Appointment Scheduling Software Market Size, Share & Industry Analysis, By Deployment Type (Web-based and Mobile App), By Application (Staff scheduling, Customer scheduling, Calendar management, Online booking, and Online payments), By Enterprise Type (SMEs and Large Enterprise), By Industry (Healthcare, Hospitality, Corporate, Retail, Beauty and Wellness, Financial Service, and Education), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

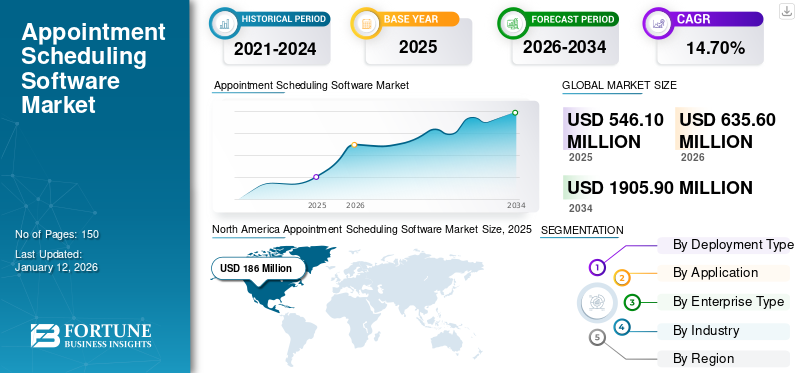

The global appointment scheduling software market size was valued at USD 546.1 million in 2025 and is projected to grow from USD 635.6 million in 2026 to USD 1,905.90 million by 2034 at a CAGR of 14.70% during 2026-2034. North America dominated the global appointment scheduling software market with a share of 34.10% in 2025.

Appointment scheduling software automates bookings and reservations for appointment-based businesses. The appointment scheduling tools manage the entire scheduling process, by enabling calendar management, automatic reminders, online payment acceptance, and cancel appointments and meetings at their convenience. Various businesses use appointment scheduling software to reduce no-show appointments, taking advantage of its features, such as rescheduling appointments, sending automatic reminders, and helping customers in reviewing their appointment slots.

The COVID-19 pandemic accelerated the shift toward work-from-home culture, highlighting the importance of online or cloud-based software. The demand for tools such as appointment booking software became more robust, with companies across various sectors integrating these solutions into their business operations.

Moreover, the scheduling system allows employees and customers to inform and schedule appointments through web-based systems. The process enables the users to control the appointment booking process and allows them to meet at their preferred times. With the advancement in technology, the adoption of online scheduling software in businesses and users saves time and money, increases their client base, and grows their brand awareness. For instance,

- According to Affinitiv company research analysis, 66% of millennials reserve their travel appointments using a smartphone, while 25% of all service appointments are scheduled online.

In the market study, an analysis is conducted on appointment scheduling software offered by market players such as Block, Inc. (Square), Appointy, MINDBODY, Inc., Valsoft SARS, Inc., JRNI, DaySmart Software, Calendly, and others.

Appointment Scheduling Software Market Trends

Adoption of Artificial Intelligence in Appointment Scheduling to Propel Market Growth

The increased demand for productivity and efficiency in business environments has led to the adoption of Artificial Intelligence (AI) in many operational activities. AI's capabilities have enhanced various tasks, making it an important tool for many industries, particularly in appointment scheduling.

With the integration of AI, the method of scheduling has experienced a significant transformation. AI-based scheduling has transformed businesses by managing appointments, making the entire process more user-friendly and efficient.

Moreover, with AI-based software, the user can forecast patterns and trends in appointment scheduling by analyzing historical data, such as identifying busy seasons, peak hours, and other factors that affect scheduling. This information allows businesses to adjust their operations, optimize their workflow, and meet customer demand. For instance,

- In October 2023, IntelePeer collaborated with Dental Robot to offer Artificial Intelligence (AI) to DSO patient communications. The communications automation platform included virtual assistants with generative AI capabilities aiding current patients and new patients with automated appointment scheduling, confirmation reminders, and rescheduling.

Thus, the integration of AI technologies creates an opportunity for appointment scheduling software market growth.

Download Free sample to learn more about this report.

Appointment Scheduling Software Market Growth Factors

Increasing Requirement of Cloud-Based Software and Applications across Organizations to Spur Market Expansion

The rise of cloud-based applications across businesses has created the opportunity for scheduling software. Various key players collaborated with SaaS-based vendors, offering solutions on a pay-per-use basis. In addition, the cloud-based solutions have facilitated appointment scheduling by enabling automated alerts through SMS and emails regarding booking details and online payment facilities. This has led to the widespread adoption of this software. Cloud implementation enables users and businesses to access data and analytics from anywhere, making it easy for service providers to keep track of the appointments even when they are traveling.

