Ambulatory Arrhythmia Monitoring Devices Market Size, Share & COVID-19 Impact Analysis, By Device Type (Holter Monitors, Event Monitors, and Mobile Cardiac Telemetry Monitors), By Type (External and Implantable), By Application (Tachycardia, Bradycardia, Atrial Fibrillation, Ventricular Fibrillation, and Others), By End User (Hospitals & ASCs, Diagnostics Centers & Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

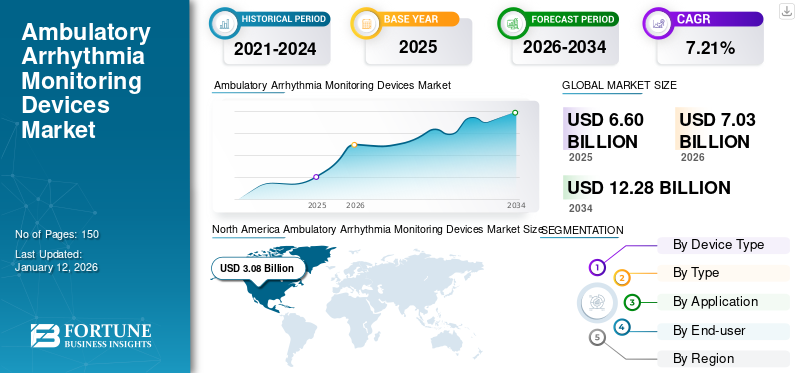

The ambulatory arrhythmia monitoring devices market size was valued at USD 6.6 billion in 2025 and is projected to grow from USD 7.03 billion in 2026 to USD 12.28 billion by 2034, exhibiting a CAGR of 7.21% during 2026-2034. North America dominated the ambulatory arrhythmia monitoring devices market with a market share of 46.58% in 2025.

The global impact of COVID-19 has been unprecedented and staggering, with ambulatory arrhythmia monitoring devices witnessing a negative impact on demand across all regions amid the pandemic. Based on our analysis, the global market exhibited a huge decline of -10.8% in 2024 as compared to the average year-on-year growth during 2019-2032. The sudden rise in CAGR is attributable to this market’s growth and demand, returning to pre-pandemic levels once the pandemic is over.

Ambulatory arrhythmia monitoring devices are primarily used to monitor the abnormalities in the heart rhythms for a prolonged period of time in home care, ASCs, hospitals, and other settings. The increasing number of geriatric population and the rising prevalence of various cardiovascular diseases, including tachycardia, bradycardia, atrial fibrillation, ventricular flatter, and others are fostering the demand for effective diagnostic options. According to the data published by the American College of Cardiology Foundation in 2019, it was reported that approximately 5.3 million people in the U.S. suffer from atrial fibrillation and the majority of the patients belong to the geriatric population.

Currently, key market players, such as Abbott, Medtronic, Boston Scientific Corporation, BioTelemetry, and others, are focused on introducing advanced cardiac arrhythmia monitoring devices to fulfill the increasing demand for these devices. For instance, in July 2021, Abbott announced the launch of the Jot Dx insertable cardiac monitor in the U.S. market to monitor heart rate remotely with significant accuracy.

Thus, the significant rise in the prevalence of cardiovascular disorders among the geriatric population and the introduction of advanced technology for remote cardiac monitoring are surging the demand and adoption of these monitoring devices among healthcare professionals. Further, other factors, such as improving healthcare infrastructure and favorable reimbursement policies for arrhythmia monitoring, are leading to increasing demand and adoption of these devices.

Limitation of Clinic Visit for Arrhythmia Monitoring During COVID-19 to Limit Market Growth

The COVID-19 pandemic negatively affected the global market. Key players operating in this market, including Abbott, Medtronic, and Boston Scientific Corporation, witnessed a huge decline in revenue from the sales of cardiac monitoring devices.

- For instance, Abbott reported a decline of 10.7% from the revenue generated from the rhythm management segment in 2020 as compared to 2019. Also, Medtronic reported a decrease of 12.1% in the revenue of Cardiac Rhythm & Heart Failure in 2020 as compared to 2019.

Also, precautionary guidelines were implied on diagnostic clinics and multi-specialty hospitals to reduce the number of inpatient visits and postponement of elective procedures. Furthermore, increasing initiatives by healthcare professionals to provide training sessions to patients for self-administration prevented delays in treatment during the COVID-19 pandemic.

- For instance, according to a report by American Heart Association, Inc., in 2020, guidelines, including the postponement of elective procedures and other non-urgent diagnostics procedures were imposed on clinics, hospitals, and other healthcare settings in the U.S. Also, it was stated that the number of inpatient visits decreased during the COVID-19 pandemic, and alternatively, telehealth services were implemented during the pandemic.

Download Free sample to learn more about this report.

