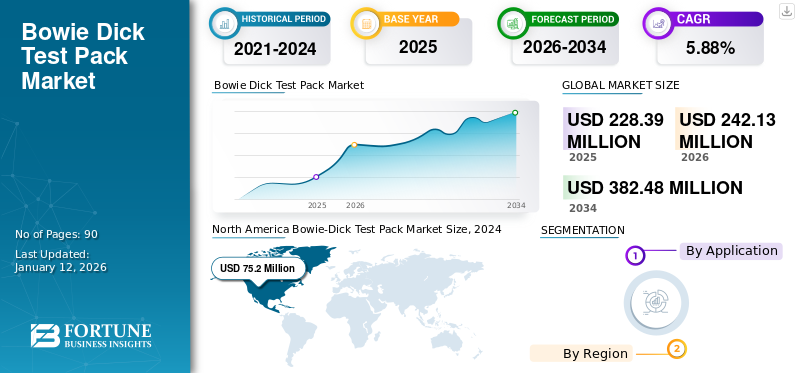

Bowie-Dick Test Pack Market Size, Share & Industry Analysis, By Application (Pharmaceutical & Medical Device Companies, Healthcare Facilities, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global bowie-dick test pack market size was USD 228.39 million in 2025. The market is projected to grow from USD 242.13 million in 2026 to USD 382.48 million by 2034 at a CAGR of 5.88% during the forecast period. North America dominated the bowie dick test pack market with a market share of 34.82% in 2025.

Bowie-dick test packs are chemical indicators used on a day-to-day basis to evaluate the performance of air removal systems such as autoclaves. These air removal Bowie-Dick type test packs are used in hospitals, laboratories, and pharmaceutical & medical device companies to verify the pre-vacuum sterilizer effectively before loading the goods or packs in the sterilization machine. There are two types of preassembled designs; single-use test packs, and reusable test packs to assess the overall performance of the air removal system, especially of a pre-vacuum-equipped sterilizer.

The key factors contributing to the market growth are the increasing number of pharmaceutical and medical device companies, increasing focus on sterilization in healthcare, and rising demand for higher value-added products. Also, the growing demand for sterilization monitoring products to control hospital-acquired infections (HAIs) caused during hospital stays or during invasive surgeries is likely to fuel the global market during the forecast period. According to the World Health Organization (WHO) 2022 Report, 8.9 million HAIs occur every year in European countries. Such a growing patient population is anticipated to surge the demand for sterilization monitoring products.

Furthermore, the strong technological advancements, growth in healthcare manufacturing facilities, and surging penetration by key companies are driving the bowie-dick test pack market growth. The growing competition for advanced product launches by key players is anticipated to boost the global market growth during the forecast period.

Global Bowie-Dick Test Pack Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 228.39 million

- 2026 Market Size: USD 242.13 million

- 2034 Forecast Market Size: USD 382.48 million

- CAGR: 5.88% from 2026–2034

Market Share:

- North America dominated the Bowie-Dick test pack market with a 34.82% share in 2025, driven by the increasing prevalence of healthcare-acquired infections (HAIs) and stringent sterilization safety norms across hospitals and clinics.

- By application, Healthcare Facilities held the largest market share in 2024 due to their adherence to strict sterilization protocols and growing hospital infrastructure across key regions.

Key Country Highlights:

- United States: The growing burden of hospital-acquired infections (HAIs) and mandatory compliance with sterilization standards by regulatory authorities is amplifying the demand for Bowie-Dick test packs across healthcare facilities.

- Europe: The presence of a strong pharmaceutical and medical device manufacturing sector coupled with mandatory sterilization guidelines is supporting market growth across the region.

- China: Increasing healthcare infrastructure development and rising focus on infection control practices in hospitals are driving the adoption of sterilization monitoring products.

- Japan: Rising emphasis on technological advancements in sterilization monitoring and adherence to strict regulatory guidelines is fostering the demand for Bowie-Dick test packs in healthcare and manufacturing sectors.

COVID-19 IMPACT

Increased Demand for Sterilization and Disinfectant Products During Pandemic Aided Market Growth

The pandemic of COVID-19 led to the acceleration in the demand for disinfectant products and sterilization in biotech, pharmaceutical, and medical device companies. The manufacturing facilities followed the protocols while engaging in the manufacturing process. Due to the COVID-19 pandemic, healthcare manufacturing facilities emphasized on the importance of sterilization monitoring steps, increasing the demand for this product.

