Adventure Tourism Market Size, Share & Industry Analysis, By Type (Hard, Soft [Camping, Hunting, Hiking, and Others], and Others), By Age Group (Below 30 Years, 30 - 50 Years, and Above 50 Years), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

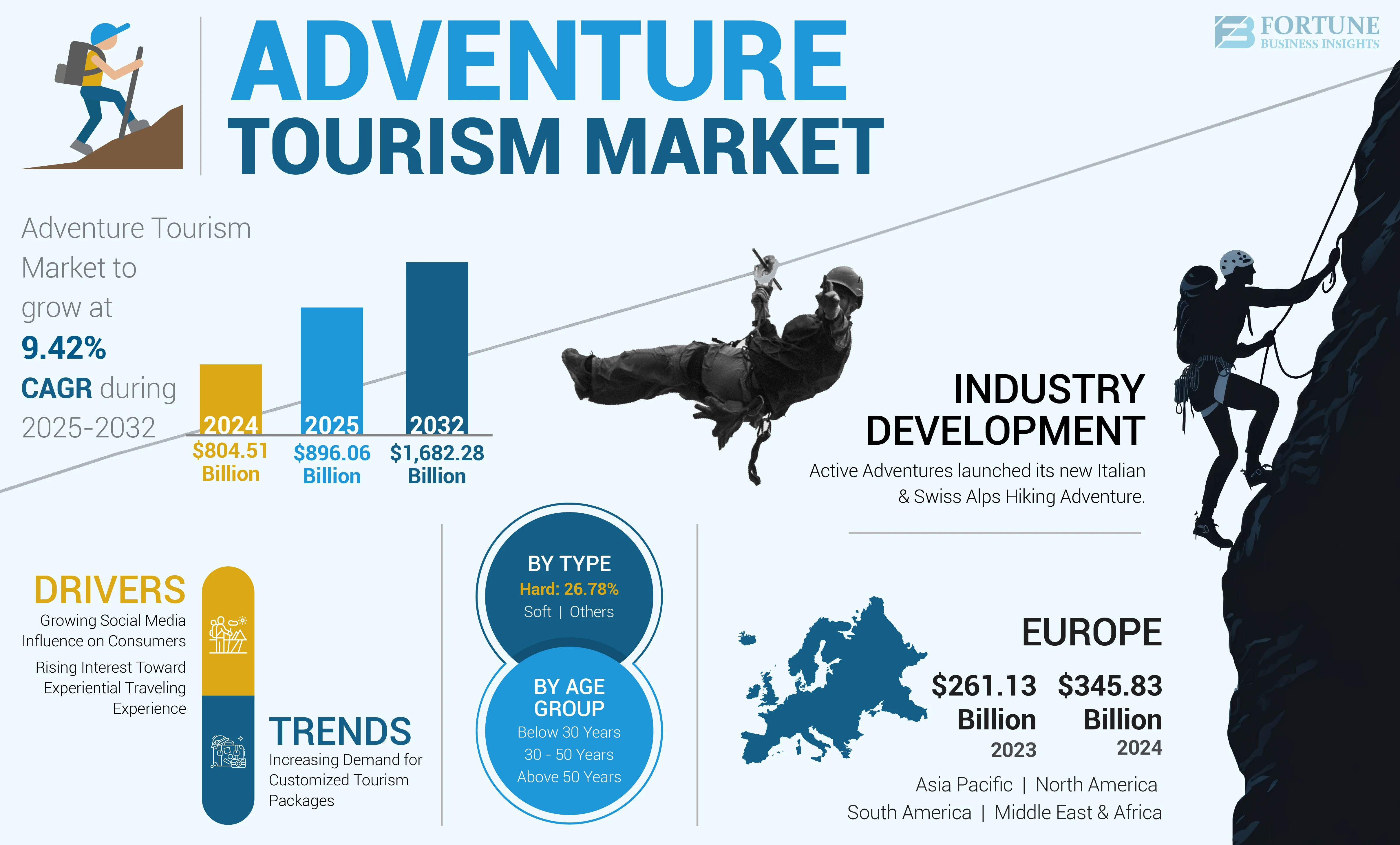

The global adventure tourism market size was valued at USD 804.51 billion in 2024. The market is projected to grow from USD 896.06 billion in 2025 to USD 1,682.28 billion by 2032, exhibiting a CAGR of 9.42% during the forecast period. Moreover, the adventure tourism market in the U.S. is expected to grow significantly, reaching USD 221.25 billion by 2032. The rising interest in experiential travel and outdoor adventures is fueling market expansion. Asia Pacific dominated the adventure tourism market with a market share of 42.99% in 2024.

