Airport Baggage Handling Software Market Size, Share & COVID-19 Impact Analysis, By Function (Baggage Control, Baggage Tracking, Baggage Sortation, and Baggage Screening) By Solution (Software and Services), By Airport Type (Domestic Airport and International Airport), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

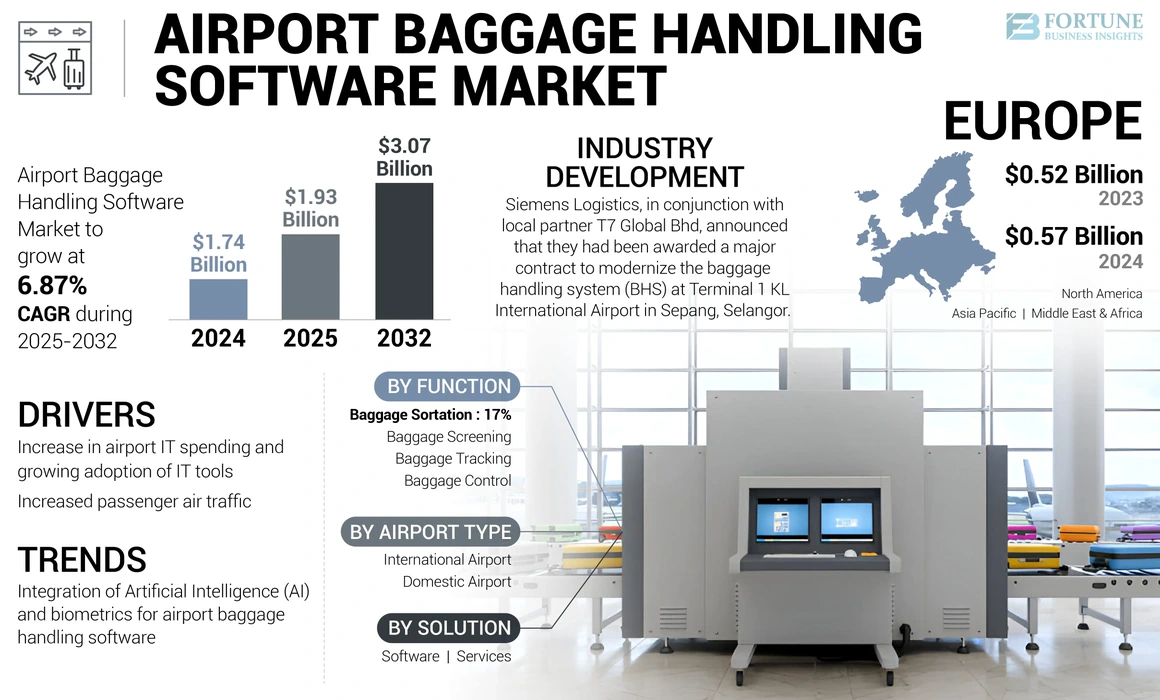

The global airport baggage handling software market size was valued at USD 1.74 Billion in 2024. The market is projected to grow from USD 1.93 Billion in 2025 to USD 3.07 Billion by 2032, exhibiting a CAGR of 6.87% during the forecast period. Europe dominated the airport baggage handling software market with a market share of 32.76% in 2024.

Airport baggage handling software is essential for the successful management of baggage handling systems, and within the airport industry, this integrated software combines some of the most advanced high-level control systems and introduces a new level of ease and efficiency to the baggage handling process. Moreover, this airport baggage handling software provides 100% tracking of bags and traceability at every stage of the baggage handling process. Each piece of baggage remains on the same controlled track throughout the baggage handling process, from check-in, through screening, to EBS and transportation, to unloading.

The mishandling of baggage is one of the major issues in an airport. According to SITA Aero, the number of mishandled and lost luggage increased over the year 2020. As the airline industry began to recover from COVID-19, the global rate of mishandled bags in 2021 increased by 24% to 4.35 bags per thousand passengers. This created an alarming situation around the major airports globally and led to increased investment in smart IT solutions for baggage handling. The major players in the market reported high revenue based on software sales and growing demand for software upgrade services. The trend is anticipated to continue due to growing IT & T airport investment plans.

The global market is set to grow as the demand for airport baggage handling software installation is rising due to the availability of advanced baggage tracking technology and other operational advantages provided by various service providers. This, in turn, will encourage many governments and private airport owners to experience seamless baggage handling. Thus, taking the above factors into consideration, the airport baggage handling software market growth in terms of revenue is anticipated during the forecast period.

COVID-19 IMPACT

COVID-19 Pandemic Led to Growing Need of Contactless Baggage Processing Services

The COVID-19 pandemic has devastated the airline industry, with passenger numbers falling and pressure to redesign operations to meet new amendments in travel regulations. While many airline operators and airports were focused on managing hassle-free processing of passenger’s need to meet the new health requirements, the impact on baggage handling was also observed. The COVID-19 pandemic has accelerated digitization projects with a push for self-service and contactless technologies and operations.