Thus, several initiatives by the government and healthcare authorities, coupled with a decrease in the number of inpatient admission in healthcare settings negatively impacted the market during the COVID-19 pandemic.

Global Ambulatory Arrhythmia Monitoring Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.6 billion

- 2026 Market Size: USD 7.03 billion

- 2034 Forecast Market Size: USD 12.28 billion

- CAGR: 7.21% from 2026–2034

Market Share:

- Region: North America dominated the market with a 46.58% share in 2025. This leadership is driven by government and private initiatives to raise awareness about arrhythmia, the presence of favorable reimbursement policies, and the launch of new, advanced monitoring devices by key players.

- By Device Type: Holter monitors held the dominant market position. The segment's leadership is attributed to the cost-effectiveness of these devices compared to other ambulatory monitors and the availability of favorable reimbursement policies, which supports their widespread adoption.

Key Country Highlights:

- Japan: The market is driven by a large patient population, with an estimated 1.32 million people suffering from arrhythmia. This high prevalence creates a significant and sustained demand for effective diagnostic and monitoring solutions.

- United States: Growth is fueled by a high prevalence of conditions such as atrial fibrillation, which affects approximately 5.3 million people. The market is also supported by national awareness campaigns, such as AFib Awareness Month, and continuous product innovation from leading companies.

- China: As a key country in the fastest-growing Asia Pacific region, the market is expanding due to an increasing prevalence of arrhythmia and a growing patient pool that requires effective and accessible diagnostic options.

- Europe: The market is propelled by a large and growing geriatric population, which is more susceptible to arrhythmias. For instance, in Germany alone, approximately 1.5 million people suffer from atrial fibrillation, representing a significant healthcare burden and driving the demand for monitoring devices.

LATEST TRENDS

Shift of Patients Toward Wearable Monitoring Devices due to Cost-effectiveness and Better Convenience

Recently, a rising shift from conventional modalities to wearable smart devices is observed among patients diagnosed with arrhythmia and cardiovascular disorders.

For instance, according to a survey by ResearchGate GmbH in 2019, it was reported that approximately 68.9% of the surveyed population suffering from cardiac rhythm abnormalities were interested in smart devices for heart rate monitoring. Also, it was stated that patients with an underlying arrhythmia were more likely to be inclined toward smart wearables for ease of use and real-time monitoring capabilities.

Also, the distinct benefits offered by these devices, including their non-invasive nature, ease of availability, and capability of monitoring a range of heart rhythm abnormalities have been instrumental for increasing preference.

Thus, distinct advantages offered by wearable medical devices and introduction of advanced smartwatches by major players are bolstering the preferential shift of patients toward wearable devices.

- For instance, in October 2020, LIVMOR, Inc. announced the premarketing approval by the U.S. FDA for LIVMOR Halo atrial fibrillation detection system to detect atrial fibrillation in a precise way by continuous monitoring the heart rate.

DRIVING FACTORS

Rising Prevalence of Arrhythmia to Drive the Ambulatory Monitoring Devices Market Growth

There is gradual rise in the prevalence of arrhythmia, including atrial fibrillation, tachycardia, bradycardia, and others. For instance, according to a journal by European Medical Group LTD, in 2019, it was stated that approximately 1.5 million people in Germany were suffering from atrial fibrillation. Also, it was reported that the annual health care burden for atrial fibrillation in Germany was around USD 730 million, roughly 0.28% of the total healthcare spending in Germany.

This huge healthcare burden results in rising initiatives for the awareness of arrhythmia-related disorders by governments and private organizations. This factor, in turn, fosters the demand and adoption of various ambulatory arrhythmia monitoring devices among healthcare professionals and drives the ambulatory arrhythmia monitoring devices market growth. Furthermore, from research articles and interviews with key opinion leaders (KOLs), it was reported that the prevalence of atrial fibrillation and other arrhythmias is more in the elderly population of age more than 65 years.

- For instance, according to Frontiers Media S.A., the number of elderly people of age more than 65 years is steadily increasing. Also, the prevalence of atrial fibrillation is around 3.7%-4.2% for 60-70 years aged people and 10%-17% for more than 80 years aged people.

Hence, the increasing number of elderly population and the rising prevalence of atrial fibrillation, tachycardia, and other arrhythmia are some of the market drivers fueling the demand for diagnostics options and boosting the adoption rate of these monitoring devices.

RESTRAINING FACTORS

Recurrent Faulty Measurement by Arrhythmia Monitoring Devices to Limit Market Growth

The rising prevalence of key disorders and the introduction of advanced monitoring devices are some of the major factors for the growth of the market. However, lack of adequate validation of the ambulatory arrhythmia monitoring devices resulting in the false positive alarm for arrhythmia is limiting the adoption rate of these devices among physicians.

- For instance, according to a survey analysis published by Innovate Healthcare in 2021, approximately 59.8% of the total alerts provided by implantable loop recorders were inaccurate.

Also, the high cost associated with ambulatory monitoring devices is limiting these devices' adoption rate.

- For instance, according to ResearchGate GmbH, the estimated price of an implantable loop recorder is around USD 5,000.0 with additional charges for implantation and monitoring.

Thus, the above factors and the limited number of trained healthcare professionals for heart rhythm monitoring are further restricting the adoption of these devices, thereby limiting the growth rate of the global market.

SEGMENTATION

By Device Type Analysis

Cost-Effectiveness of Holter Monitors Led to its Dominant Position in 2020

Holter monitors accounted for the highest market share of 55.16% among device types in 2026. The lower cost of holter monitors compared to other ambulatory monitoring devices and the availability of favorable reimbursement policies for this device led to the availability of favorable reimbursement policies. Therefore, this resulted in the dominance of this segment during the study period.

- For instance, according to Medindia, the average cost of holter monitoring is around USD 350-400. Also, according to Welch Allyn, Inc., the cost covered for this monitoring is approximately USD 30-90.

Additionally, the mobile cardiac telemetry segment is expected to grow with the highest CAGR during the forecast period. The presence of distinct advantages including real-time monitoring of heart rhythm and higher diagnostic yield is anticipated to fuel the segment growth during the forecast period.

By Type Analysis

Non-invasive Nature of External Monitors Responsible for Higher Adoption of these Devices

Based on type, the external monitors segment dominated the market with share of 74.88% in 2026. The major factors such as its non-invasive nature of monitoring heart rhythm abnormalities are attributed to this segment's dominance. Furthermore, the lower cost associated with external arrhythmia monitors is propelling the market growth of this segment during the forecast period.

- According to research articles and interviews with key opinion leaders, it was estimated that the average OEM price of a holter monitor is approximately USD 1,500 and the cost for a holter monitoring procedure is around USD 200.

Thus, the product’s lower cost compared to implantable monitors coupled with the non-invasive nature of these monitors fuels the growth opportunity of this segment during the forecast period.

On the other hand, the implantable segment is likely to grow with a moderate CAGR during the forecast period owing to its invasive monitoring procedure. However, ongoing clinical trials and the introduction of advanced features in the implantable monitors by key players and long-term monitoring capabilities are anticipated to overcome the limitation and foster the segmental growth during the study period.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Prevalence of Atrial Fibrillation Led to its Dominant Share in 2020

Based on application, the atrial fibrillation segment accounted for the highest market share of 49.04% in 2026 due to the rising prevalence of this disorder globally.

- For instance, according to a research article by World Heart Federation in 2021, it was estimated that the prevalence of atrial fibrillation in Spain is 4.4%, among which for men, the prevalence rate is 4.4% and for women, the rate is 4.5%. Also, according to CDC, atrial fibrillation is the most common type of arrhythmia diagnosed among common people in the U.S.

On the other hand, the ventricular fibrillation segment is expected to grow with the highest CAGR during the forecast period. This factor is due to the high risk associated with these disorders and rising initiatives for the awareness of this disorder among common people. For instance, according to an article by WebMD LLC., around 65-85% of the patients suffering from cardiac arrest are diagnosed with ventricular fibrillation.

By End-User Analysis

Availability of Advanced Ambulatory Arrhythmia Monitoring Devices in Diagnostics Centers and Clinics Resulted in Highest Market Share in 2020

Based on the end-user, the Diagnostics Centers and Clinics segment dominated the market share of 54.22% in 2026. This factor is due to the availability of advanced monitoring devices such as long-term holter monitors, event looping and non-looping monitors, and others. Also, the availability of trained health care physicians and technicians and the presence of favorable reimbursement policies for arrhythmia monitoring by private payers are fueling the dominance of this segment during the study period.

Additionally, the hospital and ASCs segment holds the second largest market share in 2020. Availability of multispecialty care units and higher preference for these settings among the general population compared to other settings are poised to propel the growth of this segment during the study period.

REGIONAL INSIGHTS

North America

North America Ambulatory Arrhythmia Monitoring Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 3.08 billion in 2025. Increasing initiatives by the government and other private organizations for the awareness for arrhythmia and the presence of favorable reimbursement policies for the diagnostics of the key disorders are some of the key reasons for the major market share of this region. The U.S. market is projected to reach USD 2.81 billion by 2026.

- For instance, according to Heart Rhythm Consultants, P.A., every year in September, National AFib Awareness Month is being celebrated among the U.S. population to educate the common people about the symptoms of atrial fibrillation.

Also, the presence of major key players operating in this market contributes to the major dominance of this region in 2020.

Europe

Europe accounted for the second-largest share of the global market in 2020. The growth is primarily attributed to the presence of a large number of the elderly population who are more susceptible to arrhythmias such as tachycardia, atrial fibrillation, bradycardia, and others. The UK market is projected to reach USD 0.41 billion by 2026, while the Germany market is projected to reach USD 0.57 billion by 2026.

