Aircraft Aftermarket Parts Market Size, Share & Industry Analysis, By Parts Type (MRO Parts, Consumable, Rotable Replacement Parts and Life Limited Parts), By Supply (OEMs, USM, and PMAs), By Component Type (Engine, Airframe, Interior, Cockpit Systems, Landing Gear and Others), By Platform [Commercial (Narrow Body, Wide Body, Cargo Aircraft, and Civil Helicopters) Military (Fighters, Transport Aircraft, and Military Helicopters], Business Jets,Regional Jets ) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

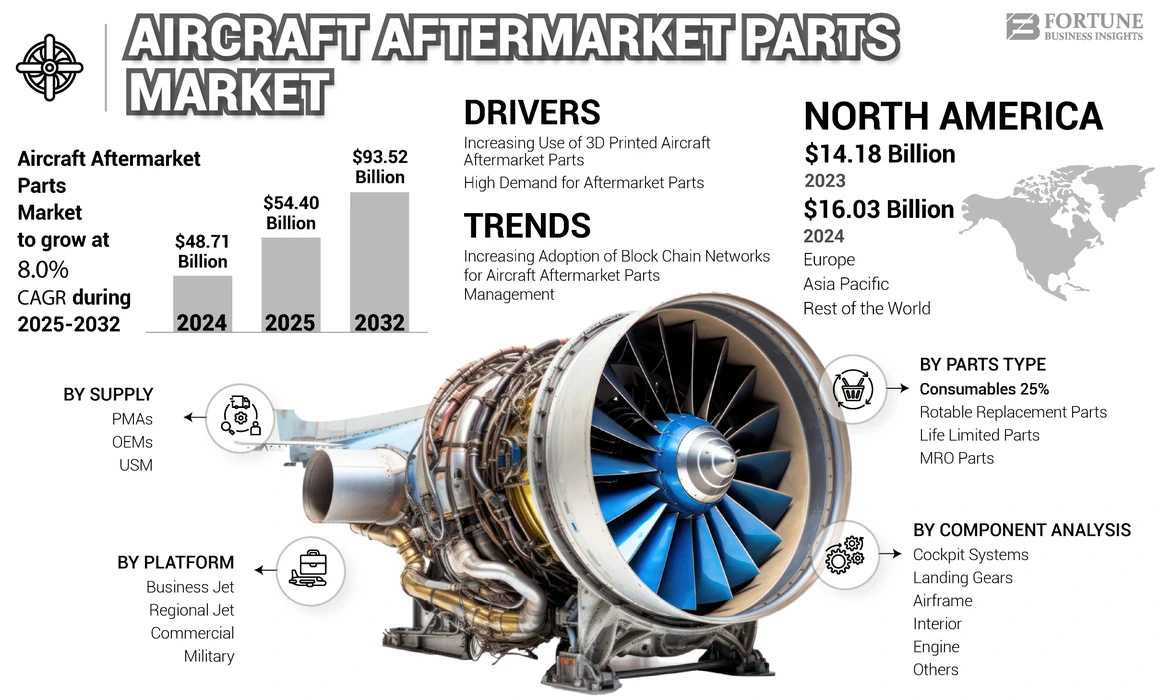

The global aircraft aftermarket parts market size was valued at USD 48.71 billion in 2024. The market is projected to grow from USD 54.40 billion in 2025 to USD 93.52 billion by 2032, exhibiting a CAGR of 8.0% during the forecast period. North America dominated the aircraft aftermarket with a market share of 33.02% in 2023.

Aircraft aftermarket services are largely dependent on the rising number of aircraft fleets across the globe. Aircraft PMO parts specialize in program management, this allows operational groups to focus on the major missions in the specified time, and as per the end-user requirements. According to Airbus SAS, it is expected that the growth of the passenger fleets will double from 21,000 aircraft in 2019 to 45,000 by 2035.

The upsurge in demand for new aircraft will facilitate the demand for maintenance, repair, and overhaul (MRO), which will further propel the demand for the aftermarket sector in the next few years. Due to lockdown in several countries in 2020, there was a huge impact on the aviation industry, resulting in a slowdown in aircraft production that impacted aircraft deliveries. The pandemic impacted around 40% of aircraft deliveries across the globe. The reduction in aircraft deliveries has drastically reduced the demand for MRO services and software and commercial aftermarket parts domain.

