Application Hosting Market Size, Share & Industry Analysis, By Hosting Type (Managed Hosting, Colocation Hosting, and Cloud Hosting), By Service Type (Application Monitoring, Application Programming Interface Management, Infrastructure Services, Database Administration, Backup and Recovery, and Application Security), By Enterprise Type (SMEs and Large Enterprises), By Application (Mobile-based and Web-based), By Industry (BFSI, IT & Telecommunication, Retail & E-commerce, Healthcare, Manufacturing, Media & Entertainment, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

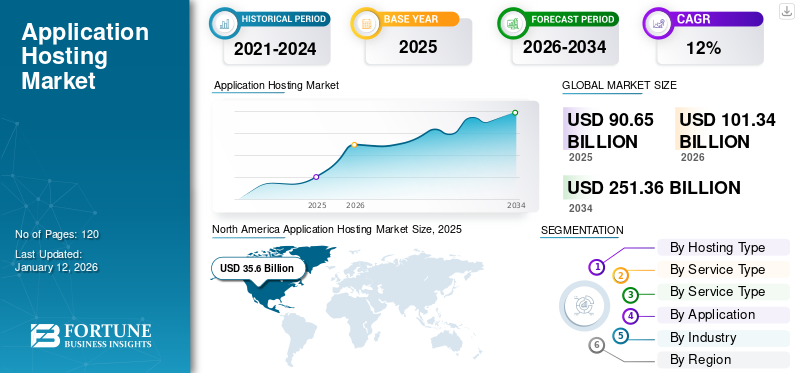

The global application hosting market size was valued at USD 90.65 billion in 2025. The market is projected to grow from USD 90.65 billion in 2026 to USD 251.36 billion by 2034, exhibiting a CAGR of 12% during the forecast period. North America dominated the global market with a share of 39.30% in 2025.

Application hosting is referred to as a software application or platform that is running on someone else’s infrastructure rather than on-premise. In this market, organizations, enterprises, businesses, and individuals can use the resources and capabilities of hosting providers to deploy, run, and maintain their applications with the requirement of their hardware infrastructure. Many service providers operate their data centers in various regions globally. This global reach enables businesses and organizations to deploy applications closer to end-users cost-effectively and efficiently, which plays an important role in driving the application hosting market growth.

The COVID-19 pandemic fueled the shift toward cloud-based solutions, as organizations were looking to enable digital collaboration and remote work. This increased the demand for cloud-hosted applications and platforms among employees working from home, as they can be accessed from anywhere with an internet connection. Further, businesses request service providers to deploy remote work solutions, such as video conferencing platforms, Virtual Desktop Infrastructure (VDI), and cloud-based productivity suites.

In the scope of work, we have included solutions offered by companies, such as Amazon Web Services, Inc., Dialogic Corporation, Microsoft Corporation, Google Cloud Platform, IBM Corporation, DXC Technology, Hostwinds, and others.

Impact of Generative AI

Growing Demand for Enhanced Performance Optimization and Automated Security is Expected to Boost Market Growth

Generative AI is capable of analyzing large volumes of datasets and identity patterns to optimize application performance. Hosting providers can use generative AI for resource allocation, optimize network configurations, and enhance load balancing for better reliability and scalability of hosted applications. In addition, gen AI technology can be used to detect and reduce security threats in real time. Hosting providers can deploy security solutions enabled with generative AI technology to identify and analyze anomalies in network traffic and defend against cyber-attacks proactively. This approach will enhance the security posture of hosted applications and infrastructure. For instance,

- In April 2024, AWS and NVIDIA engaged in strategic collaboration to launch a novel supercomputing platform that includes software, hardware infrastructure, and services designed for generative AI.

Application Hosting Market Trends

Significant Focus on Adoption of Serverless Computing Aids Market Growth

Serverless computing is becoming significantly popular for hosting scalable applications without the need to manage servers. Application hosting providers are offering serverless computing platforms and services that abstract billing complexities and infrastructure management, allowing developers to focus on building and deploying codes. This architecture provides scalability, cost efficiency, and simplicity, making it suitable for small and medium-sized enterprises (SMEs) and startup companies looking for swiftness in application deployment and maintenance. Moreover, these providers are focusing on integrating Artificial Intelligence (AI) and Machine Learning (ML) capabilities into their platforms to enhance security, performance optimization, and automation. Thus, these factors play an important role in increasing the adoption of innovative technologies in hosted applications and fuel the application hosting market growth during the forecast period.

Download Free sample to learn more about this report.

Application Hosting Market Growth Factors

Increasing Focus on Adoption of Digital Transformation Initiatives Fuels Market Growth

Organizations across industries are undergoing digital transformation initiatives to increase their operation efficiency, improve agility, and enhance customer experiences. Application hosting plays an important role in supporting digital transformation efforts by providing the infrastructure and services needed to manage, deploy, and scale digital platforms, applications, and services. For instance,

- In January 2024, Rackspace Technology launched a “Rackspace AI Anywhere” for the private cloud, powered with Artificial Intelligence (AI) and Machine Learning (ML) technology. This solution helps businesses improve their service quality, enhance customer experience, and boost value creation through AI technologies.

Further, the growth of E-commerce and online shopping is driving demand for hosting solutions. Application hosting providers offer specialized e-commerce hosting services that support secure payment processing, high-traffic online storefronts, and seamless shopping experiences for customers. These factors play a vital role in driving the application hosting market growth at a significant pace.

RESTRAINING FACTORS

Security Concerns and Lack of Customization May Hinder Market Growth

Security remains a major concern among many organizations considering application hosting. End-users are more concerned about the security of sensitive data stored in third-party data centers or accessed via the cloud. Cyber attacks, data breaches, and compliance issues can discourage businesses from fully embracing hosting solutions. Moreover, hosted application environments may have limitations in terms of configuration and customization options compared to on-premise solutions. Businesses with specialized applications may find it difficult to tailor hosted environments to meet their specific needs, which may negatively affect performance or functionality. These factors are expected to hinder market growth.

Application Hosting Market Segmentation Analysis

By Hosting Type Analysis

Growing Need for Proactive Monitoring and Maintenance of Applications and Infrastructure Boosted Demand for Managed Hosting

Based on hosting type, the market is divided into managed hosting, colocation hosting, and cloud hosting (infrastructure as a service, platform as a service, and software as a service).

The managed hosting segment captured a largest share of the market with a share of 43.64% in 2026. Managed hosting providers monitor the health and performance of applications and infrastructure in real time, proactively identifying and addressing issues before they impact performance or availability. Hosting providers apply regular updates, maintenance, and patches, ensuring that applications are up-to-date, secure, and operating at peak performance.

The cloud hosting segment is expected to grow at the highest CAGR during the forecast period, as it follows a pay-as-you-go pricing model, allowing businesses to pay only for the resources they use on a per-minute, per-second or per-hour basis. This consumption-based pricing model eliminates the need for initial capital investment and allows businesses to enhance cost by scaling resources dynamically and efficiently managing usages.

By Service Type Analysis

Growing Demand for Data Management and Storage Fueled Database Administration Segment Growth

Based on service type, the market is classified into application monitoring, application programming interface management, infrastructure services, database administration, backup and recovery, and application security.

The database administration segment captured the maximum share of the market with a share of 28.17% in 2026, as it is responsible for managing and optimizing the storage, retrieval, and organization of data within the hosted applications. It ensures efficient use of database resources, implements data modeling best practices, and optimizes data structures to improve scalability and performance.

The infrastructure services segment is expected to grow at the highest compound annual growth rate during the forecast period, as they offer built-in redundancy, disaster recovery capabilities, and failover mechanisms that ensure high availability and reliability of hosted applications. Infrastructure providers offer service level agreements with guaranteed uptime and performance levels, minimizing downtime and ensuring business continuity for critical applications.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Rising Demand for Flexibility and Agility in Large Enterprises Fueled Segment Growth

Based on enterprise type, the market is bifurcated into SMEs and large enterprises.

The large enterprises segment captured the highest market share with a share of 68.96% in 2026 as they operate in competitive and dynamic environments that require flexibility and agility to respond quickly to changing market conditions, emerging opportunities, and customer demands. Application hosting enables large enterprises to quickly deploy, scale, and update applications, allowing them to innovate faster, adapt to market changes, and stay ahead of the competition.

The SMEs segment is expected to grow at the highest CAGR in the coming years as they prefer to focus on their core business activities and strategic objectives rather than spending time and resources on managing hosting applications and infrastructure. Application hosting allows SMEs to offload infrastructure management tasks to hosting providers, enabling them to focus on innovation, customer satisfaction, and growth initiatives.

By Application Analysis

Increasing Focus on Implementing Strict Security Measures to Protect Web-based Applications Propelled Segment Growth

Based on application, the market is divided into mobile-based and web-based.

The web-based segment captured the highest market share in 2023 as hosting providers implement stringent security measures to protect web-based applications from cyber threats, including malware, data breaches, and DDoS attacks. These measures often include firewalls, encryption, regular security updates, and intrusion detection systems to safeguard sensitive data and ensure compliance with industry regulations.

The mobile-based segment is expected to grow at the highest CAGR in the coming years as mobile app hosting providers typically operate data centers in multiple regions globally, allowing businesses to deploy their apps closer to their target audience. This reduces latency and improves app responsiveness for users across the globe, regardless of their location.

By Industry Analysis

Global Presence and Network Optimization Propelled the Adoption of Application Hosting in IT & Telecommunication

Based on industry, the market is categorized into BFSI, IT & telecommunication, retail & e-commerce, healthcare, manufacturing, media & entertainment, and others (energy & utility)

The IT & telecommunication segment held the largest application hosting market share in 2024. Hosting applications in data centers located globally helps IT and telecom companies reduce latency and improve performance for their users. This is crucial for services that rely on real-time data transmission, such as video conferencing, VoIP, and online gaming.

