Aerospace and Defense PCB Market Size, Share & Industry Analysis, By Type (Single Sided, Double Sided, and Multilayer), By Design (Rigid, Flexible, Rigid-Flex, HID, and Others), By Material (Metal and Non-Metal), By Platform (Airborne, Ground, Naval, and Space), By Application (Navigation Systems, Communication Systems, Lighting Systems, Weapon Systems, Power Supply, Command & Control Systems, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

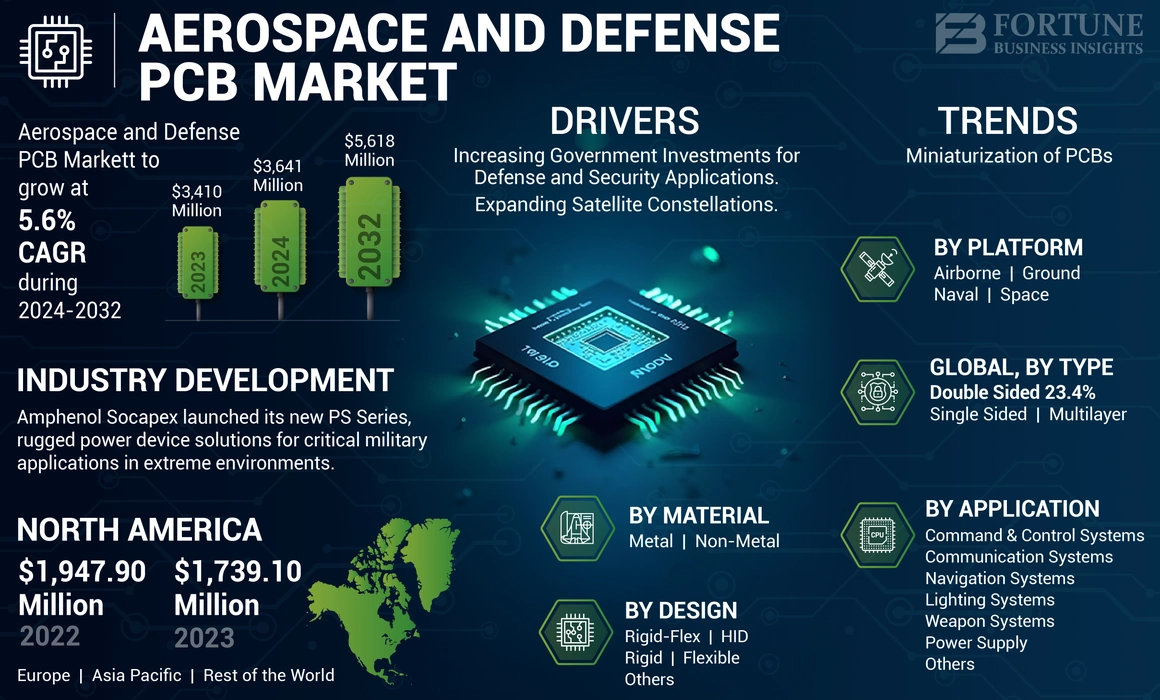

The global aerospace and defense PCB market size was valued at USD 3,410 million in 2023. The market is anticipated to grow from USD 3,641 million in 2024 to USD 5,618 million by 2032, recording a CAGR of 5.6% during the forecast period. North America dominated the aerospace and defense PCB market with a market share of 51.% in 2024.

A PCB (Printed Circuit Board) is a circuit board utilized to mechanically support and electrically connect electronic components with the help of conductive pathways, tracks, or signal traces. There are different types of PCBs, such as single-sided, double-sided, and multilayered. A variety of aerospace equipment, such as space shuttles, planes, satellites, and radio communications systems use PCBs. PCBs are essential components of aircraft equipment that power numerous systems, such as satellites, control towers, and others. Pilots rely on various types of monitoring equipment during flight, such as accelerometers and pressure sensors to track the function of the aircraft. This equipment also requires PCBs.

In the military & defense industry, PCBs are used in communication equipment, such as radio communication. The selection of a printed circuit board for communication equipment must meet the requirements of high frequency and high speed. Different types of control systems including radar jamming systems and missile detection systems need printed circuit boards for their operation. The PCBs used in the aerospace & defense industry are designed with materials that can withstand high temperature and large amounts of vibration.

The market for the aerospace and defense PCB is expected to grow significantly due to various factors, such as rise in investments for the development of electronic components in the aerospace & defense industry. Moreover, the surge in defense expenditure promotes the development of advanced and sophisticated electronic components, which is expected to propel the growth of the aerospace and defense PCB market.

Aerospace and Defense PCB Market Trends

Miniaturization of PCBs is Driving Efficiency and Reliability Across Industries

The electronics industry is witnessing a transformational shift driven by the need for miniaturization. As the demand for smaller, more powerful, and feature-rich devices surges, the design of Printed Circuit Boards (PCBs) is expected to evolve significantly in terms of miniaturization to achieve such high-density integration. The aerospace industry is driving the miniaturization of PCBs to reduce weight and improve fuel efficiency. This is enabled by advancements in High-Density Interconnect (HDI) PCB technology with features such as blind, buried, and micro-vias. The reliability of miniaturized PCBs is essential for various industries including aerospace to carry out critical operations. Miniaturization assists in the development of smaller and more advanced electronics that are able to withstand harsh environments, vibrations, and other adverse conditions.

Download Free sample to learn more about this report.

Aerospace and Defense PCB Market Growth Factors

Increasing Government Investments for Defense and Security Applications to Propel Market Growth

The growing importance of space-based assets for defense and security purposes is propelling the demand for space PCBs. These PCBs are used in various equipment, such as surveillance, intelligence gathering, and early warning systems. PCBs play a pivotal role in communication, surveillance, and intelligence gathering systems for defense and security purposes. Satellites equipped with high-resolution optical sensors, Synthetic Aperture Radar (SAR), and other advanced imaging technologies provide crucial intelligence data to monitor potential threats, assess military activities, and gather strategic information in real-time.

For instance, in April 2023, the U.S. Space Force was investing in ground and space-based surveillance systems, and commercial space tracking data to improve space domain awareness. The military branch's fiscal year 2024 budget plan includes USD 584 million for space-tracking activities, such as the development of optical telescopes and surveillance satellites to improve the detection, tracking, and identification of objects orbiting the Earth.

The Space Force has requested funding for assistance with the development of the Deep Space Advanced Radar Capability, a projected radar network that will detect threats in geostationary orbits. The budget request for FY 2024 also includes enhancements to the Ground-based Electro-Optical Deep Space Surveillance System to detect previously undetectable space threats and collect intelligence to support actionable space domain awareness.

Additionally, governments are investing in satellite electronics components that can detect and track ballistic missile launches and provide early warning signs. These electronic components are critical for national defense as they allow for fast reactions to missile threats and enhance the protection of territories and inhabitants.

Expanding Satellite Constellations to Catalyze PCB Market Growth

With dozens of satellite constellations already in orbit, the planet is expected to see many more launches in the coming years. Existing and new satellite constellations are valuable in many fields, including the Internet of Things (IoT), telecommunications, navigation, weather monitoring, and Earth & space observation, to name a few.

For instance, in September 2022, according to the U.S. Government Accountability Office (U.S. GAO), an independent, nonpartisan government agency that provides various services for the U.S. Congress, the number of active satellites steadily increased from the past few years and then skyrocketed from 1,400 in 2015 to 5,500 by the spring of 2022. This trend is anticipated to intensify, with the U.S. GAO predicting that 58,000 new satellites will be launched by the end of the decade, more than doubling the present number of operational spacecraft. The ongoing and future launches of a succession of massive constellations of satellites are anticipated to increase owing to private firms’ emphasis on deploying satellite-based critical services such as broadband internet access in underserved rural communities and so on.

Additionally, in May 2023, Atrium Space Insurance, an insurance agency that supports commercial space launches, announced that, in 2022, there were 186 satellite launches. They launched 2,509 satellites, most of which were Starlink, SpaceX's satellite internet constellation. PCBs play a crucial role in holding all the electronic components together at high altitude and varying temperatures. They are widely used in the communication, navigation, and surveillance equipment in satellites. Thus, the rising demand for satellite constellations will boost the use of PCBs in the coming years.

