Bi-Metal Band Saw Blade Market Size, Share & COVID-19 Impact Analysis, By Tooth Type (Regular, Hook, and Skip), By Product Type (Carbide Tipped and High-speed Steel), By Application (Steel, Aluminum, Cast Iron, and Others (Mold Steels, Bearing Steels)), By End user (Automotive, Aerospace & Defense, Machine Manufacturing, and Others (Military Industry)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

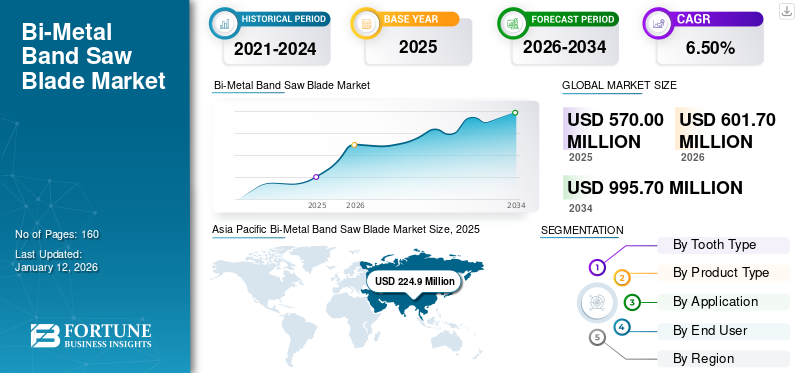

The global bi-metal band saw blade market size was valued at USD 570 million in 2025. The market is projected to grow from USD 601.7 million in 2026 to USD 995.7 million by 2034, exhibiting a CAGR of 6.50% during the forecast period. Asia Pacific dominated the global bi-metal band saw blade market with a share of 39.50% in 2025.

Metal band saw blades are made by utilizing two different layers of metal: spring steel and high-speed steel. Bi-metal band saw blades are used in the metalworking industry to cut structural steel, pipes, bronze, aluminum, and copper. These blades have various advantages, such as solid teeth, superior strength, maximum flexibility, and durability. Also, this blade is more vital than any other range of saw blades. Also, it offers the best cutting performance, superior wear resistance, a cost-effective edge, and a longer tool life. This blade type is primarily used in various industry verticals such as automobile, aerospace, military, and machine manufacturing.

Increasing production of heavy machinery subsequently increased the demand for these products to cut precision structural steel and cast iron, fueling the market growth. According to the China Construction Machinery Association (CCMA), heavy machinery sales in China increased by 39% from 2020 to 2021. Additionally, the growth of the automotive sector, which subsequently boosts the demand for these products, drives the development of the global market. Additionally, there is an increase in the prevalence of furniture and decorative interiors owing to an increasing standard of living, which creates the demand for high-quality products and fuels market growth.

COVID-19 IMPACT

Halted Manufacturing Industry Owing to COVID-19 Pandemic Hampered Growth

Partial or complete lockdown was initiated globally, which, in turn, hampered manufacturing-related activities and dropped sales of these blades. Additionally, it halted manufacturing activities, construction-related activities, and supply chain bottlenecks, which impacted the net sales of the global market. For instance, the net sales of the Nachi Fujikoshi Group dropped by 19.3% from 2019 to 2020.

According to a survey conducted by the United Nations Industrial Development Organization (UNICO), in 2020, the production of these blades in India stopped after lockdown was implemented. Also, the decline in sales of automotive, chemical products, textiles, and machinery subsequently dropped the sales of band saw blades. Also, the growth of the automotive sector declined due to the COVID-19 pandemic. For instance, Germany is famous for its automotive industries. Germany's automotive sector growth declined by 28.7% in 2020 compared to 2019, owing to the impact assessment of the COVID-19 pandemic. Such factors decrease the sales of these products. However, the decline in demand for these products in the automotive sector hampers the market growth. Furthermore, technological advancements in these products and manufacturers’ investments in research & development are projected to drive growth of the band saw blade market through 2029.

Bi-Metal Band Saw Blade Market Trends

Technological Advancements in Bi-Metal Band Saw Blades Boost the Market

Major players such as Bichamp Cutting Technology Co. Ltd., Pilana S.A., and Simonds International LLC are introducing a new range of blades with technological advancements in the band saw blade to boost market competition. Additionally, key players are introducing a new range of technologically advanced blades. For instance, in August 2020, Lenox Tools, a Stanley Black & Decker Inc. subsidiary, introduced a new GEN-TECH carbide-tipped band saw blade with a new technology named “HONEX.” This blade is designed for cutting materials such as aluminum, stainless steel, and cast iron. It is used in various industry verticals such as aerospace, manufacturing, and defense. Also, an increasing need for application-specific coatings, such as aluminum titanium nitrite and titanium nitrite, increases the durability of such blades. Such factors boost the demand for bi-metal band saw blades.

Download Free sample to learn more about this report.

Bi-Metal Band Saw Blade Market Growth Factors

Benefits Associated with these Tools Drive the Growth of the Market

These blades are used on band saws to cut tool steel, structural steel, high-speed steel, aluminum, and cast iron. It has superior strength, an edge while cutting, and a long, durable blade. It has teeth made of high-speed steel that are carbide tipped. These blades are generally more robust than carbon blades, which increases the shelf life of blades and provides high-performance sawing. The metalworking and fabrication industries require more band saw products with longer lives that produce high-quality precision cuts. These blades help manufacturers reduce overall operating costs and improve the productivity of operations. Also, complete the task within the given timeline. Additionally, the cost-effective tools that deliver high-performance metal sawing within in-house operations enhance high output, address production efficiency challenges, and reduce the cost of production in the automotive, aerospace, and defense sectors. All these factors drive the market.

RESTRAINING FACTORS

Fluctuations in Raw Material Prices Impede Market Growth

High-speed steel and tipped carbide are some of the materials key players use. The price of these raw materials is quite volatile. The fluctuation in raw material prices can increase the overall production cost required for these blades, which also impacts the profitability of manufacturers. The pricing for steel, high-speed steel, and carbide is growing daily. However, according to the World Bank Group, the net prices of metal raw materials increased by 23.9% from 2020 to 2021. This material is imported from another country and also depends on exchange rates. Hence, such a fluctuation in raw material prices is expected to restrain the market.

Bi-Metal Band Saw Blade Market Segmentation Analysis

By Tooth Type Analysis

Regular Segment Dominates the Market Owing to Increasing Demand from Manufacturing Sector

Based on tooth type, the market is segmented into regular, hook, and skip. The regular segment dominates the market, and the hook segment is projected to grow with the highest CAGR of 6.7% during the forecast period.

According to our analysis, the regular segment dominates the market share of 41.62% in 2026, owing to increasing demand from the metal fabrication and cutting sectors. Also, it offers advantages such as structural steel, cast iron, and non-ferrous metals to manufacture automotive components and spare parts. Also, it provides benefits such as a longer, more durable, and more cost-efficient blade. Such instances drive the bi-metal band saw blade market growth.

The hook segment is growing moderately due to the increasing demand for cutting materials such as alloys, cast iron, stainless steel, and metal. Also, this blade has an undercut face of 100, which is perfectly suitable for long cuts. So, it is widely used in the automotive and metal fabrication industries.

Due to increased demand for cutting non-ferrous and ferrous materials, such as aluminum, brass, bronze, nickel and copper, the skips segment is growing steadily. These types of blades have teeth with 00 rakes and 900 rakes. Also, this blade type is adopted mainly in the manufacturing, engineering, and defense sectors.

By Product Type Analysis

High-speed Steel Dominates the Market Due to Increasing Demand from Various Industry Verticals

Based on product type, the market is segmented into carbide tipped and high-speed steel.

The high-speed steel segment registered the largest market share of 55.36% in 2026. It maintained its dominance during the forecast period, owing to a surge in demand for these blades in small and medium industries. Also, this blade type has flexibility, robustness, highly efficient cutting skills, and extended durability. These products are used in the metal fabrication, automotive, aerospace, and defense sectors.

The carbide tipped segment is growing at the highest CAGR of 56.4%, owing to this blade being made using carbide material, which is more robust than carbon. Also, increasing demand from the automotive and construction industries created the need for these band saw blades.

By Application Analysis

Aluminum to Observe Highest Growth Due to Increasing Demand from the Machine Manufacturing Sector

By application, the market is segmented into steel, aluminum, cast iron, and others (mold steels, bearing steels).

The steel segment is expected to dominate the market share of 33.80% in 2026, and the aluminum segment Steel material is primarily used by machine, metal, and automotive manufacturers. Also, the alloy is used mainly in the automotive sector to manufacture various parts and components used in the automotive and aerospace sectors, which uplifts the demand for these blades for cutting purposes.

Aluminum is expected to grow with the highest CAGR owing to major players, such as Sawcraft Limited, Lenox Tools, and others, offering cutting blades for aluminum and other materials. For instance, in March 2020, Sawcraft Limited introduced a new M42 bi-metal band saw blade for cutting aluminum, carbon steel, stainless steel, and structural steel, among others. This blade has a higher cutting accuracy, which reduces the cutting time by 50%. Such factors boost the demand for bi-metal band saw blades for aluminum-cutting applications.

Cast iron and others segments are expected to grow moderately during the forecast period, owing to features such as corrosion resistance and longer blade durability. Moreover, it is primarily adopted in industry verticals such as machine manufacturing and aerospace.

By End User Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment Dominates due to Rising Demand from the Metal Fabrication Industry

Based on end user, the market is segmented into automotive, aerospace & defense, machine manufacturing, mold processing industry, and others (military industry).

The machine manufacturing segment dominates the market share of 33.80% in 2026, owing to rising industrialization across countries such as India, Brazil, Africa, and others, creating demand for these tools. Also, the machine tool industry’s growth increased by 8.4% in 2021 compared to the previous financial year, 2020. Such factors boost the development of the market.

The automotive segment registered the largest share in the market owing to growth in automotive production and increasing production of heavy machinery, which creates the demand for these products to cut stainless steel and cast iron and boosts the market growth. Additionally, increasing urbanization in developing nations such as Africa, Brazil, and India enhances the demand for vehicles such as bikes, trucks, and cars. Such factors boost the growth of these segments.

The aerospace & defense segment is projected to grow with moderate growth owing to the increasing production of aircraft and aerospace machinery. Additionally, increasing passenger traffic in China and India and rapid development in the airplane industry boost market growth.

The others segment consists of construction and the military industry. This segment is anticipated to witness decent growth due to the adoption of these products in the mining and construction industries. Also, increasing commercial and residential construction activities across various countries, such as India, the U.S., Germany, and others, require more blades to cut multiple stainless steel, cast iron, and aluminum parts.

REGIONAL INSIGHTS

Asia Pacific Bi-Metal Band Saw Blade Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The market covers an in-depth scope and deep-dive analysis of five main regions, North America, Europe, Asia Pacific, South Africa, and the Middle East & Africa.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 224.9 million in 2025 and USD 238.4 million in 2026. According to our analysis, Asia Pacific is anticipated to dominate the market during the forecast period due to several key regional players, good product offerings, and technological advancements. In addition, growth in the automotive sector and increasing sales of automotive cars, bikes, and trucks, which subsequently increase the demand for bi-metal blade products drive the market growth in this region. For instance, according to the India Brand Equity Foundation (IBEF), the export of automobiles increased by 35.9% from 2021 to the fiscal year 2022. The Japan market is projected to reach USD 50.5 million by 2026, the China market is projected to reach USD 102.9 million by 2026, and the India market is projected to reach USD 33.3 million by 2026.

China to Witness Fastest Growth Owing to Increasing Manufacturing Activities

Key players, such as Bichamp Cutting Technology Co., Ltd., Dalian Special Steel Products Co., Ltd., and Benxi Tool Co., Ltd., are present in China. In addition, major key players are planning to invest in research & development activities to launch new technologically advanced blade products for the manufacturing and automotive sectors. This factor is projected to increase the demand for these products and fuel the global bi-metal band saw bland market growth.

North America

North America is anticipated growth in the automotive and construction industries across the U.S., Canada, and Mexico. Also, major players such as Lenox Tools, Simonds International LLC, and BAHCO-Snap Europe have a strong presence in this region, which improves the product portfolio and supply chain of these products in this region. The U.S. market is projected to reach USD 132.6 million by 2026.

Europe

The Europe region is anticipated to grow with moderate growth owing to increasing funding in the infrastructure industry and increasing demand for these products from various industry verticals such as machine manufacturing, metal fabrication, and mold processing. Also, strong economic growth, which, in turn, impacted the automotive sector, subsequently increased the sales of electric vehicles across the U.K., Germany, and Spain. Such factors uplift the demand for these products for cutting alloy materials and fuel the market growth. The UK market is projected to reach USD 26.3 million by 2026, and the Germany market is projected to reach USD 37.3 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America and Middle East & Africa

South America and the Middle East & Africa regions are expected to grow decently, owing to increasing growth in the metal manufacturing and automotive sectors. Also, increasing commercial and residential construction-related activities create the demand for these products, which are cut steel rods of equal shape. These cuts are used in construction activities across the regions, boosting the market growth.

KEY INDUSTRY PLAYERS

Prominent Players Emphasize on Strategies to Improve the Overall Market Presence

Prominent players, such as Bichamp Cutting Technology, Benxi Tools Co Ltd, and others, are adopting product launch, product development, acquisition, and business expansion as vital developmental strategies to intensify market competition and improve the product portfolio through diversified locations. For instance,

January 2023: M.K. Morse Company acquired PJ Wiseman Ltd., based in the U.K., which deals in bi-metal band saw blade production, hacksaw blades, circular saw blades, and jigsaw blades. It provides products for various industry verticals such as machine manufacturing, metal fabrication, and automotive.

LIST OF KEY COMPANIES PROFILED:

- Wikus (Germany)

- Simonds International LLC (U.S.)

- Bichamp Cutting Technology Co Ltd (China)

- Stanley Black & Decker, Inc. (Lenox Tools) (U.S.)

- Eberlestrabe 28 (Germany)

- Hakansson Saws India Pvt. Ltd (India)

- Snap On Incorporated (BAHCO-Snap Europe) (U.S.)

- L.S. Starrett Company (U.S.)

- Dalian Special Steel Products Co Ltd (China)

- Benxi Tool Co Ltd (China)

KEY INDUSTRY DEVELOPMENTS:

- May 2022: Eberlestrabe 28 launched a new bi-metal band saw blade with a series named “duoflex VTX”. It is used for cutting materials such as stainless steel, high-speed steel, and cast iron. It has many advantages such as increased precision and stability and outstanding micro wear resistance cutting edge.

- May 2019: Simonds International LLC introduced a new series of metal band saw blades used for the global metal cutting tools industry. This series of new blades are used for all metal cutting operations such as production cutting, general purpose cutting, cutting of tough steels, and cutting part of structural steel.

- February 2021: BAHCO-SNA Europe, a subsidiary of Snap-On Incorporated based in the U.S., launched a new software tool named BandCalc. It is a next-generation web-based platform designed to bring automation to cutting operations.

- March 2021: BAHCO-SNA Europe, a subsidiary of Snap-On Incorporated, introduced a new high-performing carbide cutting blade with a higher precision cutting performance. These products can cut materials such as stainless steel and cast iron.

- May 2022: BAHCO, a subsidiary of Snap-On Incorporated, introduced a new 3859 easy-cut Xtreme bandsaw blade into the market. It is designed for cutting materials such as cast iron, stainless steel, and structural steel. It has precision cutting, an excellent range of cutting widths, and increased operations productivity.

- February 2022: Wikus opened a new manufacturing facility at Spangenberg based in Germany. The business expansion was done for approximately USD 13.8 billion. The new manufacturing facility was built to improve the machine capacity. Also, it enhances the product portfolio of these products and provides it through diversified geographies.

REPORT COVERAGE

The research report covers a detailed depth analysis of the tooth type, product type, application, and end user. It provides information about the leading players of bi-metal band saw blade and their business overview, product offerings, investments (R&D and expansions), revenue analysis, types, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.50% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Tooth Type, By Product Type, By Application, By End User, and By Region |

|

By Tooth Type |

|

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights report highlights that the market was valued at USD 570 Million in 2025.

According to our insights from the report, the market is expected to be valued at USD 995.7 billion in 2034.

The global market is estimated to have a remarkable CAGR of 6.50% from 2026 to 2034.

Asia Pacific dominated the global bi-metal band saw blade market with a share of 39.50% in 2025.

Within the application segment, the steel segment is expected to be the leading segment in the market during the forecast period.

An increasing urban population and growing concern regarding industrial waste recycling will drive the market.

Dalian Special Steel Products Co. Ltd., BAHCO-Snap Europe, Lenox Tools, and Bichamp Cutting Technology Co. Ltd. are some of the top companies operating in the market.

High-speed steel segment is expected to drive the market.

The major players in the market constitute approximately 70%-75% of the market, which is owed in large part to their presence in multiple regions and diverse product portfolios.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us