5G Testing Equipment Market Size, Share & Industry Analysis, By Equipment Type (Oscilloscope, Signal Generator, Spectrum Analyzer, Network Analyzer, and Others), By Application (Lab Testing, Performance Testing, and Wireless and RF Testing), By End-User (Telecom Equipment Manufacturers, IDMs & ODMs, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

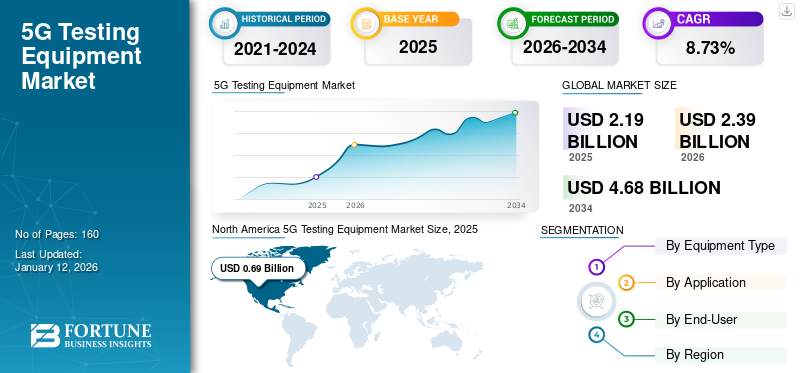

The global 5G testing equipment market size was valued at USD 2.19 billion in 2025 and is projected to grow from USD 2.39 billion in 2026 to USD 4.68 billion by 2034, exhibiting a CAGR of 8.73% during the forecast period. North America dominated the global market with a share of 8.73% in 2025.

5G testing equipment is used to measure and test the 5G device infrastructure, such as electric signals or spectrums, bandwidth, device efficiency, network, and other related parameters. Due to the increased use of IoT and connected devices, the demand for 5G testing equipment continues to increase at a steady pace. Moreover, the use of 5G test equipment for the deployment of 5G technologies is convenient due to the increased availability of large data centers.

Global 5G Testing Equipment Market Overview

Market Size:

- 2025 Value: USD 2.19 billion

- 2026 Value: USD 2.39 billion

- 2032 Forecast Value: USD 4.68 billion

- CAGR (2025–2032):8.73%

Market Share:

- Regional Leader: North America held around 8.73% share in 2025 due to strong 5G infrastructure development and early adoption.

- Fastest‑Growing Region: Asia Pacific is projected to grow at the highest CAGR, supported by rapid 5G rollout and expanding device manufacturing.

Industry Trends:

- Spectrum analyzers dominated the market in 2022, while network analyzers are expected to grow at the highest CAGR.

- Wireless and RF testing is witnessing strong demand with increasing 5G spectrum usage.

- Telecom equipment manufacturers remain the primary end-users, with rising adoption among IDMs and ODMs developing connected devices.

Driving Factors:

- Rising demand for high-speed IoT and connected devices across industries.

- Increasing network complexity due to Massive MIMO, mmWave, and advanced 5G technologies.

- Growing adoption of software-defined, flexible testing solutions to support next-gen device and network validation.

There is an increasing demand for 5G test equipment due to the deployment of 5G in individual sectors such as automobiles, entertainment, healthcare, government, and security. Additionally, the 5G test equipment market growth is expected to be driven by ongoing R&D of 5G infrastructure to make it more user-oriented and compliant with industry standards. For instance,

- In June 2023, HCLTech established a state-of-the-art OEM testing laboratory in Chennai, India, to enable global telecom infrastructure OEMs to check and verify the applicability of 5G solutions.

The COVID-19 pandemic created a growing demand for consistent network connectivity, which led to the rise in network traffic. In addition, organizations shifted toward remote work, which led to the development of network coverage globally. Various network operators enhanced the deployment of 5G to provide good network connectivity, creating growth opportunities for the market.

5G Testing Equipment Market Trends

Software-defined Testing for 5G Equipment is a Major Trend in the Market

The need for extremely reliable high connectivity with low latency is increased by the capability to provide continuous connectivity between machines in the manufacturing process. The necessity of quick communication and faster response in emergencies is making the deployment of 5G networks more widespread across various sectors. Additionally, 5G is contributing to numerous smart city purposes, such as enabling the IoT, bridging the digital divide, and providing facilities and services to citizens.

