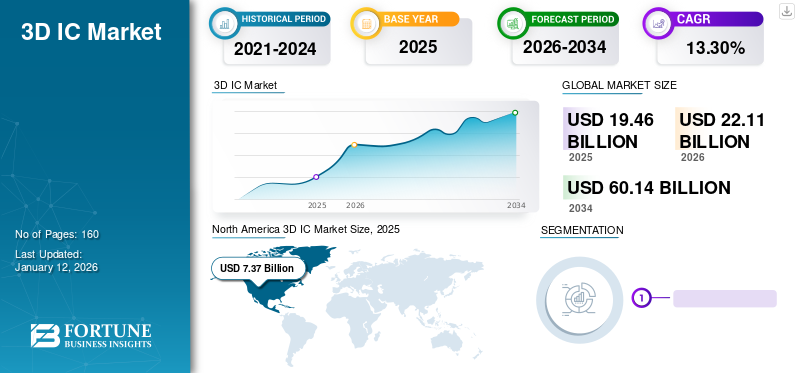

3D IC Market Size, Share & Industry Analysis, By Technology (Through-Silicon Via (TSV), 3D Fan-Out Packaging, 3D Wafer-Scale-Level Chip-Scale Packaging (WLCSP), Monolithic 3D ICs, and Others), By Component (3D Memory, LEDs, Sensors, Processors, and Others), By Application (Logic and Memory Integration, Imaging and Optoelectronics, MEMS and Sensors, LED Packaging, and Others), By End-user (Consumer Electronics, IT and Telecommunications, Automotive, Healthcare, Aerospace and Defense, Industrial, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global 3D IC market size was valued at USD 19.46 billion in 2025 and is projected to grow from USD 22.11 billion in 2026 to USD 60.14 billion by 2034, exhibiting a CAGR of 13.30% during the forecast period. North America dominated the global 3D IC market with a share of 37.90% in 2025.

The market encompasses the development, manufacturing, and commercialization of three-dimensional integrated circuits, which feature vertically stacked layers of electronic components. These circuits offer enhanced performance, reduced power consumption, and improved space efficiency over traditional 2D ICs. The market includes various components such as 3D memory, LEDs, sensors, processors, and microelectronics systems. It also covers related technologies such as Through-Silicon Via (TSV), 3D Fan-Out Packaging, 3D Wafer-Scale-Level Chip-Scale Packaging (WLCSP), Monolithic 3D ICs, and others. The high adoption of electronics devices and innovations in semiconductor technology will increase the 3D IC market share.

The COVID-19 pandemic disrupted global supply chains and manufacturing operations, leading to delays in production and development of these ICs. However, increased demand for electronic devices and data centers to support remote work and digital transformation partially offset these challenges, driving the need for advanced semiconductor solutions.

Impact of Generative AI

Rise in AI-powered Applications to Drive Market Growth

The rise of generative AI is significantly impacting the industry by driving demand for high-performance and energy-efficient semiconductor solutions. Generative AI models, such as chat GPT-4, require substantial computational power and advanced memory architectures, which 3D ICs can efficiently provide. For instance, NVIDIA's Blackwell platform, designed to handle large language models with reduced cost and energy consumption, utilizes advanced 3D IC technologies. Similarly, companies such as AMD and Intel are integrating these ICs to enhance AI processing capabilities in their chips. This surge in AI-driven applications is accelerating the adoption and innovation of these advanced ICs, which drive the global 3D IC market growth.

3D IC Market Trends

Adoption of 3D ICs in High-performance Computing to Fuel Market Growth

Key innovations in 3D packaging technology include Through-Silicon Via (TSV), 3D wafer-level packaging, and interposer technology. TSV enables the vertical stacking of dies, improving signal transmission speed and reducing power consumption. For example, AMD's Ryzen processors with 3D V-Cache use TSV to stack memory on top of logic dies, significantly boosting performance. Furthermore, the 3D wafer-level packaging integrates multiple chips into a single package without traditional wire bonding. This method is used in high-performance computing and AI applications, where reduced latency and increased bandwidth are crucial. Intel's Foveros technology, which combines logic and memory dies in a 3D stack, exemplifies this trend.

Interposer technology used in NVIDIA's GPUs, employs a silicon interposer to connect multiple dies, enhancing performance and power efficiency. These packaging advancements enable the creation of compact, high-performance, and energy-efficient devices, meeting the increasing requirements of consumer electronics, automotive, and healthcare sectors. As these technologies continue to evolve, they will further drive the adoption and growth of 3D ICs in various applications.

Download Free sample to learn more about this report.

3D IC Market Growth Factors

Increasing Demand for Advanced Consumer Electronics to Boost Market Growth

As consumers increasingly seek devices that are more powerful, efficient, and feature-rich, manufacturers are turning to 3D IC technology to meet these expectations. For instance, smartphones, tablets, and wearable devices require compact, high-performance components to support advanced functionalities such as high-resolution displays, fast processing speeds, and extended battery life.

