for acne vulgaris to patients through the provincial public drug plans in Canada.

The competitive landscape further encompasses smaller companies that offer limited products. These companies, such as Botanix Pharmaceuticals and Valeant Pharmaceutical International, Inc., have a strong national and local presence and are expected to amplify their expansion during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- ABBVIE INC. (Ireland)

- Botanix Pharmaceuticals (Australia)

- GALDERMA (Switzerland)

- Bausch Health Companies Inc. (U.S.)

- GlaxoSmithKline Plc. (U.K.)

- Bayer AG (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: tbh Skincare signed an agreement with Coles, an Australian supermarket giant, to launch its acne treatment product in 857 Coles stores across the country.

- September 2023: Glenmark Pharmaceuticals Ltd and Cosmo Pharmaceuticals NV signed a distribution and license agreement for acne treatment ointment Winlevi for Europe and South Africa.

- December 2022 - Beiersdorf AG announced the acquisition of a Belgium company, S-Biomedic NV, to strengthen its expertise in the market.

- September 2022 - La Roche-Posay introduced Effaclar Salicylic Acid Acne Treatment Serum specifically for the treatment of adult acne.

- March 2022 – Galderma introduced its breakthrough skincare cream, Twyneo to treat moderate to severe facial acne, to the U.S. market at the American Academy of Dermatology (AAD) Annual Meeting.

- January 2022 – GALDERMA announced to receive its antitrust clearance from the U.S. authorities after completing the acquisition of ALASTIN Skincare, Inc. for developing innovative and clinically-tested physician-dispensed skincare products.

- January 2021 – GlaxoSmithKline plc announced that it agreed with Eligo BioScience to advance Eligobiotics for the treatment and prevention of Acne Vulgaris with CRISPR-based therapeutics for strain-specific microbiome modulation.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market. It focuses on key aspects such as market size & forecast, critical regions for 2019-2032, new product launches, pipeline analysis, and an overview of technological developments. It also focuses on key aspects such as leading companies, products, and distribution channels. Besides this, the report offers insights into the acne treatment market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Route of Administration

|

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 12.80 billion in 2026 and is projected to reach USD 19.55 billion by 2034.

In 2025, the market value stood at USD 5.96 billion

The market will exhibit a steady growth of 5.40% CAGR over the forecast period (2026-2034).

The antibiotics segment is expected to be the leading segment in this market during the forecast period.

The acne treatment market is driven by rising global prevalence, growing skincare awareness, product innovations, and ongoing demand from post-pandemic mask-induced acne.

Allergan, GALDERMA, and Bausch Health Companies Inc. are the leading players in the global market.

North America dominated the market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us