Airborne Fire Control Radar Market Size, Share & Industry Analysis, By Platform (Fixed-Wing Aircraft, Rotorcrafts, Unmanned Aerial Vehicles (UAVs), Missiles & Guided Munitions, and Others), By Frequency Band (X-Band, Ku-Band, Ka-Band, and Others), By Technology (Active Electronically Scanned Array (AESA) and Passive Electronically Scanned Array (PESA)), By Deployment Mode (Standalone Fire Control Radar and Integrated Fire Control System), Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

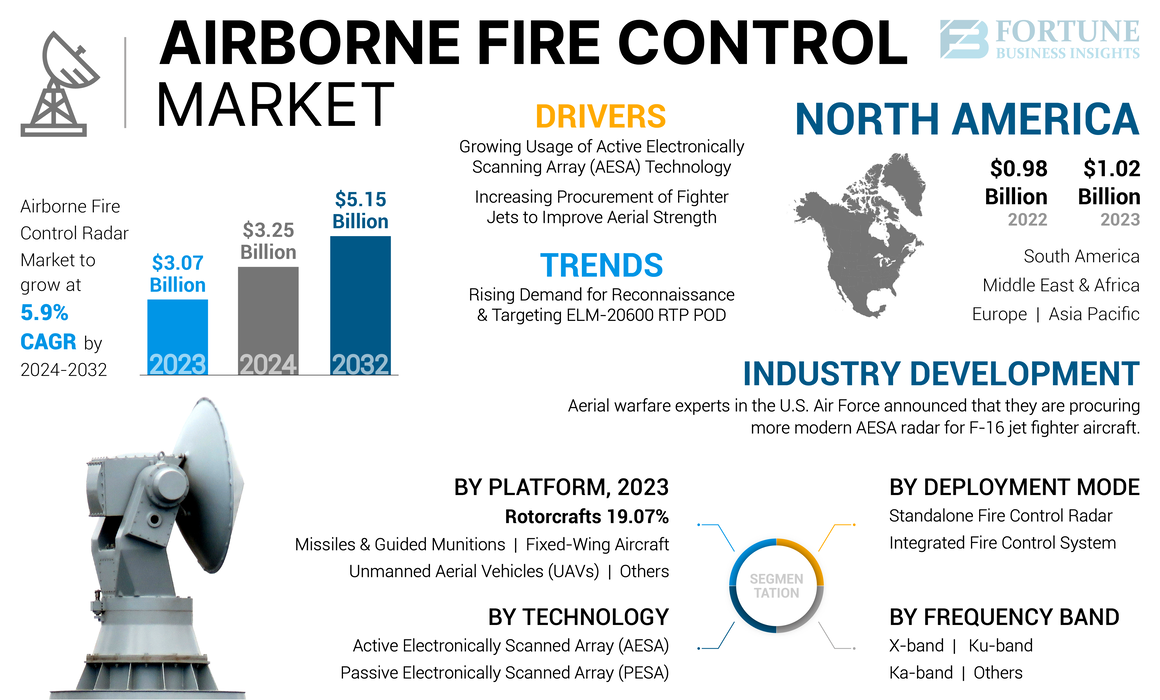

The global airborne fire control radar market size was valued at USD 3.07 billion in 2023. The market is expected to grow from USD 3.25 billion in 2024 to USD 5.15 billion by 2032, exhibiting a CAGR of 5.9% during the forecast period. North America dominated the airborne fire control radar market with a market share of 33.22% in 2023.

Specialized radar technologies known as airborne Fire Control Radar (FCR) systems are created to offer accurate targeting data for weapon systems, making it easier to engage aerial and maritime targets effectively. Modern military aircraft depend on these radars to carry out various missions, such as air-to-air combat, air-to-ground strikes, and maritime surveillance. The growth is driven by increased military spending, the rising adoption of AESA technology, and the modernization of air forces across various nations.

The COVID-19 pandemic has strongly affected the defense industry. The supply chain disruption of major players in the defense industry is a prime reason behind the cancellation of several contracts. Airbus S.A.S. stated that it incurred a loss of around USD 2200 million owing to the COVID-19 pandemic.

Airbus S.A.S. and Boeing, the prime OEMs of aircraft, faced huge losses due to the cancellation of aircraft orders. These companies planned to postpone the delivery of aircraft to overcome the economic crisis. In addition, the delivery schedule of Rafale fighter jets ordered by the Indian Air Force from Dassault Aviation (France) was affected.

Companies such as Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation are investing in the development of technologically advanced airborne fire control radars. These radars are used to provide better targeting capacity for fighter jets and combat helicopters, which are expected to favor the growth rate of the market in the forthcoming years.

Global Airborne Fire Control Radar Market Overview

Market Size:

- 2023 Value: USD 3.07 billion

- 2024 Value: USD 3.25 billion

- 2032 Forecast Value: USD 5.15 billion, with a CAGR of 5.9% from 2024–2032

Market Share:

- North America dominated the airborne fire control radar market with a 33.22% share in 2023, attributed to the presence of key aircraft manufacturers and strong defense investment.

- By military UAVs, the segment is expected to hold a 28% share in 2025.

Key Country Highlights:

- The airborne fire control radar market in Japan is expected to reach USD 159.92 million by 2025.

- China is projected to witness a strong CAGR of 6.6%, while Europe is anticipated to grow at a CAGR of 3.89% during the forecast period.

- By frequency band, the S-band segment is projected to generate USD 382.25 million in revenue by 2025.

Airborne Fire Control Radar Market Trends

Rising Demand for Reconnaissance and Targeting ELM-20600 RTP POD to Aid Growth

The increasing demand for airborne fire control radar from the U.S. Air Force and the Royal Canadian Air Force augments market growth. The growing demand for target detection equipment is slated to further propel market growth. Moreover, Israel Aerospace Industries Ltd has launched reconnaissance and targeting ELM-20600 RTP POD. The ELM-20600 RTP POD provides synthetic aperture radar imaging, target identification, and ground-based moving target indication.

It provides high-quality radar images of ground targets. It also offers long-range, wide-area surveillance & reconnaissance, accurate geo-location data for targets, and long-range battle damage assessment. Fighter pilots can handle flexible mission planning and real-time target assessment due to the ELM-20600 RTP POD. The increasing use of ELM-20600 RTP POD from defense services is expected to boost the market growth.

Download Free sample to learn more about this report.

Airborne Fire Control Radar Market Growth Factors

Growing Usage of Active Electronically Scanning Array (AESA) Technology to Drive Market Growth

The advancement of AESA-based systems is a primary factor driving market growth. AESA allows electronic control of radio waves to precisely determine a target's direction, which is attracting the interest of armed forces.

Active Electronically Scanning Array (AESA) technology is majorly used in fifth-generation fighter jets to achieve high mission reliability and multi-target tracking capabilities. The radar technology is used to provide alternate modes of multi-mission capabilities for air-to-sea, air-to-air, and air-to-ground operations with air-missile weapon capacity. Moreover, it is used to provide high-resolution raid assessments for fighter jets to hit an air-to-air target.

For instance, in December 2022, SRC, Inc. was granted a contract by the U.S. Army to improve and advance its Precision Fire Control Radar (PFCR). This radar system is a 3D Active Electronically Scanned Array (AESA) that is lightweight, air-cooled, and cost-effective. It has the capability to integrate with various weapon systems, enabling its extensive use.

The continuous pursuit of air combat superiority on a global scale has led to the widespread adoption of Active Electronically Scanned Array (AESA) radar as a standard feature in almost all new fighter jets. Furthermore, numerous older aircraft are undergoing upgrades to incorporate these radars, driving the global airborne fire control radar market growth.

Increasing Procurement of Fighter Jets to Improve Aerial Strength to Promote Growth

The emerging countries are focused on modernizing their air forces to enhance aerial strength. This modernization often includes the acquisition of advanced fighter jets equipped with sophisticated airborne fire control radar systems. For instance, the U.S. Air Force plans to procure 51 F-35A fighter jets in fiscal 2024, marking a significant increase in their fleet, which will require corresponding upgrades in radar systems to maintain operational effectiveness.

Newer fighter jets are designed to operate with advanced radar systems that provide superior target acquisition, tracking, and engagement capabilities. As these jets are procured, there is a corresponding demand for state-of-the-art airborne fire control radars that can leverage the advanced features of these aircraft.

The increasing procurement of fighter jets is a significant growth factor for the market. As nations modernize their aerial capabilities and invest in advanced technologies, the demand for sophisticated radar systems that can support these aircraft is anticipated to continue to rise, propelling the market growth.

RESTRAINING FACTORS

High Maintenance Cost of These Radars May Hamper Market Growth

Airborne fire control radars, particularly those utilizing advanced technologies such as Active Electronically Scanned Array (AESA), are inherently complex systems. These radars require specialized components and sophisticated algorithms for operation, which contribute to higher maintenance demands. The intricate nature of these systems means that any malfunction can necessitate extensive diagnostics and repairs, leading to increased costs.

Moreover, these radars are often integrated into larger systems, such as fighter jets and helicopters, which also have their own maintenance requirements. The cumulative effect of maintaining both the aircraft and its radar systems can strain budgets and resources. High operational costs can lead to reduced frequency of maintenance checks, potentially compromising system reliability.

Furthermore, the complexity of the technology, the need for specialized training, and the operational costs associated with these systems can deter investment and procurement. As defense organizations seek to balance budgets and operational readiness, addressing these maintenance challenges will be crucial for sustaining growth.

Airborne Fire Control Radar Market Segmentation Analysis

By Platform Analysis

Fixed-Wing Aircraft Segment Held Largest Market Share Due to Growing Use of AFCR in Fighter Jets

Based on platform, the market is segregated into fixed-wing aircraft, rotorcrafts, Unmanned Aerial Vehicles (UAVs), missiles & guided munitions, and others.

The fixed-wing aircraft segment held a dominant market share in 2023 and is estimated to be the fastest-growing segment during 2024-2032. This growth is attributed to the growing use of AFCR in fighter jets. Thales developed RDY-3 lightweight, multifunction, and modular airborne fire control radar. The RDY-3 radar is used to provide a cost-effective combat system for fifth-generation fighter jets. The radar consists of advanced combat modes, automatic target acquisition capacity, multi-shoot, and multi-track capability. At present, the Indian Air Force adopts RDY-3 radar technology in its fighter jet Mirage 2000.

The rise in the demand for military Unmanned Aerial Vehicles (UAVs) and unmanned aerial systems for combat, surveillance & recognition and delivery applications has boosted the market growth. IAI (Israel) has offered ELM-2054 radar for different UAV platforms, including Small Tactical UAVs (STUAV) and other compact airborne platforms. By military UAVs, the segment is expected to hold a 28% share in 2025.

To know how our report can help streamline your business, Speak to Analyst

By Frequency Band Analysis

X-band Segment Dominates with its Number of Advantages for Fighter Aircraft

Based on frequency band, the market is classified into X-band, Ku-band, Ka-band, and others.

The X-band segment is expected to register a fastest-growing CAGR during the forecast period and accounted for the highest market share in 2023. The segment’s growth is rising as fighter aircraft can quickly scan operations in the X-band frequency range.

The AFCR system is used to transmit electromagnetic waves and radio waves. The frequency of the radio waves is majorly dependent on the radar application. The X-band consists of a 2-4 Gigahertz frequency range. This growth is due to the ease of fighter aircraft access in the X-band frequency range to operate the single-target track and dual-target track capability. The track-while scan operation is most efficient in the S-band frequency range. The S-band segment is projected to generate USD 382.25 million in revenue by 2025.

The K-band consists of an 18-26.5 Gigahertz frequency range. The Ka-band consists of a 26.5-40 Gigahertz frequency range. The extended frequency range of the KU/K/KA band is set to precise air-to-surface ranging.

By Technology Analysis

Superior Precision Provided by Active Electronically Scanned Array (AESA) Radars to Boost Segment Expansion

Based on technology, the market is segmented into Active Electronically Scanned Array (AESA) and Passive Electronically Scanned Array (PESA).

The Active Electronically Scanned Array (AESA) segment is slated to hold the largest share of the market and is predicted to become the fastest-growing segment during the forecast period. The integration of Active Electronically Scanned Array (AESA) technology is a pivotal factor driving growth in the airborne fire control radar market. AESA radars provide superior precision compared to traditional mechanically scanned array radars. The adoption of active electronically scanned array technology is significantly enhancing the capabilities of airborne fire control radar systems, making them indispensable for modern military operations.

The Passive Electronically Scanned Array (PESA) segment is projected to register significant growth during the forecast period. PESA systems are generally less expensive to produce than their Active Electronically Scanned Array (AESA) counterparts. This cost advantage makes PESA radars attractive for military organizations with budget constraints, allowing them to equip more aircraft with advanced radar systems without significantly increasing expenditures.

By Deployment Mode Analysis

Military Modernization Efforts to Stimulate Standalone Fire Control Radar’s Growth

Based on deployment mode, the market is segmented as standalone fire control radar and integrated fire control system.

The standalone fire control radar segment held the largest share of the market in 2023. The segment is experiencing growth due to military modernization efforts, rising defense budgets, evolving threats, and technological advancements. As nations continue to invest in their aerial capabilities and adapt to new challenges, the demand for effective standalone fire control radars is expected to increase.

The integrated fire control system is projected to emerge as the fastest-growing segment during the forecast period. The segmental growth is attributed to the increased procurement of military aircraft, rotorcrafts, UAVs, and others to focus on air superiority and the need to counter evolving threats.

REGIONAL INSIGHTS

By region, the market is classified into Europe, Asia Pacific, South America, the Middle East & Africa, and North America.

North America Airborne Fire Control Radar Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America’s market for airborne fire control radar stood at USD 1.02 billion in 2023 and is expected to remain dominant in the forthcoming years. The region accounted for the largest airborne fire control radar market share. The growth is attributed to the presence of major aircraft manufacturers such as Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation in the region.

Europe is anticipated to grow at a CAGR of 3.89% during the forecast period. The growing demand for the AFCR system from the Air Force of the U.K. and Germany is anticipated to support market growth. In June 2022, Airbus S.A.S. and the German and Spanish Air Force signed a contract to procure 115 Eurofighter ESCAN Radars. The growing defense budget of the U.K. and Germany is further expected to support market growth. The British government had approved the defense budget of USD 55.5 billion during the financial year of 2022-2023.

Asia Pacific is estimated to capture the fastest growth during the forecast period. This is owing to the increasing procurement of fifth-generation fighter jets in China. Furthermore, the growing demand for combat helicopters and UAVs from emerging economies such as China and India is expected to provide tremendous prospects.

- The airborne fire control radar market in Japan is expected to reach USD 159.92 million by 2025.

- China is projected to witness a strong CAGR of 6.6% during the forecast period.

South America is projected to experience lucrative opportunities in the airborne fire control radar market. This growth is attributed to growing funding for cost-efficient AFCR technology by governments in Brazil and Argentina to improve the operational performance of fighter jets.

The Middle East & Africa is expected to propel the market growth during the forecast timeline. This rapid growth is due to the rising adoption of Active Electronically Scanned Array (AESA) technology in fighter jets from Saudi Arabia, Israel, and South Africa.

KEY INDUSTRY PLAYERS

Saab AB is Creating Advanced Radar Technologies to Offer an Extreme Fire Control Radar Performance

Saab AB is developing advanced radar technologies to provide an extreme fire control radar performance during battlefield operations. The company produces the next generation of PS-05/A fighter radar. This type of fighter radar is designed to provide situational awareness for the fifth-generation fighter jets. It delivers precise targeting performance for the fighter aircraft to set long-range targets. Moreover, Northrop Grumman Corporation is known for its advanced radar technologies used in platforms such as the F-35 Lightning II. In addition, Lockheed Martin Corporation develops integrated radar systems for military applications.

List of Top Airborne Fire Control Radar Companies:

- Airbus S.A.S. (Netherlands)

- Bharat Electronics Limited (BEL) (India)

- General Dynamics Corporation (U.S.)

- Israel Aerospace Industries Ltd (Israel)

- Leonardo S.p.A. (Italy)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Saab AB (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Aerial warfare experts in the U.S. Air Force announced that they are procuring more modern Active Electronically Scanned Array (AESA) radar for F-16 jet fighter aircraft. According to Northrop Grumman officials, the APG-83 AESA fire-control Scalable Agile-Beam Radar (SABR) seamlessly integrates into the F-16's structural, power, and cooling limitations without requiring modification to Group A aircraft. The company utilizes technology originally developed for the APG-77 and APG-81 radar systems featured on the U.S. F-22 and F-35 combat aircraft.

- April 2024: Advanced radar is being utilized by defense contractors in fighter jets, with magnetic systems and components playing a crucial role as the technology expands into maritime and commercial applications.

- September 2023: The Initial B-52 Active Electronically Scanned Array Radar (AESA) was provided by Raytheon Corporation to Boeing for the B-52 Radar Modernization Program of the U.S. Air Force. This radar will initially undergo system integration, verification, and testing.

- May 2023: Raytheon unveiled that its PhantomStrike radar will be incorporated into the FA-50 light combat aircraft by Korea Aerospace Industries (KAI). This advanced radar is entirely air-cooled and serves as a fire-control radar, offering extensive capabilities for detecting, tracking, and targeting threats over long ranges.

- May 2022: Raytheon Intelligence & Space (RI&S) reported the commencement of flight tests for the initial APG-79(V)4 radar system. With an Active Electronically-Scanned Array (AESA) antenna, the radar integrates gallium nitride (GaN) into its transmit/receive modules, making it the first airborne fire control radar to utilize this technology.

REPORT COVERAGE

The report provides an in-depth analysis of the market and majorly focuses on critical factors such as analysis of the market by platform, by frequency band, technology, deployment mode, and region. The report also exhibits the COVID-19 impact on the global defense industry and the fire control radar product's research ideology. The report highlights the latest market trends in the market and vital industry developments. Moreover, the report provides an analysis of several factors expected to contribute to the market's growth during the forecast period.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.9% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

|

|

By Frequency Band

|

|

|

By Technology

|

|

|

By Deployment Mode

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.07 billion in 2023 and is projected to reach USD 5.15 billion by 2032.

In 2023, the North America market value stood at USD 1.02 billion.

Growing at a CAGR of 5.9%, the market is slated to exhibit steady growth during the forecast period.

By platform, the fixed-wing aircraft segment leads by holding the largest share.

The increasing procurement of fighter jets with scanned array AESA based systems is propelling the market’s growth.

Israel Aerospace Industries Ltd, Leonardo S.p.A., and Lockheed Martin Corporation are major players in the global market.

The U.S. is estimated to exhibit the highest growth rate throughout the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us