Apple's use of this technology in its A-series chips for iPhones and iPads exemplifies this trend. By stacking multiple layers of circuits, Apple enhances performance and efficiency without increasing the physical size of the chips. Similarly, Samsung integrates these ICs intlo its Exynos processors to deliver superior performance in its flagship smartphones.

Gaming consoles such as the PlayStation 5 and Xbox Series X also benefit from these ICs, offering immersive gaming experiences with advanced graphics and faster load times. These applications highlight how the demand for advanced consumer electronics is driving the adoption and innovation of such products, expanding market growth.

RESTRAINING FACTORS

High Manufacturing Costs and Thermal Management Concerns to Impede Market Growth

The market faces several restraints that hinder its growth. High manufacturing costs are a primary concern, as the complex processes involved in stacking and integrating multiple layers of circuits require advanced technology and materials. This makes these ICs more expensive compared to traditional 2D ICs, limiting their adoption to high-end applications.

Thermal management issues also pose challenges, as densely packed circuits generate significant heat, complicating cooling solutions and affecting reliability and performance. Additionally, design and testing complexities increase the time and resources needed for development, hindering the rapid adoption of these ICs, particularly in cost-sensitive and high-volume markets.

3D IC Market Segmentation Analysis

By Technology Analysis

Through-Silicon Via (TSV) Segment Holds the Highest Share due to Need for High-speed and High-bandwidth

By technology, the market is divided into Through-Silicon Via (TSV), 3D Fan-Out Packaging, 3D Wafer-Scale-Level Chip-Scale Packaging (WLCSP), Monolithic 3D ICs, and others.

Through-Silicon Via (TSV) technology holds the highest share 30.20% in 2026 the market due to its superior performance in enabling high-speed, high-bandwidth connections between stacked layers, reducing signal latency, and improving power efficiency. TSVs also enhance the compactness and reliability of these ICs, making them ideal for advanced applications such as high-performance computing and consumer electronics.

Monolithic 3D ICs are expected to grow at the highest CAGR in the market during the forecast period due to their ability to integrate multiple layers of transistors on a single silicon wafer. This technology significantly enhances performance, power efficiency, and density while streamlining manufacturing processes and reducing costs, making it increasingly attractive for high-performance and energy-efficient applications.

By Component Analysis

3D Memory Segment Holds the Highest Share due to Burgeoning Need for Storage and Performance

By component, the market is classified into 3D memory, LEDs, sensors, processors, and others.

3D memory holds the highest share 32.07% in 2026 the market due to its ability to increase storage density and performance while reducing power consumption significantly. This technology is critical for high-demand applications such as data centers, smartphones, and AI, where efficient and compact memory solutions are essential.

Processors are expected to grow at the highest CAGR due to the increasing demand for advanced computing capabilities in fields such as AI, machine learning, and high-performance computing. The ability of this technology to enhance processor performance and power efficiency by enabling more compact and higher-bandwidth interconnections drives this rapid growth.

By Application Analysis

Logic and Memory Segment Leads due to Utility in Various Applications

Based on application, the market is divided into logic and memory integration, imaging and optoelectronics, MEMS and Sensors, LED packaging, and others.

The logic and memory integration segment holds the highest share 36.08% in 2026 and CAGR, offering significant improvements in performance and energy efficiency by enabling faster data transfer and reducing latency between components. This integration is critical for applications such as data centers, AI, and high-performance computing, where seamless and efficient data processing is essential.

Imaging and optoelectronics hold the second-highest share of the market due to the growing demand for advanced camera systems, sensors, and displays in smartphones, medical devices, and automotive applications. 3D IC technology enhances the performance and miniaturization of these components, making them more efficient and effective for high-resolution imaging and optical communication.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Dominate due to Rise in Adoption of Devices

By end-user, the market is divided into consumer electronics, IT and Telecommunications, automotive, healthcare, Aerospace and Defense, industrial, and others.

Consumer electronics hold the highest share of the market due to the high demand for compact, energy-efficient, and high-performance components in devices such as smartphones, tablets, and wearables. This technology meets these needs by offering improved processing power and reduced size, ideal for the advanced features and functionalities required in consumer electronics.

The automotive sector is expected to grow at the highest CAGR in the market due to the increasing 3D integration of advanced electronics for autonomous driving, advanced driver-assistance systems (ADAS), and in-car connectivity. These ICs enhance performance and space efficiency, which are critical for managing the complex and high-performance requirements of modern automotive systems.

