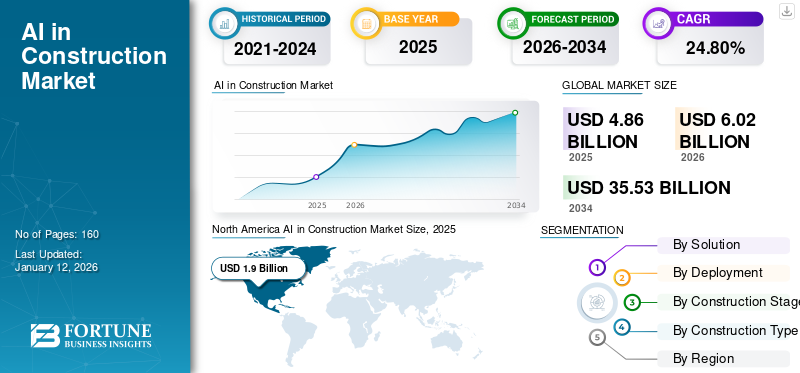

AI in Construction Market Size, Share & Industry Analysis, By Solution (Project Management, Risk Management, Schedule Management, Supply Chain Management, and Others), By Deployment (Cloud and On-premises), By Construction Stage (Pre-construction, Construction, and Post-construction); By Construction Type (Residential, Industrial, Commercial, Infrastructure), and Regional Forecast, 2026-2034

AI in Construction Market Size

The global AI in construction market size was valued at USD 4.86 billion in 2025 and is projected to grow from USD 6.02 billion in 2026 to USD 35.53 billion by 2034, exhibiting a CAGR of 24.80% during the forecast period. North America dominated the AI in construction market with a market share of 39.10% in 2025.

AI in construction is a segment of the construction industry focused on the development, implementation, and utilization of Artificial Intelligence (AI) technologies to improve various aspects of construction work. It involves the deployment of AI-driven solutions, such as machine learning algorithms, computer vision systems, and natural language processing tools to optimize processes, such as project management, risk management, schedule management, supply chain management, quality management, and safety management. The market is driven by the increasing demand for efficiency, reducing cost, enhancing safety, and sustainability across construction projects. It is a growing sector with significant potential for innovation and transformation within the construction industry.

Market Size & Growth:

- 2025 market size: USD 4.86 billion

- Projected 2034 market size: USD 35.53 billion

- Compound Annual Growth Rate (CAGR, 2026–2034): 24.80%

- 2026 projected market size: USD 6.02 billion

Regional Leadership:

- North America market share (2025): 39.10%

- Europe: Second largest market, focus on sustainability and efficiency

- Asia Pacific: Expected highest CAGR due to rapid urbanization and construction investment

Major Drivers & Trends:

- Increased demand for project efficiency, safety, cost reduction, and sustainability

- Generative AI adoption: innovation in design, scheduling, risk management, and simulation

- Growth in predictive analytics and risk management tools

- Transition to cloud-based AI deployments for scalability and collaboration

- Emphasis on delivering high-quality and timely commercial projects

Market Segmentation:

- By solution: project management, risk management, schedule management, supply chain management

- By deployment: predominance of cloud solutions over on-premises

- By stage: construction (largest share), pre-construction (fastest growth)

- By type: commercial (largest), residential (fastest growing)

Challenges / Barriers:

- Concerns regarding data privacy, security, liability

- High initial investment costs and slow technology adoption

- Data fragmentation and unstandardized construction data

The COVID-19 pandemic accelerated the adoption of AI in the construction industry as companies sought ways to increase efficiency and minimize physical contact. AI-powered solutions, such as remote monitoring, predictive maintenance, and autonomous machinery became more crucial for maintaining productivity while adhering to social distancing guidelines. Additionally, the need for digital transformation to mitigate disruptions caused by the pandemic further drove investments in AI technologies within the construction industry.

IMPACT OF GENERATIVE AI

Introduction of Advanced Algorithms for Boosting Creativity and Efficiency in Architectural Solutions to Aid Market Growth

Generative AI technology influences AI in construction by fostering innovation in design, streamlining construction processes, and enhancing simulation capabilities. Through generative AI algorithms, a multitude of design options can be swiftly generated based on input parameters. This will increase creativity and efficiency in architectural solutions while reducing time and costs in the design phase. Furthermore, generative AI optimizes construction processes by generating schedules, resource allocation plans, and logistics strategies to maximize efficiency and minimize waste. This data-driven approach enables informed decision-making and proactive risk management, eventually improving project outcomes. Moreover, generative AI facilitates the simulation of diverse construction scenarios, such as structural analysis and energy efficiency modeling, aiding in risk assessment and sustainability practices.

- As per industry experts the global AI software market is anticipated to surge from USD 64 billion in 2022 to reach USD 251 billion by 2027, with a CAGR of 31.4%. This includes various AI-centric software categories. Moreover, the Generative AI platforms and applications are estimated to generate USD 55.7 billion in revenues by 2027.

Therefore, generative AI transforms the construction industry by revolutionizing design creativity, process optimization, and risk management, leading to more efficient, sustainable, and cost-effective construction sites.

AI in Construction Market Trends

Increasing Demand for Predictive Analytics and Risk Management in Construction Industry to Accelerate Market Growth

The rising adoption of AI-based solutions for predictive analytics and risk management is driving the growth of the market. Construction firms are increasingly leveraging advanced machine learning algorithms to analyze extensive datasets, including project schedules, budgets, material usage, and performance metrics. By identifying patterns and correlations within this data, AI algorithms can forecast potential risks and delays in construction projects. This trend is fueled by the industry's growing acknowledgment of the significance of proactive risk management in ensuring project success. By employing AI for predictive analytics, construction companies can anticipate and address potential issues before they escalate, thereby minimizing delays, cost overruns, and disruptions.

Moreover, AI-driven predictive analytics enables construction firms to optimize resource allocation, enhance scheduling accuracy, and refine project planning processes. This shift toward data-driven decision-making represents a significant driver for AI in construction as companies recognize the value of harnessing AI for building information modeling. For instance,

- Autodesk and Deloitte's research highlights that enhanced data utilization significantly enhances on-site safety conditions, a benefit acknowledged by 24% of businesses.

Download Free sample to learn more about this report.

AI in Construction Market Growth Factors

Constant Need for Improved Efficiency and Productivity in Construction Industry to Fuel Market Growth

The growing need for enhanced efficiency and productivity within the construction sector serves as a primary driver propelling the AI in construction market growth. Construction projects are inherently intricate, characterized by multiple variables, stringent timelines, and financial constraints. Traditional project management approaches often prove inadequate, leading to delays, budget overruns, and compromised quality. To address these challenges, construction companies are increasingly embracing AI-powered solutions. These solutions leverage advanced technologies, such as machine learning, computer vision, and natural language processing to automate tasks, analyze extensive datasets, and facilitate real-time decision-making. For instance,

- Industry experts suggest that AI could automate up to 49% of construction tasks.

Integration of AI in construction processes enables companies to optimize project planning, scheduling, risk management, quality control, and safety hazards monitoring. This empowers them to execute projects more efficiently, meet deadlines, adhere to budgets, and deliver high-quality results. Therefore, the rising demand for improved efficiency and productivity is fueling the adoption of AI solutions in the construction industry.

RESTRAINING FACTORS

Concerns Regarding Privacy, Security, and Liability to Impede Market Growth

The industry’s traditional nature and slow adoption of technology can hinder the integration of AI. The complexity of construction projects involving various stakeholders and unpredictable environments presents challenges for AI algorithms to navigate effectively. Data availability and quality also pose significant hurdles as construction data is often fragmented and unstandardized. Furthermore, concerns regarding privacy, security, and liability can hinder the widespread adoption of AI in construction. Additionally, the high initial investments and perceived risks associated with AI implementation can deter some companies from embracing these technologies fully.

AI in Construction Market Segmentation Analysis

By Solution Analysis

Growing Need to Achieve Better Project Outcomes Fuels Adoption of Project Management Solutions

By solution, the market is segmented into project management, risk management, schedule management, supply chain management, and others. The project management solutions segment dominates the market due to its ability to automate repetitive tasks, optimize resource allocation, and predict potential risks, ensuring smoother project execution and higher profitability, with a market share of 33.06% in 2026. These AI-driven tools empower construction firms to achieve better project outcomes, making them a top choice for industry professionals seeking efficiency and competitiveness.

The risk management segment is anticipated to experience the highest CAGR as AI solutions offer predictive analytics, scenario planning, and real-time monitoring, enabling proactive identification and mitigation of risks. As construction projects become more complex and stakeholders seek to minimize uncertainties, the demand for AI-driven risk management tools is poised to surge, driving the segment’s growth.

By Deployment Analysis

Increasing Demand for Mobility, Collaboration, and Resource Optimization to Surge Adoption of Cloud Solutions

By deployment, the market is divided into cloud and on-premises. The cloud segment dominates the market due to its flexibility, scalability, and cost-effectiveness, enabling seamless access to AI tools and data from anywhere at any time, with a market share of 66.78% in 2026. As construction firms prioritize mobility, collaboration, and resource optimization, cloud-based AI solutions provide the ideal platform to meet evolving industry needs, driving their widespread adoption.

The on-premises deployment segment holds a lesser share of the market due to limitations in scalability, high upfront infrastructure costs, and maintenance requirements, which can be prohibitive for many construction firms.

By Construction Stage Analysis

Increasing Need to Meet Deadlines and Deliver High-Quality Construction Projects to Drive Product Use in Construction

Based on construction stage, the market is segmented into pre-construction, construction, and post-construction.The construction segment holds the highest market share, as AI technologies are most directly applied at this stage to optimize processes such as scheduling, resource allocation, and quality control, accounting for a 43.19% share in 2026. AI solutions at this stage streamline operations, reduce errors, and enhance productivity, making them essential for meeting deadlines and delivering high-quality construction projects efficiently.

The pre-construction segment is expected to record the highest CAGR as it is a critical phase where AI-driven tools enable accurate project estimation, risk assessment, and design optimization. For instance,

- Industry experts reveal that 37% of construction professionals have failed to meet budget or schedule targets in the past year. Additionally, only half of the project owners said that their projects are completed on schedule. Moreover, issues with budget and schedule can often be prevented with improved decision-making in the early stages of construction, thereby fueling the segment’s growth rate.

By Construction Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Need for Delivering Commercial Projects on Time to Drive Segment Growth

Based on construction type, the market is segmented into residential, industrial, commercial, and infrastructure. The commercial construction segment holds the highest share of the AI in construction market due to its scale, complexity, and high project stakes, as AI technologies optimize critical processes such as project management, scheduling, and budgeting, accounting for a 34.05% market share in 2026. Additionally, the potential for significant returns on investment in AI tools is encouraging commercial developers to adopt these technologies more readily, driving their dominance in this segment.

The residential construction segment is anticipated to record the highest CAGR due to increasing urbanization, rapid population growth, and rising demand for affordable housing.

REGIONAL INSIGHTS

The report includes market research across five regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America

North America AI in Construction Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global AI in construction market due to its highly developed construction industry and strong emphasis on innovation and technology adoption, with the market valued at USD 1.9 billion in 2025. The region's investment in AI research and development will foster the creation of advanced solutions tailored to the construction sector's needs. Additionally, supportive government initiatives, robust infrastructure, and a large number of construction projects will contribute to North America's leadership in the implementation of AI in construction. The U.S. market is projected to reach USD 1.81 billion by 2026.

Europe

Europe holds the second-largest share of the market due to the presence of a mature construction industry with a focus on sustainability, efficiency, and quality, thereby driving the adoption of AI technologies. Supportive regulations and standards are encouraging innovation and investment in AI solutions. The UK market is projected to reach USD 0.3 billion by 2026, while the Germany market is projected to reach USD 0.37 billion by 2026. Additionally, strong collaboration between research institutions, industry players, and government bodies will foster the development and deployment of advanced AI applications in construction across Europe. For instance,

- According to a study by the European Union Agency for Cybersecurity (ENISA), advanced economies have higher AI adoption rates.

