Agricultural Robots Market Size, Share & COVID-19 Impact Analysis, By Product Type (UAVs/Drones, Livestock Farming Robots, Robotic Tractors, Automated Cultivation Systems), By Application (Farm Production, Dairy and Livestock, and Others (Specialty Crops)), and Regional Forecast, 2026-2034

Agricultural Robots Market Overview

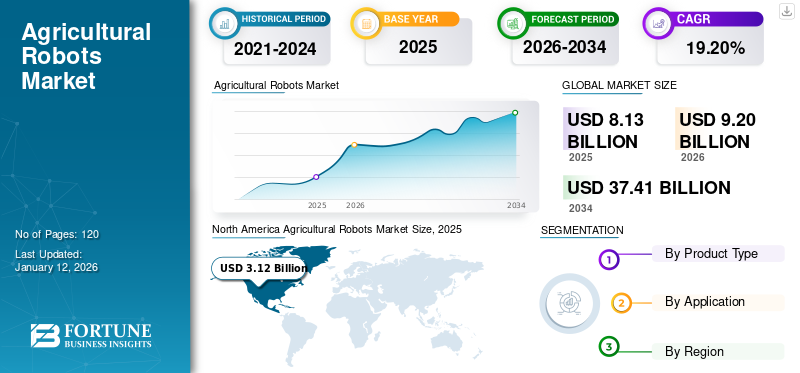

The global agricultural robots market is valued at USD 8.13 billion in 2025 and is projected to grow from USD 9.2 billion in 2026 to USD 37.41 billion by 2034, exhibiting a CAGR of 19.20% during the forecast period. The North America dominated global market with a share of 38.30% in 2025.

Agricultural robots are autonomous vehicles used in agricultural practices and animal husbandry, such as weeding, seeding, harvesting, pesticide spraying, milking, and other livestock farming applications. The integration of robotics and machinery has become essential in several agricultural practices such as precision farming, planting, fertilization, livestock monitoring, and post-harvest operations. The rising demand for food, limited workforce, versatile task-handling capacity of robots, and reduced long-term operating costs, is boosting the sales of robots used in agricultural practices. As per the Food and Agriculture Organization, the global crop demand is expected to rise by 60% by 2050. An increasing trend for smart farming across geographies is further anticipated to boost the agricultural robots market growth as they find application in weeding, harvesting, ploughing, and seeding.

Automation and digital revolution in the agricultural sector are experiencing strong growth across countries as a result of substantial investment and supportive policies for the end users. Innovative technologies and robotics are altogether increasing the overall productivity of agro-operations while reducing operating costs ultimately boosting the agriculture robots market share across geographies. Robots, such as drones, play a crucial role in land surveying, soil monitoring, irrigation, and spraying, providing valuable data, improving the health of soil and crops, and maximizing resource utilization for end users.

Several drone manufacturers are launching innovative technologies that are multifunctional in nature. For instance, DJI, a Chinese drone manufacturer, introduced two new models capable of spraying pesticides and conducting aerial seeding across farming, forestry, and aquaculture. The limited availability of skilled workforce and their growing costs are some of the prominent factors impacting the demand for agricultural equipment and farm automation across developing and developed countries. Farmers have been using chemical fertilizers and pesticides to promote crop yields, which has led to a reduction in soil nutrients and made soil less fertile, which is creating popularity for mobile robotics and precision farming. Several robot manufacturers are raising investments and introducing autonomous machines that offer smart and sustainable farming and provide high-value crops to end users. For instance, in December 2022, Naïo Technologies raised about USD 33 billion to expand its presence and double its robotic fleet over the next two years. With robotic solutions, the company aims to reduce its carbon footprint and limit the use of fertilizers across farmlands.