The BFSI segment is anticipated to showcase high CAGR during the forecast period, as banking and financial services require continuous availability and application reliability to ensure seamless transactions, account access, and customer service. Hosting providers offer redundant systems, failover mechanisms, and SLAs with guaranteed uptime to ensure uninterrupted access to critical applications and services.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Application Hosting Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 35.6 billion in 2025 and USD 39.41 billion in 2026 as businesses in the region increasingly focus on security solutions, especially in industries, such as e-commerce, healthcare, and finance. Hosting providers offer robust security measures, data protection features, and compliance certifications to safeguard critical and sensitive information. Further, the presence of a significant number of key market players in the region plays an important role in boosting market growth. The U.S. market is valued at USD 27.85 billion by 2026.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region is experiencing rapid digital transformation across various industries, including manufacturing, retail, finance, and healthcare. Application hosting enables businesses to accelerate innovation, upgrade and modernize their IT infrastructure, and deliver digital services to meet the needs of customers and markets. The Japan market is valued at USD 5.01 billion by 2026, the China market is valued at USD 5.64 billion by 2026, and the India market is valued at USD 4.09 billion by 2026.

- In October 2022, DXC Technology launched a DXC Invitational, an insurance startup across Asia Pacific. With this startup, the company aims to bring the latest innovations to the insurance industry and strengthen its business across the region.

Europe is anticipated to grow at a prominent CAGR in the coming years. European businesses value hosting providers that offer infrastructure and data centers within the EU to comply with data sovereignty requirements and ensure data residency. Hosting applications locally enables organizations to address concerns about privacy, data localization, and regulatory compliance while improving performance and reducing latency for European users. The UK market is valued at USD 4.52 billion by 2026, while the Germany market is valued at USD 4.34 billion by 2026. For instance,

- In October 2023, Amazon Web Services launched AWS European Sovereign Cloud, an autonomous cloud for Europe. It will help European customers to save all metadata they create in the EU.

The Middle East & Africa is expected to showcase noteworthy growth during the forecast period. MEA countries are experiencing rapid economic growth and urbanization, leading to increased demand for digital services in sectors, such as e-commerce, finance, logistics, and healthcare. Hosting providers offer solutions tailored to the needs of emerging markets and help businesses to grab growth opportunities.

Moreover, the adoption of these hosting solutions is expected to grow significantly in South America as hosting providers offer technical expertise and support to assist South American businesses with managing, optimizing, and deploying their operations. This ensures rapid issue resolution and smooth operations to drive digital transformation.

List of Key Companies in Application Hosting Market

Top Companies Emphasize Partnerships to Increase Their Analytics Services Globally

Prominent players put strategic efforts to sustain their competitiveness in the market. Major market participants focus on offering industry-specific services to boost their presence across regions. They concentrate on mergers and acquisitions with local players to maintain their positions in the market. Leading companies introduce novel solutions to boost their consumer base. These players are highly investing in R&D for product improvements.

List of Key Companies Profiled:

- Amazon Web Services, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Google Cloud (U.S.)

- IBM Corporation (U.S.)

- Dialogic Corporation (U.S.)

- DXC Technology (U.S.)

- Rackspace Technology (U.S.)

- DreamHost (U.S.)

- DigitalOcean, LLC. (U.S.)

- Hostwinds (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: DreamHost launched a business name generator powered by artificial intelligence technology to help online entrepreneurs with their name and domain. This tool is helpful for small business owners to support their online ventures.

- August 2023: Rackspace Technology launched a hosted private cloud Generative AI solution in collaboration with NVIDIA and Dell Technologies. The company’s ecosystem partner, FAIR, allows organizations to adopt generative AI with a simplified approach.

- August 2023: DigitalOcean launched “DigitalOcean Spaces” in its data center located in Bangalore, India. With this offering, the company aims to strengthen its commitment to fulfill the object storage needs of global small businesses by providing data storage solutions.

- June 2023: DXC Technology expanded its partnership of cloud Managed Service Provider (MSP) with Oracle to provide Oracle Cloud Infrastructure (OCI), a new application service powered by Oracle.

- February 2021: DXC Technology engaged in a strategic partnership with Temenos, a provider of banking software. With this collaboration, the company aims to boost its digital transformation initiative for its large bank customers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Hosting Type

By Service Type

By Enterprise Type

By Application

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 251.36 billion by 2034.

In 2025, the market was valued at USD 90.65 billion.

The market is projected to grow at a CAGR of 12% during the forecast period.

By application, web-based hosting led the market.

A surge in digital transformation initiatives and focus on providing enhanced customer experience aids market growth.

Amazon Web Services, Inc., Dialogic Corporation, Microsoft Corporation, Google Cloud Platform, IBM Corporation, DXC Technology, and Hostwinds are the top players in the market.

North America held the highest market share in 2025.

By industry, the BFSI is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us