Asia Pacific

Asia Pacific is expected to record the highest CAGR due to rapid urbanization, infrastructure development, and increasing investment in construction projects. As various countries across the region seek to address challenges, such as population growth and sustainable development, there's a growing recognition of the potential benefits of AI in improving construction efficiency and productivity. The Japan market is projected to reach USD 0.34 billion by 2026, the China market is projected to reach USD 0.41 billion by 2026, and the India market is projected to reach USD 0.29 billion by 2026. Additionally, the availability of skilled labor, emerging technologies, and government initiatives promoting digital transformation will further propel the adoption of AI in construction across the region. For instance,

- In June 2023, industry experts found that 38% of Indian companies surveyed had no plans to adopt digital technologies. However, digital supporters in various sectors prioritize resilience, transparency, and sustainability for future growth. They also stress the importance of innovation and faster time-to-market to remain competitive.

Middle East & Africa and South America

The Middle East & Africa and South America hold lesser shares of the market as they have smaller construction industries compared to other regions. Additionally, there may be slower adoption of advanced technologies, such as AI due to factors including limited infrastructure, regulatory barriers, and economic challenges. Moreover, cultural and organizational barriers may also hinder the widespread implementation of AI in construction in these regions.

Key Industry Players

Key Players Launch New Products to Strengthen Market Positioning

Key players operating in the AI in construction market are actively creating advanced solutions to meet customer demands. They are also focusing on enhancing their existing product portfolios to deliver flexible solutions with unique attributes. Furthermore, these organizations are proactively pursuing collaborations, acquisitions, and partnerships to bolster their product offerings.

List of Top AI in Construction Companies:

- Autodesk (U.S.)

- SAP SE (Germany)

- Bentley Systems (U.S.)

- ALICE Technologies Inc. (U.S.)

- Dassault Systèmes (France)

- Oracle Corporation (U.S.)

- Trimble Inc. (U.S.)

- Komatsu (Japan)

- Procore Technologies, Inc. (U.S.)

- Doxel (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: SAP SE unveiled advancements in its supply chain solutions, which are poised to surge manufacturing productivity, efficiency, and accuracy. AI-powered insights derived from real-time data will empower construction companies to leverage their data for informed decision-making throughout supply chains. This will optimize product development and enhance manufacturing efficiency.

- February 2024: Cadence Design Systems, Inc. extended its partnership with Dassault Systèmes at 3DEXPERIENCE World. They are integrating AI-driven Cadence, OrCAD X, and Allegro X with Dassault Systèmes' 3DEXPERIENCE Works portfolio for SOLIDWORKS users, facilitating seamless collaboration across PCB, 3D mechanical design, and simulation. This cloud-enabled integration offers an easy-to-use solution for next-gen product development, resulting in up to 5X faster design turnaround time.

- November 2023: Autodesk debuted Autodesk AI, a smart technology designed to inspire creativity, tackle obstacles, and enhance productivity across various sectors within the construction industry. The solution provides intelligent support and generative functionalities, enabling users to envision and innovate freely, offering precise and innovative results.

- November 2023: Trimble announced its Viewpoint Spectrum and Viewpoint Vista construction ERP software that features Automatic Invoicing. Integrating Azure AI Document Intelligence enhances the process by automatically converting paper and PDF invoices into validated entries within Spectrum and Vista. This streamlines workflows, saving contractors time and money.

- September 2023: Versatile, a data collection solution provider specifically for construction, collaborated with Procore Technologies Inc. This collaboration aims to streamline daily construction log updates with accurate site progress data. This advancement will automate data management, saving time, and enhancing accuracy for construction teams.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading construction stages. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

By Deployment

By Construction Stage

By Construction Type

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 35.53 billion by 2034.

In 2025, the market was valued at USD 4.86 billion.

The market is projected to record a CAGR of 24.80% during the forecast period.

By deployment, the cloud segment is expected to lead the market.

The constant need for improved efficiency and productivity in the construction industry will fuel the markets growth.

Autodesk, SAP SE, and Bentley Systems are the top players in the market.

North America dominated the AI in construction market with a market share of 39.10% in 2025.

By construction stage, the pre-construction segment is expected to record a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us