Aircraft Turbocharger Market Size, Share, Industry Analysis, By Platform (Heavyweight Aircraft and Lightweight Aircraft), By Turbocharger Type (Butterfly Valve Type and Poppet Valve Type), By Component (Compressor, Turbine, and Waste Gate), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

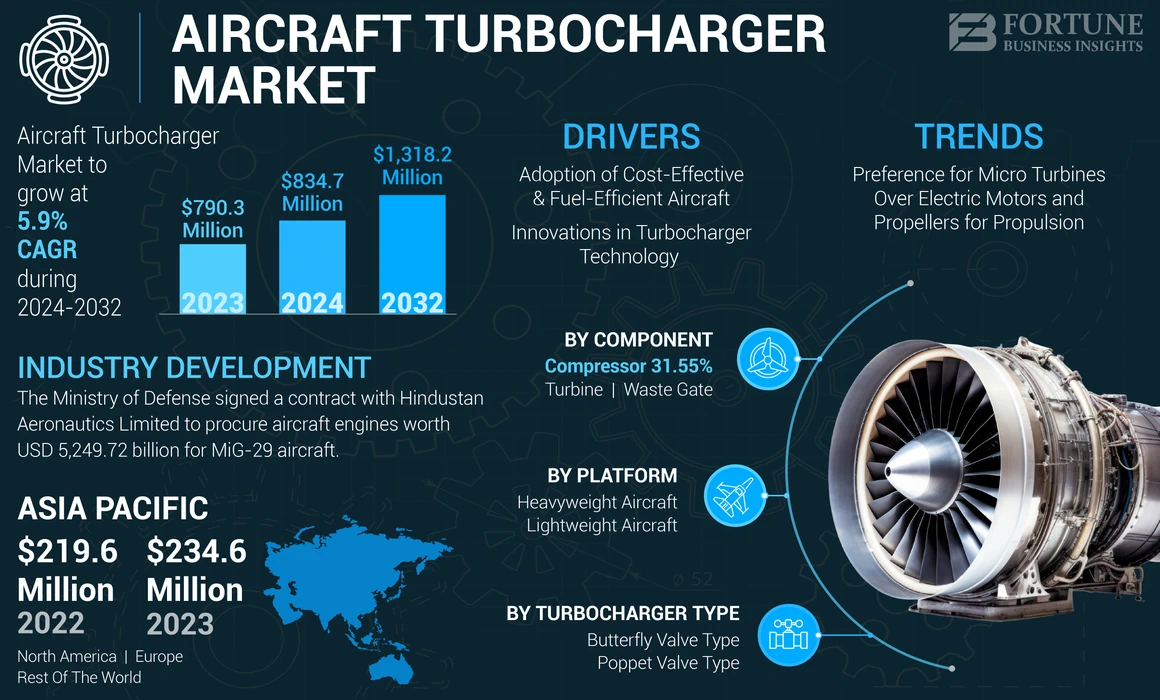

The global aircraft turbocharger market size was valued at USD 790.3 million in 2023. The market is projected to grow from USD 834.7 million in 2024 to USD 1,318.2 million by 2032, exhibiting a CAGR of 5.9% during the forecast period. Asia Pacific dominated the aircraft turbocharger market with a market share of 29.68% in 2023.

A turbocharger, often referred to as a "turbo," is a forced induction device used in internal combustion engines, including those in aircraft. It operates by harnessing the energy from exhaust gases to compress the intake air, thereby increasing the amount of air entering the engine's combustion chamber. This process allows the engine to produce more power without increasing its size.

In aircraft, turbochargers are particularly beneficial for piston engines operating at high altitudes. As the altitude increases, air pressure decreases, which can reduce engine performance. A turbocharger compensates for this by compressing the thinner air, thereby allowing the engine to maintain sea-level performance up to a certain altitude, known as the critical altitude. Above this altitude, the turbocharger's effectiveness diminishes, and engine power may decrease.

The COVID-19 pandemic caused substantial interruptions in the manufacturing processes of aircraft turbocharger producers. This was largely due to restrictions on workforce mobility and supply chain disruptions, which hampered production capabilities and led to delays in delivery schedules.

