Air Density Separator Market Size, Share & COVID-19 Impact Analysis, By Application (Recycling and Waste Processing, Chemical, Food and Beverages, Minerals and Mining, and Agriculture), and Regional Forecast, 2026-2034

Air Density Separator Market Size

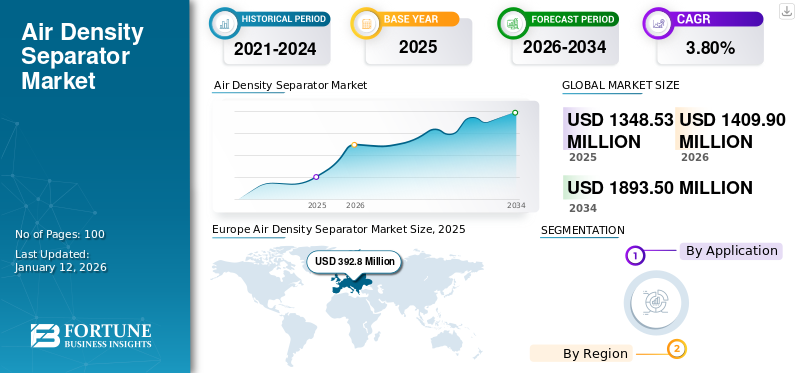

The global air density separator market size was valued at USD 1,348.53 million in 2025 and is projected to grow from USD 1,409.90 million in 2026 to USD 1,893.50 million by 2034, exhibiting a CAGR of 3.80% during the forecast period. Europe dominated the global market with a share of 29.10% in 2025.

Air density separator is an equipment that is used to segregate the finer products from the heavy material. The machinery equipment uses a controlled air principal and is used to segregate trash from material with a heavier density. The air steam is primarily used to carry material through a separator with the material made to pass through an opening while the heavier particles are separated using gravity.

Global Air Density Separator Market Overview

Market Size:

- 2025 Value: USD 1,348.53 million

- 2026 Value: USD 1,409.90 million

- 2034 Forecast Value: USD 1,893.50 million

- CAGR (2026–2034): 3.80%

Market Share:

- Regional Leader: Europe held approximately 29.10% market share in 2025

- Fastest-Growing Region: Asia Pacific is projected to outpace other regions, driven by manufacturing and recycling growth

- Top Application Segment: Recycling and waste processing dominate, with food & beverages and mining also showing strong adoption

Industry Trends:

- Micro-plastic Pollution Control: Rising use of air density separators in recycling to address global plastic pollution

- Automation & Innovation: Integration of automation and cyclic innovation for efficient, cost-effective separation

- Bulk Recycling Models: Manufacturers investing in large-scale, low-cost separation systems for waste and resource recovery

- Green Business Models: Shift toward sustainable, resource-efficient operations in recycling and processing industries

Driving Factors:

- Sustainability Push: Growing need for green business models and efficient resource use in recycling, mining, and agriculture

- Regulatory Support: Stringent waste management and recycling regulations, especially in Europe

- Technological Advancements: Development of Magnetic Density Separation (MDS) and other advanced separation technologies

- Resource Scarcity: Increased demand for metal and mineral recovery due to volatile commodity prices

Density-based separator has been proven extremely effective to have the segregation of heavier materials (metals, rocks, glass) and lighter materials (light plastic, dirt, sand, paper). Europe and North America will collectively dictate the market developments over the years. The effective presence of established air density separator players across the region and well-developed and intertwined distribution channels are the major factors contributing to the considerable share and robust growth projections of these regions. Moreover, effective integration of automation and efforts to inculcate cyclic innovation are also propelling the sales of these products across the regions. The report provides a detailed analysis on the basis of applications across diverse geographic regions.

COVID-19 IMPACT

COVID-19 Pandemic had an Adverse Impact Due to Curtailed Mining and Refinery Operations

The health emergency caused due to COVID-19 pandemic can be considered a major reason behind the gloomy performance of the market. The brief shutdown of the major and emerging economies across North America, Europe, and Asia Pacific also created hindrances to the installation of air density separators across diverse application industries. The government restrictions for operating across mining sites and limited permissions for the industrial facilities during the initial phase of the pandemic restricted the opportunities for sales and growth of the market. However, post-pandemic, the market is estimated to slowly recover from the negative growth it had experienced as a short-term impact and is set to exhibit a promising development in the second half of the forecast period.

LATEST TRENDS

Download Free sample to learn more about this report.

