Alkaline Battery Market Size, Share and Industry Analysis, By Product (Primary and Secondary), By Size (AA, AAA, 9 Volt, and Others), By Application (Remote Control, Consumer Electronics, Toys & Radios, and Others), and Regional Forecast, 2026-2034

Alkaline Battery Market Size

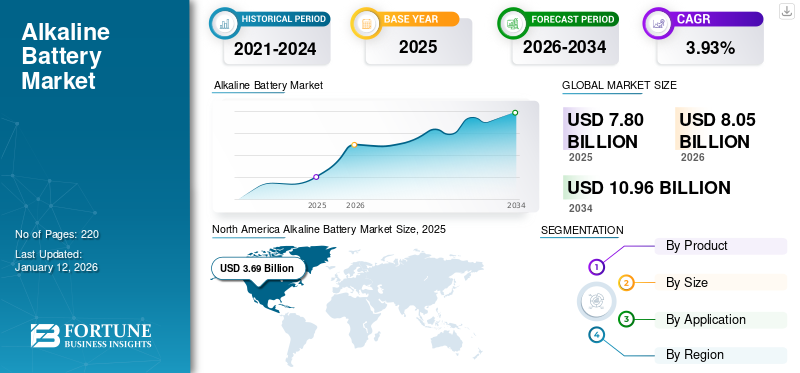

The global alkaline battery market size was USD 7.8 billion in 2025. The market is projected to grow from USD 8.05 billion in 2026 to USD 10.96 billion by 2034 at a CAGR of 3.93% over the forecast period (2026-2034). North America dominated the global market with a share of 47.15% in 2025. The Alkaline Battery Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.49 billion by 2032.

Alkaline batteries are disposable batteries or non-rechargeable batteries where electrodes are made of zinc and manganese dioxide. It has high energy density and performs well at ambient temperature, as well as at low temperatures. It has low leakage, longer life, and better dimensional stability. It is used in vehicles and for commercial and industrial purposes. They are also used in tracking devices, radios, toys, watches, calculators, cameras, flashlights, lanterns, games, fire and smoke detectors, portable stereos, telephones, tape, compact disc players, and other applications. Growth in consumer spending and the increasing demand for electronic products are the key factors set to accelerate this industry’s growth during the forecast period.

The global health emergency caused by the sudden spread of the novel coronavirus or COVID-19 has had a negative impact on almost every industry. Businesses had to suffer a significant loss in operational time due to the imposition of strict policies, such as nationwide lockdowns, to curb the virus’s reach. Accordingly, the disease outbreak has altered the demand for alkaline batteries as the demand from the end-use sectors has gone down. As the COVID-19 spread pushed many countries to implement lockdowns, it led to a decrease in the number of units produced, the number of units imported and exported, which ultimately hampered the alkaline battery industry growth.

Alkaline Battery Market Trends

Growing Advancement in Technology for Alkaline Batteries is a Current Trend

In an alkaline battery, the anode is the zinc, and the cathode is the magnesium oxide. The advancement in batteries has led to carbon usage in the cathode mix, which increases efficiency. A significant development in this alkaline type of battery has increased the performance capabilities, which would drive the demand for these batteries. Hence, significant technological advancement is one of the latest market trends.

In August 2023, Form Energy secured a USD 12 million worth grant from New York Governor in recent investment trends. The company shared plans to develop, design, and build a 10 MW/1000 MWh iron-air battery system, the location of which is yet to be determined. Form Energy has contracts for battery deployments with utilities such as Xcel Energy, Southern Company, and Great River Energy, and recently broke ground on a commercial battery plant in West Virginia.

Increasing Focus on Back-up Power is a Prominent Trend

Alkaline batteries are used to back up memory and clocks in laptop and desktop computers. Back-up power is urgently required during emergency applications for medical services, emergency lights, communications and electrical services, clean water, and other applications. Due to the instability of weather such as storms, hurricanes, cold and ice, and tornadoes, blackouts and power outages bring the need for power back up. The emerging demand for alkaline batteries from commercial applications such as data centers, telecom packaging plants, manufacturing plants, commercial buildings, agricultural operations, and processing facilities would propel alkaline batteries in the global market.

Download Free sample to learn more about this report.

Alkaline Battery Market Growth Factors

Increasing Consumer Spending to Fuel Demand for Alkaline Batteries

Increasing consumer spending for electronic gadgets would propel the alkaline battery industry’s growth during the forecast period. Consumer spending is a large component of GDP which upholds the economic stability of the country. It is used in household appliances and gadgets on a large scale, which further increases consumer spending. For instance, the average expenditures per consumer for 2018 were USD 61,224, which is an increase of 1.9% from 2017, as per the U.S. Bureau of Labor Statistics. Hence, the increasing consumer spending would fuel the demand for alkaline batteries in the forecast period.

Surging Demand for Electronics Products to Accelerate Market Growth

Electronic products are used in every sector, such as military, medical, industrial, commercial, and others. It is deployed in electronic products that are used in day-to-day activities on a large scale. The shifting dynamics in portability and mobility in telecommunication and mobile computing and the development of internet infrastructure would accelerate the use of alkaline batteries in the future.

According to the Ministry of Industry and Information Technology, China ranks first in the world in terms of production and sales of consumer electronics due to the country's improved innovation and brand-building capabilities. China remains an important global manufacturing region for consumer electronic products, attracting the world's largest electronic manufacturers to set up production facilities and research and development centers. The Ministry accelerates the cultivation of pioneering and supporting industries in the field and promotes the development of a new generation of audio-visual technology and virtual technology.

RESTRAINING FACTORS

Increasing Demand for Rechargeable Batteries to Restrain Market growth

Rechargeable batteries offer high power density, high discharge rate, good low-temperature performance, energy-efficient, and lower cost, unlike non-rechargeable batteries, negatively affecting the global alkaline battery industry. The growth of lithium-ion battery adoption is the perfect example of increasing preference for rechargeable batteries. Rechargeable batteries are more efficient and reliable; the consumer prefers more towards rechargeable batteries than an alkaline battery, which is primarily non-rechargeable. Hence, increasing demand for rechargeable batteries restraints the market growth in the coming years.

Alkaline Battery Market Segmentation Analysis

By Product Analysis

Increasing Consumer Spending to Lead to Growth of Primary Battery Segment

Based on product, this industry is segmented into the type primary and secondary. The primary battery segment held a dominant share of 91.06% in 2026. The dominance is due to the wide range of applications of non-rechargeable batteries in electronics products and household appliances. The increasing demand for electronics products, and growth in consumer spending, has enabled the development of the primary battery segment. However, stagnant growth can be observed for the secondary segment owing to the increasing demand from applications such as watches, alarm clocks, flashlights, cameras, lanterns, and others. Hence, the growth in consumer spending and high demand for electronics products would further accelerate the demand for primary alkaline batteries in the global market.

By Size Analysis

AA Segment to Lead Backed by its Long-life Span & High Storage Capacity

Based on the size, the market is segmented into AA, AAA, 9 volts, and others. The AA segment is leading the market with a share of 61.49% in 2026 owing to the higher storage capacity and long-lasting life span. The AAA segment is also growing faster due to its increasing applications in smaller and portable devices, including MP3 players, TV remote controls, digital cameras, and others.

The 9-volt segment is set to generate more market share due to its wide scope of application in walkie-talkies, alarm clocks, smoke detectors, electronic parking meters, and other consumer electronics. The other segment is also set to show a surge in the market share. It includes C, D, N, and button batteries used in medical, industrial, defense and military, and other industries. It would drive the demand for alkaline batteries in the global market.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment to Dominate Stoked by High Demand for Batteries in Such Products

Based on the application, the market is segmented into remote control, consumer electronics, toys & radios, and others. The consumer electronics segment is expected to have a dominant share of 79.50% in 2026 globally due to the increasing demand for alkaline batteries in laptops, computers, smartphones, MP3 players, and GPS units during the forecast period. The toys & radios segment is holding the second largest market share owing to the increasing application of these batteries in toys, radios, and walkie-talkies.

The other segment is also set to show a high market share in the global market, including cameras, entertainment, alarm clocks, flashlight, and tracking devices. It would propel the demand for these battery. The increasing engagement with digital technologies such as consumer IoT, smart homes, and home automation, coupled with the development of internet infrastructure and the spread of mobile communication network technologies, would drive global market growth.

The remote-control segment is growing at a steady rate owing to its wide scope of application in television sets, DVD players, and control functions such as power, playback, track change, volume, channels, heat, fan speed, or other features varying from device to device. Hence, a wide range of applications from the consumer electronics segment would drive alkaline batteries in the global market.

REGIONAL INSIGHTS

North America Alkaline Battery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 3.69 billion in 2025. The U.S. holds the largest market share for alkaline batteries owing to the growing adoption rate of consumer electronics products and increased consumer spending. It is also used in military, healthcare, and industrial applications. In addition to that, increasing investments in the healthcare industry and a wide scope of application in industrial applications would propel the alkaline battery market's growth in the forthcoming years in this region. The U.S. market is projected to reach USD 3.47 billion by 2026.

Asia Pacific

The Asia Pacific is estimated to hold the second-largest share in the global market. The growth is attributable to increased consumer spending and the booming growth in demand for electronic products. As per the International Monetary Fund (IMF) estimate, in 2020, the developing and emerging economies in the region increased by 5.6% in 2019, which signifies a growth opportunity for consumer spending in the coming years. Hence, growth in consumer demand would augment the market in the Asia Pacific during the projected period. The Japan market is projected to reach USD 0.36 billion by 2026, the China market is projected to reach USD 0.62 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

Europe

The market in Europe is expected to grow significantly due to the increasing expenditure on consumer electronics goods and gadgets. According to Statista Report 2020, the countries from Europe, such as Germany, the U.K., and France, held the leading positions in consumer expenditure. Hence, the increasing consumer spending capabilities would uphold the demand for electronic gadgets, which, in turn, would propel the demand for alkaline batteries during the forecast period in this region. The UK market is projected to reach USD 0.28 billion by 2026, while the Germany market is projected to reach USD 0.36 billion by 2026.

Middle East & Africa & Latin America

The market in the Middle East & Africa & Latin America is expected to show healthy growth in the coming years owing to the increasing investment in the electrical equipment, IT industry & telecom sector. It would augment the application of alkaline batteries. An increase in the demand for small electronic devices such as clocks, cameras, flashlights, and electronic toys, and portable radios would also accelerate the need for these batteries in the regions.

Key Industry Players

Duracell Inc. and Energizer Holdings to Lead Fueled by Their Expansion of Portfolios

The market is consolidated owing to the strong product portfolio and remarkable distribution network of major companies in the developed and emerging countries. Currently, Duracell Inc., Energizer Holdings, Camelion Batterien GmbH, and Gold Peak Industries (Holdings) Limited are the leading companies in the global market. Together these accounted for a significant share in 2024. However, the alkaline type of battery offers higher energy output, longer shelf life, and lasts longer than the carbon-zinc batteries. It has emerged as a replacement for carbon-zinc batteries. This is projected to lead to the healthy growth of the market by 2032.

The wide application of these batteries and flexible product options offered by Duracell has led the company to hold a strong position in the global market. The company offers its wide range of products under remote controls and the high drain devices segment. The strong foothold of Energizer Holdings on the global market is mainly due to its Energizer MAX family batteries, of which AA and AAA sizes are the bestselling ones.

Other key players such as Panasonic Corporation, ACDelco, Sunmol Battery Co. Ltd., Nippo, and Excell Battery Co. have also entered the competitive landscape with a wide product variation in batteries. Technical advantages and advanced features have increased their demand in the global market.

LIST OF TOP ALKALINE BATTERY COMPANIES:

- Duracell Inc. (US)

- Energizer Holdings (US)

- Camelion Batterien GmbH (Germany)

- Gold Peak Industries (Holdings) Limited (Hong Kong)

- Sanyo (Japan)

- Sony (Japan)

- Maxell Holdings, Ltd. (Japan)

- Toshiba International Corp (US)

- Zhejiang Mustang Battery Co., Ltd. (China)

- Panasonic Corporation (Japan)

- FDK Corporation (Japan)

- GPB International Limited (Germany)

KEY INDUSTRY DEVELOPMENTS:

- July 2022- Duracell has announced the launch of Coppertop AA/AAA batteries, which now contain Duracell's new Power Boost ingredients. The brand's best alkaline batteries, Duracell Optimum, are now made with 4x the patented Power Boost Ingredients vs. Copper tip with AA/AAA batteries to power all of this summer's outdoor adventures, from mild to extreme. New Duracell batteries with Power Boost ingredients may provide more power in some devices or longer life in some devices compared to older Coppertop batteries in many devices.

- November 2021- Alkaline battery maker Duracell launched a home energy storage solution through California distributor Power Center+. Power Center also markets Eguana series energy storage systems. The Duracell Power Center product line consists of 5 kW and 10 kW inverter products with lithium iron phosphate batteries that can be expanded from 14 kWh to 84 kWh. The Power Center AC connection allows new and existing solar owners to harvest excess solar energy for evening use, maximizing their solar investment while increasing energy security and independence without additional equipment.

- December 2020 - Anker Innovations, a global leader in mobile charging and consumer electronics, launched the Anker Charging Dock. It is a docking station optimized to charge the Oculus Quest 2 headset and Touch controllers. Using this, customers can insert Anker's included 1800mAH alkaline rechargeable batteries into the Touch controllers; Quest 2 users can place the controllers on the dock. The dock charges the controllers and the VR headset to full power in just 2.5 hrs.

- September 2020 – IKEA announced its plans to stop selling non-rechargeable alkaline batteries starting next year completely. The steps come in following IKEA's commitment to inspire and enable people to live a healthier and more sustainable life at home. Therefore, by October 2021, all non-rechargeable alkaline batteries will be removed from its global home furnishing range.

- May 2020- Murata Manufacturing planned to buy the battery manufacturing business of technology giant Sony. The two companies announced that they have signed a non-binding letter of intent confirming their intention to negotiate the transfer of Sony's battery business to the Murata Group. While the scope of the transfer has not yet been finalized, the parties expect the transfer to include Sony Energy Devices Corporation, the battery business of Sony's wholly owned subsidiary in Japan; Sony's battery-related manufacturing operations in China and Singapore; and assets and employees related to the battery business in Sony Group sales and research and development facilities in Japan and worldwide. Sony's consumer sales of USB batteries, alkaline batteries, button and coin batteries, mobile projectors and certain other products are not expected to be included in the transfer.

REPORT COVERAGE

The alkaline battery market research report provides a detailed analysis of the market. It focuses on key aspects such as the leading companies, product types, and leading applications across various industries. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the advanced market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 3.93% over 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Size

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 8.05 billion in 2026 and is projected to reach USD 10.96 billion by 2034.

Registering a CAGR of 3.93%, the market will exhibit steady growth over the forecast period (2026-2034).

In 2025, the North America market value stood at USD 3.69 billion.

The consumer electronics segment is expected to be the leading segment in this market during the forecast period.

The increasing consumer spending and the growing demand for electronics products are major factors driving the growth of the market. However, increasing demand for rechargeable batteries restraints the market growth.

Duracell Inc., Energizer Holdings, Camelion Batterien GmbH, and Gold Peak Industries (Holdings) Limited are the top companies in the market.

North America dominated the global market with a share of 47.15% in 2025.

Alkaline batteries are disposable batteries that have a longer shelf life and higher energy density than the other batteries. These batteries are used in various applications which include smoke alarms, portable transmitters, scanners, digital voltmeters, door locks, remote controls, laser pointers, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us