Aircraft Turbocharger Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 790.3 million

- 2024 Market Size: USD 834.7 million

- 2032 Forecast Market Size: USD 1,318.2 million

- CAGR: 5.9% from 2024–2032

Market Share:

- Asia Pacific dominated the market with a 29.68% share in 2023, driven by rapid growth in the regional aviation sector, increasing air traffic, and rising investments in advanced aircraft technology.

- By platform, heavyweight aircraft held the largest share due to higher demand for fuel-efficient engines and turbochargers for commercial and defense aviation.

Key Country Highlights:

- China & India (Asia Pacific): Fastest growth owing to expanding civil aviation fleets, growing military modernization, and demand for cost-efficient propulsion systems.

- United States (North America): Significant growth supported by technological advancements and strong presence of major turbocharger manufacturers like Honeywell and GE Aviation.

- Europe: Steady demand fueled by stringent emission regulations and rising focus on efficient turbocharger technologies in commercial aviation.

- Middle East & Latin America: Moderate growth driven by rising investments in fleet modernization and regional aviation development projects.

Aircraft Turbocharger Market Trends

Increasing Preference for Micro Turbines Over Electric Motors and Propellers for Propulsion to Accelerate Market Growth

Propeller planes come with their own set of advantages. However, sometimes there is a need for extra speed and thrust that is usually given by a jet engine. These engines can generate a large amount of power as compared to electric propellers. They can also enable airplanes to travel at much higher speeds. Studies have shown that on a pound-to-pound basis, diesel fuel is capable of storing 40 times more energy than any other lithium-based battery. Diesel also takes only minutes to refuel, which is not the case with electric drones, which take hours to recharge.

- Asia Pacific witnessed aircraft turbocharger market growth from USD 219.6 Million in 2022 to USD 234.6 Million in 2023.

- In November 2021, FusionFlight, a Texas-based company, announced its plans to apply the concept of micro-turbines for propulsion to quadcopter-style drones. This has led to the creation of the AB6 JetQuad. The AB6 JetQuad is a quadcopter featuring four micro-turbine engines instead of rotors. The vehicle makes use of kerosene, gasoline, or jet A, with its four engines producing 700 newtons of power. This drone can be used for various purposes, including remote monitoring and offering emergency medical services.

Download Free sample to learn more about this report.

Aircraft Turbocharger Market Growth Factors

Fueled Adoption of Cost- and Fuel-Efficient Aircraft is Fast-tracking the Product Demand

The aviation industry is witnessing a significant transformation driven by the adoption of cost-effective and fuel-efficient aircraft. This trend is accelerating market growth across various segments, including electric aircraft, aircraft engines, and ultralight/light aircraft. The surge in the adoption of cost-effective and fuel-efficient aircraft is reshaping the aerospace landscape. As airlines modernize their fleets with innovative technologies aimed at reducing costs and environmental impact, the market for electric aircraft, advanced engines, and ultralight models is set to experience robust growth. This trend not only reflects a response to regulatory pressures but also aligns with evolving consumer preferences for sustainable travel options.

Innovations in Turbocharger Technology Boosting the Market Growth

Recent advancements in turbocharger technology, particularly intercooled turbochargers and electric turbochargers (E-Turbos), are significantly enhancing engine performance and fuel efficiency across various sectors, including commercial and military aviation. E-Turbos represent a transformative approach to traditional turbocharging systems. They utilize an electric motor to eliminate turbo lag by powering the compressor directly at low speeds, allowing for larger and more efficient designs. This integration enables vehicles to achieve better acceleration and responsiveness without sacrificing power delivery. E-Turbos can improve fuel efficiency by approximately 2-4% in standard applications, with even greater reductions in emissions—up to 20% for NOx in diesel engines. They allow engines to operate at optimal air-fuel ratios (Lambda 1), which is crucial for meeting stringent emission regulations.

Companies like Garrett Motion are leading the charge with their award-winning E-Turbo technology, which has been recognized for its potential to enhance performance while adhering to environmental standards. The E-Turbo's design focuses on energy recuperation, capturing energy during deceleration to improve overall efficiency.

RESTRAINING FACTORS

Long Lifespan of Aircraft Engines to Restrain Market Growth

The design of the aircraft engines are made in a way so the engines can have a long life cycle, but there may be some factors that can hinder the aircraft turbocharger market growth. Owing to such long life of these engines, there is no demand for new engines except when new aircraft are produced. This factor can decrease the product’s sales. Additionally, the backlog in aircraft manufacturing has significantly affected the market growth. Aircraft manufacturing is similar to aircraft engines, so a reduction in aircraft production will limit the supply of aircraft engines, thereby decelerating the market growth.

Aircraft Turbocharger Market Segmentation Analysis

By Platform Analysis

Rising Air Travel, Fuel Efficiency, and Technological Innovations to Drive Demand for Heavyweight Aircraft

The market, by platform, is bifurcated into heavyweight aircraft and lightweight aircraft.

The heavyweight aircraft segment currently accounts for a largest portion of the global market share and will grow rapidly during the forecast period. The segment is expected to grow significantly due to rising air traffic, the demand for fuel-efficient engines, and ongoing technological advancements. This growth is indicative of broader trends within the aviation industry, where performance and efficiency are becoming increasingly paramount.

The demand for lightweight aircraft turbochargers is driven by the growing popularity of general aviation planes and Unmanned Aerial Vehicles (UAVs). Lightweight aircraft prioritize compact and efficient turbocharger designs to optimize engine performance without adding excessive weight to the aircraft structure.

By Turbocharger Type Analysis

Simplicity and Reliability Offered by Butterfly Valve to Boost Its Demand

The market, by turbocharger type, is segmented into butterfly valve type and poppet valve type.

The butterfly valve type segment is projected to be the leading and fastest-growing segment in the market. This segment is growing due to the strong expansion of the aviation industry and increasing focus on efficiency and performance. As manufacturers continue to innovate and respond to market needs, the demand for butterfly valve turbochargers is expected to rise, contributing significantly to the market's expansion over the next decade. The combination of simplicity in design and high reliability makes butterfly valves an attractive option across various industries. Their lightweight structure, low maintenance needs, quick operation, and cost-effectiveness contribute significantly to their growing demand. As industries continue to evolve with increasing automation and stringent regulations, the role of butterfly valves in efficient fluid management systems is likely to expand further, solidifying their position as a cornerstone in valve technology.

The poppet valve segment is poised for substantial growth as well, influenced by the aviation industry's shift towards more efficient and environmentally friendly technologies. As manufacturers continue to innovate and adapt to regulatory changes, the demand for poppet valve turbochargers is expected to remain strong in the coming years.

By Component Analysis

To know how our report can help streamline your business, Speak to Analyst

Continuous Innovations in Turbocharger Technology to Enhance Performance and Efficiency Will Augment Adoption of Turbines

By component, the aircraft turbocharger market is categorized into compressor, turbine, and waste gate.

The turbine segment is projected to be the leading and fastest-growing segment in the market. Rising air travel, technological advancements, regulatory pressures for efficiency, and increased defense spending support the segment’s dominance. This growth reflects the broader trends in the aviation industry, where performance enhancements and sustainability are becoming increasingly important.

The compressor segment is also poised for significant growth, supported by increasing air travel, technological advancements, and expansion of both military and commercial aviation sectors.

- The compressor segment is expected to hold a 31.55% share in 2023.

REGIONAL INSIGHTS

In terms of geography, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific Aircraft Turbocharger Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is a dominant player in the market, benefiting from the growing aviation sector and increasing investments in aircraft technology. The region includes major markets, such as China, Japan, India, and South Korea, all of which are expanding their aviation capabilities.

The North America market is poised for substantial growth in the coming years, fueled by the expanding commercial aviation industry, stringent environmental regulations, and technological innovations in turbocharger design and performance.

In 2023, Europe accounted for a substantial share of the global aircraft turbocharger market, which is projected to grow due to increasing air passenger traffic and stringent emission regulations. Turbochargers are essential for enhancing engine efficiency and reducing emissions, making them critical components in modern aircraft design.

The RoW market is still in its nascent stage, with Latin America and the Middle East showing more promise for growth compared to Africa. The aircraft turbocharger is poised for substantial growth due to rising aircraft demand, regulatory pressures for fuel efficiency, and ongoing technological advancements. The increasing defense budgets and modernization efforts will further enhance the market's potential, making it a dynamic sector within the broader aviation industry.

KEY INDUSTRY PLAYERS

Integrating Advanced Technologies to Provide Additional Capabilities in Aviation Sector Will Become Key Focus of Leading Players

The aircraft turbocharger market share is experiencing significant growth, driven by various factors including increased demand for new aircraft, technological advancements, and stringent environmental regulations. Innovations in turbocharger design and materials have led to lighter and more efficient products, thereby enhancing their performance and fuel efficiency. The integration of turbochargers with hybrid propulsion systems is also becoming more common, further driving the aircraft turbocharger market growth.

List of Top Aircraft Turbocharger Companies

- ABB Ltd. (Switzerland)

- Airmark Overhaul, Inc. (U.S.)

- BorgWarner Inc. (U.S.)

- General Electric Company (U.S.)

- Hartzell Engine Technologies LLC (U.S.)

- Honeywell International Inc. (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- PBS Group, A.S. (Czech Republic)

- Rajay Parts LLC (U.S.)

- Victor Aviation Service, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – The Ministry of Defense has reported the agreement with Hindustan Aeronautics Limited (HAL) to purchase aircraft engines for MiG-29 aircraft for a total of USD 5,249.72 billion. The program aims to improve the localization content for future RD-33 aircraft engine overhaul and repair tasks by focusing on localizing key high-value components.

- January 2024 – Rolls-Royce has entered into an innovative seven-year agreement with Azad Engineering, a company located in Hyderabad, to produce essential parts for its military aircraft engines. The alliance between Azad Engineering and Rolls-Royce in advanced aircraft engine supply chain is a major step forward for India in defense manufacturing.

- January 2024 – Akasa Airlines, a budget airline, has made an agreement with CFM International to buy over 300 Leap-1B engines for the propulsion of 150 planes. The agreement also covers a backup engine and a maintenance agreement. The agreement was finalized while French President Emmanuel Macron was visiting India on a state trip.

- October 2023 – Triumph Group, Inc. and Honeywell Aerospace signed a long-term agreement that includes multiple Honeywell engine platforms. The deal involved TRIUMPH being accountable for producing and maintaining booster pumps, electronic controllers, and hydro-mechanical fuel controllers for T55 helicopter engines, in addition to main fuel pumps for fighter aircraft engines/F124 trainer and the HTF7000 business jet engine.

- June 2023 – India and the U.S. made public an agreement involving Hindustan Aeronautics Limited (HAL) and GE Aerospace for the manufacturing of fighter aircraft engines for the Indian Air Force (IAF). The Indian Air Force will receive 114 Multi-role Fighter Aircraft (MRFA) and more Light Combat Aircraft (LCA) Mk1A, followed by LCA Mk2. ADA and DRDO are working on the development of the fifth-generation AMCA and TEDBF for deployment on naval aircraft carriers.

REPORT COVERAGE

The report covers various aspects essential for understanding the current landscape and future trends of this market. It analyzes emerging trends that could shape the market, such as increasing military expenditures and modernization of aircraft fleets, which may drive the demand for high-performance turbochargers. The report identifies major companies in the market, such as Honeywell, General Electric, and Mitsubishi Heavy Industries, and discusses their market shares and competitive strategies.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.9% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Platform

|

|

By Turbocharger Type

|

|

|

By Component

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 790.3 million in 2023.

The market is likely to record a CAGR of 5.9% over the forecast period of 2024-2032.

The market size in Asia Pacific was valued at USD 234.6 million in 2023.

Some of the top players in the market are ABB Ltd., Airmark Overhaul, Inc., BorgWarner Inc., General Electric Company, Hartzell Engine Technologies LLC, Honeywell International Inc., Kawasaki Heavy Industries, Ltd., PBS Group, A.S., Rajay Parts LLC, and Victor Aviation Service, Inc.

The China dominated the market in 2023.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us