With 5G equipment containing highly complex Radio Frequency (RF) designs, the testing and measurement sector is becoming more inclined to create flexible and effective test sets through a software-defined approach. In addition, with the increase in the adoption of software-defined testing, vendors are focusing on developing efficient and flexible 5G test equipment for multiple methods and standards suitable for the assessment of complex radio frequency designs. Test programs that create 5G challenges are also helped by the software-defined approach used in 5G testing. For instance, prototyping of Massive MIMO, mmWave, Channel Sounding, and Waveform Development using reprogrammable instrument tools is carried out for 5G test equipment. These trends contribute to the market’s growth with increased customer spending on smartphones and digitalization.

Download Free sample to learn more about this report.

5G Testing Equipment Market Growth Factors

Rising Usage of High-Speed Internet Connectivity by 5G in IoT Devices to Aid Market Growth

The demand for faster mobile communications to ensure that connected devices are perfectly secure has grown steadily. To support and facilitate communication between large-scale Internet of Things (IoT) devices, high-speed internet connectivity is an important means of access. The deployment of 5G in IoT applications provides a variety of Quality of Service (QoS) criteria, wireless connections, and large quantities of data traffic, which improves the speed and security of connections. This further enables enterprises and applications by adapting new applications and technologies with a low-cost deployment.

A wide adoption of advanced multimedia applications that contribute to an increase in 5G traffic resulted from combining device capabilities with higher bandwidth, faster, and smarter networks. According to a recent Thales Group webinar, by the end of 2023, around 438 million devices will be connected using 5G, thereby creating demand for 5G testing equipment.

To promote high speed data transfer used by connected devices, there is a demand to test the capabilities and performance of 5G testing equipment. Additionally, the demand is expected to increase as a result of connectivity needs in mobile phones, wearables, connected cars, and other consumer electronic devices.

RESTRAINING FACTORS

Technological Complexities and Cost of Testing to Impede Market Growth

The infrastructure for the 5G network and a pathway to performance gains in an evolving digital world are enabled by a combination of techniques such as millimeter wave usage, multimode integration, and beamforming. The overall 5G testing process is being faced with additional challenges caused by the added complexity of these techniques, making it a major constraint for the 5G testing equipment market growth.

Moreover, controlling testing costs could play a key role in the success of 5G. Organizations need higher frequency penetration rates due to their complex infrastructure; however, the 5G network limits the penetration rate through physical barriers.

5G Testing Equipment Market Segmentation Analysis

By Equipment Type Analysis

Rise in Network Traffic and Targeted Marketing to Lead to the Highest CAGR of Network Analyzer Segment

Based on equipment type, the market is segmented into oscilloscope, signal generator, spectrum analyzer, network analyzer, and others. With the introduction of 5G technology, low business risk factors, and an increase in network traffic, the network analyzer segment is expected to have the highest CAGR over the forecast period due to the rise of 5G technologies and growth in network traffic. A network analyzer helps to avoid potential infrastructure delays and problems with deployment. It provides large-scale analytical and technology solutions to analyze the entire system development through network analytics for the Communication Service Providers (CSP).

The spectrum analyzer segment is projected to account for 34.96% of the total market share in 2026 due to its rapid and easy analysis of the signal as well as its ability to pick up and analyze phase information for the signal.

By Application Analysis

Increase in Usage of Wireless Spectrum for Wireless and RF Testing to Aid Market Expansion

The performance testing application is expected to lead the market, contributing 47.06% of the market share in 2026. Based on application, the market is segmented into lab testing, performance testing, and wireless and RF testing. Wireless and RF testing segment is expected to grow significantly at a higher CAGR during the forecast period, owing to an increase in wireless spectrum usage among users.

The test solutions available for wireless development and deployment workflow are created to take into account many testing challenges. By using the finite RF spectrum more effectively, enhanced wireless testing promises incredible data speed. Also, with the development of advanced integrated 5G devices with wireless features, the demand for 5G testing equipment is anticipated to rise during the forecast period.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Demand for Integrated Devices for IoT Applications to Grow IDMs & ODMs Segment Share

Based on end-user, the market is categorized into telecom equipment manufacturers, IDMs & ODMs, and others, which are adopting 5G test equipment to enhance their business activities. The IDMs & ODMs segment is aimed to register the highest growth rate during the forecast period. The growth is attributed to the demand for integrated devices for unified IoT applications such as smart home energy management. IDMs & ODMs are developing innovative device technologies that improve the capacity for handling a much larger number of smart devices through greater data volumes, particularly in localized markets.

Telecom equipment manufacturers are anticipated to remain the dominant end-use segment, representing 53.85% of the total market share in 2026. This is mainly due to the deployment of 5G networks and, more generally, longer term evolutions such as LTE on a global scale.

