Asia Pacific Quantum Computing Market Size, Share & COVID-19 Impact Analysis, By Component (Hardware, Software, and Service), By Deployment (On-Premise and Cloud), By Application (Machine Learning, Optimization, Biomedical Simulations, Financial Services, Electronic Material Discovery, and Others), By End User (Healthcare, Banking, Financial Services and Insurance (BFSI), Automotive, Energy and Utilities, Chemical, Manufacturing, and Others), and Regional Forecast, 2025-2032

Asia Pacific Quantum Computing Market Size

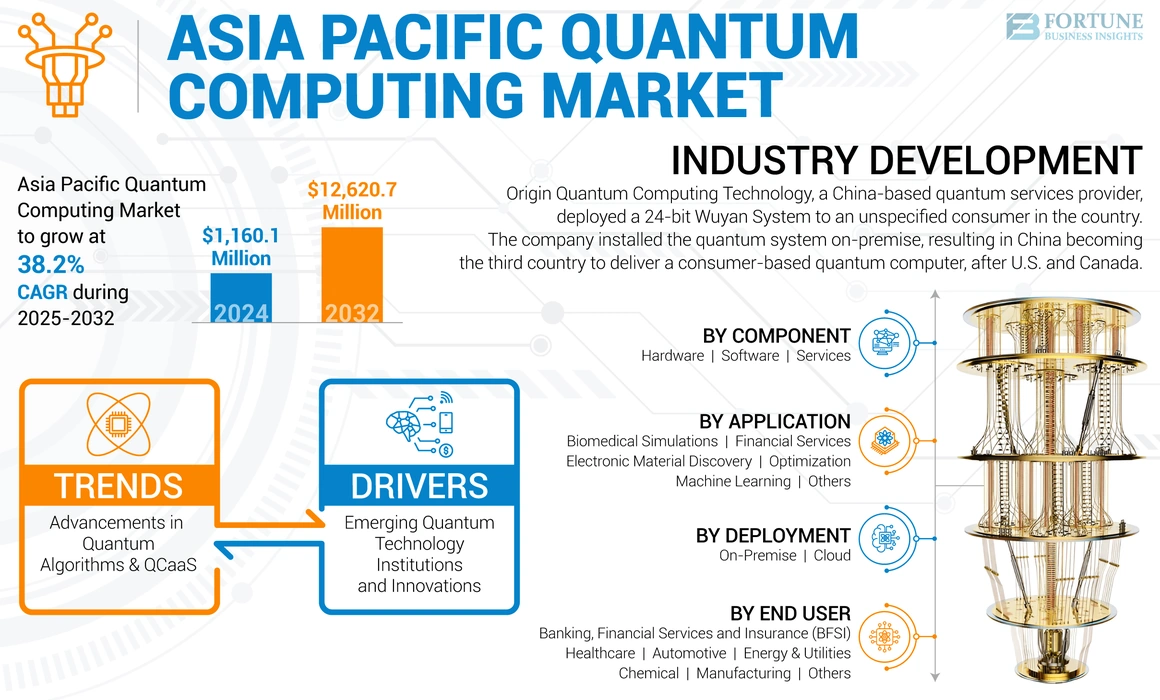

Asia Pacific is the fastest growing region in the global quantum computing market. The Asia Pacific quantum computing market is projected to grow at a CAGR of 38.2% during the forecast period. The global quantum computing market size is projected to grow from USD 1,160.1 million in 2024 to USD 12,620.7 million by 2032.

Quantum technology employs the principles of quantum mechanics, including superposition and entanglement to execute computations much more quickly than traditional computing systems. The Asia Pacific quantum computing market share is growing at a rapid pace due to increasing adoption of quantum computers in the financial services sector due to financial modeling and risk analysis capabilities.

According to a 2022 article by Nikkei Asia, Japan is preparing for quantum technology deployment in major industry sectors and aims to cater to 10 million consumers by 2030. These developments are expected to lead to the development of more powerful quantum hardware as well as the creation of new quantum software and services.

Our report on the Asia Pacific market covers the following countries – China, India, Japan, South Korea, ASEAN, Oceania, and the rest of Asia Pacific

Asia Pacific Quantum Computing Market Trends

Advancements in Quantum Algorithms and QCaaS to Drive the Asia Pacific Quantum Computing Market Growth

With continuous developments of powerful quantum hardware, researchers are making significant progress in developing quantum algorithms that can solve complex problems such as simulating chemical reactions, and improving financial forecasting, among others. There is an increasing demand for quantum computing as a service, which allows businesses and individuals to access quantum resources without the need for expensive systems.

For instance, on December 2022, Tech Mahindra partnered with IQM Quantum Computers to collectively explore quantum technologies, combining Mahindra’s expertise on hybrid algorithms, simulation, and machine learning, among others, and IQM’s expertise on hardware and development capabilities, resulting in additional business opportunities. Numerous players in the market are deploying quantum applications integrating latest algorithms and using latest technologies to deploy services through cloud and remain competitive.

Asia Pacific Quantum Computing Market Growth Factors

Emerging Quantum Technology Institutions and Innovations to Boost Market Expansion

Established technological companies such as IBM, Microsoft, Google, and Alibaba have been heavily investing in the regional quantum algorithm developments. For instance, Alibaba partnered with Chinese Academy of Sciences (CAS) to deploy a new quantum computing cloud platform. The platform was deployed to general users, which increased consumer engagement and enabled Alibaba to gather analytical insights based on experimentation, resulting in higher potential for adoption of quantum computer in the region. Additionally, according to Washington Technology Industry Association (WTIA), most quantum technology patents were held by China (54%) and Japan (15%) of the global market share. Thus, increasing consumer engagement and innovations in quantum technology are driving market growth during the forecast period.

RESTRAINING FACTORS

Business Funding Issues to Hamper the Market Growth

The high cost of developing and maintaining quantum hardware due to the requirement of highly specialized components is limiting the market growth. The components of quantum computers are highly expensive to produce, thus increasing the overall cost of handling and setups. Additionally, lack of government support and funding for research and development and limited regional startups are reducing the growth of the market. Such factors hamper the growth of quantum algorithms and applications resulting in reduced overall market growth.

KEY INDUSTRY PLAYERS

The APAC market is consolidated by leading players such as Alibaba Group, Baidu Inc., Origin Quantum Computing, IBM Corporation, JSR Corporation, and QuantumCTek Co. Ltd. These key players are deploying quantum software applications as well as hardware to expand their business models and enable technological growth while adopting strategies such as acquisitions, collaborations, product launches, and partnerships.

LIST OF TOP ASIA PACIFIC QUANTUM COMPUTING COMPANIES:

- Alibaba Group Holding Ltd. (China)

- Baidu Inc. (China)

- JSR Corporation (Japan)

- IBM Corporation (U.S.)

- QuantumCTek Co. Ltd. (China)

- QuintessenceLabs Pty. Ltd (Australia)

- Rigetti Computing Inc. (U.S.)

- D-Wave Systems Inc. (Canada)

- Origin Quantum Computing (China)

- Quantinuum Ltd. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2022: Origin Quantum Computing Technology, a China-based quantum services provider, deployed a 24-bit Wuyan System to an unspecified consumer in the country. The company installed the quantum system on-premise, resulting in China becoming the third country to deliver a consumer-based quantum computer, after U.S. and Canada.

- October 2022: Mitsui and Co. partnered with Quantinuum, which provides quantum applications to enhance the quantum computing company’s research and development in Japan. The partnership also aims to deploy value-added services and applications to aid enterprise consumers in various quantum fields.

REPORT COVERAGE

The market research report provides qualitative and quantitative insights on the market and a detailed analysis of the Asia Pacific market size & growth rate for all possible segments in the market. Along with the Asia Pacific market forecast, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 38.2% from 2025 to 2035 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Component, Deployment, Application, End User, and Country/Sub-Region |

|

|

|

By Deployment |

|

|

By Application |

|

|

By End User |

|

|

By Country/Sub-Region |

|

Frequently Asked Questions

Growing at a CAGR of 38.2%, the market will exhibit significant growth in the forecast period (2025-2032).

Emerging quantum technology institutions and innovations to boost the market growth.

Alibaba Group, Baidu Inc., Origin Quantum Computing, IBM Corporation, JSR Corporation, and QuantumCTek Co. Ltd. are the major market players in the Asia Pacific market.

China dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us