IMPACT OF COVID-19 ON THE AGRICULTURAL ROBOTS MARKET

Supply Chain Disruptions Amid The Pandemic Led to a Huge Demand-Supply Gap

The COVID-19 crisis witnessed trade barriers and supply chain disruptions across borders, generating a huge demand-supply gap in agricultural products. The pandemic crisis resulted in restrictions on farming and meat supplies, ultimately impacting the robotics market growth. The pandemic crisis had a small impact on the global agriculture robots market. During the post-pandemic, the demand for agricultural products has seen steep growth in advanced technologies to boost sustainable farming and increase crop yields. Robots play a crucial role in crop monitoring and soil analysis, gaining traction across several countries in order to improve crop and soil quality. Technological innovations are expected to surge the production of farm produce such as grains, cereals, vegetables, and fruits. After the pandemic, the demand for robots is estimated to grow at a considerable rate owing to their multi-tasking features, reduced long-term costs for the end users, and intensive demand for specialty crops. Robots and farm automation are transforming agricultural practices and providing solutions over traditional farming solutions.

AGRICULTURAL ROBOTS MARKET TRENDS

Improved Precision Farming with Drone Technology is a Latest Trend

Drones/Unmanned Aerial Vehicles UAVs are extensively being used in soil and crop monitoring, spraying, planting, irrigation, and field monitoring applications. New-age farmers are efficiently utilizing fertilizers and pesticides to boost crop yield, focusing on data-driven farming, crop spraying, monitoring, irrigation, and livestock health assessments. Farmers are performing efficient field planning through drones by analyzing weather conditions, nutrient contents, and soil fertility. Crop surveillance and supervision help end users address the timely harvesting of crops, especially seasonal and specialty crops, generating growth prospects for unmanned aerial vehicles in the agricultural sector.

Efficient and reduced operational delays, optimal resource utilization, and low cost of ownership are the benefits for end users, creating huge market demand for UAVs. Government initiatives are boosting the use of drones for farming practices. For instance, in 2022, the government of India offered 100% subsidiaries to ICAR institutes, farm machinery training and testing institutes, and state agriculture universities.

Download Free sample to learn more about this report.

AGRICULTURAL ROBOTS MARKET DRIVING FACTORS

Demand for Efficient and Sustainable Farming to Propel Market Progress

Robots and technological innovations are creating strong opportunities for farming and agricultural activities. The rising demand for efficient, sustainable, and enhanced crop yields is positively impacting robot technology. These technological innovations, increased connectivity, and data-based decision-making are optimizing several aspects of precision farming that are ultimately surging the growth of robots in the agricultural sector. Several economic benefits, government policies supporting sustainable farming, education, and awareness about precision farming are all benefitting the market for agricultural robots, such as drones, harvesting robots, and weeding and planting robots. Integration of robots and machinery in agriculture is experiencing significant market growth. Robots in agricultural activities are aiding farmers by reducing their operating costs over the workforce, monitoring crop yields, and performing harvesting activities simultaneously. Manufacturing companies are also focusing on introducing compact-sized and multifunctional robots for harvesting and other agricultural tasks. For instance, DENSO and Certhon, in a partnership, introduced the Certhon Harvest Robot in 2021, designed for detecting, cutting, and transporting tomatoes to storage boxes.

RESTRAINING FACTORS

Initial Cost of Investment and Complexity of Technology to Slow Down the Market Growth

While robots contribute to long-term cost reduction, their initial investment poses a significant short-term expense, potentially hindering the demand for autonomous machines in agriculture. The utilization of these robots in challenging environmental conditions raises concerns about potential damage from factors such as dirt, dust, and extreme weather. Managing these machines involves the expertise of trained professionals, posing a challenge for end-users. Additionally, the availability of an ample workforce in developing countries may impede the widespread adoption of robots in certain regions.

SEGMENTATION OF AGRICULTURAL ROBOTS MARKET

By Product Type Analysis

UAVs/Drones Segment to Lead Owing to Demand for Affordable Crop Monitoring Solutions

Based on product type, the market is categorized into UAVs/drones, livestock farming robots, robotic tractors, and automated cultivation systems.

UAVs/drones will dominate the market with a share of 46.52% in 2026. Unmanned aerial vehicles are experiencing substantial demand in agricultural activities driven by their data provision and optimum resource utilization. UAVs aid in detecting plant health and growth patterns of crops, enhancing crop yields, and tracking nutrient levels. Along with efficient plantation activities, the drones also help identify potential issues such as disease outbreaks, nutrient deficiencies, and weed infestations. With cost-effective solutions, the thermal cameras and sensors used in drones provide early detection of crop health and prevent end users from potential yield losses.

