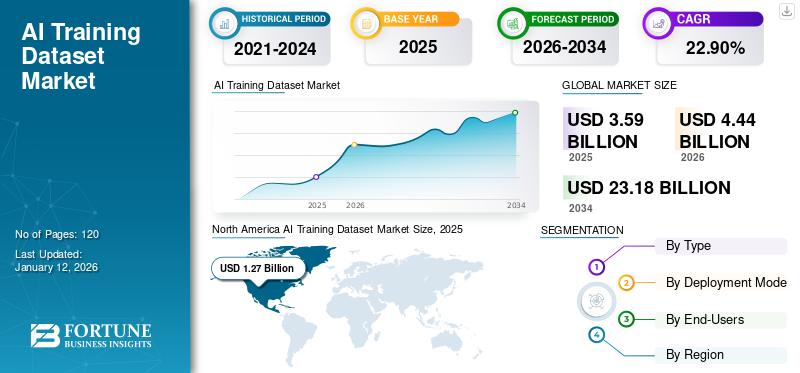

AI Training Dataset Market Size, Share & Industry Analysis, By Type (Text, Audio, Image, Video, and Others), By Deployment Mode (On-Premises and Cloud), By End-Users (IT and Telecommunications, Retail and Consumer Goods, Healthcare, Automotive, BFSI, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global AI training dataset market size was valued at USD 3.59 billion in 2025 and is projected to grow from USD 4.44 billion in 2026 to USD 23.18 billion by 2034, exhibiting a CAGR of 22.90% during the forecast period. North America dominated the global market with a share of 34.80% in 2025.

A set of labeled data or examples used for Machine Learning (ML) model training is known as an AI training dataset. The data can be in different forms, such as audio, images, videos, texts, and so on. These types are associated with an output label or annotated data that describes what it means. The training data is collected to train machine learning algorithms for recognizing patterns and prediction.

AI training dataset market growth can be attributed to factors, such as the rapid adoption of AI technologies and the increasing number of high-quality datasets. The rising trend in the expansion of training data centers across the globe also contributes to this growth. The improved forecasting with enhanced accuracy of business strategies through AI data is fostering a growing potential for AI training dataset market share. Several companies are entering the market to train ML algorithms by releasing different datasets, which operate in various use cases, to make the technology more flexible and accurate in its predictions.

The COVID-19 pandemic created an unprecedented convergence of the need for quick, evidence-based decision-making and large-scale problem-solving with rapidly increasing datasets. The market saw stagnant growth during the pandemic as the new algorithms were trained for different sets of applications.

IMPACT OF GENERATIVE AI

Advanced Capabilities of Generative AI for High-quality Training Data Fueled Market Growth

Generative AI systems democratize AI capabilities that were previously inaccessible due to the lack of training data and the computing power needed to enable algorithms to work in the context of each organization. As datasets provide the basis for learning and producing new content, the quality, quantity, and diversity of AI training datasets are of high importance for the development and effectiveness of generative AI models.

Generative AI has created a highly positive impact on the market as it helps in providing high-quality data. Companies are strategically partnering to implement generative AI for training AI models. For instance, in November 2023, Gretel, a multimodal synthetic data generation platform, agreed with AWS to accelerate the development of responsible generative AI for protecting personal and sensitive information. This partnership enables selected companies to receive direct support from professionals from both firms and private access to privacy tools and Gretel's state-of-the-art synthetic data generation models.

AI Training Dataset Market Trends

Rising Usage of Synthetic Data for Enhancing Authentication to Propel Market Growth

Synthetic data helps to create synthetic identities to secure images and protect privacy. AI can be used to take recognizable features out of video/image streams presenting people in real time. Generative AI can create synthetic data that can be used to train models, including biometric-based identities. This results in a more robust training model, which ensures the privacy of individuals and maintains data quality.

The use of synthetic data allows practitioners to create the information they require in a specific volume and at any time, with a particular focus on their specific needs. By 2024, according to an industry expert, 60% of all data used for developing AI will be synthetic rather than real.