In addition, the pandemic surged the need for monitoring of sterilization dental clinics, hospitals, and other healthcare facilities before using medical instruments for any surgical process. It also shed the light on the importance on the products which are used for the sterilization of surgical instruments and consumables, positively impacting the revenues of industry players in the market.

- For instance, the consumables segment of STERIS Company generated a revenue of USD 185.9 million in 2020, exhibiting an increase of 14.9% from 2019. The segment includes sterility assurance products such as the bowie-dick test. This growth continued in 2021 and 2022 with a year-on-year growth of 15.7% and 11.3% simultaneously.

The pandemic highlighted the importance of sterile and infection-free medical instruments during dental practice and invasive surgical procedures to avoid viral or bacterial hospital-acquired infections (HAIs). In the long term, the COVID-19 pandemic has increased the awareness about the need for sterilization and disinfectants in the healthcare system, which is projected to drive market growth during the forecast period.

Bowie-Dick Test Pack Market Trends

Integration of the Technological Advancements in Sterilization Monitoring Products to Drive Market Growth

The global market is growing at a significant level due to the rising technological developments, product launches, lab technicians training, and others, which is expected to drive the growth of the market growth. There is continuous technological development in the Bowie-Dick test products. The traditional standard packs were made from paper, but there are new electronic devices. These new systems use temperature and pressure data to provide an electronic pass or fail result rather than a chemical indicator sheet.

For instance, in May 2019, Ellab, a Denmark-based company, announced the launch of SteriSense, the latest innovative electronic Bowie-Dick test system, which offers quick and accurate test results. It is user-friendly and economically efficient and also provides ease in comparing and tracing data. This automatic electronic Bowie-Dick test device can substitute for the traditional disposable Bowie-Dick chemical test strips, which will save money and time for the same process. Thus, the increasing research and development (R&D) initiatives and the introduction of advanced Bowie-Dick test products are some of the biggest trends for market growth.

Download Free sample to learn more about this report.

Bowie-Dick Test Pack Market Growth Factors

Increasing Surgical Procedure Boosts the Demand for Equipment Sterilization Products

There is an increase in the number of invasive surgical procedures for the treatment of various health conditions. During these procedures, the surgical instrument comes in contact with the tissue, increasing the risk of infection. To ensure patient safety, surgical instruments, medical devices, and equipment must be adequately sterilized. According to the Association for the Advancement of Medical Instrumentation (AAMI) guidelines, it is compulsory to perform a Bowie-Dick test for steam penetration before starting loading.

The growing incidence of surgical-site infections (SSIs) and hospital-acquired infections supports the demand for these test packs to standardize or decontaminate the medical devices used in the surgical process. According to the National Healthcare Safety Network 2023 report, SSIs account for 20% of all HAIs infections, which increases the scope for Bowie-Dick test products in the hospital and clinics to reduce contamination.

Additionally, the increasing prevalence of cardiac diseases, orthodontic procedures, and other surgical procedures require sterilized products to conduct procedures, which ultimately drives the demand for steam sterilizers and their validating products. According to the Organization for Economic Co-operation and Development (OECD), in Norway, the number of cataract surgical procedures increased from 20,296 to 21,502 between 2018 and 2021 respectively. The increasing number of surgical procedures supports the demand for equipment sterilization products, which supports the growth of the global market.

Stringent Government Regulations to Prevent Contamination Support the Market Growth

It is mandatory to meet regulatory guidelines for the biotechnology, pharmaceutical, and medical device companies regarding the usage of air removal tests in pre-vacuum autoclave sterilizers. The U.S. Food and Drug Administration (FDA), and Association for the Advancement of Medical Instrumentation (AAMI), along with the International Organization for Standardization (ISO), British Standards Institution (BSI), and the European Committee for Standards (CEN), has set up guidelines for the use of air removal test.

Healthcare manufacturing companies have to follow the guidelines and meet the benchmark standards set by these regulatory bodies. The mandatory air removal tests are likely to increase the demand for this product.

Similarly, hospitals, clinics, and ambulatory centers also follow the regulatory bodies’ sterilization protocol before undergoing any surgical procedure to minimize the risk of infection and provide a safe environment. For instance, the National Accreditation Board for Hospitals & Healthcare Providers (NABH) and the National Accreditation Board for Testing and Calibration Laboratories (NABL) are constituent boards of India's quality council that monitor the quality and safety of health organizations.

These organizations emphasize on following all the sterilization steps to reduce the chances of infection. The guidelines and recommendations set by these regulatory bodies increase the demand for these products globally and create an opportunity for the market to grow faster.

RESTRAINING FACTORS

Noncompliance to Sterilization Standards and Low Adoption Due to Lack of Awareness May Restrain the Market Growth

Some limiting factors that are expected to restrain the global market growth during the forecast period are the lack of awareness and not following the sterilization standards by the hospitals, clinics, nursing homes, laboratories, and local healthcare manufacturers as a cost-cutting practice. Despite the sterilization monitoring guidelines, hospitals and clinics are not aware of the application and importance of the bowie-dick test in equipment standardization.

The lack of awareness or ignorance about the standardization steps by such healthcare facilities reduces the demand for these products and also hampers patient’s quality of life. According to a research paper published by the Vanderbilt University Medical Center in 2022, a lack of proper instrument sterilization has led to post-surgical infection rates of about 46%. Such practices by the end users are attributed to the limited adoption of sterilization monitoring products.

Bowie-Dick Test Pack Market Segmentation Analysis

By Application Analysis

Stringent Adherence to Safety Standards Led to Healthcare Facilities Segment Dominance in 2024

Based on application, the global market is segmented into pharmaceutical & medical device companies, healthcare facilities, and others.

The healthcare facilities segment dominated the global bowie-dick test pack market share in 2024. Healthcare facilities in developed countries focus on providing safe, effective, and infection-free high-quality treatment and services by following all the safety standards set for hospitals and clinics, which fuels the segment's growth during the forecast period.

Furthermore, the increasing number of hospitals globally enhances the demand for this product. As per 2021 data from the OECD, the number of hospitals in various countries like Austria (268), Belgium (163), and Mexico (4,995) creates demand for sterilization monitoring products.

Additionally, as per People’s Archive of Rural India Statistics, as of March 2022, there are 24,935 rural and 6,118 urban government hospitals in India. Increasing number of hospitals will boost the demand for sterilization monitoring products.

To know how our report can help streamline your business, Speak to Analyst

The pharmaceutical & medical device companies segment is anticipated to hold a dominant market share of 76.03% in 2026. Some of the critical factors contributing to the growth include the adoption of bowie-dick test packs, including recommended guidelines by the U.S. FDA for the pharmaceutical manufacturers regulating the use of Bowie Dick test packs before loading goods.

Additionally, according to the Association for the Advancement of Medical Instrumentation (AAMI) guidelines, it is compulsory to perform air removal tests before loading. The others segment includes nursing centers and research academies, which account for almost negligible market share.

REGIONAL INSIGHTS

Based on the region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America Bowie-Dick Test Pack Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 79.52 billion in 2025 and USD 84.02 billion in 2026. Some of the critical factors contributing to the region’s dominance include the increasing prevalence of healthcare-acquired infections (HAIs) and stringent safety norms to control infection during hospital stays, driving the market growth in this region. For instance, the Centers for Disease Control (CDC) estimated that HAIs infect 1.7 million patients, amongst which 99,000 die yearly. In order to control this condition, the hospitals are recommended to follow sterilization monitoring guidelines, increasing the demand for this product. The U.S. market is expected to reach USD 8.35 million by 2026.

Europe is estimated to be the second-most dominant region in terms of market share by 2032 due to the presence of many pharmaceutical and medical device manufacturing facilities in this region. These manufacturing facilities are mandatory to perform air removal tests using standardized Bowie-Dick-test sheets. The International Organization for Standardization (ISO), the European Committee for Standards (EN), the Association for the Advancement of Medical Instrumentation (AAMI), and the British Standards Institution (BSI) guide the use of air removal tests as a routine process. The UK market is expected to reach USD 51.43 million by 2026, while the Germany market is expected to reach USD 17.42 million by 2026.

The market in Asia Pacific is estimated to grow at the highest CAGR. The key factors boosting the market growth include the presence of medical device and pharmaceutical manufacturing plants and hospital facilities, which are the end users for a bowie-dick test pack. The other factor that surges the market is the healthcare disinfection guidelines. For instance, in July 2022, the Asia Pacific Society of Infection Control (APSIC) launched its revised guidelines for disinfection and sterilization of instruments in dental settings. The document defines the guidelines and recommendations for safe practices in dental settings to protect staff and prevent cross-transmission. The Japan market is expected to reach USD 14.61 million by 2026, the China market is expected to reach USD 18.48 million by 2026, and the India market is expected to reach USD 10.86 million by 2026.

The emerging markets of Latin America and the Middle East & Africa are projected to account for lower market shares during the forecast period due to the limited healthcare infrastructure and no such stringent regulations. However, rising new manufacturing plants in Latin America, the Middle East & Africa are expected to lead to future growth prospects.

KEY INDUSTRY PLAYERS

Optimization of the Product Offerings by the Key Market Players to Drive Market Development

The competitive landscape for the global market has some of the dominant key players, such as 3M, STERIS, Medline Industries, Inc., Crosstex AirView, and Getinge AB that cover the majority of the market share. Other prominent players in the global market include Konkore Packaging, PMS, Propper Manufacturing Co., Inc., Thermal Compliances, Terragene, and Mesa Labs, Inc.

The companies are focusing on optimizing their product offering by upscaling their research and development activities, which are some of the factors that will strengthen their market position. For instance, Crosstex AirView, one of the leading companies, provides Lantor Cube, a reusable bowie-dick test pack at 134°C for 3.5 minutes. This device contains 25 test sheets per pack and can be used 25 times before disposal. Additionally, Ellab A/S offers SteriSense, an electronic Bowie-Dick pack that is cost-effective compared to traditional products. These product offerings will increase their market share during the forecast period.

List of Top Bowie-Dick Test Pack Companies:

- 3M (U.S.)

- STERIS (U.S.)

- Medline Industries, LP. (U.S.)

- Crosstex International, Inc. (U.S.)

- EDM3 Solutions (U.S.)

- Getinge (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- November 2021: Getinge acquired Verrix LLC, a medical device company that develops advanced technologies to protect patients from healthcare-associated infections. This strategic acquisition helped the company to make a global market entry into the hospital sterility monitoring system.

- September 2021: Miclev AB partnered with Excelsior Scientific, a biological and chemical indicator manufacturer. Miclev AB strengthened its portfolio in sterilization indicators by making this acquisition.

- December 2020: STERIS launched Spordex, a self-contained biological indicator ampoule, to confirm the sterilization of liquids in steam autoclave cycles.

- May 2019: Ellab, a Denmark-based company, announced the launch of SteriSense, the latest innovative electronic Bowie-Dick test system, which offers quick and accurate test results. It is user-friendly, economically efficient, and easy to compare and trace data.

- April 2019: Fortive Corporation acquired the Advanced Sterilization Products (ASP) business from Ethicon, a subsidiary of Johnson & Johnson, to enhance the safe operation of hospitals and healthcare facilities worldwide.

REPORT COVERAGE

The global market report provides a detailed analysis of the market and focuses on key aspects such as market drivers, restraints, and opportunities. Moreover, the report also includes information on key industry developments, which covers mergers, acquisitions, product launches, expansion and partnerships, sales channels analysis, Porter's five forces analysis, key industry developments – mergers, partnerships, and acquisitions, and the impact of COVID-19 on the global market. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.88% from 2026 to 2034 |

|

Unit |

Value (USD million); Volume (1,000 Units) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 242.13 million in 2026 to USD 382.48 million by 2034.

In 2025, the North America market size stood at USD 79.52 million.

Growing at a CAGR of 5.88%, the market will exhibit steady growth in the forecast period (2026-2034).

The healthcare facilities segment led the segment in this market during the forecast period.

The key factors driving the market are the number of healthcare facilities globally, rising hospital-acquired infections, and the launch of innovative sterilization monitoring products.

3M, STERIS, and Medline Industries, Inc. are some of the global market players.

North America dominated the market in 2025.

Increased demand for advanced sterilization monitoring products, increased adoption of these products across hospitals, and revised guidelines related to infection control.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us