Antibiotics Market Size, Share & Industry Analysis, By Drug Class (Penicillin, Cephalosporin, Aminoglycosides, Tetracycline, Macrolides, Fluoroquinolones, Sulfonamides, and Others), By Application (Skin Infections, Respiratory Infections, Urinary Tract Infections, Septicemia, Ear Infection, Gastrointestinal Infections, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

ANTIBIOTICS MARKET SIZE AND FUTURE OUTLOOK

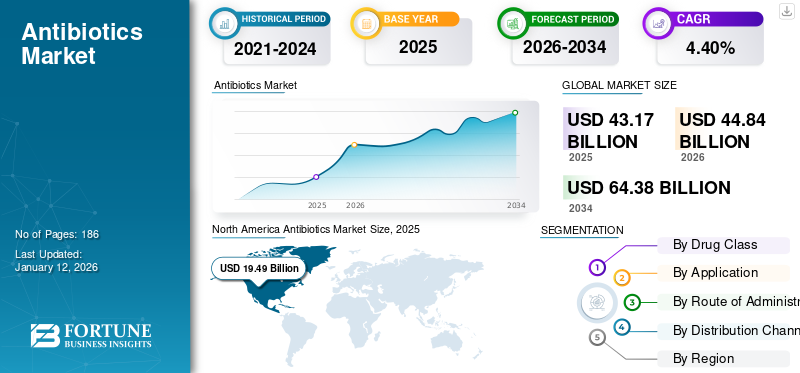

The global antibiotics market size was valued at USD 43.17 billion in 2025. The market is projected to grow from USD 44.84 billion in 2026 to USD 64.38 billion in 2034 at a CAGR of 4.40% during the forecast period. North America dominated the antibiotics market with a market share of 45.44% in 2025.

These drugs are a group of medicines used to treat bacterial infections in humans. Different generations of antibiotics are used to treat ailments related to skin, gastrointestinal tract, urinary tract, ear, and others. The global market is witnessing lower growth due to the stringent regulations in different countries that decrease the misuse and overuse of antibiotics and combat antimicrobial resistance in humans. Several government agencies and regional healthcare organizations are taking initiatives to restrict the overuse and misuse of these products in these countries.

- For instance, in January 2024, to limit the misuse of antimicrobial drugs, the Central Government of India announced that all doctors must write 'exact indications' while prescribing these drugs.

However, these are one of the essential medications for treating bacterial infections, and are thus leading to a significant rise in their consumption. The proper guidance and adequate usage increase the consumption of antibiotics to tackle various diseases. Thus, rising prevalence, increasing research and development activities, and rising number of prescriptions and consumption associated with antibiotics are propelling the market growth.

- In November 2023, a study published in the Proceedings of the National Academy of Sciences of the United States of America (PNAS) estimated antibiotic consumption across 63 countries from 2016 to 2023. The findings revealed that approximately 34.3 billion Defined Daily Doses (DDDs) of antibiotic were consumed in 2023, marking a 16.3% increase from the 29.5 billion DDDs recorded in 2016. This rising trend in antibiotic usage is significantly contributing to the growth of the market.

Key players in the market, such as Sandoz Group AG, Pfizer Inc., Astellas Pharma Inc., and GSK plc, are increasing their branded and generic product offerings in the market. Also, increasing development to launch novel antibiotic is boosting the companies’ shares in the market.

Global Antibiotics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 43.17 billion

- 2026 Market Size: USD 44.84 billion

- 2034 Forecast Market Size: USD 64.38 billion

- CAGR: 4.40% from 2026–2034

Market Share:

- North America dominated the antibiotics market with a 45.44% share in 2025, driven by the high prevalence of bacterial infections, advanced healthcare infrastructure, and strong presence of key pharmaceutical players focusing on antibiotic development.

- By drug class, penicillin is expected to retain its largest market share owing to its widespread use in treating various bacterial infections, increasing generic product launches, and affordability compared to other antibiotic classes.

Key Country Highlights:

- United States: The country is witnessing rising antibiotic consumption supported by high prescription rates and robust government funding initiatives aimed at developing advanced antibacterial therapies.