Download Free sample to learn more about this report.

AI Training Dataset Market Growth Factors

Rapid Adoption of AI Technologies for Training Datasets to Aid Market Growth

The need for AI training datasets is increasing exponentially as a result of the rapid adoption of AI technologies. Several end-users are looking to define training processes to make remote work as positive and effective as working from the office. They are also looking at the need for improved computational models and monitoring systems. According to Adecco Group's annual global workforce study in 2023, 70% of workforce have adopted AI in the workplace. Thus, this market is growing rapidly to optimize and train AI and ML systems and increase digital transformation.

Several companies are entering the market by releasing various datasets that operate across different use cases to train an ML algorithm, making this technology more flexible and accurate with its assumptions and predictions. In addition, market leaders are adopting a variety of growth strategies to extend their product offerings and geographic footprint as well as gain market shares. For instance, in June 2022, AWS added new features to its cloud platform to help developers make code more efficient and create AI training datasets for their artificial intelligence projects.

RESTRAINING FACTORS

Lack of Skilled AI Professionals and Data Privacy Concerns to Hinder Market Expansion

Developing, managing, and updating AI model training requires people with special skills in different technical disciplines. The training process could easily be interrupted by a lack of experience in any area, leading to the complete reboot of projects. In addition, sensitive data, such as personally identifiable information, financial details, and other sensitive data, can be included in training records. Encryption and cleaning of both training and output data may be required to ensure privacy. Thus, these factors are hindering the market growth.

AI Training Dataset Market Segmentation Analysis

By Type Analysis

Rapid Adoption of Text-based Data for Enhancing AI Model Capabilities Fueled Segment Growth

Based on the type, the market is segmented into text, audio, image, video, and others.

In terms of market share, the text segment dominated the market in 27.01% 2026 due to the increasing use of text data sets in IT for various automation tasks, such as word classification, speech recognition, typing, and others. Machines and applications consume enormous amounts of textual data to advance the capabilities of AI models. Text annotation is highly used in social media monitoring to develop recognition systems.

By Deployment Mode Analysis

Ease of Controllability and Accessibility by On-Premise AI Training Dataset Solutions Boosted Segment Growth

Based on deployment mode, the market is segmented into on-premises and cloud.

In terms of market share, the on-premises segment dominated the market in 56.27% 2026. An on-premises strategy that allows users to view their site from a desktop or another system has increased the use of on-premises deployment. Training in on-premise AI enables users to control their AI infrastructure and allows them to isolate information from external users.

The cloud segment is anticipated to register the highest CAGR during the forecast period. Due to the rise of data sovereignty and privacy regulations, organizations are looking for flexible solutions that balance compliance with the adaptability of cloud services. Moreover, the growth of the segment can be accredited to the growing speed of cloud technologies and the simplicity of developing and training ML models on the cloud. In October 2023, Lambda and Vast Data partnered to provide optimal cloud-based AI training infrastructure.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

IT and Telecommunications Segment Dominated the Market Owing to Rising Need for High-quality Training Data

Based on end-users, the market is categorized into IT and telecommunications, retail and consumer goods, healthcare, automotive, BFSI, and others.

In terms of market share in 27.01% 2026, the IT and telecommunications segment dominated the market. Several technology companies in the market are using AI and ML technologies to develop innovative products and improve the user experience. High-quality training data is required to ensure that algorithms are constantly optimized for these technologies to be effective. In addition, IT and telecommunications companies benefit from high-quality datasets to enhance various solutions, such as crowdsourcing, computer vision, data analytics, big data, virtual assistants, and others.

The healthcare segment is expected to grow at the highest CAGR during the forecast period. In the field of healthcare, AI provides a variety of opportunities for treatment areas, such as lifestyle and health management, diagnostics, VRAs, or wearables. In addition to that, AI finds applications for the voice-enabled symptom checker and improves organizational productivity. All of these applications require a large amount of data to provide accurate results. The healthcare sector can look forward to an even more efficient and patient-centric future as this technology continues to evolve.