Adventure tourism refers to tourist activities such as rafting, trekking, scuba diving, and climbing, which offer excitement beyond their comfort zone. Travelers explore newer kinds of tourism activities and prefer visiting undiscovered travel destinations. In this respect, increasing travelers' spending on excitement-involving tourism activities and the growing demand for related custom tour packages fuel the global market growth. In addition, evolving outdoor leisure and recreational trends are slated to favor the global services demand during the forecast period of 2024-2032. Moreover, increasing tour operators' partnerships with hospitality facility companies and adventure destination facilities accelerate the supply and demand of such services globally. At a macro level, the increasing number of national parks and trekking spots across countries propels the global market expansion.

The value chain of the global market involves a diverse set of essential elements, including industry stakeholders, marketing strategies, safety considerations, internal collaborations, and infrastructural development. Industry stakeholders typically comprise travel agencies and guides, transportation services providers, accommodation services providers, food & beverage services providers, adventure services providers, and adventure gear providers.

During the COVID-19 pandemic, lockdowns, travel restrictions, and increased health concerns sharply reduced consumer spending on adventure tours. The closure of adventure tours and accommodation facilities and limited travelers’ accessibility to transportation facilities also severely impacted market growth.

Higher travelers’ necessities of staying at indoor places, including travel accommodation and hospitality facilities, contributed to service revenues and supported market growth during the COVID-19 pandemic. However, the loosening of lockdown restrictions and reopening of adventure tourism facilities have increased the number of travelers availing themselves of adventure tourism services globally in the post-COVID-19 phase.

GLOBAL ADVENTURE TOURISM MARKET SNAPSHOT

Market Size & Forecast:

- 2024 Market Size: USD 804.51 billion

- 2025 Market Size: USD 896.06 billion

- 2032 Forecast Market Size: USD 1,682.28 billion

- CAGR: 9.42% from 2025–2032

Market Share:

- Asia Pacific dominated with a 42.99% share in 2024, driven by rising domestic and international interest in outdoor travel, especially in China, India, and Southeast Asia.

- Soft adventure (hiking, camping, fishing) led by increasing recreational site availability and family-friendly demand.

- The 30–50 age group holds the largest share, supported by a growing preference for family trips and experiential travel among working adults.

Key Country Highlights:

- U.S.: Expected to reach USD 221.25 billion by 2032; surge in customized tours and experiential travel among millennials and Gen Z.

- India: Government campaigns and local tourism infrastructure boost domestic adventure travel, especially trekking and rafting.

- France & Spain: Cultural and nature-based adventure tourism remains strong; heritage destinations gain traction.

- China: Social media-driven travel, rising disposable income, and eco-tourism push growth.

- Brazil & UAE: Surfing, sandboarding, and safari experiences gain popularity; government support for infrastructure boosts regional adventure offerings.

Adventure Tourism Market Trends

Increasing Demand for Customized Tourism Packages to Fuel Market Growth

Customized tourism packages allow consumers to personalize their traveling packages according to their interests and preferences. As the demand for personalized tourism packages increases, tour operators and travel agencies are incentivized to diversify their offerings to cater to different niche markets, including adventure tours. The companies aim to develop specialized adventure packages tailored to specific interests, skill levels, or demographics, such as family-friendly adventures, eco-conscious outdoor experiences, and others. This expansion of adventure travel options attracts a broader range of travelers, stimulating market growth.

- Asia Pacific witnessed adventure tourism market growth from USD 261.13 billion in 2023 to USD 345.83 billion in 2024.

Moreover, customized tourism packages often include value-added services such as personalized schedules, expert guides, transportation, and accommodations personalized to the needs of adventure travelers. The increasing popularity of these convenience encourages industry stakeholders to introduce more customized holiday packages. For instance,

- In December 2022, MakeMyTrip, an international tour and travel company, developed technological capabilities for introducing "Dynamic Itineraries," enabling travelers to personalize and purchase holiday packages online in real-time. Through this feature, travelers can explore various package options by applying filters such as destination city, travel date, and duration.

Download Free sample to learn more about this report.