Global Aircraft Aftermarket Parts Market Overview

Market Size & Forecast

- 2024 Market Size: USD 48.71 billion

- 2025 Market Size: USD 54.40 billion

- 2032 Forecast Market Size: USD 93.52 billion

- CAGR: 8.0% from 2025–2032

Market Share

- North America led the market with 33.02% share in 2023, supported by strong presence of key OEMs (Boeing, Collins Aerospace) and extensive MRO infrastructure in the U.S. and Canada.

- OEM segment held the largest share as airlines prefer purchasing directly from original manufacturers due to product reliability and stringent safety standards.

Key Country Highlights

- United States: Dominates due to robust MRO ecosystem, presence of GE and Boeing, and increased investments in PMA standardization and aftermarket hubs.

- China: Rapid fleet expansion in narrow-body aircraft and changing import/export regulations fueling aftermarket growth.

- India: Increasing focus on affordable MRO hubs and rising passenger traffic driving demand for aftermarket parts.

- United Kingdom: Presence of Meggitt PLC and AJW Group, with emphasis on sustainable aviation practices and recycling of used serviceable materials (USM).

Aircraft Aftermarket Parts Market Trends

Augmentation of Big Data and Digitization of Aftermarket Operational Process to Aid Growth

The rise in the demand for commercial aircraft aftermarket parts from the airlines and aftermarket service providers has significantly brought forth issues related to accessibility and availability of the parts. This has enforced companies to implement advanced technologies such as big data in the operational process. The use of big data helps companies streamline the operational processes, assist in designing cost-efficient predictive maintenance strategies, and broaden the company’s supply chain management in remote locations.

The next-generation aircraft are equipped with advanced sensors for collecting and analyzing the real-time data from the aircraft. The gathered data is further used to optimize the predictive maintenance algorithms and modeling processes. Moreover, the digitization of the MRO process has improved the visibility of the aircraft aftermarket parts and systems. Thus, the implementation of advanced technology such as big data and digitization of processes in the supply of aftermarket parts has helped the companies understand the uncertainty of orders from airlines and thus helped to make strategic decisions. Such factors are propelling the growth of the global aviation PMO parts market during the forecast period.

North America witnessed aircraft aftermarket parts market growth from USD 14.18 Billion in 2023 to USD 16.3 Billion in 2024.

Download Free sample to learn more about this report.

Aircraft Aftermarket Parts Market Growth Factors

Subsequent Demand for MRO Services to Propel Market Growth

According to Airbus SAS, the demand for commercial aircraft is estimated to be over 7,200 in the next 20 years. This will facilitate the demand for commercial aircraft PMO parts in Asian countries. The increasing demand for aircraft in the market is expected as new and existing aircraft bodies will require MRO services. This is further expected to result in new replacement parts contracts, propelling the market growth.

The increasing government concern toward carbon emission has given rise to stringent restrictions and regulations regarding aircraft components, which require frequent aircraft health checks and maintenance. This is expected to create demand for more aircraft aftermarket products.

Increasing Number of Retired Aircraft to Facilitate the Used Serviceable Materials (USM)

The pandemic has adversely impacted the revenue of airlines across the globe. To overcome the financial impact, airlines are resizing fleets by considering the early retirement of the aircraft. Thus, the commercial aircraft disassembly, dismantling, and recycling industry has been growing at a significant rate since 2020, which has increased the demand for used serviceable materials (USM) domain.

Several aircraft aftermarket parts providers, such as General Electric Company, the Boeing Company, and others prefer using these USM parts from the retired aircraft to cut down the cost incurred with the aircraft aftermarket parts. Thus, the increasing demand for USM parts will significantly contribute to the aviation PMO parts market growth.

RESTRAINING FACTORS

Issues Related to the Coordination of Facilities will Restrain the Supply Chain Network

The airlines coordinate with aftermarket parts and MRO service providers for the scheduled maintenance services. In terms of a risk minimization approach, lack of coordination between aircraft PMO parts and MRO providers incur as a restraints factor for airlines. An extra burden is created for the airliners in terms of operation and coordination between different facilities. In the day-to-day operations, it is important that both the MRO and aftermarket parts facilities effectively communicate with each other, particularly regarding the scheduled maintenance process.