Post-pandemic in 2021, 79% of airports and 74% of airline operators have prioritized contactless baggage tagging options that rely on kiosks and passenger mobile devices. A large majority, 79% of airlines and a majority of 67% of airports globally plan to make contactless unassisted self-check-in available by 2023. Travelers have embraced the transition to contactless, increasingly using mobile technology, and those who do so report higher satisfaction rates.

- SITA launched a new product called SITA Bag Manager Lite. Due to its cloud-based technology, passengers can implement and access the Baggage Reconciliation System (BRS) using a web-based device from anywhere, anytime via the Internet – no dedicated device or connection required.

LATEST TRENDS

Download Free sample to learn more about this report.

Integration of Artificial intelligence (AI) and Biometrics for Airport Baggage Handling Software is a Vital Trend

Artificial Intelligence (AI) and biometrics are improving the quality of the travel experience, and the integration of AI and biometric recognition technology is the future, especially in the airline and airport industries. However, baggage handling technology has remained conventional for many years, relying on one-dimensional barcodes, which does not ease the operations. Thus, the use of airport baggage handling software can connect different technologies that work seamlessly together, opening the door for AI and biometric solutions. For instance, Lufthansa uses facial-field biometrics to conduct contactless routing through security checks and boarding.

AI-powered airport baggage handling software and solutions can automatically identify prohibited items from baggage using an X-ray image. The Artificial Intelligence (AI)-powered airport baggage handling system looks at each image like human eyes, outlines prohibited items, and displays warnings on the screen. The use of artificial intelligence is expected to be more accurate, greener, and cheaper than checking checked baggage using scanned baggage tags. It is more environment-friendly, as there is no need for bag tags made of paper or label printers. Robots could completely take over the driving, thus reducing passengers' fear of losing their baggage. Moreover, passengers can track the status and location of their baggage at any time via tracking. Airlines and airports around the world have begun testing AI for airport baggage handling software and have achieved shocking results in terms of efficiency and reduced handling times. For instance,

- In December 2022, Eindhoven airport in the Netherlands announced that it started testing a new artificial intelligence bag identification technology in conjunction with industry partners Vanderlande and BagsID. The new baggage check-in technology will eliminate the use of bag tags and label printing machines, making Eindhoven Airport ecological and greener.

DRIVING FACTORS

Increased Passenger Air Traffic to Drive Market Growth

Air travel is the safest and fastest mode of transport, high passenger traffic is recorded every year. The sudden decline due to the pandemic in 2020 was a major setback for the aviation industry, but post-pandemic in 2022, passenger air traffic has come back to 83% of pre-pandemic levels. The biggest reason for the increase in passenger numbers is the removal of restrictions that governments place on travel. Fortunately, some major governments have agreed that travel restrictions have little to no long-term impact on the spread of COVID-19. The growing number of passengers globally has also created a need for smart baggage handling systems and check-in services. The key players involved in the market witnessed a significant demand for airport baggage handling software and services as these software are equipped with AI, serve a significant purpose, and help passengers with a hassle-free baggage check-in and handling experience. Moreover, taking passenger safety and increased passenger handling capacity into consideration, airports and airlines have adopted these digital tools that will save time and money in the long run. For instance,

- In September 2022, SITA and Middle East Airlines–Air Liban (MEA) announced that they renewed a technology contract and relocated the Baggage Reconciliation System (BRS) at Rafic Hariri International Airport. By adopting SITA’s Bag Manager Cloud solution, the airport would reach a bag processing capacity of around 9 million bags per year compared to 3 million bags in past years without any major investment.

Increase in Airport IT Spending and Growing Adoption of IT Tools to Boost Market Growth

Airlines should put a lot of focus on IT tools to manage irregular passenger traffic and provide a safe and hassle-free passenger experience during times of staff shortage. It is anticipated that the majority of airlines are planning to invest in improving IT services for baggage handling and passenger processing applications. The IT spending in the industry is expected to continue to grow, with 96% of airlines and 93% of airports expected to have the same or increased IT spending in 2022, with the sectors expected to grow by USD 37 billion and USD 6.8 billion respectively.

Moreover, most airlines plan to provide real-time baggage tracking information to passengers by 2025 to support efficient baggage management and enable passengers after periods of significant service disruption. In addition, airports are similarly prioritizing self-service initiatives and placing a strong emphasis on self-check-in and self-service check-in, with 86% planning to implement them by 2025.

RESTRAINING FACTORS

High Cost of Initial Setup and Maintenance Costs to Hinder Market Growth.