The market growth for UAVs/drones is followed by livestock farming robots owing to rising meat production and consumption across geographies. UAVs/drones, owing to their accessibility and affordability, are projected to be an attractive option for farmers in the long run.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Farm Production Segment to Hold the Highest Market Share Owing to Growing awareness about Healthy Food Consumption

Based on application, the market is segmented into farm production, dairy and livestock, and others. Others include specialty crops, turf, ornamentals, fibre crops, and silage.

The farm production segment is poised to capture the highest market share of 76.85% in 2026 among other applications. The COVID-19 crisis considerably raised awareness about healthy food consumption, boosting demand for several types of cereals, grains, oilseeds, pulses, fruits, and vegetables. Increased consumer demand for varied food products, commodities, and different types of fruits and vegetables, is generating demand for autonomous vehicles to facilitate larger farm production across different geographies. Furthermore, supportive government investment and flexible trade policies are creating demand for agricultural staple products and commodities, with farm production catered to over 3/4th of the agricultural robots market revenue in 2022.

Workforce constraints in agricultural production and harvesting practices, coupled with the reduced long-term operating costs of autonomous vehicles, are making them indispensable for end users, generating a strong demand for robots in farming practices. Enhanced agricultural output and optimized crop yield are factors fueling the growth of autonomous robots across several agro-based countries.

REGIONAL ANALYSIS OF THE AGRICULTURAL ROBOTS MARKET

Based on region, the market is studied across into North America, Europe, the Asia Pacific, South America, and the Middle East & Africa.

North America Agricultural Robots Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America has been predominantly generating strong market revenue, accounting for over one-third of the total revenue, surpassing other regions. The region’s dominance is driven by workforce shortage and rising demand for food, meat, and other processed food products, positioning North America to dominate the agricultural robots market share in the coming years.

Automation continues to grow at a rapid pace, strengthening agriculture and livestock farming practices across the region by ensuring efficient output. Key authorities and government departments are actively supporting the region through capital investment to enhance farm produce with sustainable solutions. Key robot manufacturing companies and start-ups are developing and introducing innovative and tech-enabled integrated solutions for farmers. In the livestock farming sector, stagnant dairy and meat product consumption will spur the growth of robots, such as milking and feeding robots, across the region. Growing consumer preference toward healthy, organic, and natural food items to surge the growth of autonomous machines used in specialty crop production. Several agricultural equipment manufacturers are collaborating with robotic solutions providers to penetrate the untapped market for robots, developing market opportunities for agricultural robots during the forecast period.

Farm automation is rapidly advancing in the U.S., with integrated technological solutions playing a crucial role in optimizing crop yield, enhancing crop quality, and reducing environmental impact. Drone imagery, sensor technology, precision farming, and automated equipment in farm operations are boosting the demand for smart farming across the U.S. Robots play a crucial role in providing data-based solutions and agronomical parameters for the crops and soil to address any related issues such as the risk of pests, diseases, and development of weeds which is contributing toward the increase in agricultural robots’ market share. The U.S. market is projected to reach USD 2.75 billion by 2026.

The rising demand for food and beverages, coupled with supportive government policies, is expanding the product demand. For instance, The U.S. Department of Agriculture (USDA) will be making capital expenditure of about USD 12.5 Million to support small agricultural businesses and other research programs.

To know how our report can help streamline your business, Speak to Analyst

Europe

Government initiatives by several nations in the European region are projected to create growth opportunities for robots. For instance, The European Commission has funded a farming project named Robs4Crops that aims to scale robotic implementation in farming and reduce workforce dependency on repetitive tasks such as weed control and spraying pests. Trials for this project are to be conducted in commercial farms in the Netherlands, France, Spain, and Greece in year 2022. The UK market is projected to reach USD 0.32 billion by 2026, while the Germany market is projected to reach USD 0.88 billion by 2026.

