Brain Tumor Drugs Market Size, Share & Industry Analysis, By Therapy (Targeted Therapy, Chemotherapy, Immunotherapy, and Others), By Indication (Pituitary, Meningioma, Glioma, and Others), By Distribution Channel (Hospital Pharmacy and Retail & Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

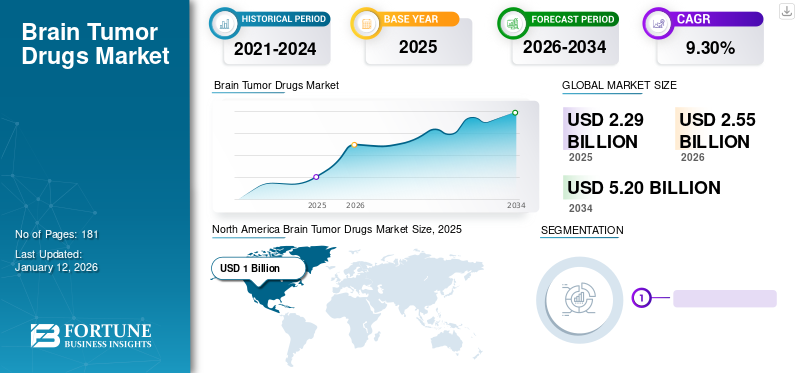

The global brain tumor drugs market size was valued at USD 2.29 billion in 2025. The market is projected to grow from USD 2.55 billion in 2026 to USD 5.2 billion by 2034, exhibiting a CAGR of 9.30% during the forecast period. North America dominated the brain tumor drugs market with a market share of 43.38% in 2025. Moreover, the U.S. brain tumor drugs market is projected to grow significantly, reaching an estimated value of USD 1.47 billion by 2030, driven by the presence of potential pipeline drugs. Increasing cases of cancer across the globe due to extreme lifestyle changes will accelerate the sales of brain tumor drugs.

Brain tumor is an abnormal mass of tissue in which brain cells grow and multiply rapidly and uncontrollably. There are majorly two types of brain tumors: primary and metastatic. Primary tumor constitutes the tumor originated from the tissues of the brain or the membranes around the brain. This type of tumor holds majority of cases. For instance, according to a study published by the “Cancer Journal for Clinicians”, in 2021, an estimated 83,570 people were diagnosed with brain tumors in the U.S., of which 70.3% cases were primary tumors.

The increasing prevalence of smoking, rising aging population, stress, exposure to electromagnetic radiations, and others are responsible for the increasing prevalence of brain tumors. In addition, rising research and development activities by companies to develop and launch new drugs and government initiatives to provide a conducive environment for the approval of drugs used to treat the condition are a few factors promoting the global brain tumor drugs market growth.

Global Brain Tumor Drugs Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 2.29 billion

- 2026 Market Size: USD 2.55 billion

- 2034 Forecast Market Size: USD 5.2 billion

- CAGR: 9.30% from 2026–2034

Market Share:

- North America dominated the brain tumor drugs market with a 43.38% share in 2025, driven by strong reimbursement policies, a robust drug pipeline, and increasing FDA approvals. The U.S. is expected to be a major contributor, with a projected market size of USD 1.47 billion by 2030, supported by promising pipeline candidates and high cancer incidence.

- By therapy, chemotherapy accounted for the largest share in 2024, owing to its status as the first line of treatment and widespread use as adjuvant therapy. However, targeted therapy and immunotherapy segments are expected to grow rapidly due to increasing product launches and advancements in personalized medicine.

Key Country Highlights:

- Japan: Market growth is supported by an aging population and increasing diagnosis rates. Advancements in molecular diagnostics and liquid biopsy for gliomas are enhancing early detection and treatment efficacy.

- United States: Driven by strong R&D investments, high prevalence of brain cancer, and favorable reimbursement. FDA approvals, such as Amneal’s ALYMSYS and innovative trials like AstraZeneca’s AZD1390, are boosting market adoption.

- China: Despite rising incidence—projected to reach 145,645 cases by 2030—treatment rates remain low (~10–15%) due to limited reimbursement. However, gradual improvement in diagnosis and growing R&D investments are expected to support market expansion.

- Europe: Favorable regulatory policies, orphan drug designations (e.g., Servier’s Vorasidenib), and increased clinical focus on glioma treatment are fueling market growth across key markets including Germany, France, and the U.K.

COVID-19 IMPACT

Deferred Diagnosis of New Cases during Pandemic Affected Market Growth

The market was negatively impacted during the COVID-19 pandemic. The market exhibited a slow growth amid the pandemic period. Factors that were responsible for the decline in the market expansion included reduced diagnosis and the treatment rate.

- According to data published by the Centers for Disease Control and Prevention, in June 2023, the pandemic disrupted health services, leading to a delay and reduction in the screening and treatment of various types of cancer. The decreased screening further resulted in a decline in cancer incidence in 2020. According to the same report, the decline in cancer incidence was 11% in 2020 compared to 2019.

In addition, disruptions in the market faced by major market players in terms of manufacturing and supply chains are responsible for the limited growth of the market. The market players witnessed a significant decline in revenue generated during 2020. For instance, F. Hoffmann-La Roche Ltd. registered a decline of 29.4% in revenues generated in 2020 for the drug Avastin. The stockpiling of medicines during the pandemic resulted in declining product sales in 2021.

LATEST TRENDS

Download Free sample to learn more about this report.

Advancements in Diagnosis to Support Market Growth

The early diagnosis and treatment of the brain tumor is challenging due to factors such as the body's blood-brain barrier that usually guards the spinal cord and brain from injurious chemicals. However, the barrier keeps out various types of chemotherapy. Therefore, effective ways become essential for the diagnosis and treatment of the condition. The prevalence of brain tumor is continuously increasing, which is attributed to the improvement of the diagnosis and treatment methods.

Prognostic biomarkers play an important role in the development of personalized medicines and improving the survival rate of the people suffering from brain tumor. The methods used to diagnose glioma at an advanced stage include neurological and neuroimaging tests. One of the key strategies for the refined diagnosis and treatment includes the assessment of genetic parameters in biopsy specimens of brain tumor patients.

The circulating nucleic acid found in blood and the other biological fluids can be used as a marker for the early diagnosis and treatment of the condition. A 2018 study published by the ‘National Cancer Institute’ on liquid biopsy may reveal whether a child with a type of brain tumor known as a diffuse midline glioma has a specific mutation associated with the disease.

The diffused molecular methods are used to analyze these genetic biomarkers and identify the nucleic acid mutations. Direct sequencing, high-resolution melting (HRM), immunohistochemistry, and droplet digital PCR (ddPCR) are some molecular methods for analyzing biomarkers. These techniques are used to diagnose and treat the tumor by identifying the presence or absence of genetic mutations. Furthermore, companies are launching advanced blood based detection tests for the diagnosis of brain tumor, which is anticipated to increase the treatment rate among patients, thereby increasing the adoption of brain tumor drugs in the forthcoming years.

- For instance, in January 2023, Datar Cancer Genetics received the U.S. FDA breakthrough designation for TriNetr-Glio – a liquid biopsy test for the detection of malignant brain tumors.

BRAIN TUMOR DRUGS MARKET GROWTH FACTORS

Rising Prevalence of Brain Cancer Cases to Propel Market Growth

The prevalence of cancer is increasing globally due to changing eating habits, lifestyle changes, increasing urbanization, and the rising prevalence of smoking. For instance, according to the WHO, in 2020, around 23.0% of adults in the world smoke tobacco. The rising prevalence of smoking among the adult population is supporting the growth of cancer cases across the globe.

Furthermore, the diagnosis and treatment rate is increasing due to the rising prevalence of various cancer types. Brain tumor holds around 1.0%-2.0% of the total cancer types and the death rate for this cancer is also very high. Factors such as high exposure to radiation and growing aging population are responsible for the higher prevalence of brain tumor.

- According to the International Agency for Research on Cancer, the incidence of brain cancer across the globe is estimated to increase from 308,102 cases in 2020 to 415,183 cases in 2040.