Adventure Tourism Market Growth Factors

Rising Interest Toward Experiential Traveling Experience to Boost Market Growth

Modern travelers, mostly millennials and Gen Z population, seek authentic and immersive experiences that allow them to connect with local cultures, landscapes, and communities. Adventure tours provide individuals with this authenticity, creating opportunities to engage with nature and regional traditions in expressive ways. Moreover, the young generation prioritizes work-life balance and values experiences outside of the workplace. Hence, traveling allows individuals to disconnect from work, recharge, and rejuvenate, leading to improved mental health and overall well-being, which increases the demand for adventure tour services.

- According to UN Tourism Statistics, young adult tourism is swiftly emerging as one of the most rapidly expanding sectors within international travel. It constituted over ~23% of the total number of tourists venturing abroad annually, which exceeded 1 billion in 2019.

Growing Social Media Influence on Consumers to Favor Market Expansion

The rising influence of social media on consumers significantly boosts the demand for adventure travel services. Social media platforms, such as Facebook, Instagram, and YouTube, have emerged as powerful tools for sharing compelling images, stories, and videos that highlight the thrill and excitement of adventurous activities. In this respect, observing captivating visuals of other individuals skydiving, exploring remote trails, or diving in exotic underwater locales can spark the desire to replicate those experiences among the users, fueling the market growth. This inspiration is particularly effective among younger travelers who are active on social media platforms, encouraging adventure tourism businesses to emphasize social media marketing efforts and stay competitive in the adventure tourism industry.

RESTRAINING FACTORS

Rising Safety Concerns May Hamper Demand for Adventure Tourism Services

The rising concerns regarding consumer safety during tourism activities impede the adventure tourism sector’s growth. Despite the increasing popularity of adventurous travel experiences, an expanding number of individuals perceive adventure tour activities as integrally risky, particularly when they involve activities such as rock climbing, whitewater rafting, or skydiving. In this respect, the fear of injury or accidents discourages potential participants from engaging in these activities, limiting the demand for relevant services globally.

- According to a study published by the National Institutes of Health on ‘Analysis of the Characteristics and Causes of Night Tourism Accidents in China’ in January 2023, the top category for accidents occurs at entertainment venues, representing 30.8% of incidents, with theme parks having the highest occurrence rate at 9.35%

Adventure Tourism Market Segmentation Analysis

By Type Analysis

Increasing Number of Camping Sites and Hiking Locations to Fuel Demand for Soft Activities

The global adventure tourism market is segmented into hard, soft, and others, based on type.

The soft segment dominated the global market in 2023. Soft adventure travels typically include land-based activities such as camping, hiking, hunting, and canopy tours. The rising number of camping sites and hiking locations globally contributes to the popularity of soft activities, increasing the global market share. In addition, the increasing participation in recreational outdoor activities, such as hiking and fishing fuel the segmental revenue growth. For instance, according to the American Sportfishing Association, a U.S.-based association, over 54.5 million Americans went fishing in 2022, with an increase of 2.1 million compared to the previous year.

The hard segment is growing rapidly due to the increasing availability of water-based activities, including river rafting and scuba diving, notably across coastal countries. The growing demand for winter outdoor activities, including skiing, sledding, ice climbing, and snowboarding, also fuels the demand for hard adventure tour services globally. For instance, The hard segment is expected to hold a 26.78% share in 2024.

- According to the National Ski Areas Association (NSAA), a U.S.-based association, over 64.7 million skiers visited ski areas in the U.S. during 2022-2023, a 6.6% increase compared to the previous season.

To know how our report can help streamline your business, Speak to Analyst

By Age Group Analysis

Emerging Trend of Family Trips to Encourage Individuals in the 30-50 Years Category to Pursue Adventure Travel Experiences

The global market is segmented into below 30 years, 30 - 50 years, and above 50 years based on age group.

The 30-50 years segment leads the global adventure tourism market share. The individuals in this age group are typically married and have children. In this regard, the emerging trend of family trips within this age group is significant, given the need for more family time and memorable experiences. Several prominent players including Intrepid Travel, Butterfield & Robinson, Backroads, and others are launching family tours. For instance, in April 2024, Backroads, a California, U.S.-based adventure travel company, announced its new Multi-Adventure Trips for families across various countries, including Belgium, Scotland, and Slovenia. Increasing married couples’ spending on such kind of trips is slated drive the 30-50 years segmental revenue during 2024-2032.

