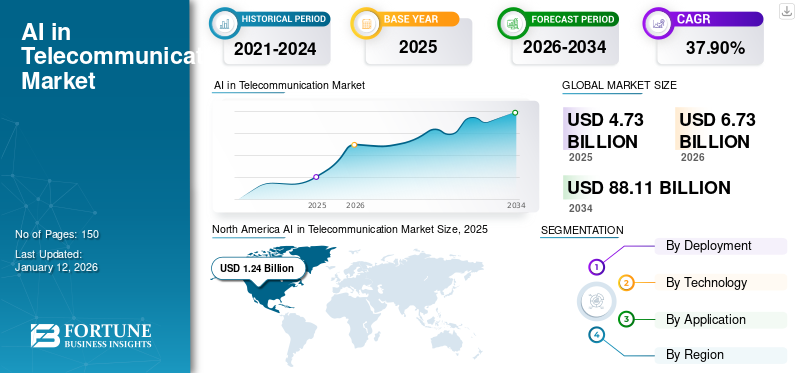

AI in Telecommunication Market Size, Share & Industry Analysis, By Deployment (Cloud and On-Premises), By Technology (Machine Learning, Natural Language Processing, Big Data, and Others (Deep Learning)), By Application (Network/IT Operations Management, Customer Service and Marketing VDAS, CRM Management, Radio Access Network, Customer Experience Management, Predictive Maintenance, and Others (Fraud Mitigation)), and Regional Forecast 2026– 2034

KEY MARKET INSIGHTS

The global AI in telecommunication market size was valued at USD 4.73 billion in 2025. and is projected to grow from USD 6.73 billion in 2026 to USD 88.11 billion by 2034, exhibiting a CAGR of 37.90% during the forecast period. North America dominated the global market with a share of 26.40% in 2025.

AI in telecommunications refers to the strategic implementation of artificial intelligence technologies to streamline operations, enhance service delivery, and drive business growth within the telecom sector. By leveraging AI algorithms and machine learning, telecom companies optimize network performance, automate routine tasks, and personalize customer interactions. It enables them to enhance operational efficiency, reduce operational costs, and stay competitive in a rapidly evolving market. AI's predictive capabilities also aid in anticipating network issues, ensuring uninterrupted service, and enhancing overall customer satisfaction, resulting in increased revenue and market share. The usage of AI in the telecommunication sector is rapidly growing worldwide, driven by the increasing demand for advanced network management, the need for personalized customer experiences, and the industry's drive for greater operational efficiency and cost savings.

- In February 2023, Deloitte and NVIDIA collaborated to launch AI-powered telecommunication solutions aimed at helping telecom clients improve operational efficiency and enhance machine learning, customer services using automation, and GPU-accelerated AI technologies. These solutions reduced transportation costs, optimized truck rolls, and improved customer satisfaction, highlighting the company’s commitment to delivering innovative AI solutions to the telecommunication industry.

The COVID-19 pandemic had a significant impact on the AI in telecommunication market growth, reshaping the industry's landscape in several ways. The increased reliance on remote work and digital communication due to lockdowns and social distancing measures drove up demand for AI-powered solutions to manage networks and enhance customer interactions. Furthermore, the economic downturn resulting from the pandemic led some telecom companies to reassess their budgets and prioritize investments in AI technologies for immediate cost savings or operational efficiencies.

- As per industry experts, there was an uptick in AI hiring, adoption, and investment, reflecting long-term industry trends expected to persist post-pandemic. Global investment in AI-focused private companies increased by 40% from 2019 to 2020, with a notable 27% of firms reporting increased investment in AI capabilities due to the COVID-19 pandemic.

Download Free sample to learn more about this report.

IMPACT of GENERATIVE AI

Leveraging Generative AI for Operationalizing Processes to Enhance Efficiency

Telecom companies are exploring the implementation of generative AI to understand the costs, ROI, and early use cases. This technology offers pathways for telecom providers to analyze unstructured data across different parts of their business, enabling them to break down data silos and deliver insights that enhance customer service and network performance. However, operationalizing generative AI requires building the right foundations, including modernizing data systems and ensuring data security and compliance. Telecom companies also consider options to build, buy, or rent generative AI training and inference capacity, as well as the costs and scalability of these options.