- Europe: The region benefits from strong research and development infrastructure and regulatory approvals that encourage the launch of novel antibiotic therapies targeting resistant bacterial infections.

- China: The market is propelled by the commercialization of affordable, effective generic antibiotics, combined with rising awareness about antimicrobial resistance and governmental efforts to regulate appropriate antibiotic usage.

- Japan: Key pharmaceutical players are enhancing their focus on the development and approval of innovative combination therapies to address the challenges posed by antimicrobial resistance.

MARKET DYNAMICS:

MARKET DRIVERS:

Rising Prevalence of Bacterial Infections to Propel Market Growth

The increasing number of cases of bacterial infections across the globe is one of the major factors driving the global antibiotics market growth. These may include Urinary Tract Infections (UTI), respiratory infections, tuberculosis, skin infections, sexually transmitted diseases, and others.

- For instance, according to the report titled "Global Tuberculosis Report 2024," published by the World Health Organization (WHO), around 10.8 million people across the world were suffering from tuberculosis in 2023, which is caused by the bacteria Mycobacterium tuberculosis.

Similarly, rising cases of Healthcare-Associated Infections (HAIs) upsurge the demand for antibiotics drugs. The HAIs include surgical site infections, urinary tract infections, and others. Such conditions increase the demand for antibiotic to treat bacterial infections and thus drive the market growth.

- For instance, according to the data published by the WHO, around 1 in 10 patients is affected by HAIs, and this is higher in low-/middle-income countries.

Moreover, the increasing antimicrobial drug resistance infections increases the demand for innovative treatment options to decrease antibiotic resistance in humans, leading to research and development for the launch of therapeutically effective antibiotics, which is also bolstering market growth.

MARKET RESTRAINTS:

Surging Antimicrobial Resistance and Healthcare Expenditure Restricts Market Growth

The prolonged use of various antibacterial drugs, such as broad-spectrum antibiotics, has augmented the Antimicrobial Resistance (AMR) among patients. The misuse and overuse of antimicrobials are the main drivers in the development of drug-resistant pathogens.

- For instance, according to the data published by the Lancet journal, a global burden of bacterial antimicrobial resistance from 1990 to 2021 was studied. It was found that in 2021, AMR led directly to 1.14 million deaths amongst the 4.71 million deaths, and if this trend continues, it is also projected that 10.0 million deaths will be caused by AMR in 2050. Such factors are hampering the adoption of the available antibiotics, leading to the loss of developmental costs and thus restraining market growth.

In contrast, AMR is increasing the cost of health expenditure, leading to an additional burden on the healthcare systems.

- For instance, in November 2023, as per the data released by the World Health Organization, Antimicrobial Resistance (AMR) could lead to an increase of USD 1.0 trillion in healthcare expenses by 2050, along with potential GDP losses ranging from USD 1.0 trillion to USD 3.4 trillion annually by 2030.

MARKET OPPORTUNITIES:

Development of Novel Advanced Therapies to Treat Antibiotic-resistant Infections Provides a Lucrative Market Opportunity

The emergence of antibiotic-resistant infections presents a significant challenge to global health. On the other hand, it is also creating lucrative opportunities within the antibiotics market for the development of novel advanced combination therapies. Due to the rising awareness about antibiotic-resistant infections, biopharmaceutical companies are focusing on developing advanced combination therapies. The clinical trial landscape for combination drugs is also expanding rapidly.

- For instance, in February 2025, AbbVie Inc. announced the approval of EMBLAVEO (aztreonam and avibactam) by the U.S. Food and Drug Administration (FDA). It is a combination antibiotic of monobactam and a β-lactamase inhibitor. It is used to treat adults aged 18 and older with complicated intra-abdominal infections (cIAI). Such approvals and launches are expected to offer significant growth opportunities in the market.

MARKET CHALLENGES:

Decrease in Prescriptions of Antibiotics Due to AMR is Challenging Market Growth

Healthcare systems across the globe are facing key challenges due to the increase in Antimicrobial Resistance (AMR). Additionally, a decrease in the prescriptions of antibiotics is also hampering the growth of the market.

- For instance, in July 2022, a study was published by the Agency for Healthcare Research and Quality; the researchers examined the outcomes of the AHRQ Safety Program, which supported 389 ambulatory clinics to promote the proper use of antibiotics. As per the program, the antibiotic prescriptions at the clinics that participated observed a reduction of nearly 48.0%, while prescriptions specifically for acute respiratory infection diagnoses fell by 37.0%.

Such initiatives lead to a decrease in the prescription rate and, thus, hampering the overall market growth.

ANTIBIOTICS MARKET TRENDS:

Antimicrobial Stewardship Programs for Responsible Use is a Prominent Trend

Excessive use of antibiotics leads to an increase in the prevalence of resistant bacteria. The more frequent usage generates a huge opportunity for bacteria to develop resistance. This results in antibiotics potentially becoming ineffective when needed in the future.

Thus, to reduce the wastage of the drug and improve the effectiveness of these medications against bacteria, Antimicrobial Stewardship Programs (ASPs) have emerged as a pivotal global antibiotics market trend in the healthcare sector.

- For instance, in March 2024, ReAct Africa collaborated with LifeArc to launch "ASPIRE" (Antibiotic Stewardship Programme through Innovation, Research, and Education). This initiative aimed to combat antimicrobial resistance by revolutionizing antibiotic usage in Zambia and Kenya and incorporating innovative digital solutions alongside targeted interventions to foster long-term improvements in policy and practice.

- North America witnessed a antibiotics market growth from USD 18.14 Billion in 2022 to USD 18.79 Billion in 2023.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic negatively impacted the growth of the market in 2020. This was due to the disruptions in the delivery of essential healthcare services and a decrease in in-person primary care consultations and hospital visits. Also, there was a decline in prescriptions during the COVID-19 pandemic. However, the sales of drugs came back to pre-pandemic levels in 2021 with the increasing volume of patient visits to hospitals and clinics.

SEGMENTATION ANALYSIS

By Drug Class

Increasing Generic Launches of Penicillin Boosted Segment's Growth

Based on drug class, the market is segmented into cephalosporin, penicillin, aminoglycosides, macrolides, tetracycline, fluoroquinolones, sulfonamides, and others.

The penicillin segment dominated the global antibiotics market share 28.59% in 2026 driven by the rising prevalence of bacterial infections and increased sales of penicillin for numerous bacterial infections. Additionally, growing launches of generic penicillin are significantly boosting the adoption.

- For instance, in March 2025, Avenacy launched a suite of five antibiotic products for injection, including Penicillin G Potassium for Injection, USP, with an aim to strengthen the company's portfolio of high-usage and critical injectable products.

The cephalosporin segment is anticipated to expand at a higher CAGR during the forecast period.

This growth is attributable to the presence of different generations of cephalosporin with specific activity and indications, allowing healthcare providers to choose the most appropriate cephalosporin based on the type of infection and the susceptibility of the bacteria, thus boosting the adoption and growth of the segment. Moreover, rising regulatory approvals for the new generation of cephalosporin will boost the segment's growth in the market.

- For instance, in April 2024, Basilea Pharmaceutica Ltd announced that the U.S. Food and Drug Administration (FDA) had approved ZEVTERA (ceftobiprole medocaril sodium) for injection. It is used to treat patients with Staphylococcus aureus bloodstream infections (bacteremia) (SAB), Acute Bacterial Skin and Skin Structure Infections (ABSSSI), and Community-Acquired Bacterial Pneumonia (CABP). Such approvals boost the growth of the segment in the market.

The fluoroquinolones segment is expected to grow with moderate CAGR during the forecast period. The segment's growth is augmented by rising generic launches associated with fluoroquinolones.

- For instance, in March 2024, ANI Pharmaceuticals, Inc. launched a generic version of the Reference Listed Drug (RLD) Levaquin, a levofloxacin oral solution in the U.S.

Macrolides, tetracycline, fluoroquinolones, aminoglycosides, and other drug classes have showcased marked variations in preference among healthcare providers in different countries. Also, increasing funding activities in the region for developing novel drug products is expected to boost the market segment's growth.

- For instance, in June 2021, BioVersys, a Basel, Switzerland-based pharmaceutical company, secured up to USD 4.35 million in funds from CARB-X to develop a new class of antibiotics targeting species pathogens—that have become resistant to most existing antibacterial products.

To know how our report can help streamline your business, Speak to Analyst

By Application

Rising Prevalence of Respiratory Infections has contributed to Higher Share of the Segment

Based on application, this market is classified into skin infections, respiratory infections, urinary tract infections, septicemia, ear infection, gastrointestinal infections, and others.

The respiratory infections segment dominated the application segment share 23.75% in 2026. This higher share is attributable to the growing prevalence of several respiratory infections, leading to the rising demand for effective products for treatment, in turn supplementing the segment's dominance.

- For instance, in November 2024, according to UNICEF, the incidence of pneumonia is over 1,400 cases per 100,000 children across the globe. Such a high number of cases associated with respiratory infections is propelling the segment's growth.

The rising demand for drugs to treat these diseases is anticipated to boost segmental growth.

Furthermore, the Urinary Tract Infections (UTI) application segment is anticipated to hold the second-highest share of the market and is expected to grow significantly during the forecast period. The rising incidence of UTIs due to poor sanitation in females and males, as well as the increasing number of drug approvals for UTI treatment, have boosted the segment's growth.

- For instance, in February 2024, Allecra Therapeutics GmbH announced that the U.S. Food and Drug Administration (FDA) had approved EXBLIFEP (cefepime/enmetazobactam). This medication is indicated for treating complicated Urinary Tract Infections (cUTIs), including pyelonephritis, in patients aged 18 and older.

The ear infection segment is expected to grow with a moderate CAGR during the forecast period. The growth of the segment is attributed to increasing product launches for the treatment of bacterial ear infection.

- For instance, in March 2024, Amneal Pharmaceuticals, Inc. received Abbreviated New Drug Application ("ANDA") approval from the U.S. Food and Drug Administration for ciprofloxacin and dexamethasone otic suspension for the treatment of acute otitis externa.

Skin infections and gastrointestinal infections segments captured considerable market share in 2024 and are projected to secure an increased market share by the end of 2032. Potential pipeline candidates in clinical trials are anticipated to boost the growth of the segment.

- For instance, companies such as Helperby Therapeutics Ltd. are potential candidates in R&D for the treatment of bacterial skin infections.

By Route of Administration

Dominance of Parenteral Route of Administration is Attributed to an Increasing Incidence of Hospital Acquired Infections (HAIs)

Based on route of administration, the global market is classified as oral, parenteral, and others.

The parenteral segment held a major portion of the market share 58.08% in 2026. Rapid absorption and enhanced bioavailability of the parenteral dosage form and preference for severe infections such as sepsis, pneumonia, and bloodstream infections where high concentrations of antibiotics are required are boosting the growth of the segment. Additionally, new product launches and regulatory approval for parenteral dosage forms will boost the segment's growth.

- For instance, in February 2025, Shionogi & Co., Ltd. announced that its partner, JEIL PHARMACEUTICAL CO., LTD., South Korea, received marketing approval for Fetroja (cefiderocol) injection from the South Korean regulatory authorities used for the gram-negative bacterial infection treatment. Also, increasing regulatory approval for the commercialization of parenteral dosage forms is expected to boost the growth of the segment.

On the other hand, the oral segment holds a significant share of the market. The convenience and effectiveness of oral dosage forms make it a preferred choice for healthcare providers and patients, which is the prominent factor projected to boost segmental growth during the forecast period.

- For instance, in March 2025, GSK plc announced that the U.S. Food and Drug Administration (FDA) had approved Blujepa (gepotidacin). It is an oral antibiotic used for the treatment of urinary tract infections.

The other routes of administration segment include inhaled, rectal, topical, and others. The rising demand for these products and increasing generics is anticipated to boost the adoption and growth of the market during the forecast period.

By Distribution Channel

Rising Shift toward at-Home delivery to Exhibit High Growth of Online Pharmacy Segment in Near Future

The global market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy based on distribution channel.

Online pharmacy is expected to grow with the highest CAGR during the forecast period. Owing to rising technological advancement and increasing demand for remote consultation, the segment is anticipated to witness strong growth in the coming years.

The hospital pharmacies segment is expected to hold a significant portion of the market share of 60.71% in 2026, owing to the increasing shift of patients toward hospitals for a wide range of infectious disease treatments. Also, the growing number of prescriptions by general practitioners are expected to boost the distribution of antibiotic products by hospital pharmacies.

- For instance, according to the English Surveillance Programme for Antimicrobial Utilization and Resistance (ESPAUR) 2023-2024 report, most antibiotics in England are prescribed in general practice, which is around 71.7% of overall consumption.

On the other hand, the retail pharmacy segment held a substantial portion of the market, owing to the rise in accessibility and convenience for patients to secure the drugs with proper guidance over AMR. These pharmacies also aim to offer primary care services, which is likely to boost the growth of the retail pharmacy segment.

- For instance, in September 2024, Pharmaprix, a pharmacy chain in Quebec, announced expanding the care clinic network. These innovative clinics, averaging 450 square feet, offer a range of primary care services, including treatment for hormonal contraception, shingles, acne, urinary tract infections, and allergic rhinitis. Such advancements in these channels are expected to boost the segment's growth in the market.

ANTIBIOTICS MARKET REGIONAL OUTLOOK:

On the basis of region, the global market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America Antibiotics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 19.49 billion in 2025 and USD 20.26 billion in 2026.. The rising cases of bacterial infectious diseases, the growing aging population, and the presence of advanced healthcare facilities boost the mindful adoption of these products and decrease antimicrobial resistance.

Additionally, the presence of key players in the market with advanced research and development facilities to launch new-aged products for multi-drug resistance infection propels market growth.

- For example, in October 2023, Venatorx Pharmaceuticals, Inc. received a contract from the Biomedical Advanced Research and Development Authority (BARDA), a part of the U.S. Department of Health and Human Services (HHS). This funding supported the development of oral ceftibuten-ledaborbactam etzadroxil for treating complicated urinary tract infections (cUTI), including pyelonephritis. Such funding activities are likely to aid the growth of the market in this region.

U.S.:

The U.S. dominated the North American region, owing to the rising prevalence and increasing consumption of these products in the country. The U.S. market is projected to reach USD 17.94 billion by 2026.

- According to the Centers for Disease Control and Prevention, the total antibiotic use rate in 2023 was 756 prescriptions per 1,000 people. Such a high number of prescriptions are expected to boost the country's market growth.

Europe:

On the other hand, Europe held the second-largest share of the market. The advanced healthcare infrastructure and increasing investment in research and development activities are the key aspects driving the demand for these drugs in the European market. The UK market is projected to reach USD 1.02 billion by 2026, and the Germany market is projected to reach USD 1.12 billion by 2026.

- April 2024, UTILITY Therapeutics, Ltd., U.K., announced that the U.S. FDA had approved Pivya (pivmecillinam) tablets to treat uncomplicated female UTIs.

Asia Pacific:

Asia Pacific is estimated to grow at the highest CAGR during the forecast period. Rising prevalence and high consumption of these products, coupled with the presence of affordable and effective generic drugs, collectively propel the market's growth in the region. The Japan market is projected to reach USD 1.63 billion by 2026, the China market is projected to reach USD 2.56 billion by 2026, and the India market is projected to reach USD 1.97 billion by 2026.

- For instance, in February 2024, Cipla Limited received approval from the Central Drugs Standard Control Organization (CDSCO) to commercialize Plazomicin. It is a new intravenous (IV) aminoglycoside indicated for the treatment of complicated Urinary Tract Infections (cUTI).

Latin America and the Middle East & Africa:

Latin America and the Middle East & Africa are projected to account for considerable market revenue share during the forecast period. The emerging healthcare sector and the increasing awareness about several bacterial infections are expected to augment the growth of the market in these regions during 2025-2032.

- For example, in January 2025, the 13th International Pharmacy and Medicine Conference announced the establishment of three new pharmaceutical industries in Sharjah, with a total investment exceeding USD 84.0 million. These factories will focus on producing respiratory products, eye drops, antibiotic capsules, stomach medications, and first aid supplies.