The above 50 years segment is growing rapidly, driven by the increasing demand for luxury adventure tours. Travel agents and key players in the market launch new and attractive adventure tours to attract premium customers. For instance, in September 2023, Mountain Travel Sobek, a California, U.S.-based adventure travel company, launched six new adventure tours, including Luxury Patagonia Hiking and Galápagos & Ecuadorian Cloud Forest.

REGIONAL INSIGHTS

Geographically, the global market analysis covers North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Adventure Tourism Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Led by France and Spain, Europe dominates the global market. Increasing travelers’ demand for culture-related adventure travel and the growing trend of traveling and exploring undiscovered cultural destinations in Germany, Spain, and Italy fuels the regional market growth. In addition, growing travelers’ preference for nature-inspired travel destinations creates lucrative opportunities for tour operators to increase their service revenues across Europe.

North America emerged as the second-leading market in 2023. Increasing international arrivals in the U.S. and Mexico drive the North American adventure tourism market growth. In addition, the rising availability of custom holiday packages targeting couples and evolving outdoor recreation and leisure trends accelerate service revenues across the region.

Asia Pacific is forecast to witness rapid growth throughout the forecast timeframe (2024-2032). Tourism industry associations and government organizations launch promotion campaigns to attract foreign investments in the local tourism industry, notably in China, India, and Southeast Asia. Such efforts positively influence domestic and international travelers to spend on adventure tours. For instance,

- In January 2024, Lao government officials conducted an ASEAN Tourism Seminar to implement various strategies to promote the local adventure tourism industry. The government also opened a platform for academics and tourism experts to gather ideas for collaborating and developing tourism in the country.

The demand for adventure travel across the South American and the Middle East & African markets is forecast to witness positive growth in the foreseeable future. Increasing domestic and international travelers' interest in surfing, bicycle riding, and skiing activities, coupled with growing infrastructural facilities related to adventure travel locations, bolsters the demand for tourism-related services across these regions.

KEY INDUSTRY PLAYERS

Major Players Emphasize Mergers & Acquisitions to Stay Competitive

Key industry participants focus on mergers & acquisitions to stay ahead of the competition and achieve greater brand reputation. For instance, in January 2024, Travel + Leisure Co., a global membership and leisure travel company, acquired Accor’s Vacation Club business for USD 48.4 million. This acquisition will likely enable the company to increase its base of 24 resorts and nearly 30,000 members located in the Asia Pacific, Turkey, and the Middle East & Africa in the near future.

List of Top Adventure Tourism Companies:

- Active Adventures (New Zealand)

- Intrepid Travel (Australia)

- Butterfield & Robinson (Canada)

- G Adventures (Canada)

- TUI Group (Germany)

- Geographic Expeditions Inc. (U.S.)

- ROW Adventures (U.S.)

- Mountain Travel Sobek (U.S.)

- Cox & Kings Ltd. (U.K.)

- Discovery Nomads (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Active Adventures, a New Zealand-based adventure tourism company, launched its new Italian & Swiss Alps Hiking Adventure. According to the company, the adventure offers small group trips across Monte Rosa massif.

- August 2023: Modern Adventure, a provider of group tours and experiences, invested USD 4.8 million to expand its services business in the U.S.

- June 2023: Tourism Adventure Group (TAG), a global travel company, acquired Work & Travel Company, a shop service provider in Australia and New Zealand. This acquisition will enable the company to expand its business presence in these countries.

- June 2023: True North, an Australian luxury tourism company, partnered with Today the Brave, an advertisement company, to strengthen its brand reputation in Australia.

- January 2023: Desert Adventures Tourism (L.L.C.), a UAE-based destination management company offering services in the U.A.E. Oman and Jordan, signed a partnership agreement with Global Destinations, an Indian desert adventure services provider, to expand its business in the Indian market.

REPORT COVERAGE

The adventure tourism market report analyzes the market in-depth and highlights crucial aspects such as prominent companies and type and age group analysis. Besides this, the research report provides insights into the market trends and highlights significant industry developments.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.42% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Age Group

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 804.51 billion in 2024 and is anticipated to reach USD 1,682.28 billion by 2032.

Ascending at a CAGR of 9.42%, the global market is expected to exhibit steady growth over the forecast period.

By type, the soft segment dominated the market in 2024

The rising interest toward experiential traveling experience is poised to favor market expansion throughout the forecast period.

Active Adventures, Intrepid Travel, Butterfield & Robinson, G Adventures, and TUI Group are the leading companies across the globe.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us