REGIONAL INSIGHTS

Based on geography, the global market is studied across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America 3D IC Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 7.37 billion in 2025 and USD 8.34 billion in 2026. North America holds the highest share in the market due to its strong presence of leading technology companies and semiconductor manufacturers, such as Intel, AMD, and NVIDIA, which drive innovation and adoption of advanced IC technologies. The region's well-established 3D IC industry, significant investments in R&D, and high demand for consumer electronics, data centers, and AI applications, further bolster its market dominance. Additionally, its robust supply chain and high-tech ecosystem support the widespread implementation and development such technologies. The U.S. market is projected to reach USD 4.87 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific 3D IC market is expected to grow at the highest CAGR due to its rapidly expanding electronics manufacturing sector and increasing adoption of advanced technologies. Major semiconductor market players such as TSMC, Samsung, and Sony are heavily investing in the region, driving innovations and production capabilities. Additionally, the burgeoning demand for consumer electronics, including smartphones and Internet of Things (IoT) devices, in countries including China, South Korea, and Japan is fueling the growth of these ICs. The Japan market is projected to reach USD 1.38 billion by 2026, the China market is projected to reach USD 1.74 billion by 2026, and the India market is projected to reach USD 1.11 billion by 2026.

Europe

Europe holds a significant share in the market due to its strong emphasis on innovation and advanced semiconductor research. Key players such as STMicroelectronics and Infineon Technologies drive technology development and deployment across various sectors. The region's focus on high-tech industries, including automotive and industrial automation, supports substantial demand for these advanced ICs. Additionally, European Union initiatives and funding for technology advancement and digital transformation bolster the region's presence in the market. The U.K. market is projected to reach USD 0.99 billion by 2026, while the Germany market is projected to reach USD 0.85 billion by 2026.

The Middle East & Africa is expected to grow at the second-highest CAGR in the market due to increasing investments in smart infrastructure, automotive, and telecommunications. The expansion of tech hubs and smart city projects, such as those in Dubai and Johannesburg, drives demand for advanced semiconductor technologies. Additionally, growing government initiatives and economic diversification efforts are supporting the adoption of these ICs to enhance local technology capabilities and digital transformation.

South America is expected to grow at the lowest CAGR in the market due to relatively lower levels of investment in advanced semiconductor technology and a less developed technology infrastructure compared to other regions. Limited local manufacturing capabilities and lower demand for high-performance electronic products also contribute to slower growth in the sector.

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positioning

Key market players are launching new products to enhance their market position by leveraging the latest technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Top 3D IC Companies:

- Samsung (South Korea)

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

- Advanced Micro Devices, Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Micron Technology, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Amkor Technology, Inc. (U.S.)

- ASE Technology Holding Co., Ltd. (Taiwan)

- Toshiba Corporation (Japan)

- Qualcomm Incorporated (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024- Ansys announced its implementation of NVIDIA Omniverse APIs to provide 3D-IC designers with real-time visualization of physics solver results. This initiative aimed to advance semiconductor system design, enhancing applications such as 5G/6G, IoT, AI/ML, cloud computing, and autonomous vehicles.

- April 2024- Cadence Design Systems, Inc. and TSMC extended their collaboration, announcing a range of technological advancements to accelerate design in 3D-IC, advanced process nodes, design IP, and photonics. This partnership enhances system and semiconductor design for AI, automotive, aerospace, hyperscale, and mobile applications, leading to significant recent technological achievements.

- April 2024- Synopsys, Inc. announced expanded EDA and IP collaborations with TSMC, introducing a co-optimized Photonic IC flow for improved power and performance and advanced design flows for AI, high-performance computing, and mobile applications. Synopsys' tools are ready for TSMC N3/N3P and N2 processes, with new AI-driven solutions such as Synopsys DSO.ai.

- March 2024- At GTC, NVIDIA launched over two dozen new microservices, enabling healthcare enterprises to leverage generative AI advancements on any cloud platform. The suite comprises optimized workflows and NVIDIA NIM AI models with industry-standard APIs, facilitating the creation and deployment of cloud-native applications. These microservices enhance natural language, imaging, speech recognition, digital biology generation, prediction, and simulation.

- March 2024- Advanced Semiconductor Engineering, Inc. extended its VIPack platform to meet the rising demand for complex chiplet incorporation in AI applications. This extension reduces the chip-on-wafer interconnect pitch from 40μm to 20μm using advanced microbump technology. These new solutions support 2D, 2.5D, and 3D packaging capabilities, enabling greater creativity and scalability for architects.

- November 2023- Samsung Electronics launched its new 3D chip packaging technology, SAINT, to compete with TSMC. SAINT includes three variants, SAINT S, SAINT D, and SAINT L, aimed at improving the performance and integration of memory and processors for high-performance chips, including AI applications.

- November 2023- Semiconductor company AMD opened its largest global design center in Bengaluru, marking a milestone in its commitment to expanding R&D and engineering in India. The 500,000 sq. ft. campus would host about 3,000 engineers focused on developing semiconductor technologies, including 3D stacking, AI, and ML.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of 3D IC Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Component

By Application

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 60.14 billion by 2034.

In 2025, the market was valued at USD 19.46 billion.

The market is projected to grow at a CAGR of 13.30% during the forecast period

By technology, the Through-Silicon Via (TSV) segment leads the market.

Increasing demand for advanced consumer electronics is a key factor boosting market growth.

Samsung, Taiwan Semiconductor Manufacturing Company (TSMC), Advanced Micro Devices, Inc., and Broadcom Inc. are the top players in the market.

North America holds the highest market share.

By end-user, automotive is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic