Below-Grade Waterproofing Membranes Market Size, Share & Industry Analysis, By Material (Bitumen, Polymers, Rubberized Asphalt, and Others), By End-use (Residential, Commercial, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

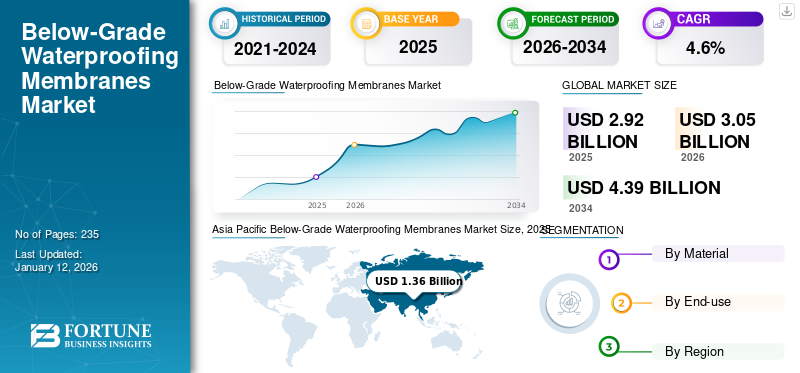

The global below-grade waterproofing membranes market size was valued at USD 2.92 billion in 2025 and is projected to grow from USD 3.05 billion in 2026 to USD 4.39 billion by 2034 at a CAGR of 4.6% during the forecast period. Asia Pacific dominated the below-grade waterproofing membranes market with a market share of 47% in 2025.

Below-grade waterproofing membrane is a specialized material or barrier system used in construction to prevent water from entering the below-grade portions of a building, such as basements or foundation walls. These membranes are designed to resist water penetration and provide protection against moisture, ensuring structural integrity and longevity of the structure. They are typically coatings and membranes applied to the exterior surface of below-grade walls to create a waterproof seal.

Rapid urbanization and rising demand for new infrastructure is expected to drive the below-grade waterproofing membranes market. Furthermore, the increasing adoption of green building practices in developing countries will create new opportunities for market growth.

GCP Applied Technologies, Inc., Mapei S.p.A., Minerals Technologies Inc. (CETCO), Sika AG, W. R. Meadows, Inc., Carlisle Companies Inc. are key players of below-grade waterproofing membranes operating in the industry.

Global Below-Grade Waterproofing Membranes Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 2.92 billion

- 2026 Market Size: USD 3.05 billion

- 2034 Forecast Market Size: USD 4.39 billion

- CAGR: 4.6% from 2026–2034

Market Share:

- Asia Pacific dominated the below-grade waterproofing membranes market with a 47% share in 2025, driven by rapid urbanization, regulatory support, and growing infrastructure development in emerging economies.

- By material, bitumen is expected to retain the largest market share in 2025, supported by its cost-effectiveness, ease of installation, and reinforcement capabilities with materials like fiberglass and polyester.

Key Country Highlights:

- China: Urban growth, strict building codes, and large-scale underground construction projects are fueling demand for cost-effective and durable waterproofing solutions.

- United States: Increasing commercial construction and stringent environmental regulations are driving demand for advanced waterproofing membranes, especially in infrastructure and wastewater management.

- India: Rising urban migration and infrastructure investment are boosting demand for below-grade membranes in residential and industrial projects.

- Germany: Dominates Europe’s market with a focus on sustainable building practices and restoration projects requiring durable waterproofing systems.

- UAE: Urban expansion and government mandates for building integrity in extreme climates are accelerating demand for waterproofing membranes in both commercial and infrastructure projects.

MARKET DYNAMICS

BELOW-GRADE WATERPROOFING MEMBRANES MARKET TRENDS

Rising Adoption of Green Building Practices to Create New Market Trend

The rising emphasis on green building practices is presenting a lucrative market opportunity for below-grade waterproofing membranes. As global awareness of environmental sustainability continues to rise, construction activities are evolving to align with these practices. One of the major aspects of these opportunities is the development of eco-friendly waterproofing products. Manufacturers can invest in research and development to create waterproofing membranes made from recycled or sustainable materials. Such initiatives help reduce the carbon footprint of construction activities and cater to the rising demand for eco-friendly construction solutions. This approach aligns with the priorities of environmentally conscious architects, builders, and developers, helping manufacturers differentiate themselves in a competitive market. This resonates with the principles of sustainability and help in avoiding potential legal challenges and liabilities associated with non-compliant products as environmental regulations become more stringent.

Thus, catering to green building practices is environmentally responsible and economically viable in the long term for manufacturers and consumers. This move toward sustainability fosters innovation and drives below-grade waterproofing membranes market growth in an increasingly eco-conscious construction sector.

MARKET DRIVERS

Rapid Urbanization to Create Demand for New Infrastructure, Driving the Market Growth

Rapid urbanization is expected to play a pivotal role in increasing the demand for below-grade waterproofing membranes. According to an article published by the World Economic Forum in 2022, more than 4.3 billion people, or 55% of the world's population, lived in urban areas and this number is expected to increase to 80% by 2050. As more people migrate to cities, there is an increasing demand for and investments in infrastructure development projects, including commercial and residential construction, such as underground parking facilities and transportation networks. The urban cities often have limited space, requiring more extensive underground construction to optimize land use. The population growth in the urban areas is likely to lead to a surge in construction projects, many of which involve below-ground structures, such as basements, subways, and tunnels. Waterproofing membranes have become a critical component of infrastructure and building designs, as they enhance the longevity of structures and reduce maintenance costs. This is expected to result in the wider adoption of waterproofing solutions to protect underground infrastructure against damage caused by water infiltration, making below-grade waterproofing membranes an essential part of any construction project.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Fluctuating Raw Material Prices Along with the Need for Skilled Labor During Installation to Hamper Market Growth

The cost of raw materials is a critical factor influencing the demand for below-grade waterproofing membranes. These materials typically include bitumen, polymers, and various chemical additives. Fluctuations in the prices of these materials can have a substantial impact on the manufacturing costs of waterproofing membranes. Bitumen is a primary component in many waterproofing membranes, and is particularly susceptible to price fluctuations due to factors such as global oil prices volatility, supply and demand imbalances, and geopolitical instability in oil-producing regions. These fluctuations create unpredictability in membrane’s production cost. Additionally, many waterproofing materials are derived from petrochemical sources, making them vulnerable to price fluctuations while also exposing the industry to environmental concerns and regulatory pressures related to the use of materials derived from fossil fuels.

To address these restraints, manufacturers can explore alternative materials and implement supply chain strategies to stabilize material costs. Additionally, investing in training and certification programs is necessary to ensure a skilled workforce capable of maintaining high-quality installation standards. These initiatives can help mitigate the impact of cost fluctuations and support market growth.

MARKET OPPORTUNITIES

Increased Awareness of Water Intrusion Issue has led to Create Opportunity for Product

The increased awareness of water intrusion issues in construction and building management has led to a significant rise in demand for below-grade waterproofing membranes. As more property owners and builders recognize the potential consequences of water intrusion, such as structural damage, mold growth, and health hazards, there's a greater urgency to maintain dry and safe environments. This has led to a proactive approach to building design and maintenance.

Many countries have implemented stricter building codes and regulations regarding moisture control in buildings. Compliance with these regulations often necessitates using robust waterproofing solutions, increasing the demand for below-grade membranes. Additionally, with rising real estate development and investment, there is a growing emphasis on long-term property value. Waterproofing solutions are essential investments to protect buildings from water damage, thus reinforcing the demand.

MARKET CHALLENGES

Competition from Alternative Solutions May Hamper Market Growth

The below-grade waterproofing membranes market may face significant challenges due to rising competition from alternative solutions. As advancements in construction materials and techniques continue to emerge, newer options such as spray-applied membranes, liquid waterproofing agents, and advanced polymer-based solutions are gaining traction. These alternatives often claim to offer enhanced performance characteristics, including improved flexibility, resistance to chemical damage, and faster installation times.

Moreover, many of these innovative solutions can be more cost-effective, providing contractors and property developers with attractive options that could sway their purchasing decisions. As consumers become increasingly aware of these alternatives, there may be a shift in preference that could reduce the demand for traditional waterproofing membranes.

IMPACT OF COVID-19

Stalled Construction Activities Due to COVID-19 Pandemic Hampered Market Growth

The COVID-19 pandemic had a significant impact on the market, presenting both challenges and opportunities. The initial disruptions in construction activities due to lockdowns and supply chain disruptions led to project delays and increased costs of construction materials.

Several construction sites experienced temporary closures or slowdowns, resulting in delays in project completion. The uncertainty caused by the pandemic prompted investors and developers to exercise caution, resulting in a slowdown in new construction activities and a re-evaluation of existing projects. This scenario negatively impacted the demand for below-grade waterproofing services and products. However, countries across the world have moved past the pandemic and entered the recovery phase, driving renewed demand for waterproofing solutions. The market is increasing in tandem with the construction industry and is likely to follow a positive growth trend in the future. This factor is likely to create attractive opportunities for market growth during the forecast period.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade and Geopolitical Policies to Influence the Product Cost and Market Dynamics

International trade policies between major economies significantly impact raw material prices and the final cost of products in the market. Many countries have experienced heightened protectionist policies that have led to increased operational costs for businesses. This trend has particularly affected Western democracies, where companies face rising tax burdens and borrowing costs due to trade restrictions targeting essential industrial sectors, including construction materials such as waterproofing membranes.

The geopolitical landscape is shifting toward a more fragmented model of trade, with countries forming blocs based on political affiliations. This fragmentation could reduce trade growth between these blocs while increasing the focus on intra-bloc trade. However, these developments are also influenced by international trade policies. For example, India's "Make in India" initiative aims to boost local manufacturing and infrastructure investment, which could be affected by global trade dynamics and protectionist measures from other countries.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Innovations for Improving Product Functionality and Lifespan to Provide Lucrative Growth Opportunities

Manufacturers are focusing on developing modern waterproofing membranes with superior performance characteristics, including ease of installation and longer lifespans. Innovations include self-adhesive membranes that reduce labor costs and composite membranes that enhance durability. The rise of smart and self-healing membranes is also notable; these products can autonomously detect and repair leaks, significantly improving their functionality and lifespan.

Additionally, there is a growing trend toward eco-friendly products made from recycled or sustainable materials. Manufacturers are investing in R&D to create waterproofing solutions that minimize carbon footprints, aligning with the priorities of environmentally conscious builders and developers. The increasing emphasis on green building practices is creating lucrative opportunities for below-grade waterproofing membranes that meet sustainability standards.

SEGMENTATION ANALYSIS

By Material

Bitumen Became the Most Popular Material Due to its Cost Effectiveness and Ease of Installation

Based on material, the market is segmented into bitumen, polymers, rubberized asphalt, and others.

The bitumen segment held the largest below-grade waterproofing membranes market share in 2024. Bitumen-based membranes are often preferred for their ease of handling and application, contributing to cost-effective and efficient installation processes. These membranes are also reinforced with materials, such as fiberglass or polyester, to enhance the strength of the final product. Rising demand for easy-to-install and cost-effective membranes will drive the segment’s growth.

Polymers is the other prominent segment, which includes thermoplastic polyolefins (TPO) and ethylene propylene diene monomer (EPDM). These membranes offer superior water resistance and waterproofing, making them a preferred choice for various end-users. The segment is expected to dominate the market share of 53.44% in 2026.