Most of the MRO facilities are not well organized and lack an integrated approach with other facilities. In some circumstances, the MRO facility is not responsive to the operational parameters of the aircraft. Moreover, aftermarket parts facilities may operate from remote locations. Thus, if the aircraft owner is willing to carry out maintenance, then the lack of proper information about processes may act as an additional burden resulting in restraining the growth of the market.

Aircraft Aftermarket Parts Market Segmentation Analysis

By Parts Type Analysis

Rotatable Replacement Parts Segment to Grow at Highest CAGR

Based on the parts type, the market is classified into MRO parts and rotable replacement parts.

The MRO parts segment is expected to showcase considerable growth during the forecast period. The growth is due to the rising next-generation aircraft and the growing needs of the customers maintenance demand for such advanced aircraft worldwide.

The rotable replacement parts segment is anticipated to grow at the highest CAGR during the forecast period. The growth of the segment can be attributed to the increasing demand for scheduled checks such as class A checks, class B checks, and class D checks. The airlines are focusing more on the scheduled checks. However, every aircraft undergoes a complete check and components and systems replacement every six years. This will boost the growth of the market.

- The consumables segment is expected to hold a 25% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Supply Analysis

Increasing demand from Airline Operators for Purchasing Products from OEMs drive Market Growth

The global aviation aircraft aftermarket is categorized into OEMs, USM, and PMAs.

The OEM segment held the largest aircraft aftermarket parts market share in 2023. The greater market share of this segment is attributed to the increasing focus on airline operators purchasing aircraft products from OEM manufacturers, owing to the higher reliability of OEM-manufactured products. Additionally, vigorous testing is carried out of the products manufactured and supplied by OEMs, introducing higher reliability.

The USM and PMA segment also accounted for a decent share in 2023. The USM segment is expected to record the fastest growth rate of 9% due to the increasing focus of airline operators to promote sustainability and sustainable flying operations.

By Component Analysis

Interior Systems Segment to be Fastest-Growing Segment

The global aviation PMO parts market is segmented into engine, airframe, interior, cockpit systems, and others based on the component.

The engine segment is estimated to hold the largest aircraft aftermarket parts market share as the cost incurred in the maintenance and parts is high compared to other components. In February 2021, Uganda Airlines signed a total care agreement with Rolls-Royce. In this agreement, Rolls-Royce has charged Uganda Airlines on a dollar-per-flying-hour payment basis. The company will provide all the maintenance services related to Trent 7000 engines.

The airframe segment is expected to grow significantly during the forecast period due to the rise in the airline aircraft modernization programs. The airframe maintenance service involves high cost and time-consuming processes. Thus, it is generally carried out every six years.

The interior segment is expected to exhibit a high growth rate during the forecast period. This segment comprises aircraft interior components and systems maintenance-related services. The rise in the demand for passenger safety and comfort has propelled the demand for modernizing the older aircraft with technologically advanced interior systems.

The cockpit segment is anticipated to experience considerable growth due to the emergence of artificial intelligence and internet of things (IoT) based systems and components. The airliners are actively involved in upgrading their commercial fleets with these AI and IoT integrated systems.

Others segment comprises landing gear, wheels, and other components in the aircraft.

By Platform Analysis

Increasing demand for International and Regional Commutation is Driving the Demand for Market.

Based on platform, the market is segmented into commercial, military, business jets, and regional jets.

The commercial segment is estimated to hold the major market share as the demand for passenger and cargo flights rises over the years with increasing passenger travels. Furthermore, the expansion of the freight transportation and e-commerce industries has led to higher demand for aircraft aftermarket parts from this segment.

The military segment is expected to grow at a significant rate during the forecast period due to the rise of defense and military spending. This is on account of the escalated tense situations in European nations due to the impact of the Russia-Ukraine war, resulting in increased MRO contracts and aircraft deliveries.

The business jets and regional jets segments also account for a decent market share and are expected to grow at a steady growth rate. This is owing to the increasing regional passenger traveling and a rise in the number of high net-worth individuals.

REGIONAL INSIGHTS

The global Aircraft Aftermarket Parts market is segmented on regions into North America, Europe, Asia-Pacific, and the Rest of the World.

