Airborne Optronics Market Size, Share & Industry Analysis, By Aircraft Type (Fixed Wing, Rotary Wing, Urban Air Mobility, and Unmanned Aerial Vehicles), By Application (Commercial, Military, and Space), By Technology (Multispectral and Hyperspectral), By System (Reconnaissance System, Targeting System, Search and Track System, Surveillance System, Warning/Detection System, Countermeasure System, Navigation and Guidance System, and Special Mission System), By End-user (Aftermarket and OEM), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

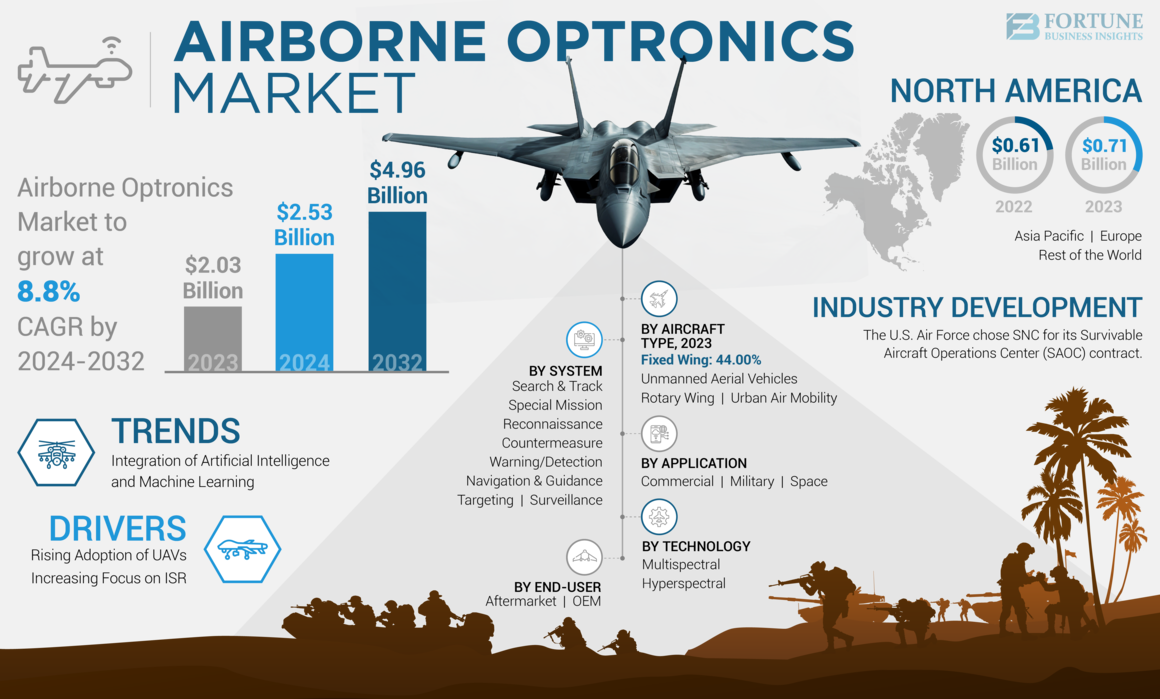

The global airborne optronics market size was USD 2.03 billion in 2023 and is projected to grow from USD 2.53 billion in 2024 to USD 4.96 billion by 2032 at a CAGR of 8.8% during the 2024-2032 period. North America dominated the airborne optronics market with a market share of 34.98% in 2023.

Airborne optronics is a technology that combines optical and electronic technologies to enhance airborne surveillance, navigation, and targeting capabilities. It uses digital imaging systems, infrared sensors, laser range finders, and other electronic sensors to capture images, analyze data, and display it to the operator. This technology is used to improve the capabilities of manned and unmanned aircraft, providing benefits such as increased safety, improved navigation, and enhanced surveillance.