This segment is anticipated to forecast a CAGR of 6.9% during the forecast period.

Rubberized asphalt is expected to witness considerable CAGR of 3.40% during the forecast period. These products consist of asphalt modified with synthetic rubber or polymer additives, which enhance its durability and flexibility. These enhanced properties are likely to prompt demand and drive the segment’s growth.

By End-use

To know how our report can help streamline your business, Speak to Analyst

Others Segment Led Due to Cost and Longevity Benefits

Based on end-use, the market is segmented into residential, commercial, and others.

The others segment accounted for the dominant market share in 2024 and is expected to hold a majority market share during the forecast period. This segment covers the membranes that are consumed in industrial and infrastructure construction activities. Waterproofing membranes have become a critical component of modern construction designs as they enhance the longevity of structures and reduce maintenance costs. Furthermore, the implementation of stricter building codes and regulations across the globe is likely to boost the adoption of advanced waterproofing solutions in new construction projects. This will further drive the segment’s growth during the forecast period.

Factors such as the rapidly growing population, rising urbanization activities, and increasing investments in the real estate sector are contributing to the growth of the residential segment. The residential segment led the market share by 63.93% in 2026. The migration of people from rural to urban areas for better earning and living standards has fueled the need for residential spaces, thereby leading to the segment’s notable growth.

BELOW-GRADE WATERPROOFING MEMBRANES MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across Asia Pacific, North America, Europe, Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Below-Grade Waterproofing Membranes Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the highest market share in 2026, valued at USD 1.43 billion. In 2025, the market value led the region by USD 1.36 billion. The region is poised for substantial growth driven by urbanization, regulatory support, and a focus on energy efficiency. However, addressing challenges related to skilled labor and quality control will be crucial for sustained market development. As construction activities continue to rise across emerging economies, the demand for effective waterproofing solutions will remain a priority for builders and developers alike. The market value in China is expected to be USD 0.92 billion in 2025.

On the other hand, India is projecting to hit USD 0.27 billion and Japan is likely to hold USD 0.11 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America accounted for substantial market growth in 2024. The region is to be anticipated the third-largest market with USD 0.5 billion in 2026. This growth is primarily driven by increasing construction spending, particularly in the commercial sector, and the rising adoption of waterproofing solutions in wastewater treatment to prevent groundwater contamination. Infrastructure growth has spurred the below-grade waterproofing membranes demand due to extensive use in protecting structures such as tunnels and bridges. The U.S. remains the largest market player, holding a significant share fueled by its burgeoning construction industry. The U.S. market size is anticipated to reach USD 0.42 billion in 2026.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.7 billion in 2026, exhibiting the second-fastest growing CAGR of 4.00% during the forecast period. In Europe, the market is driven by increasing construction activities, particularly in refurbishment and restoration projects, and stringent regulatory standards that demand high-quality waterproofing solutions. Bitumen remains the leading material due to its cost-effectiveness, durability, and compatibility with various substrates. Germany is expected to dominate the regional market, fueled by advanced construction practices and a strong focus on sustainable building methods. Additionally, the emphasis on energy efficiency and the preservation of historical structures are key factors influencing the demand for innovative waterproofing technologies in the region. The market value in U.K. is expected to be USD 0.14 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.17 billion in 2026. France is likely to hold USD 0.12 billion in 2025.

Latin America

Latin America region is to be anticipated the fourth-largest market with USD 0.19 billion in 2026. The Latin American market is primarily driven by a surge in construction activities across the region, particularly in countries such as Brazil and Mexico, where urbanization and rising disposable incomes are increasing the demand for residential and commercial structures. The market is characterized by a growing emphasis on improving construction standards and infrastructure development, which further fuels the adoption of effective waterproofing solutions.

Middle East & Africa

The Middle East & Africa region is experiencing growth driven by the expanding construction sector, spurred by urbanization and large-scale infrastructure development initiatives. The region's climatic challenges, including arid conditions and sporadic heavy rainfall, necessitate effective waterproofing solutions to protect buildings and infrastructure from water damage. Saudi Arabia region is expected to lead the market size with USD 0.07 billion in 2025. Additionally, governments are increasingly enforcing building codes that mandate the use of waterproofing materials, further boosting market demand.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Technology Development and Capacity Expansion Strategies to Maintain Their Dominance

GCP Applied Technologies, Inc., Mapei S.p.A., Minerals Technologies Inc. (CETCO), Sika AG, W. R. Meadows, Inc., Carlisle Companies Inc. are the key players in the market. These companies are making major investments in developing additives that address evolving demands for sustainability and performance.

Leading manufacturers are investing heavily in expanding their production capacities to meet this rising demand. For instance, companies are establishing new manufacturing facilities or upgrading existing ones to enhance output and ensure consistent supply. Additionally, manufacturers are focusing on strategic partnerships and acquisitions to strengthen their market presence and cater to diverse regional requirements.

Furthermore, manufacturers are incorporating sustainable practices by using eco-friendly materials and reducing the carbon footprint of their production processes. These technological advancements not only improve the performance of waterproofing membranes but also align with the growing emphasis on sustainability in construction practices. As a result, key manufacturers are well-positioned to address the evolving needs of the construction industry while maintaining a competitive edge in the market.

LIST OF KEY BELOW-GRADE WATERPROOFING MEMBRANES COMPANIES PROFILED:

- BASF SE (Germany)

- GCP Applied Technologies, Inc. (U.S)

- Mapei S.p.A. (Italy)

- Minerals Technologies Inc. (CETCO) (U.S)

- Polyguard (U.S)

- RPM International Inc. (U.S)

- Sika AG (Switzerland)

- Soprema US (U.S)

- Tamko Building Products LLC (U.S)

- W. R. Meadows, Inc. (U.S)

- AVM Industries (U.S)

- Jiangsu Canlon Building Materials Co., Ltd. (China)

- Carlisle Companies Inc. (U.S)

- Dörken Systems Inc. (Canada)

- Oriental Yuhong Waterproof Technology Co., Ltd (China)

- Penetron (U.S)

- Xypex Chemical Corporation (Canada)

- Max Frank GmbH & Co. KG (Germany)

KEY INDUSTRY DEVELOPMENTS

- December 2024 – Meadows, Inc. introduced Meadow-Pruf Co-Spray, a liquid waterproofing membrane designed for below-grade vertical applications. The product features cutting-edge technology and is suited for cold weather, providing a robust and effective waterproofing solution for challenging environments.

- September 2024 – Penetron Admix, a waterproofing additive with crystalline properties, was chosen to safeguard the underground concrete structures against elevated groundwater levels.

- August 2024 – Oriental Yuhong commenced construction of a new facility in Houston for production, R&D, and logistics. Phase one includes production lines for TPO waterproof membranes and the establishment of a North American R&D center.

- June 2024 – Sika inaugurated a new facility in Liaoning, the largest province in northeastern China. This facility would produce a complete variety of products, such as mortars, tile adhesives, and waterproofing solutions. This newly built, highly efficient plant allows Sika to fulfill market demands while considerably minimizing logistical distances.

- February 2024 – Mapei strengthened its internationalization strategy by acquiring Bitumat, a prominent company that specializes in the production and sales of waterproofing systems, located in Dammam on the eastern coast of Saudi Arabia.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, material, and end-use. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.6% from 2026 to 2034 |

|

Segmentation |

By Material

|

|

By End-use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 3.05 billion in 2026 and is projected to reach USD 4.39 billion by 2034.

Recording a CAGR of 4.6%, the market is slated to exhibit steady growth during the forecast period.

By end-use, others segment led the market.

Asia Pacific held the highest market share in 2024.

Rapid urbanization is a key factor driving market growth.

Rising adoption of green building practices is a key factor driving product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us