Bahrain Oilfield Service Market Size, Share & COVID-19 Impact Analysis, By Type (Equipment Rental, Field Operation, and Analytical Services), By Service (Geophysical, Drilling, Completion & Workover, Production, Processing & Separation), By Application (Onshore, Offshore {Shallow Water, Deep Water, Ultra-deep Water}) and Forecasts, 2025-2032

Bahrain Oilfield Service Market Size

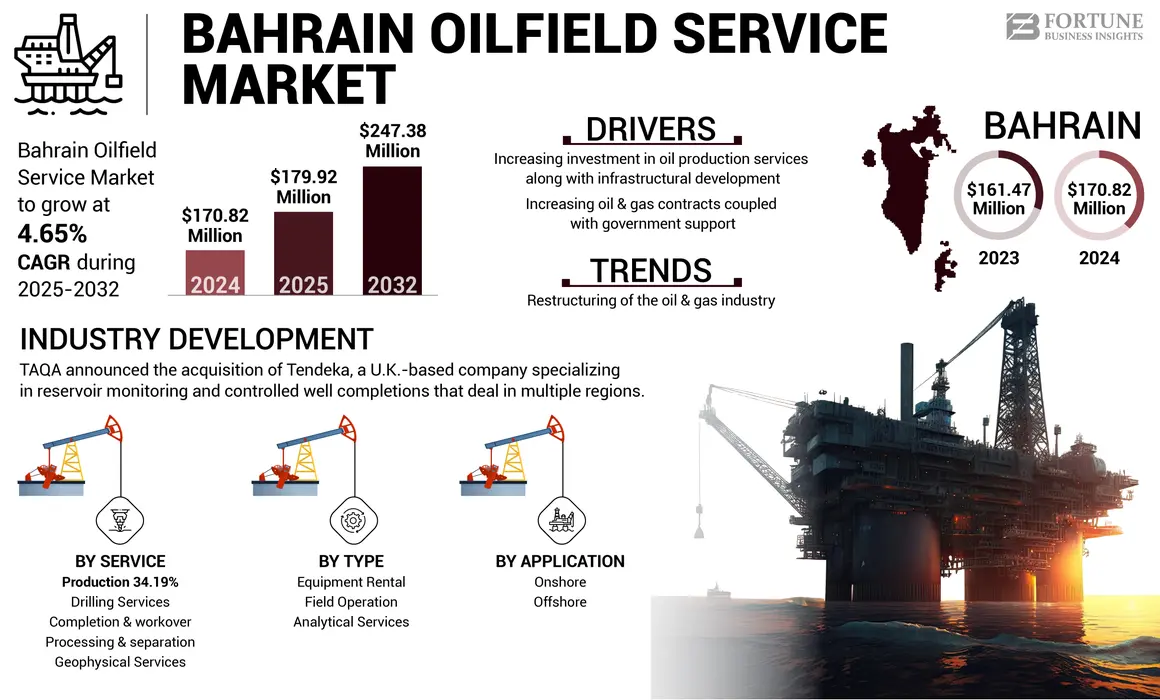

The Bahrain oilfield service market size was valued at USD 170.82 million in 2024. The market is projected to grow from USD 179.92 million in 2025 to USD 247.38 million by 2032, exhibiting a CAGR of 4.65% during the forecast period.

Oilfield services refer to the wide range of specialized activities and support the oil and gas market/industry provides. These services include drilling, well construction, production optimization, reservoir evaluation, equipment maintenance, and logistics. They play a crucial role in exploration, extraction, and overall operations within the oilfield.

COVID-19 IMPACT

COVID-19 Outbreak Slowed Down the Production and Services of Oil

The pandemic led to a decline in global oil demand as travel restrictions, lockdowns, and economic slowdowns reduced the need for transportation and energy. This sharply dropped oil prices and reduced exploration and production activities in oilfields. The reduced demand and price volatility negatively affected the revenues and profitability of oilfield service companies in Bahrain. Moreover, many oil and gas projects in Bahrain and the broader region were delayed or canceled due to the pandemic. Travel restrictions, social distancing measures, and health concerns made construction, maintenance, and exploration challenging. This resulted in delayed project execution, leading to decreased business opportunities for oilfield services providers.