REGIONAL INSIGHTS

Based on geography, the market is fragmented into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America AI Training Dataset Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 1.27 billion in 2025 and USD 1.54 billion in 2026. North America held a major market share in 2024. Large IT companies that are early users of digital technologies for training AI data can be considered as a major contributor to this growth in the region. In addition, to speed up the adoption of AI technology in emerging sectors, vendors in the U.S. market are focusing on providing new datasets. Such factors are contributing to the growth of this market in the region. The U.S. market is expected to reach USD 1.01 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is anticipated to grow at the highest rate during the forecast period. The rising number of data centers, increased government spending, and improved infrastructure drives the growth of the region. The Japan market is set to reach USD 0.28 billion by 2026, the China market is expected to reach USD 0.30 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

Middle East & Africa is expected to register the second-highest growth rate in the market during the forecast period. Several energy and material companies have been early investors in AI that is driving the growth of AI training dataset solutions and services and contributing to the expansion of the market in the region.

List of Key Companies in AI Training Dataset Market

Market Players Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Their Business Reach

Major industry players operating in the market are providing enhanced AI-trained data solutions to reduce bias in machine learning models and increase efficiency during AI tasks. AI training dataset companies prioritize acquiring small and local firms to expand their business reach. Moreover, mergers & acquisitions, leading investments, and strategic partnerships contribute to an increase in demand for products.

List of Key Companies Profiled:

- Amazon Web Services, Inc. (U.S.)

- Appen Limited (Australia)

- Cogito Tech (India)

- Deep Vision Data (U.S.)

- Samasource Impact Sourcing, Inc. (U.S.)

- Google LLC (U.S.)

- Alegion AI, Inc. (U.S.)

- Clickworker GmbH (U.S.)

- TELUS International (Canada)

- Scale AI, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: TELUS International, a digital customer experience innovator in AI and content moderation, launched Experts Engine, a fully managed, technology-driven, on-demand expert acquisition solution for generative AI models. It programmatically brings together human expertise and Gen AI tasks, such as data collection, data generation, annotation, and validation, to build high-quality training sets for the most challenging master models, including the Large Language Model (LLM).

- September 2023: Cogito Tech, a player in data labeling for AI development, launched an appeal to AI vendors globally by introducing a “Nutrition Facts” style model for an AI training dataset known as DataSum. The company has been actively encouraging a more Ethical approach to AI, ML, and employment practices.

- June 2023: Sama, a provider of data annotation solutions that power AI models, launched Platform 2.0, a new computer vision platform designed to reduce the risk of ML algorithm failure in AI training models.

- May 2023: Appen Limited, a player in AI lifecycle data, announced a partnership with Reka AI, an emerging AI company making its way from stealth. This partnership aims to combine Appen's data services with Reka's proprietary multimodal language models.

- March 2022: Appen Limited invested in Mindtech, a synthetic data company focusing on the development of training data for AI computer vision models. This investment is part of Appen's strategy to invest capital in product-led businesses generating new and emerging sources of training data for supporting the AI lifecycle.

REPORT COVERAGE

An Infographic Representation of AI Training Dataset Market

To get information on various segments, share your queries with us

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies and leading end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 22.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Deployment Mode

By End-Users

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the AI training dataset market is projected to reach USD 23.18 billion by 2034.

In 2025, the market value stood at USD 3.59 billion.

The market is projected to grow at a CAGR of 22.90% during the forecast period.

In 2026, the IT and Telecommunications segment led the market.

The rapid adoption of AI technologies for training datasets to aid market growth.

Amazon Web Services, Inc., Appen Limited, Cogito Tech, Deep Vision Data, Samasource Impact Sourcing, Inc., Google LLC, Alegion AI, Inc., Clickworker GmbH, TELUS International, and Scale AI, Inc. are the top AI training dataset companies in the global market.

In 2025, North America recorded the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic