Home / Automotive & Transportation / Automotive Interior & Exterior / Automotive Smart Antenna Market

Automotive Smart Antenna Market Size, Share & Industry Analysis, By Type (Shark Fin, Fixed Mast, and Others), By Component (Transceiver, ECU, and Others), By Vehicle Type (SUV, Hatchbacks/Sedan, Light Commercial Vehicle, and Heavy Commercial Vehicle), By Frequency Range (Below 1 GHz, 1-2 GHz, 2-4 GHz and Above 5 GHz), and Regional Forecast, 2024-2032

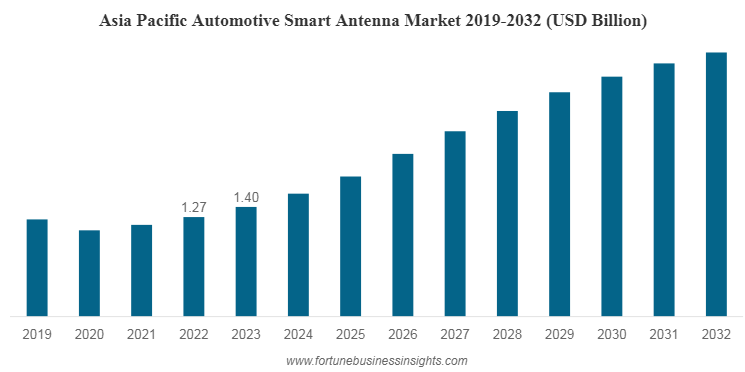

Report Format: PDF | Latest Update: Mar, 2025 | Published Date: Jul, 2024 | Report ID: FBI105579 | Status : PublishedThe global automotive smart antenna market size was valued at USD 2.37 billion in 2023 and is projected to grow from USD 2.65 billion in 2024 to USD 5.58 billion by 2032, exhibiting a CAGR of 9.7% during the forecast period. Asia Pacific dominated the global market with a share of 59.07% in 2023.

Automotive smart antennas are antennas integrated into the vehicle that offer communication between the vehicles and infrastructure. It comprises an antenna array capable of digital signal processing algorithms that display data and carry out various applications within the vehicle. Some of the most common applications of smart antenna include acoustic signal processing and cellular systems such as 5G and LTE.

The market is expected to grow significantly in the coming years, with the automotive industry witnessing a surge in automotive production and streamlining the supply and demand chain. Furthermore, the increasing integration of 5G technology and expansion in the connected vehicle architecture of passenger cars, commercial vehicles, and various vehicle types is further driving the demand for communication technology in vehicles. Expansion in the electrification technology and the rising vehicle production due to increased demand for passenger and commercial vehicles are the main factors driving the demand for smart vehicle communications systems, further propelling the global market growth.

The market witnessed a significant stunt in terms of growth during the COVID-19 pandemic period owing to the shutdown of manufacturing facilities, which resulted in a decline in vehicle production, further reducing the demand for smart components and hampering market growth.

Automotive Smart Antenna Market Trends

Integration of 5G Technology for Automotive Data Communication Systems to Fuel Market Growth

The manufacturers within the automotive industry are highly focused on introducing the latest technologies to speed up the data transmission process from the vehicle to the infrastructure with high-speed data transmission. 5G offers ultra-fast data speed, low latency, and high reliability, which are some of the vital aspects of automotive applications. Furthermore, the installation of Beamforming and MIMO (multiple input, multiple output) technologies further aids in the rapid adoption of 5G in automotive applications. Moreover, with the increasing expansion of safety systems and autonomous driving technology, the automotive smart antenna is expected to witness heavy demand across all vehicle platforms. Thus, the integration of 5G technology for automotive data communication systems is expected to fuel market growth.

Automotive Smart Antenna Market Growth Factors

Increasing Demand for Reliable and High-Speed Vehicle Data Transfer to Spur Market Growth

The automotive industry is aiming toward rapid deployment of connected vehicle technology. Vehicles are increasingly becoming connected platforms, providing a variety of services, including real-time navigation, multimedia streaming, remote diagnostics, and over-the-air software updates. To support these services, vehicles must have strong connectivity to external networks such as 5G cellular networks, Wi-Fi hotspots, and satellite systems.

Smart antennas play an important role in meeting these connectivity demands by intelligently identifying and tracking the best available signal source. They play a crucial role in cellular applications for connected vehicles. The system can dynamically switch between different antennas or frequency bands based on signal strength, network congestion, and bandwidth needs. This ensures that vehicles maintain a stable and high-speed connection even when moving between coverage areas or encountering signal attenuation caused by obstacles or environmental conditions.

Increasing Adoption of ADAS and Autonomous Driving Technology to Propel Market Growth

Automotive smart antennas are critical for empowering vehicle-to-everything (V2X) communication, which is demanded for optimized road safety and autonomous driving capabilities. Vehicle-to-vehicle (V2X) communication enables vehicles to exchange real-time data with one another and with infrastructure and pedestrians to support advanced driver assistance systems (ADAS) and collision avoidance mechanisms.

Vehicles that use smart antennas for V2X communication can transmit and receive critical safety messages such as hazard warnings, traffic signal information, and pedestrian detection alerts with low latency and high reliability. This enables faster decision-making and response times, lowering the risk of accidents and refining overall traffic flow. Smart antennas include strong security measures to restrict unauthorized access and preserve the confidentiality, integrity, and authenticity of communication data. These antennas use techniques such as secure bootstrapping, mutual authentication, encryption, and intrusion detection to establish secure communication channels with trusted entities, including authorized vehicles, infrastructure providers, and cloud servers.

RESTRAINING FACTORS

Interference and Coexistence in Urban Areas with High Wireless Activity Might Degrade Communication Performance

Urban areas with connected infrastructure tend to have a high amount of wireless data transmission activities, which might hamper reliability and cause degradation in transfer performance. Furthermore, in metro cities with large mega structures and skyscrapers, the possibility of multipath propagation can occur when signals get reflected off various materials and surfaces or scatter due to obstructions, which can further create more signal distortion and interference, further creating issues in successful data transmission. Thus, coexistence with other wireless systems, such as Wi-Fi, Bluetooth, and cellular networks, requires careful spectrum management and interference mitigation techniques, and these few factors are expected to hamper automotive smart antenna market growth in the future.

Automotive Smart Antenna Market Segmentation Analysis

By Type Analysis

Shark Fin Segment Led Due to Increasing Demand for Strong and Aerodynamic Antenna Structure

Based on type, the market is segmented into shark fin, fixed mast, and others.

The shark fin segment dominated the automotive smart antenna market share in 2023. The segment is expected to grow at the highest growth rate during the forecast period. The segment's leading share can be credited to the higher demand among automotive OEM manufacturers to integrate shark fin antennas into their vehicle bodies to offer a more tactile and aerodynamic design for antennas, further increasing the longevity of the antennas.

The fixed mast and others segments also accounted for a significant share of the market in 2023. The demand for fixed mast automotive antenna is attributed to the lower cost of installation and integration of fixed mast automotive antennas with vehicle systems. The higher availability of its components in the markets further drives the growth of this segment.

By Component Analysis

Higher Demand for Accurate Signal Processing and Transmission Contributes to the Greater Demand for Transceivers

Based on component, the automotive smart antenna market is segmented into transceiver, ECU, and others.

The transceiver segment held the largest market share in 2023 and is expected to retain its dominance during the forecast period. The demand is attributed to the greater focus of manufacturers on introducing highly reliable signal processors and data transmission transceivers for accurate data transfer, which is one of the leading factors contributing to the growing demand for transceivers. Moreover, increasing integration of 5G technology is further poised to fuel the segment growth.

The ECU and others segments also accounted for a noteworthy position in terms of market share in 2023. The demand for encompassing signal processing, beamforming, channel estimation, network interface, system control, and integration with vehicle electronics are some of the main factors driving the growth of these segments.

By Vehicle Type Analysis

Increasing Demand from Consumers toward Owning SUVs to Foster the Segment Growth

Based on vehicle type, the market for automotive smart antenna is segmented into SUVs, hatchbacks/sedan, light commercial vehicle, and heavy commercial vehicle.

The SUVs segment is slated to witness the highest share and growth rate during the forecast period and is expected to continue its growth significantly during the study period. The demand is attributed to the swelling demand for SUVs as they offer versatility in terms of passenger and cargo space. They often have larger interiors compared to sedans or hatchbacks, making them ideal for families, outdoor enthusiasts, or anyone needing to transport large items.

The hatchbacks/sedan segment accounted for the second-largest market share in 2023. The demand for these vehicles is attributed to the increasing consumer preference for owning vehicles and having personal transportation at ease. Hatchbacks offer an economic choice for the populace to own a vehicle. Similarly, sedans are a popular choice among the upper middle class, which opts for luxurious travel, thus contributing to their sales.

By Frequency Range Analysis

Rising Focus of OEMs on Introducing Various Connected Vehicle Technology to Impel 2-4 GHz Segment Expansion

Based on frequency range, the market for automotive smart antenna is segmented into below 1 GHz, 1-2 GHz, 2-4 GHz, and above 5 GHz.

The 2-4 GHz segment held the largest market share in 2023. The larger market share is owing to the increasing focus of OEMs on introducing a variety of connected vehicle technology and infotainment systems for consumers, which contributed to the market share of this segment in 2023.

The above 5 GHz segment is expected to expand at the fastest-growing rate during the forecast period owing to the increasing focus of manufacturers on fast-tracking next-generation data transmission integration, such as introducing 5G into vehicles to streamline vehicle data transmission and interpretation of data along with increasing Wi-Fi based application in vehicles.

REGIONAL INSIGHTS

By region, the market for automotive smart antenna is segregated into the Asia Pacific, North America, Europe, and the rest of the world.