Cost is one of the major factors considered when adopting a digital tool for mass applications. Baggage handling plays a crucial role when it comes to airline and airport operations. Using digital tools and software for luggage management is a prominent trend being adopted by almost every airline and airport operator globally. These digital tools and software possess a high cost in terms of setup and maintenance. The reason behind the high cost is compatibility with existing systems. These programs are customized according to airport infrastructure, taking airline passenger traffic into consideration. Moreover, the software integration requires a significant period of time with other resources, which raises the initial setup cost higher than normal. In addition to their higher setup cost, these tools have a higher maintenance cost compared to conventional baggage handling systems, which requires experts and a skilled workforce to maintain and troubleshoot the difficulties when needed. Thus, high cost is still a major threat when it comes to digital tools and airport baggage handling software.

SEGMENTATION

By Function Analysis

To know how our report can help streamline your business, Speak to Analyst

Baggage Tracking Segment to Dominate the Market Owing to Adoption of Advanced Technology

Based on function, the market is segmented into baggage control, baggage tracking, baggage sortation, and baggage screening. The baggage tracking segment is expected to dominate the market during the forecast period. The high growth of the segment is attributed to the growing adoption of advanced technology, particularly RFID. RFID technology is anticipated to reduce baggage mishandling by 25%, resulting in major savings for airline operators as well as better passenger experience. RFID has demonstrated a read rate of 99.9% in baggage handling and is the most reliable and cost-effective technology to increase capacity and improve the baggage handling process. For instance,

- Delta Airlines was the first airline to implement RFID for baggage handling in the airline industry. The airline is one of the largest carriers of passengers in the U.S. and handles more than 120 million bags each year, implementing RFID technology at its 344 stations worldwide.

The baggage screening segment is expected to witness significant growth, owing to growing terrorism and illegal activities across the globe. Baggage screening devices are now equipped with advanced AI-powered software that locates prohibited items on X-ray images of scanned bags. These systems can scan up to 30 frames per second and detect prohibited items in black and white two-dimensional X-rays, color X-rays, and three-dimensional CT scan images. In addition, it dramatically increases passenger safety and eliminates human error in the baggage check process. This creates a high demand and is expected to boost the segment growth during the forecast period.

By Solution Analysis

Software Segment Held Highest Market Share due to High Demand for Baggage Handling Systems

Based on solution, the market is bifurcated into software and solutions. The software segment is expected to hold the highest market share, owing to the growing demand for digitized and fully automated baggage handling systems. The software enables 100% tracking and traceability as each bag continues to remain in the same tote throughout the baggage handling and screening process. Moreover, switching to this software technology can save up to 70% of energy usage. Key players involved in the market are coming up with new software solutions that are programmed to function in high performance airport environments. For instance, airport baggage handling experts BEUMER Group came up with baggage handling software, BEUMER Airport Suite. This software is a proven solution in the industry, known for its high performance, and has been installed at major airports worldwide.

The service segment is anticipated to witness significant growth owing to the growing demand for the upgrade of mid-technology baggage handling systems. The major airports across the globe have expressed the need to fully automate digital solutions; hence, maintenance and upgrading services are expected to witness high demand. Moreover, the growing investments in modernizing airport infrastructure in regions, such as Asia and the Middle East, will boost the segment growth during the forecast period.

By Airport Type Analysis

International Airport Segment to Grow Significantly Fueled by the Adoption of Smart Solutions for International Baggage Handling

Based on airport type, the market is bifurcated into domestic airport and international airport. The international airport segment is expected to witness high growth numbers due to growing concern over baggage mishandling for international travelers. For instance, the global baggage mishandling rate on international routes is 8.7%. However, it is only 1.85% for domestic flights. In other words, globally, the probability of a bag being mishandled on international routes is about 4.7 times higher than on domestic routes. This has created an alarming situation for airlines and airport operators globally and has led to large investments in international baggage handling technology, such as the adoption of IoT by airlines and airports, which has made it easier to track baggage at any corner of the world.

The domestic airport segment held the highest market share in the base year due to growing passenger air traffic at domestic routes across different regions. In 2021, domestic travel numbers were 61% higher than 2019 levels. This is anticipated to improve to 93% in 2022 and 103% in 2023. Thus, the traffic will reach pre-pandemic levels, as will the number of baggage mishandling cases. To minimize such cases, domestic airlines and operators have already upgraded the baggage handling infrastructure by incorporating carts and totes with different technologies such as bag kiosks and self-bag drop stations.

