Brain Implants Market Size, Share & Industry Analysis, By Product (Deep Brain Stimulation, Vagus Nerve Stimulation, and Responsive Neurostimulation), By Application (Epilepsy, Parkinson’s Disease, Alzheimer’s Disease, Schizophrenia, and Others), By End-user (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

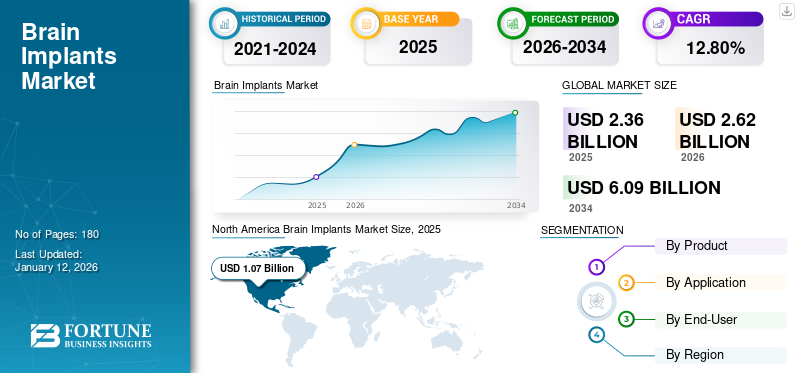

The global brain implants market size was valued at USD 2.36 billion in 2025 and is projected to grow from USD 2.62 billion in 2026 to USD 6.09 billion by 2034, exhibiting a CAGR of 12.80% during the forecast period. North America dominated the brain implants market with a market share of 45.53% in 2025.

Brain implants are the technological devices that are directly connected to the brain. These devices are surgically implanted into the brain to provide therapeutic functions. They are also referred to as neural implants, which act by electrically stimulating specific structures of the brain and reducing the symptoms of various brain disorders. The increasing prevalence of different brain disorders among the population majorly contributes to the growing demand for these novel products for the management of this disease.

- For instance, according to the data published by the World Health Organization (WHO) in February 2023, around 50 million people across the globe have epilepsy, among which 80% of them are living in low and middle-income countries.

- In addition, a study backed by Parkinson's Foundation in 2022 revealed that around 90,000 people in the U.S. are diagnosed with Parkinson’s disease every year.

Moreover, the growing investment of medical device manufacturers in the research and development of new implantable devices is expected to spur the brain implants market growth. For instance, according to a press released by the University of Auckland in February 2023, Auckland Bioengineering Institute (ABI) received funding of USD 6.0 million to accelerate the clinical trials of an implantable brain pressure sensor. These brain pressure sensors are being developed to help patients with the neurological disorder hydrocephalus.

Global Brain Implants Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 2.36 billion

- 2026 Market Size: USD 2.62 billion

- 2034 Forecast Market Size: USD 6.09 billion

- CAGR: 12.80% from 2026–2034

Market Share:

- North America dominated the brain implants market with a 45.53% share in 2025, driven by the rising prevalence of neurological disorders, increased healthcare expenditure on brain conditions, and the presence of robust reimbursement frameworks for advanced neuromodulation therapies.

- By product type, deep brain stimulation (DBS) held the largest market share in 2024, owing to multiple FDA approvals across several neurological conditions like epilepsy and Parkinson’s disease, coupled with growing clinical applications and reimbursement support.

Key Country Highlights:

- United States: The country is witnessing strong adoption of brain implants due to a growing patient pool with neurological disorders, well-established reimbursement policies, and active R&D investments by key players in advanced neuromodulation technologies.

- Europe: Rising awareness through nationwide campaigns on brain health, along with favorable reimbursement scenarios and increasing adoption of cost-effective neural implants, are fueling market growth across the region.

- China: The country is experiencing accelerated market expansion driven by the increasing geriatric population, rising healthcare investments, and introduction of affordable brain implant devices tailored for the local population.

- Japan: The market is supported by technological advancements in neuromodulation therapies, rising patient awareness regarding treatment options, and government initiatives to improve access to neurological care across the country.

COVID-19 IMPACT

Reduced Number of Patient Visits and the Temporary Hold on Surgeries Resulted in Slow Growth

The impact of COVID-19 impact on the market was negative. The temporary shutdown of the hospitals and specialty clinics resulted in the slower growth of the market. The higher focus of healthcare providers on COVID-19 patients also resulted in the slower growth of the market during the pandemic.