Use of Density Separation Equipment to Tackle Micro-plastic Pollution Threat is Set to Emerge as a Promising Trend

Most governments across the world have initiated an operation to address the growing threat of micro-plastic pollution to develop and create a sustainable ecosystem with a sense of ecological conservation. Over the past few decades, synthetic polymers have paved a way for the development of the modern world. The same phenomenon has also created global plastic pollution crises. As per the current trend, nearly 80% of the plastic developed is never recycled and discarded. The application of air density separators in waste processing and recycling operations is set to gain momentum over the forecast period and will witness considerable traction across all the major economies across the globe.

Most of the manufacturers are making hefty investments and are constantly working to develop bulk recycling models using density separation techniques. The manufacturers are trying to build and market a separation system that will minimize the total cost of operation. The companies are also working to develop an integrated selection algorithm that will provide a minimal cost of product separation and optimal processing sequence. This bulk processing will process and consider optimal sequence on the criteria of proper sequence for isolating target material from the mixed material stream.

DRIVING FACTORS

Continuous Efforts to Develop Innovative Solutions with Minimal Use of Resources to Drive Market Growth

The separator application industry is trying to adopt a cyclic innovation model for operations and transform their processes into Green Businesses. The use of equipment, such as air density separators, is anticipated to serve the purpose of transformation into green business models. Moreover, increasing challenges in the minerals and mining, recycling, and waste processing industries pave the way for the inclusion and integration of modern technologies into the fold. The scarce availability of the metals and steep increment in the requirement of those respective metals have increased the volatility in market pricing. This volatility has subsequently increased the vitality of mineral processing and recycling operations across the globe.

The development of Magnetic Density Separation (MDS) is an equipment capable of separating materials with different densities, faster pace of operation, accuracy offered in the separation, and a cost-effective model. MDS is anticipated to push the sales of the product and emerge as a decisive growth factor for the market.

RESTRAINING FACTORS

High Capital Investments May Restrain the Market Growth

The requirement of sizable expenditure associated with the installation and application of this equipment at industrial establishments is cited as a major factor constraining development prospects. Moreover, the conventional setup requires a large space for a setup, which eliminates its possibility of application in cramped and tight spaces. Air density separators also had limitations in terms of feed rate and elevated table frequency as the greater feed rate and higher table frequency deteriorate the quality of the production due to reduced time of residence for the particle settlement. The adverse impact on the effectiveness in terms of handling excessive load and heavy capital investment are constraining the sales of the product across the globe.

SEGMENTATION

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Waste Processing and Recycling Segment to Dominate Due to the Trend of Recycling Waste Products

On the basis of application, the market is classified into recycling and waste processing, chemical, food and beverages, minerals and mining, and agriculture.

The increasing trend of recycling waste products and the high trend to segregate waste and recycling metal scrap and related products provide a substantial share of the recycling and waste processing segment. The application of separation machinery to clean and separate waste which acts as one of the prominent raw materials for biofuel generation is expected to contribute to the growth of the recycling and waste processing segment with a share of 40.11% in 2026.

The food and beverages segment is anticipated to procure a sizable share of the global market after the waste processing and recycling segment. The increasing requirement of gravity and density-based separation solutions for the processing of food products and their cleaning. The development of compact and high-capacity models acts as a contributing factor for the swift and high rate of adoption of the products in the market.

REGIONAL INSIGHTS

On the basis of region, the market is analyzed across North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

Europe

Europe Air Density Separator Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Europe represents a major share of the global air density separator market, driven by the strong presence of established and globally active manufacturers supported by well-integrated regional supply chains. The region dominated the market in 2025, with a market size of USD 392.8 million, reflecting high adoption across waste management, recycling, and material recovery applications. Regulatory enforcement across the European Union emphasizing structured waste disposal, recycling efficiency, and circular economy targets continues to reinforce demand for advanced separation technologies. Market participants are increasingly focused on introducing robust and technologically advanced systems to address diverse industrial requirements. Within the region, the U.K. benefits from the presence of global players and strict regulatory oversight related to waste processing, supporting steady market expansion. The U.K. market is projected to reach USD 86.1 billion by 2026, while Germany is expected to reach USD 53.7 billion by the same year, underpinned by strong industrial activity and regulatory compliance requirements.

North America

North America is projected to account for a noteworthy share of the global air density separator market, supported by continuous modernization of waste processing infrastructure and increasing adoption of automated separation technologies. Market growth is reinforced by demand for high-efficiency systems capable of maintaining targeted throughput while improving contaminant removal rates. Regulatory emphasis on environmental compliance and landfill diversion is encouraging operators to deploy advanced air density separators as part of integrated material recovery facilities. The U.S. remains the dominant contributor within the region, with its market projected to reach USD 241.40 billion by 2026, supported by strong investments in industrial automation and sustainable waste management practices.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to register the fastest market growth over the forecast period, driven by expanding industrialization and the availability of significant growth opportunities across China, India, and several ASEAN economies. The development of large-scale manufacturing clusters in China is strengthening regional supply capabilities, with domestic players producing cost-effective machinery that enhances market penetration. Rising urbanization, increasing waste generation, and improving regulatory focus on recycling are further supporting demand. By 2026, the Japan market is projected to reach USD 110.7 billion, China USD 147.9 billion, and India USD 52.6 billion, reflecting broad-based growth driven by infrastructure expansion and industrial demand.

Latin America

Latin America is witnessing gradual adoption of air density separators as governments and private operators invest in improving waste management and recycling infrastructure. Market growth is supported by increasing awareness of resource recovery and the need to enhance operational efficiency in material separation processes. While regulatory frameworks vary across countries, alignment with global environmental standards is gaining traction, encouraging investments in advanced separation equipment across municipal and industrial waste processing facilities.

Middle East & Africa

The Middle East & Africa market remains in an early development stage but shows steady potential due to growing urban populations and rising waste volumes. Government-led initiatives focused on sustainable waste management, recycling, and environmental protection are gradually shaping demand for air density separators. Adoption is primarily driven by large-scale infrastructure and industrial projects, with increasing emphasis on efficient material recovery systems to support long-term sustainability objectives across the region.

KEY INDUSTRY PLAYERS

Companies are Working on Finalizing Mergers and Acquisitions to Solidify their Presence in the Market

Air density separator companies are aiming to execute both organic and inorganic market strategies to have a substantial presence in the global market. Various companies are emphasizing on developing a wide array of their product portfolio to attract customers from different application industries toward their products. Moreover, most of the market players are actively engaged in having mergers and acquisitions of smaller yet potential entities to increase their presence in the market.

Companies, such as ANDRITZ, Blue Group, and LYBOVER, Nihot Recycling Technology B.V., can be considered as the key players in the market. These companies have decent brand goodwill and a fair share of the customer base across multiple geographies.

List of Top Air Density Separator Companies:

- ANDRITZ (Denmark)

- Metso Outotec (Finland)

- LYBOVER (Belgium)

- Blue Group (U.K.)

- Hillenbrand, Inc. (U.S.)

- Acrowood (U.S.)

- M&K (U.K.)

- Nihot Recycling Technology B.V. (Netherlands)

- Neuenhauser Recycling Technology GmbH (Germany)

- CSS Recycling Equipment Solutions (Australia)

KEY INDUSTRY DEVELOPMENTS:

- August 2022 – FLSmidth, a prominent service and technology provider for customers operating in cement and mining industries, has recently completed the acquisition of ThyssenKrupp’s mining business. The mining business will operate as a wholly-owned subsidiary of the organization after having the required approval from all the regulatory authorities across the globe.

- June 2022 – Gerard Daniel launched its recently developed vibratory separator machine sizing app. The app will help customers to identify the machine best suited for their operations. The sizing app considers four important operational parameters to decide on suitable machines for efficient and profitable operations.

- October 2022 – General Kinematics launched its separator named the De-Stoner Air Classifier. The product developed by the company can be used for a wide range of materials, can process high amounts of volume, and is claimed to be jam resistant.

- November 2022 – Alfa Laval, a manufacturer of specialized products and solutions for heavy industries, has recently announced the launch of its complete series of premium separators, which can be used for applications in pharmaceuticals and biotechnology industries.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The air density separator market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies and applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1,893.50 million in 2026.

The market is likely to grow at a CAGR of 3.80% over the forecast period (2026-2034).

The recycling and waste processing segment is expected to hold a substantial share of the market due to development of robust, reliable, and smart products in the market.

The market size in Europe stood at USD 392.8 million in 2025.

Application of robust products with advanced precision is anticipated to drive the market requirements.

Some of the top players in the market are ANDRITZ, Metso Outec, and Neuenhauser Group.

Europe dominated the market in terms of market share in 2026.

Heavy capital expenditure in the market creates considerable hindrances to market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us