Biological Safety Cabinet Market Size, Share & Industry Analysis, By Type (Class I, Class II [Type A, Type B, and Type C], and Class III), By End User (Hospitals & Clinical Laboratories, Academic & Research Institutes, Biotechnology and Pharmaceutical Companies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

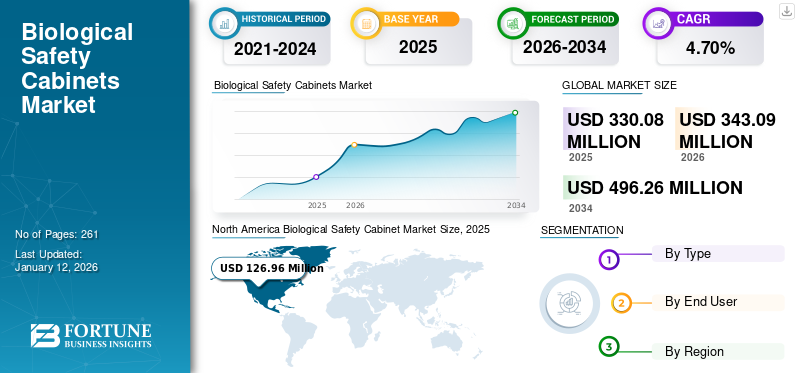

The global biological safety cabinet market size was valued at USD 330.08 million in 2025 and is projected to grow from USD 343.09 million in 2026 to USD 496.26 million by 2034, exhibiting a CAGR of 4.70% during the forecast period. North America dominated the biological safety cabinet market with a market share of 38.46% in 2025.

Biological safety cabinets are primary containment devices designed to protect personnel, products, and the environment from exposure to biohazards and infectious agents. The increasing prevalence of chronic diseases, rising healthcare expenditure, and increasing research & development activities among the pharmaceutical and biotechnological companies are some of the crucial factors contributing to the growing adoption of these products in the market.

- For instance, according to 2025 data published by the World Health Organization (WHO), about 3.0 to 5.0 million patients suffer from severe seasonal influenza worldwide annually.

Increasing government funding initiatives, along with ongoing technological advancements in these products, are likely to boost their demand in the market. Additionally, prominent players such as Thermo Fisher Scientific Inc., Esco Micro Pte Ltd., and others are also focusing on their research and development activities to develop and introduce innovative systems, thereby supporting the growth of the global biological safety cabinet market.

Market Dynamics

Market Drivers

Increasing Prevalence of Chronic Diseases to Boost Market Growth

The growing prevalence of various chronic conditions, such as infectious diseases, among the patient population is resulting in a growing number of hospital admissions for these diseases nationwide. An increasing number of patient admissions is boosting the number of diagnostic procedures, subsequently augmenting the adoption rate of biosafety cabinets among healthcare providers.

- For instance, according to the statistics published by the Centers for Disease Control and Prevention (CDC), there were about 9,633 cases of tuberculosis in 2023, compared to 8,332 in 2022 in the U.S.

Moreover, the increasing number of research and development activities to study potential candidates among pharmaceutical and biotechnology companies is further contributing to the growing market penetration of these products, thereby supporting the global biological safety cabinet market growth.

Therefore, the factors mentioned above are driving prominent players to focus on research and development activities aimed at developing and introducing innovative devices in the market.

Other Prominent Drivers

- Greater awareness of biosecurity, infectious disease risk, and preparedness for pathogen research and vaccine development is expected to drive the product demand.

Market Restraints

High Cost of these Devices to Hinder Market Growth

There is an increasing demand for biosafety cabinets to protect personnel and samples from contamination. However, the high cost associated with these cabinets is likely to limit their adoption, especially in emerging markets such as China, India, and others. Increasing technological advancements in these devices by major players operating in the industry are resulting in growing prices owing to higher manufacturing costs.

Moreover, biosafety cabinets are energy-intensive and can produce large amounts of heat in the laboratory, further creating the requirement for powerful ventilation and cooling systems, which further increases the cost of these systems. Thus, the total cost of ownership, including the cost of operation, maintenance, and others, increases proportionally with specialized construction, extended use, integration of advanced HEPA filters, and others. These factors are anticipated to limit the adoption of these systems globally.

- For instance, according to the 2024 data published by Excedr, it was reported that Labconco’s BSCs range from USD 6,000.0 to USD 15,000.0

Other Prominent Restraints

- Alternative containment solutions or lower-cost variants to hamper market growth.

- Supply chain issues for components such as filters, UV lamps, and materials to limit penetration rate.

Market Opportunities

Emerging Nations Offer Lucrative Opportunities in the Market

The increasing prevalence of infectious diseases in countries such as Brazil, Mexico, and others, along with growing research and development activities, is expected to augment the demand for technologically advanced biosafety cabinets in these countries.

The growing healthcare expenditure in emerging nations is resulting in improved healthcare infrastructure, which is a vital factor contributing to the increasing diagnosis of these conditions among patients globally. Moreover, governmental organizations are increasingly focusing on research and development funding in emerging countries to promote the development of drugs and innovative healthcare solutions, further increasing the penetration rate of these products in the market.

- For instance, in January 2024, G-SHOCK launched two new models in the GPR-H1000 range featuring an optical heart sensor and GPS function, which provides support even in the harshest environments. This helped the company to increase its brand presence.

Additionally, increasing awareness about the benefits of biosafety cabinets, coupled with technological advancements, is further expected to boost the demand for these products, particularly in developing nations, thereby presenting lucrative growth opportunities in the market.

Market Challenges

Regulatory Barriers to Limit Market Growth

There an increasing advantages associated with technologically advanced biosafety cabinets, resulting in a rising penetration rate of these products in the market. However, stringent regulatory guidelines remain a vital factor limiting the adoption of these devices in the market. The biosafety cabinets are subject to various regional and international standards, such as NSF/ANSI 49 in the U.S. and EN 12469 in Europe, which require manufacturers to continuously update the design of their biosafety cabinets, which adds to additional cost and development time.

This, along with complex regulatory compliance including extensive documentation, rigorous testing, regular audits, and others, further increases operational costs, and are often time-consuming, thereby limiting the adoption rate for these systems, especially among the start-ups in the market.

- The NSF/ANSI 49 Standard mandates several critical aspects of BSC design and functionality, including the use of high-efficiency particulate air (HEPA) filters and adequate lighting conditions.

Biological Safety Cabinet Market Trends

Increasing Technological Advancements in these Devices to Boost the Product Demand

There has been an increasing focus on the integration of advanced technologies into these systems by prominent manufacturers operating in the industry. The integration of features, including advanced sensors, represents a shift from traditional to advanced biosafety cabinets. The incorporation of artificial intelligence in these systems offers significant advantages such as predictive maintenance, automated compliance, real-time monitoring, and increased operator safety.

Moreover, modular design, improved user interface, and advanced containment measures, among others, are some of the other advantages of advanced biosafety cabinets. The ongoing technological advancement in these devices is resulting in the rising adoption rate for these systems, further leading the focus of key players toward the development and introduction of innovative products in the market.

- In August 2024, Labconco introduced a redesigned Logic Biosafety Cabinet (BSC) with innovative features, with an aim to strengthen its product portfolio.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Growing Number of Product Launches Boosted the Class II Segment Growth

Based on type, the market is segmented into class I, class II, and class III. Class II is further divided into type A, type B, and type C.

The class II segment held a dominant market share of 88.95% in 2026. The increasing benefits of class II BSCs, including comprehensive protection for personnel, samples, and the environment through the combination of HEPA-filtered laminar airflow and an inward-flowing air curtain at the front opening, are key factors driving their demand. This, coupled with the growing focus of key players on research and development activities to develop and launch novel products, is anticipated to further support the growth of the segment in the market.

- In May 2025, Thermo Fisher Scientific Inc. launched the Thermo Scientific 1500 Series Class II, Type A2 biosafety cabinet (BSC), a solution designed to provide protection and operational convenience with an aim to strengthen its product portfolio.

The class I segment is expected to grow at a considerable CAGR during the forecast period. The increasing prevalence of infectious diseases and rising focus on lab safety initiatives are some of the factors supporting the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Increasing Number of Biotechnology and Pharmaceutical Companies Boosted the Segmental Growth

Based on end user, the market is classified into hospitals & clinical laboratories, biotechnology and pharmaceutical companies, academic & research institutes, and others.

The biotechnology and pharmaceutical companies segment dominated the market in 2026 with a share of 39.72%. The increasing prevalence of chronic conditions has increased the requirement to maintain the microbiological quality of products to ensure efficacy and patient safety. In addition, the growing number of pharmaceutical and biotechnology companies, along with expanding research and development facilities, is expected to further support the growth of the segment.

- For instance, according to 2025 statistics published by Cross River Therapy, there are about 5,000 pharmaceutical companies operating in the U.S.

The academic & research institutes segment is expected to grow at a considerable CAGR during the forecast period, owing to an increasing research and development activity. Key players are focusing on launching innovative biosafety cabinets, which are likely to further support segment growth.

Biological Safety Cabinet Market Regional Outlook

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Biological Safety Cabinet Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 126.96 million in 2025 and USD 132.43 million in 2026. The increasing prevalence of chronic diseases, rising healthcare expenditure, strong laboratory infrastructure, large pharmaceutical & biotechnology sector, growing research and development activities, and increasing initiatives by key players to introduce novel products are some of the major factors contributing to the growth of the market.

- For instance, according to 2023 data published by the Centers for Medicare & Medicaid Services, the per capita healthcare expenditure is about USD 14,570 in the U.S.

The growing research and development activities to develop new drugs and solutions for patients suffering from rare diseases are some of the factors contributing to the growth of the market in the U.S. The U.S. market is projected to reach USD 117.86 million by 2026.

Europe

In Europe, the market is expected to grow at a considerable CAGR during the study period. The growth is due to the increasing prevalence of chronic diseases, the increasing number of diagnostic labs and research institutions, and the rising technological advancements in biosafety cabinets. The increasing focus of prominent players toward receiving regulatory certifications is likely to boost the growth of the region in the market. The UK market is projected to reach USD 24.75 million by 2026, while the Germany market is projected to reach USD 28.58 million by 2026.

- In July 2025, NuAire, Inc., received certifications, namely, EN 12469 (the European Standard for Microbiological Safety Cabinets) for its NuAire NU-543E and NU-543S Class II cabinets to strengthen its product portfolio.

Asia Pacific

Asia Pacific is anticipated to register considerable growth during the study period. The growth is primarily owing to the increasing prevalence of chronic conditions, rising awareness about the benefits of BSCs, growing funding for research and development activities, coupled with growing strategic initiatives among governmental organizations to maintain laboratory safety and efficacy. This, along with the increasing focus of key players toward the introduction of novel products, is further likely to support the growth of the market in the region. The Japan market is projected to reach USD 11.69 million by 2026, the China market is projected to reach USD 19.42 million by 2026, and the India market is projected to reach USD 6.97 million by 2026.

- For instance, in November 2023, Esco Micro Pte. Ltd. launched the Labculture Plus G4 Class II Biosafety Cabinet with an aim to strengthen its product portfolio.

Latin America

In Latin America, the market is expected to grow at a considerable CAGR during the forecast period. This is due to the rising healthcare expenditure in the region, increasing development of healthcare infrastructure, and growing demand for biosafety cabinets among the population. Moreover, the increasing focus on the establishment of an advanced pathogen research laboratory is also likely to boost the penetration rate for these products in the market.

- For instance, in July 2024, the Brazilian Government laid the foundation for the construction of Orion, a biosafety level 4 research laboratory for studying the deadliest viruses in Brazil.

Middle East & Africa

The increasing number of patients suffering from chronic diseases, coupled with increasing efforts by governmental organizations in various ways to raise awareness about the benefits of biosafety cabinets, is contributing to the increasing adoption of these products in the market. Additionally, the growing focus on launching biosafety-level mobile labs is driving the market growth.

- In January 2023, the Abu Dhabi Public Health Centre (ADPHC) introduced the mobile Biosafety Level 3 (BSL-3) laboratory equipped to handle highly infectious agents, including Crimean-Congo hemorrhagic fever, yellow fever, and others.

Competitive Landscape

Key Industry Players

Major Players Focus on R&D Initiatives to Reinforce their Market Presence

Increasing focus on research and development activities to launch innovative biosafety cabinets, coupled with a strong geographical presence globally, are some of the crucial factors contributing to the dominance of players such as Thermo Fisher Scientific Inc. in the market. Furthermore, the growing focus of prominent players to expand their global presence is anticipated to support the global biological safety cabinet market share.

Moreover, other key players, including Haier Biomedical, and others, are also witnessing growth in the market owing to their strategic focus on acquisitions and partnerships among other players to increase their brand presence.

- In October 2024, Haier Biomedical collaborated with Grosseron and launched a limited-edition pink biosafety cabinet with an aim to raise breast cancer awareness and address the increasing prevalence of the condition among patients globally.

List of Key Biological Safety Cabinet Companies Profiled

- Thermo Fisher Scientific Inc. (U.S.)

- Haier Biomedical (China)

- Esco Micro Pte. Ltd. (Singapore)

- Labconco (U.S.)

- Kewaunee International Group (U.S.)

- Brinda Pharma Technologies (India)

- Biobase Biodusty(Shandong), Co., Ltd. (China)

- Baker Co. (U.S.)

- Germfree (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2025 – Biobase Biodusty(Shandong), Co., Ltd., launched a radiation protection biosafety cabinet that combines advanced technology with humanized design, with an aim to strengthen its product portfolio.

- November 2024 – Kewaunee International Group, a player dedicated to laboratory furniture and technical products, acquired NuAire, Inc., with an aim to diversify its product portfolio for biosafety cabinets.

- March 2023 – Labconco launched ReVo, an innovative microbiological safety cabinet, with an aim to widen its product channel. The ReVo is a new Class II, Type A2 solution for biosafety, thoughtfully designed with simplicity in mind.

- November 2022 – Haier Biomedical launched Mini and Dual Exhaust Filter Model HR700-IIA2 and HR900-IIA-D biosafety cabinets with an aim to strengthen its product portfolio.

- April 2021 – Tecniplast Group acquired BioAir Spa with the aim of widening its portfolio for biosafety cabinets and other equipment globally.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, and end user of the products. Besides this, the global report offers insights into the global market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth and advancement of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2023 |

|

Growth Rate |

CAGR of 4.70% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type · Class I · Class II o Type A o Type B o Type C o Class III |

|

By End User · Hospitals & Clinical Laboratories · Academic & Research Institutes · Biotechnology and Pharmaceutical Companies · Others |

|

|

By Geography · North America (By Type, By End User, and by Country) o U.S. (By Type) o Canada (By Type) · Europe (By Type, By End User, and by Country/Sub-region) o U.K. (By Type) o Germany (By Type) o France (By Type) o Italy (By Type) o Spain (By Type) o Scandinavia (By Type) o Rest of Europe (By Type) · Asia Pacific (By Type, By End User, and by Country/Sub-region) o China (By Type) o Japan (By Type) o India (By Type) o Australia (By Type) o Southeast Asia (By Type) o Rest of Asia Pacific (By Type) · Latin America (By Type, By End User, and by Country/Sub-region) o Brazil (By Type) o Mexico (By Type) o Rest of Latin America (By Type) · Middle East & Africa (By Type, By End User, and by Country/Sub-region) o GCC (By Type) o South Africa (By Type) o Rest of the Middle East & Africa (By Type) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 330.08 million in 2025 and is projected to reach USD 496.26 million by 2034.

In 2025, the North America regional market value stood at USD 126.96 million.

Growing at a CAGR of 6.70%, the market will exhibit steady growth over the forecast period (2026-2034).

By type, the class II segment led the segment.

Technological advancements are the key factor supporting the market's growth.

Thermo Fisher Scientific Inc., Esco Micro Pte. Ltd., and Haier Biomedical are the major players in the global market.

North America dominated the market share in 2025.

The increasing prevalence of chronic conditions, growing research and development activities are some of the factors expected to drive the adoption of these devices globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us