Moreover, the imposition of lockdown restrictions by the government authorities across the regions resulted in a reduced number of patient visits to hospitals and clinics. These restrictions also led to the cancellation or postponement of brain implant surgeries, resulting in decreased demand for these implants globally.

- For instance, according to a study published by the National Library of Medicine in November 2021, there was a reduction of 33.6% in neurosurgical referrals and operations by 55.6% during the COVID-19 pandemic.

The key players operating in the market witnessed declined revenues owing to the supply-demand gap resulting from the COVID-19 pandemic. However, the lifting of lockdown restrictions resulted in an increased number of clinic visits in 2021. These factors contributed to the recovery of missed and cancelled appointments and resulted in a slow recovery of the market in 2021 globally.

- For instance, the neuromodulation segment of Boston Scientific Corporation generated a revenue of USD 761.0 million in 2020, witnessing a decline of 12.8% compared to USD 873.0 million in 2019. The segment demonstrated a growth of 19.4% in 2021 compared to 2020 in terms of revenue, which was USD 909.0 million in 2021.

Brain Implants Market Trends

Growing Focus of Market Players on Research of New Types of Probes for Brain Implant

The focus of the market players is shifting toward research and development of new ways to treat brain disorders. The current deep brain stimulation probes, which are made of silicon, often leave scars around the implantation site. These occur due to a mismatch between the stiffness of the artificial materials and the soft tissue of the brain.

To combat this scarring, many research institutes are working on the development of a new generation of flexible probes, which are made up of new bendable materials and offer a better match with the softness of the brain tissue.

- For instance, according to an article published by the University of Glasgow in June 2023, the researchers at the Glasgow University worked in collaboration with Prof Giulia Curia’s group for examination of the performance of sucrose, maltose, silk fibroin, and alginate for the development of flexible probe that could be placed in the brain and open up treatment for more conditions.

In addition to this, the growing focus of researchers on combining two advanced therapies, cell therapy and bioelectronics, into a single device is accelerating the market growth. The aim of using this device is to improve functionality and sensitivity in paralyzed limbs. For instance, in March 2023, the University of Cambridge developed a new type of neural implant that can restore limb function. These implants can also be used by those who have lost the use of their arms or legs.

Download Free sample to learn more about this report.

Brain Implants Market Growth Factors

Rising Prevalence of Neurological Diseases to Drive the Demand for Brain Implants

The increasing number of neurodegenerative disease cases such as epilepsy, Parkinson's disease, and other movement disorders among the growing aging population has led to the growing demand for these implants across the globe. These disorders are commonly found in individuals with a family history of disease and usually occur in older people.

- For instance, according to an article published by ALZHEIMER’s ASSOCIATION in March 2023, 6.7 million Americans aged above 65 are living with Alzheimer's disease. This number is projected to grow to 13.8 million by 2060.

- According to the statistics published by the World Health Organization (WHO) in January 2022, approximately 24.0 million people across the globe are affected by Schizophrenia.

The rising awareness of neurological disorders owing to the initiatives taken by Alzheimer’s associations and market players across the globe has resulted in higher diagnosis and treatment rates. Along with these, improving healthcare infrastructure and rising healthcare expenditure in developing and developed nations augment the demand for these implants in the market.

- For instance, according to an article published by PMGroup Worldwide Ltd., in September 2023, Alzheimer’s Research UK launched a ‘Change The Ending’ campaign to spread awareness about Alzheimer’s in the country.

- In September 2023, the Dignity Foundation launched the National Alliance for Dementia Care (NADC) in Kolkata. The initiative aimed to raise awareness, establish care standards, and implement improved policies for supporting individuals living with Alzheimer’s disease.

Increasing Investment in Research and Development of Innovative Products to Propel the Market Growth

The rising prevalence of neurological diseases among the growing population is contributing to the rising demand for these implants in the market, resulting in an increased focus of market players to research, develop, and launch innovative new products for the management of the condition.

The R&D efforts taken by market players to develop technologically advanced devices for the management of these disease conditions are expected to exhibit a higher demand for these implants in the market during the forecast period. Therefore, the increasing investment of the key players toward the development and launch of novel products for catering to the demand of the rising patient population is driving the market growth.

- For instance, in January 2023, Precision Neuroscience is focused on the development of a device called Layer 7 Cortical Interface. The development of this brain implant is aimed to assist patients with paralysis.

Thus, the increasing patient population undergoing treatment, along with the rising focus of market players on the development of new devices for the management of neurological conditions, is expected to spur market growth during the forecast period.

RESTRAINING FACTORS

High Overall Treatment Cost of Neurological Disorders and the Inflated Price of Brain Implants May Limit Product Adoption

Several benefits offered by brain implants in the management of different movement disorders have contributed to their growing adoption. However, the higher cost of the implant and increased out-of-pocket spending are limiting its adoption in emerging countries. Moreover, an association of development and approval costs is also one of the crucial factors that are limiting the penetration of these implants in developing countries.

- For instance, according to an article published by Digicore Technologies Pvt. Ltd. in July 2023, the average cost of a deep brain stimulation device in Turkey ranges between USD 28,000 and USD 29,000.

Therefore, the lack of accessibility to these advanced treatment options and the exorbitant cost associated with these devices is expected to restrain the market growth.

Other challenges, such as poor healthcare infrastructure and limited awareness of neurological disorders, are limiting its penetration in the growing markets. These factors limit the penetration of these medical devices in emerging countries. Moreover, the increasing gap between the patient population and the treatment for the conditions, due to the lack of reimbursement policies along with increased out-of-pocket expenditure, is hampering the adoption of these devices in the market.

- For instance, according to an article published by H.Lundbeck A/S in July 2023, more than 40% of the pain among patients of Parkinson’s disease remains undiagnosed as they do not understand it can be related to Parkinson’s disease.

Thus, the lack of awareness regarding various neurological conditions among the general population in emerging countries, including Mexico, Saudi Arabia, and other African countries, is limiting the market growth. In addition, the lack of reimbursement policies for these devices is restraining the growth of the market in these countries.

Brain Implants Market Segmentation Analysis

By Product Analysis

Deep Brain Stimulation Segment Dominated Owing to Growing Number of FDA Approvals

On the basis of product, the market is segmented into deep brain stimulation, vagus nerve stimulation, and responsive neurostimulation.

The deep brain stimulation segment held the largest share with 65.60% in 2026, owing to its FDA approval for several neurological conditions, including epilepsy, tremor, and Parkinson’s disease.

The vagus nerve stimulation segment is expected to grow at a significant CAGR during the forecast period. The optimal efficacy provided by the VNS system in the management of seizure frequency in epilepsy is majorly contributing to its growing adoption in the market. Moreover, its expanding range of other clinical indications is also spurring the segment growth.

- For instance, according to an article published by Mayo Foundation for Medical Education and Research (MFMER) in April 2023, a vagus nerve stimulator is being studied for the treatment of other disorders such as rheumatoid arthritis, bipolar disorders, and gut disorders, such as inflammatory bowel disease.

The responsive neurostimulation segment is expected to expand at the fastest growth rate. The ability of the device to deliver personalized and real-time treatment at the seizure source, along with its potential to continuously monitor the brain’s electrical activity and recognize patient-specific abnormal patterns, contribute to its growing penetration in the U.S. market.

The growing focus of responsive neurostimulation devices manufacturers on conducting additional studies to determine that RNS can be used for the treatment of other brain disorders, including depression, impulse control disorders, memory disorders, and post-traumatic stress disorder, is anticipated to lead to its growing adoption. Moreover, the reimbursement provided by the payors in the U.S. for the implantation of the RNS system also augments the segment growth.

- For instance, based on the annual report published by Neurospace Inc. in December 2022, commercial payors, along with Medicare and Medicaid, routinely provided coverage for the implementation of their RNS system. The company believes that these established, differentiated, and favorable reimbursement paradigms will continue to support its broad commercial adoption.

On the other hand, the rising prevalence of neurological disorders, along with the increasing focus of market players on R&D and collaborations to develop and introduce innovative products, is expected to fuel the segmental growth in the market.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Growing Prevalence of Epilepsy to Propel the Segment Growth

On the basis of application, the market is segmented into epilepsy, Parkinson’s disease, Alzheimer’s disease, schizophrenia, and others.

The epilepsy segment dominated the market in 2024. The rising prevalence of epilepsy in developed and developing countries of different regions is majorly contributing to the segment growth. Moreover, the growing investment of market players in the research and development of new electrodes using advanced materials that have dissolvable coatings and could safely guide flexible implants into brains majorly is further anticipated to impel the segment growth.

- For instance, according to an article published by the University of Glasgow in June 2023, the Glasgow team, along with their research partners in Italy, have explored the potential of different biological materials for the future development of brain implants. These materials allowed flexibility for the probes to reach their target in the brain.

The Alzheimer's disease segment is expected to grow at a higher CAGR during the forecast period, owing to its rising prevalence across regions. Along with this, the increased focus of key players on gaining approval and introducing more products for the treatment of disease is another factor contributing to the segment’s growth.

- For instance, in September 2023, Neuralink, a neurotechnology company, received approval from the Food and Drug Administration (FDA) to conduct its first-in-human clinical trial for its brain implant technology.

The Parkinson’s disease segment led the market accounting for 33.94% market share in 2026. On the other hand, schizophrenia, and others segments are expected to grow during the forecast period owing to the rising awareness of diseases and healthcare infrastructure in growing economies. This rising awareness has led to an increase in the diagnosis rate and demand for these implants. For instance, in January 2023, American Hospital Dubai launched a new digital health information channel at Arab Health 2023. The launch of this digital platform aimed to raise awareness regarding healthy lifestyles and provide education, guidance, and expert opinions for individual healthcare in the country.

Thus, the increasing patient population, along with the rising diagnosis rate, is contributing to the growing demand for these implants in the market.

By End-user Analysis

Increased Number of Patients Visits with Neurological Disorders to Hospitals Contributes to the Segment Growth

On the basis of end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospitals segment held the largest share in the market with 73.35% in 2026. The segment is projected to grow at the highest CAGR during the forecast period. The increased number of patient visits to hospitals for the treatment of various neurological disorders and the increased number of surgeries are the major reasons contributing to the segment growth. Moreover, rising awareness of different neurological diseases, improving accessibility of treatment, and continuously improving healthcare infrastructure in developing nations are further augmenting the segment’s growth.

- For instance, in October 2022, The University of New Mexico Hospital dedicated their new Nene & Jamie Koch Comprehensive Movement Disorder Center (CMDC) and UNM Senior Health Center (SHC) to the care and management of Parkinson’s disease and other related movement disorders.

On the other hand, the specialty clinics segment is expected to grow during the forecast period owing to its growing focus on launching new multidisciplinary clinics for diagnosing neurological diseases. Moreover, the increasing number of inpatient admissions to these clinics is also propelling the segment’s growth.

- For instance, according to an article published by The Regents of The University of California in June 2021, UC San Francisco inaugurated their new Neurology Complex Diagnosis Clinic. This clinic is an innovative multidisciplinary centre for the diagnosis of neurological diseases.

REGIONAL INSIGHTS

Based on region, the brain implants market is segregated into the North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Brain Implants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated a revenue of USD 1.07 billion in 2025 and accounted for the largest share. The region is expected to dominate the market in the near future owing to the growing prevalence of various neurological disorders along with higher diagnosis and treatment rates. The U.S. market is projected to reach USD 1.04 billion by 2026.

Moreover, growing healthcare expenditure on brain disorders in the region and the presence of adequate reimbursement for various disorders promote the adoption of advanced and novel treatments in the key countries in the region.

- According to the American Brain Foundation, in May 2023, the direct and indirect expenditure of the U.S. on major neurological diseases was about USD 800 billion, among which Alzheimer’s is the largest contributor.

Europe

On the other hand, Europe market for brain implants accounted for a substantial share in 2024. Different initiatives and campaigns launched by non-profit organizations to raise awareness of brain disorders in the community are augmenting the growth of the market in the region. In addition, reimbursements provided by the European countries and the consideration of brain implants as a cost-effective intervention from the U.K. payer perspective augments its growing market penetration. The UK market is projected to reach USD 0.22 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

- For instance, according to an article published by Dynseo in September 2023, Alzheimer’s Society in the U.K. launched “Dementia Friends,” a campaign for raising awareness about challenges faced by people who have dementia.

Asia Pacific

The market in the Asia Pacific is expected to grow at a comparatively higher CAGR during the forecast period owing to the rising prevalence of the geriatric population prone to developing various neurological conditions. The introduction of cost-effective brain implants by the companies present in the region to increase the penetration of these implants in the regional market, along with the rising awareness of new and recent treatments among the patient population, are some of the factors boosting the brain implants market share. The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.14 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

- For instance, according to an article published by Digicore Technologies Pvt. Ltd. in July 2023, the cost of deep brain stimulators in the U.S. ranges between USD 35,000 and 100,000. In contrast, in India, it costs between USD 15,000 to 30,000.

Rest of the world

Furthermore, the rest of the world market is expected to grow during the forecast period. The rising prevalence of various neurological disorders, the increased awareness of neurodegenerative diseases among the general population, and the rising efforts of the key players to improve the accessibility of neural implants are the major factors responsible for the growth of the market in these regions.

- In June 2021, Next-Generation Neuro Spinal Hospital was inaugurated in Dubai Science Park. The hospital has unique treatment options and offers advanced diagnosis and robotics treatment across neuroscience, spine, orthopedics, and oncology areas.

Thus, these factors are augmenting the growth of the market in these regions.

Key Industry Players

Medtronic to Lead the Market with Strong Product Portfolio

This is a consolidated market comprising players with a limited range of products. The increasing sales of the company’s deep brain stimulation devices in the U.S. and other markets is the major reason behind Medtronic's growing market share. In addition, the company's rising R&D expenditure for neuromodulation devices is another factor contributing to its higher market share.

- In 2022, Medtronic increased its R&D expenses by around 10.1% in 2022 as compared to the previous year. The direct R&D expenses for 2022 were around USD 2,746.0 million, compared to USD 2,493.0 million in 2021.

Boston Scientific Corporation is increasing its focus on the introduction of the products globally with strategic mergers & acquisitions. Along with this, the company's strong emphasis on the expansion of its R&D facility to develop and launch innovative products for various neurological conditions is expected to contribute to its market share.

- For instance, in 2021, Boston Scientific Corporation invested USD 1,000.0 million in research and development and launched around 90 products for advancing patient care.

The growing investment of other players, such as LivaNova PLC and NeuroPace, Inc., in the research and development of novel products, along with their strong focus on receiving approval for their existing products to increase their penetration, is expected to increase the market share of these companies in the future.

List of Top Brain Implants Companies:

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- NeuroPace, Inc. (U.S.)

- NDI Medical, LLC (U.S.)

- ALEVA NEUROTHERAPEUTICS (Switzerland)

- LivaNova PLC. (U.K.)

KEY INDUSTRY DEVELOPMENTS

- October 2023 - Precision Neuroscience Corporation acquired a manufacturing facility in Dallas for the production of the key components of its brain implants.

- August 2023 – Neuralink, a brain implant company, raised funding of USD 280.0 million for the development of their U.S. FDA-approved technology and has planned to conduct human clinical trials in the near future.

- July 2021- Paradromics Inc. received funding of USD 20.0 million from the Prime Movers Lab and Westcott Investment Group. The company planned to use this funding to combine neural science and medical device engineering to create new clinical therapies.

- June 2021- Synchron, a brain-computer interface company, raised funding of USD 40.0 million to begin the clinical trial of the Stentrode device among human participants. This device is an implant delivered to the brain through blood vessels.

- March 2021 - Inbrain Neuroelectronics, a bioelectronic company, raised USD 15.1 million to test its graphene brain implant technology on humans.

REPORT COVERAGE

The report covers a detailed analysis and overview of the brain implants market. It is focused on key aspects such as competitive landscape, product, application, end-user, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.80% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 2.62 billion in 2026 to USD 6.09 billion by 2034.

In 2025, the market value stood at USD 2.36 billion.

The market is expected to exhibit steady growth at a CAGR of 12.80% during the forecast period (2026-2034).

By product, the deep brain stimulation segment dominated the market in 2026.

The rising prevalence of neurological disease, increasing diagnosis of the condition, and increasing research and development activities by the major market players.

Boston Scientific Corporation, Medtronic, and Abbott are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us