Bahrain Oilfield Service Market Trends

Download Free sample to learn more about this report.

Restructuring of the Oil & Gas Industry to Spur Market Potential

The Bahrain government plans to release a national energy strategy (NES) in 2021 as a part to reform & restructure the oil and gas sector. The strategy mainly describes the changes in the state of oil and gas companies and highlights strategic priorities in the energy sector. Additionally, efforts are underway to delineate various oil and gas reserves, which in turn is likely to present potential growth opportunities for international oil companies (IOCs) and oilfield service companies. For example, Bahrain has contracted U.S.-based oilfield service company Halliburton to drill two offshore appraisal wells. The aim of the contract was to assess the economic viability of the oil wells.

Bahrain Oilfield Service Market Growth Factors

Increasing Investment in Oil Production Services Along with Infrastructural Development Propel Market Growth

Bahrain invests in enhanced oil recovery techniques to maximize production from mature oil fields. EOR methods, such as steam, gas, and chemical treatments, require specialized services and expertise. The demand for oilfield services is driven by the need to implement and manage these enhanced recovery techniques. Moreover, Bahrain is investing in expanding and upgrading its oil and gas infrastructure, including pipelines, refineries, and storage facilities. Construction, maintenance, and optimization of these facilities require various oilfield services. The demand for services in areas like engineering, construction, and project management is driven by infrastructure development projects. These factors augment the Bahrain oilfield service market growth.

Increasing Oil & Gas Contracts Coupled with Government Support to Propel Market Growth

Bahrain has a well-established oil and gas industry, and the oilfield services sector is a crucial part of the industry. One of the major factors driving the demand for companies in Bahrain is the government's support for the oil & gas industry and services companies in Bahrain.

For example, in February 2023, six leading global energy infrastructure groups showed interest in providing engineering, procurement, and construction (EPC) services for Tatweer Petroleum Associated Gas Compression Project Phase 7 in Bahrain for field development with an aim to increase oil & gas production.

RESTRAINING FACTORS

Increasing Focus on Diversifying the Industrial Sector to Hamper Market Growth

The economy of Bahrain is heavily dependent upon oil and gas. However, the problem faced by Bahrain's government is that its proven oil reserves are low, and the cost of extraction is high.

Moreover, the country focuses on diversifying its economy and becoming less oil-dependent. For instance, in 2021, the government unveiled an economic recovery plan.

The plan includes USD 30 billion worth of strategic investments, and new targets to attract foreign direct investment (FDI), among other initiatives.

The government highlighted six priority sectors for the future: tourism and logistics, financial services, telecommunications, IT and the digital economy, and manufacturing.

SEGMENTATION

By Type Analysis

Field Operation Dominates the Regional Market Owing to Wide Adoption during Oilfield Operations

Based on type, the Bahrain oilfield service market share is segregated into analytical services, field operation, and equipment rental. The field operation segment dominates this market. The factors driving the segment’s growth are increasing oil production, advancements in technology, exploration of new oil fields, aging of oil fields, and others.

Furthermore, the complexity associated with oilfield operations, focus on improving data management, cost savings, and meeting regulatory compliance needs will likely drive the demand for analytical services.

By Service Type Analysis

Production Oilfield Service Dominates the Regional Market due to the Adoption of Major Production Equipment during Oil Exploration & Production

Based on the service type, the market share is segmented into production, drilling, geophysical, processing & separation, and completion & workover.

The production of oilfields is one of the growing services in the oilfield industry across the region. It consists of services equipment such as artificial lift, support vessel, well testing, subsea equipment, enhanced oil recovery, and many others. The country's focus on expanding/increasing its oil production and enhancing existing oil wells is driving the demand for production oilfield services across the region.