In North America and Asia Pacific, the incidence and prevalence of brain cancer is increasing rapidly. The increasing prevalence of this condition is supporting the growth of treatment and diagnosis in these regions. As per the American Cancer Society, the number of brain cancer in the U.S. was about 24,530 in 2021. Furthermore, the rising research and development for developing new drugs and increasing government funding for supporting R&D activities are anticipated to promote the market growth of brain tumor drugs.

- In October 2022, the government of Australia granted a fund of USD 4.0 million from the Medical Research Future Fund (MRFF) to support brain cancer research in order to improve the well-being and health of the patients suffering from brain cancer and tumors.

The increasing prevalence of brain cancer and the surging rate of diagnosis and treatment rate worldwide are elevating the demand for brain tumor drugs.

Strong Presence of Pipeline Candidates to Support Market Growth

Rising prevalence of brain cancer and increasing diagnosis rates, especially in developed countries, are presenting a large patient pool requiring treatment. This along with increasing focus of key players on R&D activities to introduce advanced drugs with clinical benefits for the treatment and management of the condition is driving the market growth.

Identification of the unmet needs, such as availability of these drugs in the market, aligned with the different stages in managing brain cancer, may bring about a change in priorities for research & development and improving the therapeutic approach of physicians. Numerous pharmaceutical companies are investing in R&D activities to develop novel drugs that can be used for the treatment of brain tumors.

- For instance, according to the ClinicalTrials.gov., by 2021, there are more than 150 candidates available in the clinical trials for brain tumor, which are funded by the industry.

In addition, research institutes are receiving funding from government authorities to conduct research on brain tumor drugs. For instance, in September 2020, Oklahoma Medical Research Foundation received a rare Pediatric Disease Designation and Orphan Drug Designation for their drug OKN-007, an investigational drug for treating malignant glioma.

RESTRAINING FACTORS

Comparatively Lower Diagnosis and Treatment Rates Coupled with Limited Reimbursement May Decline Market Growth

Several side effects associated with brain tumor drugs, along with the high costs of these drugs, are some of the prominent factors limiting the growth of the market. Additionally, lower diagnosis and treatment rate, and limited reimbursement policies for these drugs in developing countries are expected to decline the market growth.

The diagnosis and treatment rates for brain cancer are much lower in developing countries than developed countries. For instance, according to an NCBI article published in 2022, the incidence of brain and CNS cancer cases in China is projected to increase to 145,645 in 2030 compared to 99,977 in 2020, an increase of 45.7%. However, the treatment rate of this type of cancer is very low as compared to that in developed countries. The treatment rate in China is around 10%-15%. The main reason behind the lower treatment rate is the presence of limited reimbursement policies.

Despite that, the diagnosis and treatment in developing countries is increasing. However, the high cost of these treatments and drugs is limiting their adoption in the market. Furthermore, the lack of reimbursement policies in developing countries for the treatment of brain tumor is limiting the growth of these drugs in developing countries.

SEGMENTATION

By Therapy Analysis

Increasing Number of Patients Undergoing Chemotherapy to Drive the Growth of the Segment

Based on therapy, the market is segmented into targeted therapy, chemotherapy, immunotherapy, and others.

The chemotherapy segment dominated the market share 38.49% in 2026. The chemotherapy segment led the market in terms of revenue as chemotherapy is widely accepted as adjuvant therapy in medical practice for the treatment of brain tumors. Chemotherapy is considered the first line of treatment for brain cancer.

- According to Cancer Research U.K., approximately 28% of patients diagnosed with cancer in England had chemotherapy as their primary cancer treatment.

The targeted therapy segment is projected to exhibit significant growth during the study period. This is due to the increasing product adoption and shifting preferences of people toward targeted therapy for cancer treatment. Additionally, the growing product launches of the targeted therapy drugs and increasing clinical collaborations for drug development are projected to support the market growth.

The immunotherapy segment is expected to grow significantly during the forecast period. This is due to the increasing focus on R&D activities related to immunotherapy for brain tumor treatment. Additionally, increasing approvals and launches of immunotherapy drugs for the treatment are expected to support the market growth.