To advance their generative AI strategies, telecom companies need to secure the right talent and upskill frontline workers to leverage generative AI in their work effectively. They also need to prioritize security and risk analysis to mitigate potential vulnerabilities. While the impactful use cases for generative AI are still being discovered, larger telecom providers may need to embrace this technology to remain fully competitive. Telecom companies are experimenting with it to fully understand and leverage the potential of generative AI in their operations.

AI in Telecommunication Market Trends

Streamlined AI App Development Methodologies to Drive In-house AI Growth in Telecommunications

The telecommunications sector is witnessing a notable rise in the integration of AI in telecommunication technologies to enhance operational efficiencies and service offerings. A key driver of this trend is the adoption of streamlined AI application development methodologies, enabling telecom firms to swiftly deploy tailored AI solutions internally. This approach involves leveraging pre-built AI models and frameworks, significantly reducing the time and resources required for AI application development. As a result, telecom companies can expedite the creation and implementation of AI-powered solutions, such as network optimization, automated customer service, and predictive maintenance. Moreover, internal AI development empowers telecom firms to maintain control over their AI strategies, ensuring alignment with their strategic objectives and adherence to data privacy regulations. In essence, streamlined AI app development is enabling telecom companies to harness AI's transformative potential and drive innovation across the AI in telecommunication.

- In March 2023, SK Telecom launched its in-house AI chatbot, "A.," integrating services from e-commerce to music streaming and positioning it as a super app version of ChatGPT. ‘A.’ offered personalized experiences and was considered for international expansion.

AI in Telecommunication Market Growth Factors

Efficient Data Management and Automation to Drive Product Adoption

Telecom companies are increasingly turning to AI in telecommunication solutions to meet the growing demand for surveillance and classification of digital information. With the exponential increase in data volumes and the need to efficiently monitor and categorize it, AI offers advanced solutions that can automate these processes. AI algorithms can analyze vast amounts of data in real-time, identifying patterns, anomalies, and trends that would be challenging for human operators to detect. This capability is particularly valuable for telecom companies, enabling them to enhance network security, optimize network performance, and deliver personalized services to customers.

- In August 2023, the Telecom Regulatory Authority of India (TRAI) proposed incorporating AI in its new draft regulation for Quality of Service Standards to enhance network monitoring and quality measurement. The draft regulation also included a segmented approach to measuring Quality of Service standards across different segments of the telecommunications network.

This enhances the customer experience and helps telecom companies reduce operational costs by automating repetitive tasks. Overall, the integration of AI in telecommunication is driven by the need to efficiently manage and leverage the massive amounts of data generated in the industry, leading to improved services, increased efficiency, and enhanced customer satisfaction.

RESTRAINING FACTORS

Data Privacy Concerns and Lack of Skilled AI Talent to Hinder Market Growth

Data privacy concerns in the AI in telecommunications market stem from the need to handle vast amounts of sensitive customer data while ensuring compliance with regulations such as GDPR and CCPA. Telecom companies must implement stringent data protection measures and transparent governance practices to address these concerns effectively. Additionally, the shortage of skilled AI talent presents a significant challenge for telecom firms. The demand for data scientists, AI engineers, and other AI professionals exceeds the current supply, hindering the development and deployment of AI solutions in the telecom sector. This talent gap could impede AI in telecommunication market growth as companies struggle to find and retain qualified AI experts.

AI in Telecommunication Market Segmentation Analysis

By Deployment Analysis

Cloud Segment to Dominate owing to Cost-Effective AI Solutions

Based on deployment,The On-Premises segment is projected to dominate the market with a share of 53.46% in 2026, the market is bifurcated into cloud and on-premises. Cloud-based solutions are projected to exhibit the highest growth rate owing to their affordability and ease of availability for businesses. AI in telecommunication deployments is proliferating due to cloud deployments, as cloud infrastructure reduces the need for costly on-premises hardware and allows for flexible, scalable AI implementation. This shift is enabling telecom companies to adopt AI solutions more readily, driving efficiency and innovation in their operations.

- As per the NetApp 2023 State of CloudOps report, 70% of organizations have implemented cloud cost management solutions, including open-source, commercial, or custom options.

On-premises deployments hold the highest market share due to the need for data security and compliance, as well as the perceived control over infrastructure and data that comes with in-house setups. Additionally, the nature of telecom operations often requires low latency and high reliability, which are easier to achieve with on-premises solutions.

By Technology Analysis

Big Data Segment to Lead due to Surging Data Generation in Telecom Companies

Based on technology,The On-Premises segment is projected to dominate the market with a share of 53.46% in 2026, the market is segregated into machine learning, natural language processing, big data, and others, such as deep learning. Big data is projected to dominate the market share due to its ability to provide valuable insights into customer behavior, network performance, and operational efficiency, leading to improved decision-making and customer satisfaction. Additionally, the telecom industry generates vast amounts of data daily, and harnessing this data through big data analytics extends new revenue streams and business opportunities.

Machine learning technology holds the highest growth rate due to its versatility and ability to continuously learn from data, allowing it to adapt to diverse applications and industries. Moreover, the increasing availability of big data and advancements in computing power have accelerated the development and adoption of machine learning, fueling its rapid growth rate.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Network/IT Operations Management Segment to Show the Highest Growth Rate due to Complexity of Telecom Networks

As per application,The Customer Service and Marketing segment is projected to dominate the market with a share of 47.52% in 2026, the market is classified into network/IT operations management, customer service and marketing VDAS, CRM management, radio access network, customer experience management, predictive maintenance, and others. Network/IT operations management is projected to exhibit the highest growth rate due to the increasing complexity of telecom networks, including the integration of new technologies such as 5G and IoT, which require advanced management tools to ensure optimal performance and security. Moreover, the growing demand for real-time analytics and automation to enhance network efficiency and reduce downtime is driving the adoption of network/IT operations management solutions.

Customer service and marketing VDAs are dominating the AI in telecommunication market share due to their ability to enhance customer interactions, personalize marketing campaigns, and improve overall customer satisfaction. Additionally, these VDAs automate routine tasks, streamline operations, and aid telecom companies stay competitive in a rapidly evolving market.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

North America AI in Telecommunication Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.24 billion in 2025 and USD 1.72 billion in 2026. North America is poised to hold the highest market share due to its advanced telecommunications infrastructure, including robust network connectivity, high-speed internet, and widespread coverage, creating a conducive environment for implementing AI solutions. The region's growing number of telecom companies using automation and AI for customer service and network optimization purposes further support its market dominance. Additionally, North America's transforming technology and communications sector are driving the market for AI within the region. The region's increased investments in AI in telecommunications, along with the emergence of several vendors catering to the growing market, are expected to contribute significantly to its continued dominance.The U.S. market is valued at USD 0.93 billion by 2026.

- In December 2023, AT&T's USD 14 billion deal with Ericsson signaled a shift toward flexible wireless technology, challenging market dominance. Ericsson's Open RAN technology, adopted by Dish and Rakuten, offered competition and cost savings, accelerated by bans on Huawei, with AI playing a key role.

Asia Pacific is poised to exhibit the highest growth rate during the forecasted period, which can be attributed to several factors. Firstly, the region is experiencing significant technological advancements, particularly in emerging economies such as China and India, which are driving the adoption of Artificial Intelligence (AI) in various industries, including telecommunications. Additionally, the increasing demand for advanced telecommunications services and the growing number of mobile subscribers are fueling the need for AI-driven solutions to improve network efficiency and customer experience. Moreover, government initiatives and investments in digital infrastructure are further accelerating the adoption of AI in telecommunication in the region. The Japan market is valued at USD 0.36 billion by 2026, the China market is valued at USD 0.46 billion by 2026, and the India market is valued at USD 0.33 billion by 2026.

Europe is making strides in AI adoption within the telecom sector, with several countries leading the way in innovation. The U.K., Germany, and France are investing heavily in AI research and development, particularly in areas such as network optimization and customer service. Additionally, European telecom companies are increasingly leveraging AI to improve operational efficiency and offer more personalized services to customers. Despite these advancements, challenges such as data privacy regulations and the need for skilled AI professionals remain vital considerations for further growth in the region. The UK market is valued at USD 0.31 billion by 2026, while the Germany market is valued at USD 0.33 billion by 2026.

In the Middle East & Africa, AI adoption in the telecom sector is on the rise, driven by the increasing demand for advanced telecommunications services and the growing mobile subscriber base. The UAE and South Africa are at the forefront in implementing AI-driven solutions to enhance network performance and customer experience. In South America, the telecom sector is gradually embracing AI technologies to enhance service delivery and operational efficiency. Brazil and Argentina are spearheading AI adoption in the region, with telecom companies leveraging AI to optimize network infrastructure and enhance customer interactions.

Key Industry Players

Key players are expanding their Resources and Support toward AI-based Startups to Enhance Innovations

Key players in various industries are increasingly expanding their resources and support toward AI-based startups to enhance innovation. This trend is driven by the recognition of startups’ potential to bring disruptive innovation to the market. By investing in and collaborating with these startups, established companies can access new technologies and ideas to stay competitive and drive growth.

- For instance, in August 2023, SK Telecom, South Korea's largest telecom company, invested USD 100 million in Anthropic, a Google-backed AI startup. The funding is aimed at strengthening SK Telecom's telecommunications-driven AI business, showcasing a trend of established companies supporting AI startups to drive innovation and competitiveness.

List of Top AI in Telecommunication Companies

- Infosys Limited (India)

- IBM Corporation (U.S.)

- Cisco Systems Inc. (U.S.)

- Telefonaktiebolaget LM Ericsson (Sweden)

- Nokia Corporation (Finland)

- Intel Corporation (U.S.)

- Alphabet Inc. (U.S.)

- Nuance Communications, Inc. (U.S.)

- Nvidia Corporation (U.S.)

- AT&T Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Deutsche Telekom launched a smartphone concept at the Mobile World Congress in Barcelona, relying solely on AI instead of traditional applications. The app-less AI-powered smartphone removed conventional features such as video games, text messaging, banking, and social media, offering a new approach to smartphone functionality.

- February 2024: Rakuten partnered with OpenAI to develop and deliver advanced AI tools tailored for the telecommunications industry. The partnership expanded Rakuten’s AI platform to include solutions for network optimization, customer analytics service, and predictive maintenance, enhancing operators' ability to resolve and detect network issues in real-time.

- February 2024: Jio Platforms launched 'Jio Brain', an AI-based platform integrating machine learning capabilities into enterprise networks, telecom operator networks, or industry-specific IT environments without requiring extensive network or IT transformations. The platform aimed to enhance operational efficiency and performance.

- January 2024: Vodafone signed a USD 1.5 billion deal with Microsoft for a 10-year partnership to bring generative AI, digital, enterprise, edge computing, and cloud services to over 300 million consumers and businesses in its African and European markets. The partnership included Vodafone’s investment in customer-focused AI, leveraging Copilot technologies, OpenAI, and Microsoft's Azure.

- December 2023: Tollring launched Record AI, an AI-powered cloud-based call recording software solution. Record AI aimed to democratize AI automation, offering intelligent automated analysis of calls and platform-agnostic regulatory compliance call recording on Session Border Regulators for IP networks, Cisco BroadWorks, and Microsoft Teams.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 37.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Technology

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 88.11 billion by 2034.

In 2025, the global market was valued at USD 4.73 billion.

The market is projected to grow at a CAGR of 37.90% during the forecast period.

In 2025, big data technology led the market.

The growing demand for online data monitoring and categorization is a key factor driving AI adoption in telecommunication.

IBM Corporation, Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Intel Corporation, Alphabet Inc., Nuance Communications, Inc., and Nvidia Corporation are the top players operating in the market.

In 2025, North America held the highest market share.

By deployment, the cloud is expected to exhibit the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us