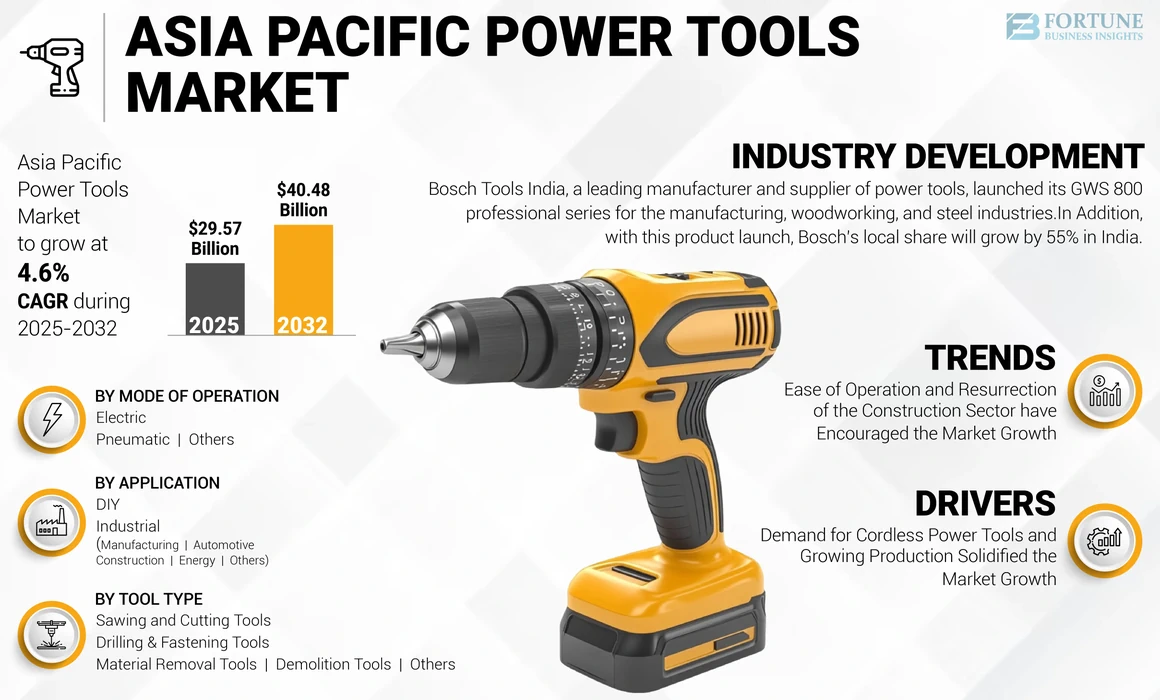

Asia Pacific Power Tools Market Size, Share & COVID-19 Impact Analysis, By Mode of Operation (Electric, Pneumatic, and Others), By Tool Type (Drilling & Fastening Tools, Material Removal Tools, Sawing & Cutting Tools, Demolition Tools, and Others), By Application (DIY and Industrial) and Country Forecast 2025-2032

Asia Pacific Power Tools Market Size

The Asia Pacific power tools market size is projected to grow at a CAGR of 4.6% during the forecast period. The global market is projected to grow from USD 29.57 billion in 2025 to USD 40.48 billion by 2032.

Asia Pacific is expected to grow progressively due to the growing adoption of power tools in the manufacturing, automotive, and construction sectors. Furthermore, technological advancements such as smart power monitoring, tool ergonomics, and app-based live tracking have helped to reduce operations time. Also, expanding pneumatic tools and hydraulic tools usage in heavy-duty applications to ease the field workload and reduce labor costs is pushing the market growth.

Also, the growing demand for power tools to ease operation and smooth connectivity has helped the tool type grow. Various types of tools used in drilling & fastening, material removal, sawing & cutting, and demolition steadily expand the market share. Moreover, stagnant demand for power tools in industries and growing D.I.Y activities held the market stable over the forecast period.

LATEST TRENDS

Ease of Operation and Resurrection of the Construction Sector have Encouraged the Market Growth

Various complex operations in the infrastructure and construction sector, such as demolition, hammering, drilling and others, have supported the demand. The government has shifted its focus to infrastructure development, and demolition activities have encouraged market growth. Similarly, the growing D.I.Y trend gave rise to the use of these tools for house improvisation, which has increased the Asia Pacific power tools market share.

For instance, according to the National Bureau of Statistics, in 2022, China’s infrastructure investment in the first 10 months rose by 8.7%; similarly, it rose 0.1 % points higher from the first three quarters.

DRIVING FACTORS

Demand for Cordless Power Tools and Growing Production Solidified the Market Growth

The demand for handy cordless power tools has positively influenced the market with enhanced battery capabilities that have extended the cordless power tools market share. Furthermore, Internet of Things(IoT) features and smart tool monitoring have also helped the demand for these tools in D.I.Y. Also, industrialization in the South Asia zone and foreign direct investments in India have solidified the Asia Pacific market growth over the forecast period.

For instance, in January 2022, Bosch developed a new DIY Advanced Tool named Trim Router 18V-8. It comprises a compact yet powerful 18V battery pack that is used for all systems comprising garden tools, home appliances, and 40 other DIY tools.

RESTRAINING FACTORS

Slowed Infrastructure Development and Manufacturing Drop Hampered the Market Growth

The market has witnessed a shortfall in the pandemic owing to halt in infrastructure projects and construction activities in China. Also, the slowdown of industrial activities in the South Asia region has hampered growth in the near term. However, as the construction and industrial sector enters the recovery phase, companies plan to ramp up their production and automotive is set to restart production altogether.

For instance, the China government has announced 19 new policies that aim to resurrect economic growth and deepen the property crisis. The country’s cabinet has approved new funding of USD 146 billion and flexibility to support the real estate market.

KEY INDUSTRY PLAYERS

In the global competitive market scenarios, recognized and emerging players in the market have observed a drop in demand owing to a downfall in production and construction activities. To revive the market, prominent players widened their product portfolio with expansion strategies to fill the supply-demand gap. Additionally, DIY activities and openings in the market have endorsed small players to subsequent presence while expanding the market size over the forecast period.

List of Top Asia Pacific Power Tools Companies:

- Robert Bosch GmbH (Germany)

- Stanley, Black & Decker, Inc. (U.S.)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Sweden)

- Makita Corporation (Japan)

- Hitachi Power Tools (Japan)

- Kulkarni Power Tools KPT (India)

- Cumi Power Tools (India)

- Techtronic Industries Co. Ltd. (Hong Kong)

- Chervon Holdings Limited (China)

- Positec Group (Suzhou)

KEY INDUSTRY DEVELOPMENTS:

- February 2023 – Bosch Tools India, a leading manufacturer and supplier of power tools, launched its GWS 800 professional series for the manufacturing, woodworking, and steel industries. In Addition, with this product launch, Bosch’s local share will grow by 55% in India.

- September 2021 –Robert Bosch Power Tools GmbH, a global leader in the power tool sector, announced the addition of its comprehensive product line of woodcutting and woodworking solutions with the launch of its 18V and 12V cordless sanders. The newly released cordless sanders are specially designed for convenience and optimal balance.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report provides a detailed market analysis. It focuses on key aspects such as an overview of technological advancements, the dominance of these tools across the Asian countries, and pricing analysis. Additionally, it includes an overview of the market scenario for DIY and the industrial sector. It also focuses on new product launches, market segments Analysis, key industry developments such as mergers, partnerships & acquisitions, strategies, and the impact of COVID-19 on the market. Besides this, the report offers insights into the market trends, supply chain analysis, and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the market’s growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode of Operation, By Tool Type, By Application, By Country |

|

By Mode of Operation |

|

|

By Tool Type |

|

|

By Application |

|

|

By Country |

|

Frequently Asked Questions

Growing at a CAGR of 4.6%, the market will grow progressively in the forecast period (2025-2032).

Demand for Cordless Power Tools and Growing Production Solidified the Market Growth.

Robert Bosch GmbH, Stanley, Black & Decker, Inc., Techtronic Industries Co. Ltd.,Cumi Power Tools, Chevron Holdings Limited, and Positec Group are the major players in the China market.

China is dominating the market share with the growing construction sector in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us