REGIONAL INSIGHTS

Regionally, the market is fragmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America 5G Testing Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

As per the analysis, North America held a major 5G testing equipment market share in 2022 due to an increase in deployment of 5G infrastructure and the presence of major network service providers in the region. Telecom service providers have already implemented 5G testing equipment at an early stage. Technological advancements in 5G in the region are expected to help gain traction in this market. For instance, The U.S. market is projected to reach USD 0.48 billion by 2026.

- In October 2022, EXFO received funding of USD 15.9 million from the federal government to accelerate 5G technology development and job creation in Canada.

To know how our report can help streamline your business, Speak to Analyst

Due to the growing demand for higher data transfer speeds for residential and commercial purposes, as well as an increased need for 5G testing equipment, Europe is also expected to experience strong demand for 5G testing services.

Asia Pacific

Asia Pacific is estimated to grow at a faster pace, with the trend anticipated to continue over the forecast period. Increased manufacturing of 5G devices and their adoption by major economies, such as India, China, and Japan, have led to regional growth. These evolving economies have made substantial contributions in aiding the region's adoption of the 5G testing equipment platform. The Japan market is projected to reach USD 0.15 billion by 2026, the China market is projected to reach USD 0.23 billion by 2026, and the India market is projected to reach USD 0.10 billion by 2026.

- October 2022 - HFCL Limited, a telecommunications equipment manufacturer and technology provider, announced the launch of 5G Lab, a service that accelerates the deployment of 5G solutions and services.

Europe

The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.15 billion by 2026.

List of Key Companies in 5G Testing Equipment Market

Rising Product Demand and Growing Focus on Partnerships and Acquisitions to Increase Reach

Market player’s focus drives the 5G testing equipment industry to transition consumers to 5G connection and supporting users by enabling more devices to run on a network. Additionally, market players focus on acquisition of small and local firms to expand their business presence. Moreover, acquisitions, mergers, partnerships, and collaborations with increasing investments in 5G technologies to increase the product demand is set to further drive market growth.

List of Key Companies Profiled:

- Keysight Technologies (U.S.)

- Anritsu (Japan)

- VIAVI Solutions Inc. (U.S.)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- TEKTRONIX, INC. (U.S.)

- Artiza Networks, Inc. (Japan)

- Mobileum (U.S.)

- Teradyne Inc. (U.S.)

- Spirent Communications (U.K.)

- EXFO Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Artiza Networks, Inc. launched a high-performance network testing product, FH MONITOR. This product is designed to accelerate O-RU debugging by offering streamlined capture evidence for test scenarios and analysis capabilities with the aim of creating a testing environment for RF developers.

- February 2024: Keysight Technologies Inc. collaborated with NVIDIA Corporation to introduce a comprehensive validation and training solution for neural receivers. This innovative 6G neural receiver design flow provides advanced insights and tools to enable the unified integration of AI abilities into wireless communication networks.

- January 2024: Anritsu successfully validated NB-IoT Protocol Conformance Tests on their ME7834NR, a 5G NR Mobile Device Test Platform, with Sony Altair device, with the aim of developing and deploying IoT devices in the regions without native cell network coverage.

- November 2023: Anritsu collaborated with AeroGT Labs, RanLOS, and TOYO Corporation (TOYO) to introduce the 5G antenna over-the-air (OTA) measurement system with Anritsu’s MT8000A, a 5G Radio Communication Test Station and RanLOS’ OTA test solution to create an important step in developments of 5G connected vehicles.

- May 2023: Tektronix, Inc., a provider of test and measurement solutions, launched the Double Pulse Test solution, WBGDPT. The Tektronix WBGPTD solution is capable of providing automated, repeatable, and accurate measurements of wide bandgap devices by supporting important advancements in solar energy, electric vehicles, and industrial controls.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.73% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

By Application

By End-User

By Region

|

Frequently Asked Questions

The market is projected to reach USD 4.68 billion by 2034.

In 2025, the market value stood at USD 2.19 billion.

The market is projected to grow at a CAGR of 8.73% during the forecast period.

The telecom equipment manufacturers segment is likely to lead the market.

Increasing usage of high-speed internet connectivity by 5G in IoT devices to aid market growth.

Keysight Technologies, Anritsu, VIAVI Solutions Inc., NATIONAL INSTRUMENTS CORP., TEKTRONIX, INC., Artiza Networks, Inc., Mobileum, Teradyne Inc., Spirent Communications, and EXFO Inc. are the top players in the global market.

North America is expected to hold the highest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us