- For instance, according to Eurostat, approximately 50% of the total population in Europe were aged in between 65 and 69 years in 2019.

Furthermore, developed healthcare infrastructure coupled with the presence of trained healthcare professionals is resulting in the growing demand and adoption of ambulatory monitoring devices in this region.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The increasing prevalence of arrhythmia is the primarily attributing factor for the highest CAGR growth of this region. The Japan market is projected to reach USD 0.27 billion by 2026, the China market is projected to reach USD 0.51 billion by 2026, and the India market is projected to reach USD 0.25 billion by 2026.

- For instance, according to Elsevier Inc., the total patient population for arrhythmia in Japan was 1.32 million in 2017. This huge patient population is increasing the rising demand for arrhythmia diagnostic options and fueling the demand and adoption of ambulatory monitoring devices among healthcare professionals in this region.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to grow with a moderate CAGR during the forecast period due to limited awareness and treatment options for arrhythmia and other cardiovascular disorders. Lack of insurance coverage for the diagnosis of key disorders limits the demand and adoption of ambulatory monitoring devices in this region. Although governments and other for-profit and non-profit organizations are focusing on developing healthcare infrastructure in some countries, including South Africa, the UAE, Saudi Arabia, and others.

To know how our report can help streamline your business, Speak to Analyst

- For instance, according to a report by Informa U.K. Limited in April 2021, the South African government implemented the National Health Insurance scheme to provide better access to healthcare services for the general population.

Thus, rising initiatives for the development of healthcare infrastructure in emerging countries of Latin America and Middle East & Africa are likely to foster the demand and adoption of ambulatory arrhythmia monitoring devices in the near future.

KEY INDUSTRY PLAYERS

Advance Product Offerings by Major Players Led to Dominant Market Position

The market is dominated by a few established players such as Abbott, Medtronic, Boston Scientific Corporation, and BioTelemetry. The strong focus on the introduction of advanced monitoring devices, including insertable cardiac monitors and event monitors to cater to the unmet demand for ambulatory monitoring devices globally is one of the key reasons for the market dominance of these companies.

- For instance, in June 2020, Boston Scientific Corporation announced the pre-marketing approval for LUX-Dx insertable cardiac monitors with an aim to monitor the heart rhythm in the long-term and detect arrhythmic conditions, including atrial fibrillation, cryptogenic stroke, and others.

On the other hand, market players, including iRhythm Technologies, Inc., Medi-Lynx Cardiac Monitoring, LLC, and others are constantly focusing on inorganic growth strategies, including partnership and acquisition of other major market players operating in the market. These strategies are assisting them in increasing their brand presence and widening the product offerings. The other key players operating in the market are ZOLL Medical Corporation, CamNtech Ltd, and others.

- For instance, in September 2019, iRhythm Technologies, Inc. announced a collaboration with Verilyl, a subsidiary company of Alphabet Inc., to provide early warnings for asymptomatic atrial fibrillation among the general population.

LIST OF KEY COMPANIES PROFILED:

- Abbott (Lake Bluff, U.S.)

- Medtronic (Dublin, Ireland)

- Boston Scientific Corporation (Marlborough, U.S.)

- BioTelemetry (Malvern, U.S.)

- iRhythm Technologies, Inc. (San Francisco, U.S.)

- Medi-Lynx Cardiac Monitoring, LLC. (Plano, U.S.)

- CamNtech Ltd (Fenstanton, U.K.)

- ZOLL Medical Corporation (Chelmsford, U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2019 – ZOLL Medical Corporation announced the µCor heart failure and arrhythmia management system to monitor the heart rhythm abnormality and help in the early detection of heart failure decompensation.

- June 2019 – BIOTRONIK SE & Co. KG announced f BIOMONITOR III, an injectable cardiac monitor in Central Europe with a view to provide accuracy while detecting types of arrhythmia invasively.

REPORT COVERAGE

The ambulatory arrhythmia monitoring devices market research report provides a detailed industry analysis and focuses on key aspects such as leading companies, products, and end-users. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the market report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 7.21% from 2026-2034 |

|

Segmentation |

By Device type

|

|

By Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD USD 7.03 billion in 2026 and is projected to reach USD 12.28 billion by 2034.

In 2025, the North America market value stood at USD 3.08 billion.

In 2026, the global market share of the atrial fibrillation segment was 49.04%.

The market will exhibit steady growth at a CAGR of 7.21% during the forecast period (2026-2034).

By application, the atrial fibrillation segment is leading the market.

The rising prevalence of arrhythmia and the introduction of advanced monitoring devices are the key drivers of the market.

Abbott, Medtronic, Boston Scientific Corporation, and BioTelemetry are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us