The drilling segment is estimated to hold a significant market share owing to growing offshore well drilling to explore, extract, store, and process petroleum and natural gas. The segment is further analyzed by much granular level covering services such as offshore drilling, oil country tubular goods (OCTG), directional drilling services, drilling fluids, well casing, well cementing, drill bits, drilling rigs, logging while drilling (LWD), measurement while drilling (MWD), managed pressure drilling (MPD), waste management, and other drilling services.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Onshore Applications Dominate the Market due to Major Oil Production

Based on the application, the market is segmented onshore & offshore. The onshore application largely accounts for the demand for oilfield services in Bahrain owing to their more reliable and flexible equipment and services, which boosts the demand for this market. However, the country had historic oil production from offshore locations. Moreover, the offshore segment in oilfield services is expected to grow significantly during the forecast period owing to rising investment in subsea oil & gas assets.

COUNTRY ANALYSIS

Bahrain's oil and gas reserves are located mainly in the Bahrain Field, one of the largest oilfields in the Persian Gulf. The Bahrain Petroleum Company (Bapco) is Bahrain's main oil and gas producer and operates the Bahrain Field. The Bahrain National Gas Company (Banagas) is responsible for the processing and distribution of natural gas in Bahrain. This industry includes companies that provide drilling, well completion, well testing, well maintenance, and production enhancement. The Bahrain oilfield service industry is expected to grow in the coming years as the country increases its oil and gas production and expands its infrastructure. This market plays a crucial role in the country's economy. It is expected to grow as it invests in new technologies and infrastructure to increase the country’s oil and gas production.

KEY INDUSTRY PLAYERS

Key Players Focus on Mergers & Acquisitions to Gain Competitive Edge

Bahrain's oilfield service market is dominated by international and domestic companies, including Tatweer Petroleum Services LLC, Al-Badi Petroleum Services (BPS), and SLB. These companies have a dominant market share due to their strong regional presence, extensive experience, and comprehensive range of services.

Other key players operating in this market include National Energy Services Reunited Corp, Halliburton, and National Energy Services Reunited Corp.

List of Top Bahrain Oilfield Service Companies:

- SLB (U.S.)

- Halliburton (U.S.)

- National Energy Services Reunited Corp (U.S.)

- Petrodar International (Bahrain)

- Al-Badi Petroleum Services (Qatar)

- MB Petroleum Services (Oman)

- Tatweer Petroleum Services LLC (Bahrain)

KEY INDUSTRY DEVELOPMENTS:

- April 2022 - Tatweer Petroleum will likely award an engineering, procurement, and construction contract regarding its Bahrain Oil Field Associated Gas Compression Stations by the second quarter of 2023.

- January 2023 – National Energy Services Reunited Corp., an international industry leader providing energy services in the Middle East and North Africa, announced that the company has secured a long-term wireline oilfield services platform contract in Saudi Arabia that will expand the scope of services over a contract period of nine years provided.

- February 2022 - TAQA announced the acquisition of Tendeka, a U.K.-based company specializing in reservoir monitoring and controlled well completions that deal in multiple regions.

- October 2021 - Intertek, a leading quality assurance provider to industries globally, announced it had been awarded a contract by Tatweer Petroleum to provide quality assurance solutions in Bahrain. Intertek provides highly skilled engineers and inspection experts with a 'factory-to-field' inspection and quality assurance program assisting Tatweer Petroleum in validating the specifications, value, safety, and standards of raw materials, assets, and products.

- November 2020 - India's state-run Tatweer Petroleum W.L.L, Bahrain, awarded the "Provision of Workover Rigs and Associated Services" project. The project has been awarded to the following Oil and Gas Companies: AlMansoori Workover Services, MB Petroleum Services L.L.C.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as leading companies, market sizing, competitive landscape, product/service types, porters five forces analysis, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.65% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Service

|

|

|

By Application

|

Frequently Asked Questions

The Fortune Business Insights study shows that the market was USD 170.82 million in 2024.

This market is projected to grow at a compound annual growth rate (CAGR) of 4.65% during the forecast period.

Based on service, the production segment dominates the Bahrain market.

The Bahrain market size is expected to reach USD 247.38 million by 2032.

The key market drivers are increasing oil & gas production and technological advancement in the oil field services offerings.

The top players in the market are SLB, Halliburton, TAQA, and MB Petroleum Services Weatherford, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us