Asia Pacific Led Due to Increasing Demand for Next-Generation Vehicles among Consumers in Asian Countries

The Asia Pacific held the largest market share as it stood at USD 1.40 billion in 2023. The higher market share and highest growth rate of the region can be attributed to the higher penetration of vehicles with increasing consumer spending power in major Asian countries such as India, China, and Japan, which is driving the demand for large-scale vehicle production. This, coupled with expansion in manufacturing facilities, is further resulting in heavy demand for vehicle components such as smart antennas in the region.

Europe and North America hold a significant market shares and are also expected to grow at a steady rate during the forecast period, owing to the increasing demand for connected vehicle technology. Moreover, the capacity of North American and European countries to facilitate the latest technology into the vehicle and infrastructure ecosystem is further expected to drive the adoption of this technology in these countries.

The rest of the world is expected to be one of the most upcoming markets and is expected to grow at the second-highest growth rate during the forecast period. Increasing infrastructure expansion in metro cities in Middle East & African countries is driving the demand for next-generation vehicles in the region.

List of Key Companies in Automotive Smart Antenna Market

Companies are Emphasizing Expanding Their Presence for Early Adoption of Their Products

Companies in the automotive smart antenna industry are focusing on promoting and expanding their presence in the upcoming and leading automotive markets so that their products can be adopted early by major vehicle manufacturers. They are strongly motivated to innovate and are constantly improving their antenna architecture to offer extensive usability to their end users. Major players in the market recognize the untapped potential of telematics and are highly involved in introducing innovations and telematics application-based technology to lure vehicle manufacturers into auto component contracts for their next-generation vehicles.

The players in the automotive smart antenna industry are also focused on expanding their operations in major regions with higher vehicle production capacity. In addition, the growing initiatives from various end users across the world toward smooth data transmission from infrastructure to vehicle and vice versa are some of the key development areas to focus on.

LIST OF KEY COMPANIES PROFILED:

- Mitsumi Electric Co., Ltd. (Japan)

- Continental AG (Germany)

- Harada Industry Co., Ltd. (Japan)

- Molex (U.S.)

- INFAC Corporation (South Korea)

- Ficosa International SA (Spain)

- Huf Group (Germany)

- Harman International Inc. (U.S.)

- Fuba Automotive Electronics GmbH (Germany)

- Laird Connectivity (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Calian GNSS, also formerly known as Tallysman Wireless, announced that it has released its latest professional-grade GNSS antenna. The antenna integrates the Quectel chipset and offers various solutions such as dual-band GNSS, extended filtering, low phase center, low signal-to-noise ratio, and similar. The company claims the TW5387 antenna offers suitable choices for automotive, UAV, and robotics applications, which require accuracy and precise timing.

- December 2023: LG showcased its latest technological innovation in vehicle connectivity solutions at the CES 2024 held in Las Vegas. The company unveiled its new generation of transparent automotive antenna. The company’s entry into the automotive antenna market is expected to further expand its customer base and product business in the communication auto component segment.

- June 2023: u-blox and Calian announced their strategic partnership in which both companies designed and developed PointPerfect Augmented Smart GNSS Antenna/Receivers. U-box is one of the major players in automotive wireless technology. The PointPerfect services are currently available in North America, Europe, and a few parts of the Asian region.

- February 2023: Leading semiconductor Chipmaker Company Qualcomm announced that it has launched its latest version of the Snapdragon automotive 5G platform for smart cars. The Snapdragon 5G uses a modem-to-antenna 5G solution, which is expected to elevate the wireless data transmission process further.

- January 2022: Denso Corporation launched an improved version of the global safety package “Global Safety Package 3” to enhance vehicle sensing systems. The product improvement features include upgradation in the antenna design, reduced size and cost, and MIMO technology for smaller antennas for higher radio wave efficiency.

REPORT COVERAGE

The report provides a detailed automotive smart antenna market analysis and focuses on key aspects such as prominent companies, product types, and leading product technologies. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth over recent years.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2023 |

Estimated Year |

2024 |

Forecast Period |

2024-2032 |

Historical Period |

2019-2022 |

Growth Rate |

CAGR of 9.7% from 2024 to 2032 |

Unit |

Value (USD Billion) |

Segmentation |

By Type

By Component

By Vehicle Type

By Frequency Range

By Region

|

Frequently Asked Questions

What is the projected value of the global automotive smart antenna market?

Fortune Business Insights says that the market was valued at USD 2.37 billion in 2023 and is projected to reach USD 5.58 billion by 2032.

At what CAGR is the automotive smart antenna market estimated to grow during the forecast period?

The market is expected to register a growth rate of (CAGR) 9.7% during the forecast period 2024-2032.

What factors are predicted to drive global market growth?

The increasing demand for reliable and high-speed vehicle data transfer is expected to fuel market growth.

Which is the leading region in the global market?

The Asia Pacific led the global market in 2023.

Which was the leading type segment in the global market?

By type, the shark fin segment dominated in 2023.

- Global

- 2023

- 2019-2022

- 200