Cloud-based software minimizes the initial investment required for implementation. Users can select the feasible solution depending on the nature of the service provided and the budget for the subscription of the cloud-based booking system. For instance,

- In January 2024, Qued Inc., a cloud-based software provider, launched a workflow management software suite designed for industrializing and restructuring load appointment scheduling for 3PLs, shippers, and truckers. Further, it has become an integration partner of McLeod Software, a transportation execution and freight management platform.

Owing to these factors, the global market is expected to grow significantly during the forecast period.

RESTRAINING FACTORS

Inadequate Integration and Complexity in Deploying Solutions Restrains Market Growth

The availability of open-source solutions is an affordable option for small-scale users and individuals, as it does not require capital investments. Organizations with limited resources and knowledge can download and implement these solutions across numerous platforms.

Moreover, these platforms are known for their robustness and reliability even under active conditions. Open-source software typically benefits from continuous improvements driven by collaborations within the community and through forums. Most small-scale users and individuals use open-source solutions due to a need for more funds.

Thus, the rising adoption of open-source platforms is expected to hinder the adoption of appointment scheduling software.

Appointment Scheduling Software Market Segmentation Analysis

By Deployment Type Analysis

Mobile Apps Segment Surges with Affordable Devices and Deployment

Based on deployment type, the market is divided into web-based and mobile apps. web-based segment is set to show the highest share of 55.66% in 2026, due to the new wave of 5G deployment in various markets and the availability of affordable 5G devices that cater to consumers with lower income. This trend is driving the development of new 5G applications for enterprises and consumers in developing markets.

Various players are offering appointment scheduling software through mobile apps. These applications allow users to efficiently manage appointment-related tasks, send and receive notifications, handle schedules with the click of a button, communicate with clients and team members, and access and keep track of all necessary information in one place. For instance, in January 2023, Verint acquired Qudini, a provider of appointment scheduling solutions. Qudini enables interaction between customers and employee over the video chat, phone, or face-to-face.

In addition, many companies have adopted remote work policies and these software provides the advantage of accessing the team schedules and appointment information from anywhere through mobile at a suitable time. This feature benefits the utility of scheduling software for modern businesses.

By Application Analysis

Calendar Management Segment to Gain Prominence Due to Precision in Scheduling

Based on application, the market is segmented into staff scheduling, customer scheduling, calendar management, online booking, and online payments. Calendar management segment is expected to hold the highest share of 29.74% in 2026, helping businesses in maintaining a clear schedule for each appointment and providing timely reminders to customers. Calendar management allows the users to create new appointments, modify imported appointments, and make changes or cancellations to appointments booked by clients. For instance,

- In July 2023, Google Workspace collaborated with Stripe, a financial infrastructure platform for businesses, to integrate Google Calendar. This integration would allow businesses to receive payments for services directly, streamlining the booking and payment process for their customers.

By Enterprise Type Analysis

Large Enterprises Thrive with Integrated Software for Customer Experience Optimization

Enterprises are rapidly changing their digital strategies to enhance their businesses and improve the customer experience by adopting appointment scheduling software. Based on enterprise type, the market is divided into SMEs and large enterprises.

Large enterprises capture a larger market share of 57.25% in 2026, due to the adoption of these software. The adoption of the software enhances sophisticated and integrated software solutions to manage client appointments, improve customer experience, and anticipate their needs. This software enables large enterprises to improve digital customer experience and efficiency with multiple divisions, staff, products, or dedicated teams.

The deployment of software by Small and Medium-Sized Enterprises (SMEs) is gradually increasing. These organizations are slowly adopting such software into their workflows to manage large numbers of appointments, reservations, and the coordination of staff and customers across multiple locations. For instance,

- In April 2023, Web.com, a domain register provider, introduced an online appointment scheduling platform, MySchedulr. This platform simplifies the process for small businesses by allowing them to directly accept appointments through their websites and accept payments through booking links.

Thus, the SMEs segment is anticipated to grow significantly during the forecast period.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Hospitality Segment’ Soaring CAGR Fueled by Technology Integration

Based on industry, the market is segmented into healthcare, hospitality, corporate, retail, beauty and wellness, financial service, and education. The hospitality industry segment is expected to grow market share of 21.71% in 2026. The growth is driven by the technology evolution in the hospitality sector, where businesses rely on touchless sales methods. It offers a range of cost-savings benefits and also opens up new revenue opportunities. The integration of software automates hotels and restaurants by managing various tasks such as reservations, guest services, operations, and marketing, allowing to achieve higher levels of profitability.

Moreover, with the adoption of smart technology it enhances guest experiences through mobile devices and offers a self-appointment booking application without having calls and emails. Thus, the need for this software across the hospitality industry assists users and businesses to offer the best personalized and automated experience.

REGIONAL INSIGHTS

Geographically, the market is categorized into five key regions: North America, Europe, the Middle East & Africa, Asia Pacific, and South America.

North America Appointment Scheduling Software Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 186 million in 2025 and USD 216.1 million in 2026, due to the presence of key regional market players and the significant shift of individuals toward the adoption of software and digital applications for streamlined appointment management. Additionally, Canada shows noticeable growth in the market, with Canadian business leaders strategically adopting software solutions to transform their business models. The U.S. market is projected to reach USD 117.3 million by 2026. For instance,

- In June 2023, Nova Scotia Health launched a scheduling app called Noona for cancer patients. This app empowers patients to access their schedules, receive appointment reminders, make changes, resulting in improved communication between health teams and patients and monitor patients' symptoms remotely.

Europe

Europe is expected to hold a significant market share during the forecast period. This is due to the presence of prominent players in the market and the growing adoption of software and application integration to improve business value. The UK market is projected to reach USD 39.8 million by 2026, and the Germany market is projected to reach USD 43.1 million by 2026. For instance,

- In June 2023, Salonkee, a salon booking platform and management solution for the beauty and hair industry in Luxembourg, raised USD 30 million in a growth funding round. The company would use these funds to expand its market presence across Europe and meet the high demand for its product.

Asia Pacific

Asia Pacific region is witnessing a surge in demand for cloud workload protection, due to the increasing adoption of software and a heightened focus on improving customer experiences. Moreover, businesses have shifted their operations to the cloud, which has led to the need for robust technology. The Japan market is projected to reach USD 33.6 million by 2026, the China market is projected to reach USD 22 million by 2026, and the India market is projected to reach USD 17.8 million by 2026.

Middle East and South America

The market growth in the Middle East and South America is mainly driven by the increasing economic value of digital transformation. As a result, countries in these regions are making investments in software to enhance their business landscapes. For instance, in February 2024, Boom Health launched a mobile healthcare application to improve home healthcare in the UAE. The app includes appointment scheduling, in-home caretaker visits, virtual consultations, non-emergency transport, and medical equipment supplies, aiding users with convenience and accessibility.

Key Industry Players

Strategic Acquisition to Boost Market Expansion of Key Players

Key players in the global market, such as Block, Inc. (Square), Appointy, MINDBODY, Inc., Valsoft SARS, Inc., JRNI, DaySmart Software, and others are focused on expanding their market presence. They do so by launching specific solutions and services to attract a large customer base, thereby increasing sales. Moreover, key players focus on increasing market share and reaching customers through strategic acquisitions.

List of Top Appointment Scheduling Software Companies:

- Block, Inc. (Square) (U.S.)

- Appointy (India)

- MINDBODY, Inc. (U.S.)

- Valsoft SARS, Inc. (Canada)

- JRNI (U.S.)

- DaySmart Software (U.S.)

- Calendly (U.S.)

- Coconut Software Corporation. (Canada)

- Setmore Appointments (U.S.)

- Engageware (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Uber Freight launched a piloted scheduling application programming interface (API). The API is designed for the Uber Freight's transportation management systems fostering seamless communication across carriers and shippers by automating appointment scheduling.

- February 2024: Amenities Health launched a tool aiding health systems to incorporate patient scheduling and modern provider search. The online solution enables consumer with mobile-app experience with online appointment scheduling through a health system's public-facing website.

- January 2024: Q-nomy launched Cubu platform that is designed to incorporate the Cubu Portal into any firm’s website to modernize and ease the process for customers to access queue management and appointment booking services.

- July 2023 – JRNI launched AI-powered automation across its intelligent customer engagement platform. This platform uses AI to communicate and identify with customers and consumers while automating appointment booking and event management workflows.

- March 2023 - Engageware launched Peer Analytics, the industry’s appointment-scheduling analytics, which was made available to Engageware’s credit union and bank customers. The Peer Analytics solution would provide data-driven insights, allowing financial institutions to identify new appointment-scheduling opportunities.

REPORT COVERAGE

The research report includes prominent regions across the globe to get a better knowledge of this software. Furthermore, it provides insights into the most recent industry and market trends and an analysis of technologies adopted on a global scale. It also highlights the factors that drive and hinder market growth, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.70% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment Type

By Application

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 1,905.90 million by 2034.

In 2025, the market was valued at USD 546.1 million.

The market is projected to grow at a CAGR of 14.70% during the forecast period.

The mobile app segment will lead the market.

The increasing requirement of cloud-based software and applications across organizations is the key factor driving market growth.

Block, Inc. (Square), Appointy, MINDBODY, Inc., Valsoft SARS, Inc., JRNI, and DaySmart Software are the top players in the market.

North America dominated the global appointment scheduling software market with a share of 34.10% in 2025.

By industry, hospitality is expected to grow with a highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us