RESTRAINING FACTORS

High Capital Expenditure Requirements to Hinder Market Growth

New entrants need significant investments in equipment, technology, and infrastructure to establish a competitive PCB manufacturing facility. The cost of manufacturing PCBs relies on various factors, such as cost of material, technology, and complexity of the design. As the complexity of the circuit increases, the required number of components used in PCBs also increases, which may result in higher procurement costs and assembly fees. Moreover, complex circuits can require a larger PCB area to fit in more components and traces, and may also require more layers. These factors can increase the cost and expenditure required to manufacture PCBs. PCBs that are larger in size may require higher shipping costs. In addition, transportation of large PCBs incurs additional charges, such as oversize cargo fees or higher shipping costs. These factors can hinder the aerospace and defense PCB market growth.

Aerospace and Defense PCB Market Segmentation Analysis

By Type Analysis

Multilayer Segment Held Largest Market Share in 2023 Due to Miniaturization of PCBs

On the basis of type, the market is classified into single sided, double sided, and multilayer.

The multilayer segment is the largest segment in the market due to increasing adoption of advanced electronic components across the aerospace and defense sectors. The demand for multilayer PCBs utilizing advanced materials, such as high-frequency laminates, flexible substrates, and materials capable of withstanding extreme temperatures and environmental conditions is growing. Moreover, increasing miniaturization of PCBs is another factor driving the segment’s growth during the forecast period.

One of the benefits of multilayer PCB is its smaller and compact size. This acts as a major benefit to modern electronics as the latest trend is the development of smaller, more compact yet more powerful gadgets. The smaller PCBs are lightweight as the multiple connectors used to join the separate single and double-layered PCBs are removed to achieve a multilayered design. Therefore, this characteristic is beneficial for modern electronics, which aim for ease of mobility. Moreover, multilayer PCBs are used in high-speed circuits, which are essential for various applications in the military & defense industry. Amid the ongoing Russia-Ukraine war, increased defense budgets across European countries, integration of advanced avionics, communication systems, radar, and electronic warfare capabilities, and growth in satellite communication systems and space exploration missions within Europe are the factors fueling the segment’s growth during the forecast period.

For instance, in August 2024, Airbus Defense and Space awarded contracts to European aerospace and defense PCB manufacturers to supply multilayer aerospace and defense PCBs for its Eurofighter Typhoon and A400M military transport aircraft. These PCBs support critical avionics and mission systems.

The double sided segment is the fastest-growing segment and estimated to grow significantly during the forecast period. Double sided PCBs have higher demand due to their significant role in aerospace and defense applications owing to their ability to provide higher component density, improved signal integrity, flexibility in routing, effective heat dissipation, and cost-efficiency.

To know how our report can help streamline your business, Speak to Analyst

By Design Analysis

Rigid Segment Leads Due to Rise in Demand for Advanced Radar Systems

On the basis of design, the market is classified into rigid, flexible, rigid-flex, HID, and others.

The rigid segment is largest in the market owing to the growing demand for aerospace and defense applications, such as radar installations, power supplies, and communication systems. For instance, in August 2022, Lockheed Martin and Northrop Grumman signed a contract to develop a new advanced radar system for the U.S. Air Force, featuring advanced radar technology including rigid PCBs. Increased investments in defense modernization across European countries, high demand for rigid aerospace and defense PCBs in avionics, flight control systems, and communication networks, and integration of advanced radar systems, electronic warfare capabilities, and navigation in military aircraft and Unmanned Aerial Vehicles (UAVs) are the factors fueling the segment’s growth during the forecast period.

The high-density interconnect segment is estimated to grow at the fastest rate during the forecast period. Growing demand for inflight entertainment, electronic flight instrumentation, electrical transmission, and cockpit & board instrumentation control systems in the aerospace & defense industry will drive the segment’s growth during the forecast period. For instance, in June 2023, Raytheon Technologies signed a contract with the U.S. Air Force to develop a new advanced radar system for fighter jets, utilizing HDI technology to improve air-to-air combat capabilities.

By Material Analysis

Non-Metal Segment Dominates With Surge in R&D to Design and Develop Lightweight Materials

On the basis of material, the market is classified into metal and non-metal.

The non-metal segment holds the largest share of the market due to an increase in R&D investments for the development of lightweight materials, which are critical for enhancing fuel efficiency in aircraft and improving the mobility of military vehicles. For instance, in June 2023, BAE Systems secured a contract to supply non-metal PCBs for a next-generation military vehicle program. The contract highlights the use of advanced composite materials to reduce vehicle weight and improve electronic system integration for enhanced battlefield capabilities.

The non-metal segment is projected to grow at the fastest rate during the forecast period as there is a rise in the development of radar systems for the defense industry. For instance, in July 2023, Raytheon Technologies signed a partnership agreement with a specialized copper-based PCB supplier to develop advanced radar systems for naval vessels. The collaboration aims to leverage copper's high conductivity and EMI shielding properties for improved system performance.

By Platform Analysis

Airborne Platform Holds Leading Position with Increasing Use of High-Performance Miniaturized PCB Solutions

On the basis of platform, the market is classified into airborne, ground, naval, and space. By platform, the market is further segmented into commercial aircraft, UAV, and military aircraft. The ground segment includes communication station, vetronics, unmanned ground vehicles, and others. Under the naval segment, naval vessels and unmanned naval vehicles are considered. Moreover, on the basis of space, the market is further bifurcated into satellite and launch systems.

The airborne segment acquires the largest aerospace and defense PCB market share due to the modernization of the commercial aircraft fleet, demand for lightweight & compact electronics, and integration of advanced technologies. The growth in the adoption of advanced materials and manufacturing techniques and rise in use of high-performance, miniaturized, and lightweight PCB solutions for airborne platforms are expected to drive the growth of the segment. For instance, in December 2023, Raytheon Technologies signed an agreement with a PCB manufacturer specializing in High-Density Interconnect (HDI) technology for the production of PCBs for satellite communication terminals on airborne platforms. The partnership focuses on maximizing data transmission efficiency and reliability.

The space segment is estimated to record the fastest CAGR during the forecast period. Increasing satellite deployments, advancements in space technology, emerging private sector space exploration activities, and space tourism are some of the key factors driving the segment’s growth during the forecast period.

By Application Analysis

Application in Communications Systems is High Due to Rising Demand for Reliable and High-Speed Communication Systems

On the basis of application, the market is classified into navigation systems, communication systems, lighting systems, weapon systems, power supply, command & control systems, and others.

The communication systems segment is the largest segment due to the growing demand for reliable and high-speed communication systems enabling the transmission and processing of signals across various platforms and prevalence of C5ISR systems. For instance, in September 2023, Boeing secured a contract to supply PCBs for the communication and control systems of a new fleet of commercial satellites. The contract highlights the use of PCBs in satellite communications to enable global connectivity and boost data transmission capabilities.

The navigation system segment is estimated to grow at the fastest rate during the forecast period due to the high adoption of precision navigation systems and rising integration of sensors and systems. For instance, in April 2023, Lockheed Martin awarded a contract to a specialized PCB manufacturer for the development of ruggedized PCBs for next-generation airborne navigation systems. The contract emphasizes the use of advanced materials and manufacturing processes to enhance the reliability and performance of military aircraft.

REGIONAL INSIGHTS

The global market is segmented on the basis of region into North America, Europe, Asia Pacific, and the rest of the world.

North America Aerospace and Defense PCB Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In 2024, North America emerged as the leading market with a valuation of USD 1,851.3 million, driven by the expansion of defense budgets which fuels investment in advanced military electronic systems. Key players, such as L3Harris Technologies Corporation, General Dynamics Corporation, and Honeywell International, Inc. are expected to fuel the market growth in the region.

- In March 2024, Boeing secured contracts from the U.S. Air Force for the production of PCBs for satellite communication payloads. These PCBs are crucial for ensuring reliable data transmission and network connectivity in space.

- In April 2024, Lockheed Martin signed contracts with U.S. suppliers for the development of ceramic-based PCBs for advanced radar systems used in fighter jets and missile defense applications. These PCBs offer superior thermal performance and signal integrity.

Asia Pacific is forecast to experience significant growth during the forecast period owing to high adoption of the high-density interconnect technology for various defense and aviation platforms and technological advancements in advanced electronics. High demand for lightweight construction, flexibility, and high thermal stability, expansion of commercial and regional aircraft, and growing defense budget for modernization and new procurements are the factors driving the regional market’s growth during the forecast period.