COMPETITIVE LANDSCAPE:

KEY INDUSTRY PLAYERS:

Key Players are focusing on Acquisitions and Collaborations to Strengthen their Market Position

This market represents a semi-fragmented structure with players such as Pfizer Inc., Astellas Pharma Inc., Sandoz Group AG, and Merck & Co., Inc. accounting for a substantial share in 2024. The top market players are focusing on generic launches and strategies, such as acquisitions and collaborations, to strengthen their positions globally.

Other key players with an important presence in the global market include GSK plc, Johnson & Johnson Services, Inc., Bayer AG, and Bristol-Myers Squibb Company. These companies are anticipated to focus on research and development and new product launches to increase their market share during the forecast period.

LIST OF KEY ANTIBIOTICS COMPANIES PROFILED:

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- GSK plc. (U.K.)

- Sandoz Group AG (Switzerland)

- Bayer AG (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.) (U.S.)

- AbbVie Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Iterum Therapeutics plc, Ireland, announced that the U.S. Food and Drug Administration (FDA) had approved ORLYNVAH (sulopenem etzadroxil and probenecid). This medication is intended to treat uncomplicated Urinary Tract Infections (uUTIs).

- February 2024: Venatorx Pharmaceuticals, Inc. and Melinta Therapeutics announced that the FDA issued a Complete Response Letter (CRL) for their New Drug Application (NDA) of cefepime-taniborbactam.

- January 2024: Orchid Pharma's Exblifeb received approval from the European Medicines Agency. This drug is used in the treatment of various infections such as pneumonia, Urinary Tract Infections (UTIs), and others.

- November 2023: The Global Antibiotic Research & Development Partnership (GARDP) and Innoviva Specialty Therapeutics collaboratively announced its primary endpoint, zoliflodacin, a first-in-class antibiotic in an unprecedented global pivotal phase 3 clinical trial.

- April 2023: Meiji Seika Pharma Co., Ltd. initiated the global Phase 3 clinical trial for OP0595 nacubactam for combating antimicrobial resistance.

REPORT COVERAGE

The global antibiotics market research report provides detailed industry analysis. It focuses on key aspects, such as an overview of the advanced product, the rising number of several bacterial infections, key countries, and pricing analysis. Additionally, it includes key industry developments such as mergers, partnerships, & acquisitions, and brand analysis. Besides these, it offers insights into the market trends and highlights key industry developments. Furthermore, the report comprises a detailed pipeline analysis of new drugs and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.40% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Drug Class, Application, Route of Administration, Distribution Channel, and Region |

|

By Drug Class |

· Penicillin · Cephalosporin · Aminoglycosides · Tetracycline · Macrolides · Fluoroquinolones · Sulfonamides · Others |

|

By Application |

· Skin Infections · Respiratory Infections · Urinary Tract Infections · Septicemia · Ear Infection · Gastrointestinal Infections · Others |

|

By Route of Administration |

· Oral · Parenteral · Others |

|

By Distribution Channel |

· Hospital Pharmacy · Retail Pharmacy · Online Pharmacy |

|

By Region |

· North America (By Drug Class, Application, Route of Administration, Distribution Channel, and Country) o U.S. o Canada · Europe (By Drug Class, Application, Route of Administration, Distribution Channel, and Country/Sub-region) o U.K. o Germany o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Drug Class, Application, Route of Administration, Distribution Channel, and Country/Sub-region) o Japan o China o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Drug Class, Application, Route of Administration, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Drug Class, Application, Route of Administration, Distribution Channel, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 44.84 billion in 2026 and is projected to reach USD 64.38 billion by 2034.

In 2025, market value in North America stood at USD 19.49 billion.

Registering a CAGR of 4.40%, the market will exhibit steady growth over the forecast period (2026-2034).

Pfizer Inc., Abbott Laboratories, Novartis AG, and Merck & Co., Inc. are some of the major players in the global market.

North America dominated the antibiotics market with a market share of 45.44% in 2025.

The increasing use of antibiotics in developing countries and the rising prescriptions around the globe are expected to drive the growth and adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us