Asia Pacific

Asia Pacific shows the highest growth prospects for the application of robots in farming and horticulture activities. In the Asia Pacific region, heavy agricultural operations are driven by a large population and increasing trade across borders. Rising trends toward sustainable food practices and the demand for efficient and high-quality farm products are boosting the deployment of technological solutions across the region. Start-ups in developing countries such as India, Vietnam, and China are securing significant funds to develop small agricultural robots for end users. The Japan market is projected to reach USD 0.43 billion by 2026, the China market is projected to reach USD 1.44 billion by 2026, and the India market is projected to reach USD 0.41 billion by 2026.

South American

South American countries such as Brazil and Argentina are prominent exporters of agro-products such as meat, soybeans, fruits, and vegetables, with a steady growth in trade surplus over the past two decades. The market’s steady growth in capital expenditure on agricultural innovation shows a considerable growth for robots.

Middle East & Africa

Farmers in the Middle East & Africa are embracing technology-based solutions in their agricultural settings owing to increased overall productivity, reduced workforce and operating costs, and enhanced monitoring solutions. Sustainable practices and supportive policies are fostering the demand for the adoption of modern agricultural equipment such as drones and weeding robots.

COMPETITIVE LANDSCAPE

Heavy Capital Expenditure and New Product Launches To Create Market Opportunities For the Market Participants

Key players in the market are making huge investments in research and development activities to provide multifunctional and integrated robotic solutions for end users. Start-up companies are raising significant funds to tap into the potential and untapped market.

CNH Industrial, Deere & Company, AGCO Corporation, Yanmar Holdings Co., Ltd, and Lely are focusing on expanding through mergers and acquisition strategies and are also striving to widen their product portfolios for a varied range of applications.

John Deere strives to deliver automated solutions through smart machines and advanced technology.

- In 2021, John Deere acquired Bear Flag Robotics to expand its product portfolio by adding autonomous technology solutions such as robotic tractors to Deere’s portfolio and penetrating the market.

LIST OF KEY COMPANIES PROFILED:

- Deere & Co. (U.S)

- DJI (China)

- CNH Industrial (U.K.)

- AGCO Corporation (U.S.)

- DeLaval (Sweden)

- YANMAR HOLDINGS CO., LTD (Japan)

- Lely (Netherlands)

- BouMatic Robotics (Canada)

- AgEagle Aerial Systems Inc (U.S.)

- Robert Bosch GmbH (Germany)

- Naïo Technologies (France)

RECENT KEY DEVELOPMENTS IN THE AGRICULTURAL ROBOTICS INDUSTRY:

- December 2023: Chipotle Mexican Grill would be investing in Greenfield Robotics, a Kansas-based regenerative farming company, to expand the presence of agricultural robots globally.

- November 2023: Chinese drone manufacturer DJI introduced two models of drones, the T60 and T25P, designed for diverse application such as farmland spraying and aerial seeding. These drones are lightweight and used in agriculture, forestry, and aquaculture.

- September 2023: Robotics Plus, a New Zealand-based agri-tech company launched a multi-purpose autonomous robot named Prospr for orchard and vineyard crop harvesting.

- July 2023: P100, an agricultural drone was launched by XAG in Vietnam that is fully autonomous, easy to operate, and has a high payload capacity of up to 50 kg.

- June 2021: CNH Industrial N.V. acquired 100% stock of Raven Industries during the fourth quarter of 2021. The acquisition aimed to expand its equipment presence in the agricultural sector across various geographies.

- August 2021: TartanSense offered agricultural robots for small farmers to perform activities such as weeding, pest control, sowing, spraying, and harvesting by raising funds of about USD 5 billion in Series A round led by FMC Ventures.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2023 to 2030 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 19.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market stood at USD 9.2 billion in 2026.

According to Fortune Business Insights, the market will reach USD 37.41 billion by 2034.

Growing at a CAGR of 19.20%, the market will exhibit strong growth during the forecast period.

Growing automation in farming activities and awareness about precision agriculture is a key factor driving market growth.

The top companies in the market are CNH Industrial, Deere & Company, AGCO Corporation, Yanmar Holdings Co., Ltd, and Lely.

The North America dominated global market with a share of 38.30% in 2025.

UAVs/drones are expected to hold the highest share in the market.

The farm production segment to hold the highest market share during the forecast period.

Aerial robots gaining momentum in the market owing to their several benefits such as fertilizer spraying, crop, and soil monitoring.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us