Europe is anticipated to witness notable growth throughout the forecast period due to increased investments in defense modernization across European countries. Moreover, high demand for rigid PCBs in avionics, flight control systems, and communication networks and integration of advanced radar systems, electronic warfare capabilities, and navigation in military aircraft and Unmanned Aerial Vehicles (UAVs) are the factors fueling the regional market’s growth during the forecast period.

The rest of the world is expected to observe moderate growth due to the increasing demand of UAVs, commercial aircraft, and procurement of military aircraft across the globe. Rising procurement of military hardware and launch of defense modernization programs in the Middle East & Africa countries, such as Saudi Arabia, the U.A.E., Israel, and Turkey amid the ongoing Russia-Ukraine war and Israel-Hamas conflict will drive the regional market’s growth during the forecast period.

KEY INDUSTRY PLAYERS

Key Players to Focus on Development of Technologically Advanced Products and Acquisition Strategies to Drive Market Growth

The prominent market players are prioritizing the advancement of their product offerings. The development of a diverse range of solutions and heightened investment in research & development are key factors contributing to the market dominance of these players. Within the industry, many major players are embracing both organic and inorganic growth approaches, including mergers and acquisitions and the introduction of new products, to sustain their competitive edge.

List of Top Aerospace and Defense PCB Companies:

- Advanced Circuits (U.S.)

- Amitron Corporation (U.S.)

- Amphenol Printed Circuits Inc. (U.S.)

- APCT Inc. (U.S.)

- Corintech Ltd. (U.K.)

- Delta Circuits Inc. (U.S.)

- Epec Engineered Technologies LLC (U.S.)

- Firan Technology Group Corp. (Canada)

- IEC Electronics Corp. (U.S.)

- Sanmina Corporation (U.S.)

- SMTC Corporation (Canada)

- TechnoTronix Inc. (U.S.)

- TTM Technologies Inc. (U.S.)

- Fujikura Printed Circuits Ltd. (U.S.)

- Mer-Mar Electronics (U.S.)

- Technoprobe S.P.A (Italy)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Amphenol Socapex launched its new PS Series, rugged power device solutions for critical military applications in extreme rugged environments.

- November 2023: Epec Engineered Technologies acquired Precision Technology Inc., which will enhance the company’s capabilities to provide a greater range of high-quality PCBs and other electronic products.

- April 2023: Firan Technology Group Corporation acquired Holaday Circuits LLC and IMI Inc. subsequently. The acquisition of IMI will enhance Firan Technology’s capabilities in RF circuit boards for aerospace and defense industry, while Holaday Circuits will help the company offer high-tech circuit boards, specifically for defense applications.

- March 2022: Sanmina Corporation and Reliance Strategic Business Ventures Ltd. (RSBVL), a subsidiary of Reliance Industries Ltd., India’s largest privately-held company, announced that they had signed an agreement for the creation of a joint venture through Sanmina SCI India Pvt. Ltd.. The joint venture will be focusing on providing high technology hardware for various markets, such as communication networking, medical & healthcare systems, industrial & clean-tech, and aerospace & defense.

- October 2021: Compass Diversified Holdings Inc. announced the commencement of a definitive agreement to sell off Compass AC Holdings Inc., its majority owned subsidiary and a parent company of Advanced Circuits Inc. Compass AC Holdings will be sold to Tempo Automation Holdings Inc., the world’s leading software-accelerated electronics manufacturer.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on important aspects, such as key players, components, platforms, end-users, and applications depending on various regions. Moreover, it offers deep insights into the market trends, competitive landscape, market competition, pricing of aerospace and defense PCBs, and market status, and highlights key industry developments. Also, it encompasses several direct and indirect factors that have contributed to the expansion of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 5.6% from 2024 to 2032 |

|

Segmentation |

By Type

|

|

By Design

|

|

|

By Material

|

|

|

By Platform

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 3,641 million in 2024 and is projected to reach USD 5,618 million by 2032.

The market will register a CAGR of 5.6% over the forecast period of 2024-2032.

By application, the airborne segment is expected to lead the market during the forecast period.

TTM Technologies is the leading player in the market.

North America dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us