The Russia-Ukraine war has had a significant impact on the airborne optronics market. The war disrupted global economic recovery from the COVID-19 pandemic. This led to economic sanctions, commodity price surges, and supply chain disruptions, causing inflation across goods and services globally.

Airborne Optronics Market Overview & Key Metrics

Market Size & Forecast:

- 2023 Market Size: USD 2.03 billion

- 2024 Market Size: USD 2.53 billion

- 2032 Forecast Market Size: USD 4.96 billion

- CAGR: 8.8% (2024–2032)

Market Share:

- North America dominated the airborne optronics market with a 34.98% share in 2023, driven by high defense spending, adoption of advanced multispectral/hyperspectral imaging technologies, and presence of major players like Northrop Grumman, FLIR Systems, and L3Harris Technologies.

- By aircraft type, fixed wing platforms are expected to retain the largest share due to their widespread use in surveillance, reconnaissance, and targeting operations.

Key Country Highlights:

- United States: Focus on integrating AI and ML into airborne optronics systems to enhance ISR (Intelligence, Surveillance, Reconnaissance) and precision targeting capabilities for defense applications.

- France & Germany: Strong aerospace and defense industry presence, with companies like Thales, Safran, and Hensoldt leading in multispectral and infrared sensor development.

- China & India: Increasing defense budgets and military modernization programs drive adoption of UAV-based optronics for border security and territorial surveillance missions.

- Israel: Pioneering in compact electro-optical and infrared systems for UAV and rotary-wing aircraft, supporting both domestic defense and export markets.

Airborne Optronics Market Trends

Integration of Machine Learning and Artificial Intelligence (AI) to Propel Market Growth

Advanced computing technologies such as Artificial Intelligence (AI) and Machine Learning (ML) can transform the way data is processed and analyzed in optoelectronic systems. Using artificial intelligence and machine learning algorithms, aerial optics achieve better object detection, object tracking, and decision making.

For example, using image analysis based on artificial intelligence, optronic systems can automatically identify and classify objects of interest with high accuracy, which reduces human workload. For example, in June 2022, global electro-optical equipment supplier HGH introduced GAIA artificial intelligence technology. This innovative AI processing brings unique features to the market to automatically classify objects in panoramic thermal images. The AI module uses three proprietary neural networks adapted for maritime, land, and air surveillance applications. It classifies long-distance objects and objects of different sizes, which greatly reduces the number of false alarms in a wide area and simplifies the daily operations of users. In addition, GAIA's AI advantage is the I2QTM image processing library, which ensures excellent image quality day and night, regardless of environmental conditions.

- North America witnessed airborne optronics market growth from USD 0.61 Billion in 2022 to USD 0.71 Billion in 2023.

In addition, AI and machine learning are integrated into targeting and guidance systems, enabling more precise and dynamic target acquisition and engagement. This is especially valuable in fast combat scenarios where quick decision making is critical. Thus, the proliferation of artificial intelligence and machine learning techniques in various industries offers aircraft optics manufacturers the opportunity to develop intelligent and autonomous systems.

Download Free sample to learn more about this report.

Airborne Optronics Market Growth Factors

Surging Adoption of Unmanned Aerial Vehicles (UAVs) to Boost the Market Growth

The growth of the aviation market is driven by a rise in the number of UAVs (unmanned aerial vehicles) called drones. These versatile systems are extensively used in a broad range of applications in both commercial and military sectors. UAVs require sophisticated optronics systems such as infrared (IR) cameras and electro-optical (EO), targeting systems, and laser rangefinders to perform their missions effectively. These optronic technologies facilitate UAVs in performing critical missions including surveillance, situational awareness, target acquisition, and reconnaissance in a variety of operational environments.

In addition, major avionics companies are collaborating to develop advanced avionics for UAVs. For example, in November 2022, the company Safran Electronics and Defense inked a contract with Leonardo S.p.A. for the development and delivery of the electro-optical system of Euroflir 610 aircraft to the Eurodrone program. Based on the Euroflir 410 model, the Euroflir 610 plays an important role in the ISTAR (Intelligence, Surveillance, Target Acquisition and Reconnaissance) missions of the European MALE UAV. It offers exceptional target detection and observation capabilities in a variety of environmental conditions owing to advanced features such as precise target geolocation and multispectral telescope. Such developments will further augment the avionics market size during the forecast period.

Surging Focus on Intelligence, Surveillance, and Reconnaissance (ISR) to Propel the Market Growth

In the modern security environment, the significance of effective ISR (intelligence, surveillance and reconnaissance) has become increasingly important. Both law enforcement and military agencies are heavily dependent on ISR capabilities to improve situational awareness, monitor potential threats, and gather critical information. Airborne optronic systems play a key role in these ISR operations. Advanced infrared and electro-optical sensors with data processing and high-resolution imaging capabilities enable real-time tracking, data collection, and target tracking in a range of environments. The emphasis on ISR operations, impelled by factors such as counterterrorism efforts, homeland security concerns, and border control, has directly contributed to the escalated demand for advanced avionics solutions.

In addition, the optical sensor suppliers are keen to equip numerous type of aircraft with sensors for various ISR missions. For example, in May 2023, Hensoldt AG, a provider of sensor solutions, and AEROMOT, a Brazilian company, inked an agreement for the installation of aircraft equipped with advanced sensor technology. The contract focuses on the delivery and integration of the "MissionGrid" mission system, which includes the "ARGOS II" optron observation system, the "PrecISR-1000" radar, and the data links necessary for operation. The MissionGrid integrated into the Diamond Aircraft DA62 MPP enables the aircraft to perform advanced ISR missions. Commencing in 2025, Porto Alegre-based AEROMOT is anticipated to have exclusive rights to produce the DA62. This agreement enables Hensoldt AG to offer the "MissionGrid Airborne Mission System" in a highly demanded platform for ISR missions. Such developments will further accelerate the growth of the airborne optronics market.

RESTRAINING FACTORS

Challenges of Complex Maintenance and Installation of the Equipment Hampers the Market Growth

The complex maintenance and installation of aero-optronic equipment creates significant costs and challenges that limit market expansion. Typically, these systems are integrated into a range of space platforms, such as UAVs (unmanned aerial vehicles), aircraft, and satellites, with unique complexities and facility requirements. One of the most important challenges is the physical integration of optronic systems into new or existing flight platforms. These facilities often require special expertise, custom designs and extensive testing for ensuring proper operation and seamless integration with other shipboard systems. The process is labor-intensive and time-consuming, which increases the overall cost.

Additionally, the harsh operating environments found on aircraft platforms, such as electromagnetic interference, extreme temperatures, and vibration, create significant demand for optronic devices. These systems must be designed for withstanding conditions that increase the cost and complexity of maintenance and installation procedures. Maintenance and repair procedures for aircraft optronics are expensive. These systems require regular software updates, calibration, and replacement of parts due to wear or damage from use. For mitigating these challenges, optronic end-users and manufacturers must invest in advanced maintenance services, robust supply chain management systems, and specialized training programs, which escalate the overall expenses associated with these systems.

Airborne Optronics Market Segmentation Analysis

By Aircraft Type Analysis

Fixed Wing Segment Dominates as the Product Offers Enhanced Capabilities in Surveillance, Identification, Intelligence Collection, and Targeting

By aircraft type, the market has been studied across fixed wing, rotary wing, urban air mobility, and unmanned aerial vehicles.

The fixed wing segment held the largest market share in 2023. The fixed wing market is a significant segment within the broader airborne optronics industry. Fixed wing aircraft are equipped with various optronics systems to enhance their capabilities in surveillance, identification, intelligence collection, and targeting.

- The Fixed Wing segment is expected to hold a 44% share in 2023.

The rotary wing segment is expected to experience the fastest growth during the 2024-2032 period. The segment growth is due to the increasing demand for advanced surveillance and reconnaissance capabilities in military and commercial applications. Rotary wing aircraft, such as helicopters, are particularly useful for tasks that require vertical takeoff and landing, hovering, and precise maneuverability, which makes them suitable for a variety of missions including search and rescue, medical evacuation, and military operations.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Demand for Better Situational Awareness, Precision Targeting, and Electronic Warfare Capabilities Boost the Growth of Military Segment

By application, the market for airborne optronics is divided into commercial, military, and space.

The military segment held the largest market share in 2023. Military modernization initiatives significantly influence the growth of the market by driving the demand for advanced surveillance and reconnaissance capabilities. These initiatives involve upgrading airborne platforms with cutting-edge technologies, including optronics systems, to enhance defense capabilities and maintain military superiority. As nations invest in modernizing their defense forces, there is a growing need for versatile, compact, and high-performance airborne optronics systems that offer features such as high-resolution imaging, long-range target detection, day-and-night vision capabilities, and seamless integration into various mission scenarios.

The commercial segment is expected to experience the fastest growth during 2024-2032. The segment is growing due to several factors such as increased demand from commercial aviation, expansion of urban air mobility, increased focus on safety and efficiency, government support and regulations, and others.

By Technology Analysis

Multispectral Segment to Expand Due to Broad Spectral Coverage and Data Fusion Capabilities

By technology, the market is segmented into multispectral and hyperspectral.

The multispectral segment dominated the market in 2023. The multispectral market is expanding due to its well-established and cost-effective nature, offering versatile applications across various sectors. The technology provides broad spectral coverage and data fusion capabilities, driving its adoption in airborne optronics systems. Its ability to efficiently detect and track military targets using mid-wave and long-wave infrared, measure radiation specific to objects, and operate independently of external light sources contributes to its growth in applications such as surveillance, reconnaissance, and target identification.

The hyperspectral segment is expected to experience the fastest growth during 2024-2032. The hyperspectral optronics market is growing due to its ability to capture detailed spectral information, enabling precise identification of objects and materials in various applications. This technology is particularly useful in defense and surveillance applications where accurate identification of targets is crucial. The growing demand for advanced defense capabilities and the increasing adoption of unmanned aerial vehicles (UAVs) are also driving the growth of the hyperspectral optronics market.

By System Analysis

Reconnaissance System Segment Dominated the Market due to Rising Demand from Military Applications

Based on system, the market is segmented into reconnaissance system, targeting system search and track system, surveillance system, warning/detection system, countermeasure system, navigation and guidance system, and special mission system.

The reconnaissance system segment held the highest market share in 2023 and is poised to exhibit the fastest growth rate during 2024-2032 as the increasing demand for advanced intelligence, surveillance, and reconnaissance (ISR) capabilities drives the growth of airborne intelligence systems. The integration of multi-sensor systems, miniaturization, and the need for real-time data processing will further drive the expansion of this segment.

By End-user Analysis

Increased Aircraft Production and Addition of Advanced Optical Systems to new Platforms Boost the Growth of OEM Segment

By end-user, the market for airborne optronics is fragmented into aftermarket and OEM.

The OEM segment held the largest market share in 2023. OEM segment held a commanding majority of the airborne optronics market in 2023, highlighting the strong demand for integrating these advanced technologies directly into new aircraft production. Technological advancements have enabled the creation of lightweight and compact optronics systems, essential components of unmanned aerial vehicles (UAVs) and smaller aircraft. The development of multispectral and hyperspectral imaging technologies has significantly enhanced the capabilities of airborne optronics systems. These technologies provide detailed data and high-resolution imagery, improving situational awareness and surveillance capabilities.

The aftermarket segment is expected to experience the fastest growth during the 2024-2032 period. While the original equipment manufacturer (OEM) segment still dominates the market, the aftermarket is growing in importance. It provides essential maintenance, repair, upgrade, and retrofit services that help sustain the performance of optronics systems over the long term.

REGIONAL INSIGHTS

Based on region, the global market is segmented into North America, Europe, Asia Pacific, and rest of the world.

North America Airborne Optronics Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market is projected to contribute the largest airborne optronics market share. The regional growth is driven by the rapid advancement of technologically advanced optronics, coupled with the increasing demand for commercial aircraft and the presence of leading players such as Northrop Grumman Corporation, FLIR Systems, Lockheed Martin, L3Harris Technologies, and Collins Aerospace.

The European market is a significant player in the global market, driven by the presence of established aerospace industries in countries such as the U.K., France, and Germany. European defense forces prioritize the development and integration of advanced optronics systems to enhance surveillance and reconnaissance capabilities.

The Asia Pacific market is growing rapidly, driven by increased defense spending and modernization efforts in countries such as China and India. The region's geopolitical dynamics and territorial concerns contribute to the demand for advanced airborne platforms equipped with state-of-the-art optronics systems. Asia Pacific manufacturers are also emerging as significant players, contributing to the global supply chain. The focus on developing indigenous optronics capabilities and fostering collaborations with international partners positions the region as a key influencer in shaping the future of airborne optronics technologies.

The market in the rest of the world, which includes Latin America and the Middle East & Africa, is expected to record significant growth potential in the coming years. The Middle East region is a major market for airborne optronics due to ongoing military modernization programs and the need for advanced surveillance and reconnaissance capabilities. Countries such as Israel, Saudi Arabia, and the UAE are investing heavily in optronics technology. Latin America is also an emerging market for optronics, driven by the need for border surveillance, drug interdiction, and disaster response capabilities. Countries such as Brazil and Mexico are investing in airborne optronics for their military and law enforcement agencies.

KEY INDUSTRY PLAYERS

Key Market Leaders Invest Heavily in Research and Development to Expand their Product Line

Some of the major companies operating in the global aircraft optronics market are Northrop Grumman Corporation, Thales SA, Safran SA¸ Teledyne FLIR LLC, Elbit Systems Ltd., Leonardo S.p.A., Lockheed Martin Corporation, Hensoldt AG, Collins Aerospace and L3Harris Technologies contributing significantly to the growth and development of the industry. Key players are investing heavily in research and development to develop advanced, cutting-edge airborne optronics technologies. This includes innovations in areas like multispectral and hyperspectral imaging, AI/machine learning integration, and lightweight/compact system design. Major players are also engaging in mergers, acquisitions, and collaborative partnerships to expand their market reach, access new technologies, and strengthen their competitive position.

List of Top Airborne Optronics Companies:

- L3Harris Technologies, Inc., (U.S.)

- Safran (France)

- ELBIT SYSTEMS LTD (Israel)

- Hensoldt AG (Germany)

- Northrop Grumman Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- Collins Aerospace (U.S.)

- FLIR Systems, Inc. (U.S.)

- Thales (France)

- Leonardo S.P.A. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 - The U.S. Air Force selected SNC, a global aerospace and defense company known for its expertise in elite mission system integration, for its Survivable Aircraft Operations Center (SAOC) contract. As part of the multibillion-dollar award, SNC would modernize and supply the USAF's existing E-4B "Nightwatch" aircraft. This highly specialized aircraft serves as the Air Command Center for the President (POTUS), the Secretary of Defense (SECDEF), and the Chairman of the Joint Chiefs of Staff (CJCS) to provide continuous critical command, control and communications (C3) during a nation emergency.

- April 2024 - Dutch military procurement organization Command Materiel and IT (COMMIT) awarded a contract for seven more Thales Ground Master 200 Multi-Mission Compact radars (GM200 MM/C) and two additional systems. The contract follows nine GM 200 MM/C radars ordered earlier in 2019.

- February 2023 – Sensor solutions provider HENSOLDT began developing important key elements of a new type of sensor network in the German-French-Spanish weapons project FCAS (= Future Combat Air System). As a member of the German FCMS GbR (FCMS = Future Combat Mission System) consortium, HENSOLDT received an approximately USD 108.6 million contract from the French procurement authority DGA for the development of demonstrators in the core competence areas of radar, intelligence, and self-monitoring, extensive networking of defense electronics, optics, and sensor technology.

- November 2022 - Safran Electronics and Defense signed a contract with Leonardo to develop and supply the electro-optical (optronic) system of high-performance aircraft Euroflir 610 for the Eurodrone program. Derived from the Euroflir 410 architecture, the Euroflir 610 is a 25-inch aircraft optronic system critical to the ISTAR (Intelligence, Surveillance, Target Acquisition and Reconnaissance) of the European MALE UAV.

- April 2022 - Collins Aerospace was awarded the development of a Very Low Frequency (VLF) communications system for the E-6B Capital Investment Program (E-XX), part of the Navy's Take Charge and Move Out (TACAMO) weapon system. The contract includes development planning and risk mitigation engineering to modernize airborne VLF systems to support the capabilities of the Strategic Air Command, Control and Communications Program Office (PMA-271). Development work and the resulting system improved security measures to combat advanced and new threats. This risk mitigation measure meets SWaP-C requirements to integrate the VLF system into the C-130J-30 aircraft as part of the initial test.

REPORT COVERAGE

Furthermore, the research report provides an overview of airborne optronics market trends, competitive landscape, market competition, product pricing, market status, and key industry developments. Apart from the factors mentioned above, the market report covers several direct and indirect factors that have influenced the global market size in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 8.8% from 2024 to 2032 |

|

Segmentation

|

By Aircraft Type

|

|

By Application

|

|

|

By Technology

|

|

|

By System

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global airborne optronics market size was valued at USD 2.03 billion in 2023 and is projected to grow from USD 2.53 billion in 2024 to USD 4.96 billion by 2032, at a CAGR of 8.8% during the forecast period.

Registering a CAGR of 8.8%, the market will exhibit steady growth during the forecast period.

Key growth drivers include the surging adoption of unmanned aerial vehicles (UAVs), increasing focus on intelligence, surveillance, and reconnaissance (ISR) operations, and the integration of artificial intelligence (AI) and machine learning (ML) into airborne sensor systems for improved object detection and decision-making.

North America dominated the airborne optronics market in 2023 with a market share of 34.98%, supported by strong investments in aerospace technologies, increasing demand for commercial and military aircraft, and the presence of major industry players like Northrop Grumman, Lockheed Martin, and L3Harris Technologies.

Some notable trends include the integration of multispectral and hyperspectral imaging systems, adoption of AI-powered image processing, and collaborations between avionics firms to develop next-generation electro-optical systems for UAVs and advanced manned platforms.

op players in the global market include L3Harris Technologies, Safran, Elbit Systems, Hensoldt AG, Northrop Grumman, Lockheed Martin, Collins Aerospace, FLIR Systems, Thales, and Leonardo S.P.A. These companies invest heavily in R&D and strategic partnerships to strengthen their product portfolios

Airborne optronics systems are used across various platforms including fixed wing aircraft, rotary wing helicopters, unmanned aerial vehicles (UAVs), and emerging urban air mobility vehicles, enabling missions like surveillance, targeting, and environmental monitoring.

AI and machine learning algorithms help automatically identify, classify, and track objects, reduce false alarms, and enable faster, more accurate decision-making. This is critical for ISR, targeting, and navigation systems, especially in dynamic combat scenarios.

The military segment holds the largest share of the market, driven by modernization initiatives that prioritize advanced surveillance, reconnaissance, and targeting capabilities, including day-and-night vision and long-range detection.

Key restraints include the complexity and high cost of integrating, maintaining, and calibrating airborne optronics systems, as well as challenges posed by harsh operational environments like vibrations, electromagnetic interference, and extreme temperatures.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us