REGIONAL INSIGHTS

Europe Airport Baggage Handling Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Based on region, the global market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

Europe dominated the airport baggage handling software market share in 2024. Europe’s market size stood at USD 0.57 billion in 2024. The growth of the region is attributed to the presence of major key players such as SITA Aero. The company is involved in providing baggage handling tools to airlines and airport operators. The company has 2,500 customers across the globe, and provides its solutions and services to around 400 members, which counts to 90% of the world's airline business. Moreover, airlines in the region are adopting contactless baggage handling services to track their bags in case of mishandling. For instance,

- In 2021, Lufthansa Group launched a completely contactless way for passengers to report delayed baggage using a mobile device, avoiding long waiting queues at busy baggage service counters or offices.

The market on North America is expected to witness a moderate growth during the forecast period owing to slow adoption of automated baggage handling solutions. However, the airline industry in the region is now slowly adopting digital techniques to manage high passenger traffic and minimize baggage handling cases. For instance, the U.S. airlines’ baggage handling performance improved in 2021. The improvement was a result of ongoing advancements in airline bag tracking systems, airport facilities, and employee training.

The market in Asia Pacific is expected to experience substantial growth during the projection period. The growth of the region is attributed to the growing airline industry in countries such as India and China. Moreover, the growing presence of IT firms in India and Japan that program high-precision software for baggage handling applications should propel market growth in the region. Nevertheless, Asian Airlines never disappoints their passengers in terms of service, as these Asian airlines are committed to continuing the excellent progress made in providing a clean, safe, and seamless travel experience for domestic and international passengers.

The market in the rest of the world is expected to grow significantly during the forecast period. Increasing number of construction of new airports and the growing trend of next-generation smart airports in the United Arab Emirates, Saudi Arabia, and Qatar are the major reasons for market growth in the region during the forecast period.

KEY INDUSTRY PLAYERS

Companies are Focusing on Expanding their Services and Product Portfolio

Different regional and international players are consistently working on expanding their businesses in the market. Major players in the market, including SITA, Siemens AG, and BEUMER Group, have an extensive range of product portfolios, with airports and airlines using those software and services across the globe. For instance, in November 2022, Siemens Logistics announced that it was selected to deliver the Baggage Handling System (BHS) for the new Noida International Airport (NIA). The airport project will initially substitute the Indira Gandhi International airport by handling 12 million passengers per year and is expandable to 30 million passengers.

LIST OF KEY COMPANIES PROFILED:

- BEUMER Group (India)

- Amadeus IT Group (Spain)

- Siemens AG (Germany)

- SITA (Switzerland)

- Vanderlande Industries (Netherlands)

- Leonardo SPA (Italy)

- Daifuku Co. Ltd. (Japan)

- Collins Aerospace (U.S.)

- Alstef Group (France)

- A-ICE (Rome)

KEY INDUSTRY DEVELOPMENTS:

- In June 2022, SITA announced that it entered into a partnership agreement with Alstef Group, a company that has expertise in baggage handling systems. The company launched Swift Drop, a new self-bag drop solution that speeds up the experience of checking your own bag. Mexico City’s brand new Felipe Ángeles International Airport became the first airport globally to install 20 Swift Drop units.

- In November 2022, Amadeus Company announced that more than 100 new Auto Bag Drop (ABD) machines will be installed at Paris-Charles de Gaulle and Paris-Orly airports. This machine helps passengers by assisting them to choose self-serve bag drop at more than half of the check-in service points across Paris airports.

- In December 2022, Siemens Logistics, in conjunction with local partner T7 Global Bhd, announced that they had been awarded a major contract to modernize the Baggage Handling System (BHS) at Terminal 1 KL International Airport in Sepang, Selangor. Siemens Logistics will provide the latest VarioStore early bag storage and high-performance controlling software.

- In January 2022, Vanderlande Industries announced that its concept for a self-screening passenger security checkpoint solution for airports has been selected by the U.S. Department of Homeland Security (DHS) for further design, development and operational testing. The company will supply and integrate the screening lanes and its smart virtual divest assistant solution.

- In December 2022, Collins Aerospace and Materna IPS signed a Memorandum of Understanding (MoU) working together to improve airport operations, passenger check-in and baggage management. Materna IPS is an international provider of automated passenger check-in services for airlines and airports, providing self-service hardware and software implementation.

REPORT COVERAGE

The global airport baggage handling software market report provides a detailed analysis of the market and focuses on key aspects such as major players, types, and applications based on the airports and airlines. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report includes several direct and indirect aspects that have contributed to the global market size in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.87% from 2025-2032 |

|

Segmentation |

By Function, Solution, Airport Type, and Geography |

|

By Function

|

|

|

By Solution

|

|

|

By Airport Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.93 Billion in 2025 and is projected to reach USD 3.07 Billion by 2032.

The market will exhibit a CAGR of 6.87% during the forecast period.

On the basis of airport type, the domestic airport segment is the leading segment in the market.

SITA, Siemens AG, and BEUMER Group are some of the leading players in the global market.

Europe dominated the market in terms of share in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us