North America Aircraft Aftermarket Parts Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America stood at USD 14.18 billion in 2023 and is expected to dominate the global market during the forecast period. The growth is attributed to maintenance repair and overhaul MRO service providers focusing on the rising investment in the aftermarket facilities in the U.S. and Canada. Moreover, the U.S. comprises key players in the aviation PMO parts domain such as the Boeing Company, Collins Aerospace, and other dominant players. Besides, the U.S.-based firms have a strong supply chain network for MRO services and aircraft parts. Furthermore, the rise in the demand for standardization of parts manufacturer approval (PMA) processes in the U.S. will boost the growth of the market.

Europe is estimated to showcase exponential growth in the forthcoming years. The restructuring of the government norms related to the import and export of the aftermarket parts propel the growth of the market. However, the risk associated with the high fuel prices, impact of Brexit on trades, labor shortage, and global trade war may hamper the growth of the European countries.

The market in Asia-Pacific is projected to grow at the highest CAGR during the forecast period. Aftermarket parts providers are investing in establishing aftermarket hubs in countries such as Japan, Singapore, and Australia that are expected to augment market growth.

The China aviation PMO parts sector is expected to grow significantly. The growth is attributed to the growing narrow-body aircraft and related fleet services facilities in China. Moreover, the changes in the import and export of governmental norms have propelled the growth of the market.

The market in the Rest of the world is expected to grow at an exponential growth during the forecast period. The increasing number of next-generation fleet sizes in countries such as the UAE, Saudi Arabia, and Israel is expected to boost the Middle Eastern region, whereas, the growing aircraft aftermarket storage infrastructure spending by countries such as Brazil and Argentina will favor the market growth.

List of Key Companies in Aircraft Aftermarket Parts Market

General Electric Company is a Prominent Player Offering Aftermarkets Parts to Key Airlines

General Electric Company is a leader in providing engine-based aftermarket parts solutions. The company has a wide range of product portfolios and has a major presence in the U.S., Singapore, and India, securing a stable market position. The company invests in research & development and new product innovation activities. Moreover, the company is focused on mergers, agreements, and contracts to sustain its position in the market.

LIST OF KEY COMPANIES PROFILED:

- The Boeing Company (The US)

- Collins Aerospace (The US)

- Honeywell International Inc. (The US)

- General Electric Company (The US)

- Eaton Technologies (The US)

- Meggitt PLC (The UK)

- UTC Aerospace Systems (The US)

- AJW Group (The UK)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 – Collin Aerospace and HNA Aviation Group announced a MRO agreement under which Collin Aerospace would offer its maintenance, repair, and overhaul services to the air service provider’s subsidiaries. HNA and its subsidiaries are one of the largest operating group in China providing domestic and international air services.

- July 2023 - Marubeni Corporation announced that the company expanded its aircraft aftermarket business through the acquisition of 50% shares in Diversified Aero Services, LLC. The company is one of the leading and biggest distributors of aircraft expendable and rotable parts.

- August 2022 - Sumitomo Corporation announced that the company acquired 51% stake in the Werner Aero LLC. The company specializes in manufacturing and providing aircraft spare parts as well as aircraft end-of-life solutions and also deals with the sale of serviceable and maintained aircraft parts in the market.

- May 2022 – Motherson, an auto component supplier, announced that recently the company received a contract from Boeing to manufacture and supply aftermarket molded polymer parts for commercial airplane interior.

REPORT COVERAGE

The global aircraft aftermarket parts market report provides a detailed analysis of the market and focuses on key aspects such as key players, types, applications based on a commercial platform. Moreover, the report offers insights on the parent market, global commercial MRO market trends, and competitive landscape and highlights key industry developments. In addition to the factors mentioned above, the market report encompasses several direct and indirect factors that have contributed to the sizing of the global market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.0% over 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Parts Type

|

|

By Supply

|

|

|

By Component Type

|

|

|

By Platform

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 48.71 billion in 2024.

Registering a CAGR of 8.0%, the market will exhibit steady growth over the forecast period (2025-2032).

The Engine in the component segment is the most leading segment for the market.

General Electric Corporation is the leading player in the global market.

North America dominated the market in terms of share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us