Biopolymer Packaging Market Size, Share & Industry Analysis By Material (Synthetic Biopolymers, Natural Biopolymers, and Others), By Product Type (Bottles, Cups & Trays, Bags & Pouches, Boxes & Cartons, Films & Wraps, and Others), By End-use Industry (Food & Beverages, Personal Care & Cosmetics, Chemicals, Electrical & Electronics, Pharmaceuticals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

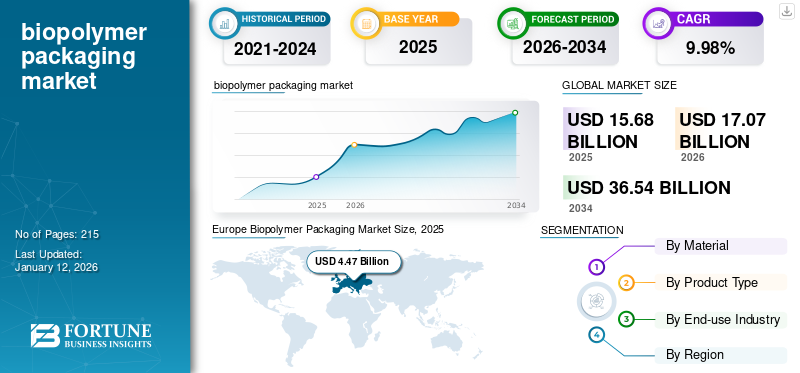

The global biopolymer packaging market size was valued at USD 15.68 billion in 2025. It is projected to grow from USD 17.07 billion in 2026 to USD 36.54 billion by 2034, exhibiting a CAGR of 9.98% during the forecast period. Europe dominated the biopolymer packaging market with a market share of 28.51% in 2025.

The global biopolymer packaging market encompasses packaging materials made from biopolymers, which are biodegradable or bio-based polymers derived from renewable resources such as plants, animals, or microorganisms. These materials are used as alternatives to conventional petrochemical-based plastics, offering sustainable and environmentally friendly packaging solutions.

Amcor PLC and Sonoco Products Company are the leading manufacturers in the biopolymer packaging market, accounting for the largest global market share.

Global Biopolymer Packaging Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 15.68 billion

- 2026 Market Size: USD 17.07 billion

- 2034 Forecast Market Size: USD 36.54 billion

- CAGR: 9.98% from 2026–2034

Market Share:

- Europe dominated the biopolymer packaging market with a 28.51% share in 2025, supported by strong public demand for sustainable products and strict EU regulations such as the 2021 directive banning single-use plastics.

- By material, synthetic biopolymers are expected to retain the largest market share in 2025 due to superior thermal stability, tensile strength, and ease of processing in rigid food and healthcare packaging applications.

Key Country Highlights:

- United States: Growth is driven by strong environmental regulations, corporate sustainability commitments, and state-level bans on single-use plastics in California and New York.

- China: Demand is increasing due to government bans on non-biodegradable plastics in major cities and rising awareness of sustainable packaging alternatives like PLA and starch-based biopolymers.

- Germany: The country’s leadership in sustainable packaging solutions and advanced R&D is driving strong adoption of compostable and recyclable biopolymer packaging in both food and personal care sectors.

- Mexico: As the second-largest beauty market in Latin America, Mexico imported USD 1.4 billion in personal care products in 2022, boosting demand for sustainable biopolymer-based packaging.

- United Arab Emirates: Rising investments, urbanization, and a USD 107.8 billion chemicals sector in the GCC are contributing to increased biopolymer packaging adoption in the Middle East & Africa region.

MARKET DYNAMICS

MARKET DRIVERS

Growing Environmental Concerns and Corporate Commitments to Sustainability Propels Market Growth

The increasing levels of plastic waste in landfills and oceans have raised global awareness about its harmful effects on ecosystems. Microplastics and their long-term impact on marine life and human health have further highlighted the need for alternatives such as biopolymer packaging. Businesses are increasingly incorporating biopolymer packaging to reduce dependency on fossil-fuel-derived plastics and transition toward circular economy practices, ensuring packaging materials can either decompose naturally or be repurposed efficiently. Such factors drive the global biopolymer packaging market growth.

Eco-Friendly Practices in and Personal Care Industry Enhances Market Growth

The pharmaceutical industry is under pressure to adopt eco-friendly practices. Biopolymer packaging offers sustainable solutions for pill bottles, blister packs, and medical device packaging. In the personal care sector, increasing consumer demand for packaging that is both hygienic and environmentally sustainable, driving the use of biodegradable materials for items such as cosmetic containers and hygiene product wraps. To support these efforts, companies and governments are developing systems where used biopolymer packaging can be collected, composted, or recycled, reducing reliance on non-renewable materials and waste.

MARKET RESTRAINTS

High Production Costs and Limited Availability of Raw Materials to Hamper Market Growth

Biopolymers are generally more expensive to produce compared to traditional petroleum-based plastics due to limited availability of raw materials such as starch, polylactic acid (PLA), or polyhydroxyalkanoates (PHA). High production costs lead to higher product prices, making biopolymer packaging less competitive, particularly in cost-sensitive industries such as food and beverage. Henceforth, the high costs are expected to hinder the production and scalability of biopolymers.

MARKET OPPORTUNITIES

Advancements in Feedstock Development and Technological Innovations in Production Will Generate Growth Opportunities

Technological innovations such as synthetic biology and fermentation-based production methods such as microbial fermentation for PHA, are paving the way for cost-effective and scalable biopolymer manufacturing. Using alternative feedstocks such as agricultural waste, algae, and seaweed reduces dependency on food crops. Moreover, ongoing research and development aimed at improving biopolymer properties enable their use in advanced applications, including frozen foods, electronics, and medical packaging.

MARKET CHALLENGES

Performance Limitations and Disposal and Recycling Issues to Challenge Market Growth

Biopolymers often fall short in terms of mechanical strength, thermal resistance, and barrier properties compared to conventional plastics. Although biopolymers are marketed as sustainable, improper disposal or lack of infrastructure for composting or recycling can negate their environmental benefits. In many regions, consumers and waste management systems are unaware of how to handle biodegradable materials, causing contamination in recycling streams. Europe witnessed a growth from USD 4.47 billion in 2025 to USD 4.84 billion in 2026.

Download Free sample to learn more about this report.

MARKET TRENDS

Shift Toward Bio-Based and Compostable Materials Emerges as a Key Trend

There is increasing adoption of bio-based materials, such as PLA, PHA, and bio-PE, as they offer sustainable alternatives to petroleum-based plastics. Compostable materials are also gaining traction for applications requiring short-term use. Manufacturers are focusing on improving the mechanical, thermal, and barrier properties of biopolymers to expand their applications. Innovations in biopolymer blends and hybrid materials are addressing performance gaps in durability and oxygen resistance.

IMPACT OF TRADE PROTECTIONISM

Tariffs on imported raw materials or finished biopolymer products can raise production costs for packaging manufacturers. Countries imposing export restrictions on corn or cassava during periods of domestic shortage can disrupt the supply of raw materials for biopolymer production. Additionally, restrictions on cross-border trade can lead to delays or shortages of essential feedstocks and biopolymer resins, impacting global supply chains and hindering the ability of manufacturers to meet growing demand.

RESEARCH AND DEVELOPMENT

Major focus in research and development is on enhancing the mechanical, thermal, and barrier properties of biopolymers to compete with conventional plastics. These advancements are expanding the use of biopolymers in demanding sectors such as frozen foods, electronics, and pharmaceuticals.

SEGMENTATION ANALYSIS

By Material

Superior Performance Characteristics Boosts the Synthetic Biopolymers Segment Growth

Based on material, the market is segmented into synthetic biopolymers, natural biopolymers, and others.

Synthetic biopolymers segment led the market share by 52.61% in 2025. Synthetic biopolymers, such as PLA, often offer better thermal stability, tensile strength, and barrier properties compared to natural alternatives. PLA is widely used in rigid packaging for food containers due to its clarity, rigidity, and ease of processing. These biopolymers can be customized for diverse applications, including in food packaging, healthcare, and industrial goods.

Natural biopolymers are the second-dominating material segment. These materials rely heavily on crops such as corn and cassava, creating competition with food supplies and raising cost volatility concerns.

By Product Type Analysis

Wide Industry Applications Boost the Growth of the Bottles Segment

Based on product type, the market is segmented into bottles, cups & trays, bags & pouches, boxes & cartons, films & wraps, and others.

Bottles are the dominating product type segment. Bottles serve a wider range of industries, including beverages, personal care, and cleaning products, while cups and trays are primarily used in foodservice. Biopolymer bottles are often designed for reuse or recycling, offering long-term sustainability benefits compared to single-use cups and trays. Bottle segment is projecting to hold 29.41% of the market share in 2026.

Cups & trays is the second-dominating segment, driven by the increased demand for sustainable meal packaging solutions in the foodservice sector. The rising adoption of PLA or PHA-based compostable cups and trays is particularly notable in regions with established industrial composting infrastructure, where these materials can be effectively processed to reduce waste. Cups and Trays segment is anticipating to capture significant CAGR of 10.12% during the forecast period.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Increasing Consumer Preference for Biodegradable and Compostable Packaging Propels Food & Beverage Segment Growth

Based on end use, the market is segmented into food & beverages, personal care & cosmetics, chemicals, electrical & electronics, pharmaceuticals, and others.

Food and beverages is the dominating end use segment. The food & beverage industry is the largest consumer of packaging globally, making it the primary driver for biopolymer packaging. PLA and PHA-based packaging are used for trays, cups, films, and bottles in ready-to-eat meals, drinks and fresh produce. Growing environmental awareness has led consumers to prefer biodegradable and compostable packaging for food and beverages, further fueling demand for sustainable solutions in this sector.

- The food & beverages sector is likely to hold 33.33% of the market share in 2026.

Personal care & cosmetics are the second-leading end-use segments. Personal care & cosmetics brands use biopolymer packaging to differentiate themselves as environmentally conscious and appeal to consumers who prioritize sustainability. Personal care & cosmetics are anticipating to grow with a CAGR of 9.94% during the forecast period.

BIOPOLYMER PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Europe

Europe Biopolymer Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Strong Consumer Preference for Sustainable Personal Care Packaging Enhances Europe’s Market Growth

European market to be anticipated as the second-largest market with USD 4.84 billion in 2026, recording the second-largest CAGR of 9.19% during the forecast period. Europe is the dominating region of the biopolymer packaging marke share. The growth is majorly driven by stringent regulations and strong public support for sustainability. The market in U.K. is estimated to be USD 0.88 billion in 2026.

The Germany’s market size is foreseen to be valued at USD 1.08 billion and France’s likely to be USD 0.81 billion in 2025.

- The European Union’s 2021 directive, which bans single-use plastic items such as cutlery, plates, and straws, has accelerated the shift toward biopolymer alternatives.

North America

Growing Demand for Compostable Packaging Drive the North America Market Growth

North American market held the largest market size of USD 5.64 billion in 2025. In 2023, the market value stood at USD 4.77 billion.

North America is a significant market for biopolymer packaging due to stringent environmental regulations, strong consumer awareness, and corporate sustainability commitments. The U.S. market size is estimated to be USD 5.36 billion in 2026.

- Several U.S. states such as California, New York, and Canadian provinces have implemented bans on single-use plastics, fostering the demand for biopolymers. Canada’s federal ban on single-use plastics, effective December 2023, includes items such as straws, cutlery, and food containers.

Asia Pacific

Increasing Government Initiatives Cushions the Market Growth in Asia Pacific

Asia Pacific region is to be anticipated the third-largest market with USD 3.7 billion in 2026. The Asia Pacific region is a fast-growing market due to increasing awareness, government initiatives, and the region’s high dependence on plastic packaging. The market in China is likely to be USD 1.31 billion in 2026. Japan’s market is expecting to stand at USD 0.66 billion and India is likely to be USD 0.91 billion in 2026.

- Since 2021, major Chinese cities have implemented a ban on non-biodegradable single-use plastics, driving demand for PLA and starch-based packaging.

Latin America

Latin America to Witness Growth Opportunities due to Surge in Demand from Personal Care Sector

Latin America is expecting to be the fourth-largest market, valuating USD 1.62 billion in 2026. presents emerging opportunities for biopolymer packaging, with Brazil, Mexico, and Argentina are at the forefront of product adoption.

- Mexico is one of the world's top 10 markets for personal care & cosmetic and ranks second in Latin America for beauty products, following Brazil. According to the U.S. Department of Commerce’s International Trade Administration (ITA), Mexico imported USD 1.4 billion worth of cosmetics and personal care products in 2022.

Middle East & Africa

Rising Investments and Adoption of Biopolymer Packages in the Middle East & Africa is Driving the Market Growth

The Middle East & Africa region presents both opportunities and challenges for the biopolymer packaging market. While adoption of biopolymer packaging is still in its nascent stage, growth is accelerating due to urbanization, regulatory pressure, and international investments. The Saudi Arabia market size is projecting to hold USD 0.29 billion in 2025.

- According to the Gulf Petrochemicals and Chemicals Association, the chemical industry in the GCC (Gulf Cooperation Council) generated USD 107.8 billion in revenue in 2022, contributing 5% to the region's GDP and 39% to the manufacturing GDP.

FUTURE OUTLOOK

The biopolymer packaging market is poised for robust growth, driven by technological advancements, increasing demand for synthetic and natural biopolymer products, and a heightened focus on sustainability. Companies that embrace innovation and adapt to evolving regulatory landscapes are likely to gain a competitive edge in this dynamic market.

The biopolymer packaging plays a vital role in ensuring the integrity of temperature-sensitive products across various industries. Staying abreast of market trends, challenges, and opportunities is essential for stakeholders aiming to thrive in this evolving landscape.

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global biopolymer packaging market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The market also focuses on the key developments by the manufacturers.

Major players in the industry include Amcor PLC, Sonoco Products Company, Constantia Flexibles Group GmbH, Sealed Air Corporation, Clondalkin Group Holdings BV, Albéa Group, and others. Other companies are focused on delivering advanced packaging solutions to fulfill the industry's evolving requirements.

Some of the Key Companies Profiled in the Report:

- Amcor PLC (Australia)

- Sonoco Products Company (U.S.)

- Constantia Flexibles Group GmbH (Austria)

- Sealed Air Corporation (U.S.)

- Clondalkin Group Holdings BV (Netherlands)

- Albéa Group (France)

- Taghleef Industries (UAE)

- Toray Industries Inc. (Japan)

- Plantic Technologies (Australia)

- United Biopolymers (Portugal)

- NatureWorks(U.S.)

- Xiamen Changsu Industrial Co., Ltd. (China)

- Spectra Packaging (U.K.)

- Evanesce Inc. (Canada)

- Fortis X (South Africa)

KEY INDUSTRY DEVELOPMENTS:

- November 2024 – Lactips, a French company specialising in the production of natural polymers that are 100% biobased, water-soluble, and biodegradable in various environments, entered into a Joint Development Agreement (JDA) with Walki, a leading Finnish packaging converting company. They aim of create fully biodegradable, plastics-free food packaging using natural polymers recyclable in the paper stream.

- October 2024 – UPM Specialty Papers and Eastman developed a novel biopolymer-coated paper packaging solution designed for food applications requiring grease and oxygen barriers. The solution integrates Eastman’s biobased and compostable Solus™ performance additives with BioPBSTM polymer to form a thin coating on UPM’s compostable and recyclable barrier base papers.

- August 2023 – Amcor launched AmFiber™ high-barrier performance paper packaging in North America, designed to be curbside-recyclable. The packaging meets brand and product needs by delivering the right barrier, shelf-life, and machine performance.

- May 2023 – BASF extended its ecovio® portfolio for extrusion coating on paper and board by adding a certified home and industrial compostable grade for cold and hot food packaging. The new ecovio® 70 PS14H6 is food-contact approved and offers excellent barrier properties against liquids, fats, grease, mineral oil, and temperature stability up to 100°C.

- June 2020 – Mitsubishi Chemical Corporation announced a joint development project with Nippon Paper Industries Co., Ltd to create a sustainable packaging material. The packaging uses MCC’s compostable and biodegradable polymer, BioPBS™, with NPI’s paper-based barrier material, SHIELDPLUS®, both made from renewable raw materials.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In July 2023, Braskem invested USD 87 million in additional production capacity at its bio-based ethylene plant located in the Petrochemical Complex of Triunfo, Rio Grande do Sul, Brazil. The investment constitutes an expansion by 30% of Braskem’s overall production capacity, aims to meet the growing global demand for bio-based products. The plant will now produce around 200,000 to 260,000 tons of product per year.

REPORT COVERAGE

The market research report provides a detailed market analysis. It covers key aspects, such as top key players, competitive landscape, market segments, and Porter’s five forces analysis. Besides, the report highlights market trends and key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.98% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 15.68 billion in 2025.

The market is likely to grow at a CAGR of 9.98% over the forecast period.

Bottles product type segment leads the market.

The market size of Europe stood at USD 4.47 billion in 2025.

The key market drivers are growing environmental concerns and corporate commitments to sustainability.

Some of the top players in the market are Amcor PLC, Sonoco Products Company, Constantia Flexibles Group GmbH, Sealed Air Corporation, Clondalkin Group Holdings BV, Albéa Group, and others.

The global market size is expected to reach USD 36.54 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us