- For instance, in December 2022, IN8bio Inc., a biopharmaceutical company, received the Investigational New Drug (IND) clearance from the U.S. FDA to launch phase 2 clinical trial for its proprietary drug resistant immunotherapy for patients newly diagnosed with glioblastoma.

The others segment includes steroids, hormones, and other therapies. The segment is projected to grow at a significant rate during the forecast period. The increasing demand for steroids for the treatment of this type of cancer is projected to support the growth of this segment.

By Indication Analysis

To know how our report can help streamline your business, Speak to Analyst

Glioma Segment to Dominate Driven by Growing Prevalence of Malignant Brain Tumor

On the basis of indication, the market is segmented into pituitary, meningioma, glioma, and others.

The glioma segment dominated the market 41.24% in 2026 and is expected to grow at a substantial CAGR over the study period. This is due to the rising prevalence of malignant brain tumor globally, along with the increasing launches of drugs for treating glioblastoma to support the market growth. For instance, in December 2020, CNS Pharmaceuticals, Inc. received IND approval from the U.S. FDA for its drug Berubicin to treat metastatic cancer of the brain and central nervous system.

The meningioma segment is anticipated to have a considerable CAGR during the forecast period. This is due to various factors such as the rising incidence of meningioma and growing research studies on primary tumor. For instance, according to an NCBI article published in 2021, metastatic brain tumors were the most prevalent tumor affecting adult Saudis (25%), followed by astrocytoma and meningioma at 17.8% each.

The pituitary segment is projected to grow with a significant CAGR during the study period due to various factors such as rising incidences of petard tumor across the globe and improved diagnosis rates of various types of brain tumors.

The others segment is expected to grow with a significant CAGR over the forecast period. This is due to the increasing prevalence of rare brain tumors globally.

By Distribution Channel Analysis

Increasing Hospital Admissions for Treatment to Support the Hospital Pharmacy Segment Growth

Based on distribution channel, the market is segmented into hospital pharmacy and retail & online pharmacy.

The hospital pharmacy segment dominated the market with a significant share 94.25% in 2026. Brain tumor drugs are prescribed after diagnosis and require administration in hospitals, which supports the growth of this segment. Additionally, the claim of health insurance policies in hospitals supports the growth of hospital pharmacies.

The growth of the retail pharmacy & online pharmacy segment is due to the gradual shift of patients toward online pharmacies due to their popularity among the general population.

REGIONAL INSIGHTS

North America Brain Tumor Drugs Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 1 billion in 2025 and USD 1.1 billion in 2026. The domination of the North America brain tumor drugs market share can be credited to various factors such as proper reimbursement policies in the U.S. and the increasing launch of new drugs in the market. For instance, in April 2022, Amneal Pharmaceuticals LLC. received the U.S. FDA approval for its product ALYMSYS (bevacizumab-maly), a biosimilar of Avastin for the treatment of various cancers including recurrent glioblastoma in adults. The U.S. market is projected to reach USD 1.02 billion by 2026.

Europe

Europe dominated the global brain tumor drugs market with a share of 26.83% in 2025. In Europe, the market is primarily being driven by the prevalence of primary tumor, favorable regulatory scenarios in key European countries, and increasing focus on research activities for developing novel drugs. For instance, in January 2023, the European Medicines Agency (EMA) designated orphan drug status to the drug "Vorasidenib," developed by Les Laboratoires Servier. The drug is intended for the treatment of low-grade gliomas. The orphan drug status would provide scientific and regulatory support to the developer to advance their development process and can apply for marketing authorization.

- The UK market is projected to reach USD 0.04 billion by 2026, while the Germany market is projected to reach USD 0.18 billion by 2026.

Asia Pacific

Asia Pacific dominated the global brain tumor drugs market with a share of 18.98% in 2025. The Asia Pacific market is projected to grow at the fastest CAGR during the forecast period due to varying regulatory policies for the approval of new drugs. Additionally, rising awareness about cancer and its types is expected to support the market growth in this region. For instance, according to the Brain Tumor Research Organization, in Australia, the average rating of brain tumor care was the lowest of all cancers, with a score of 8.37 out of 10. The Japan market is projected to reach USD 0.15 billion by 2026, the China market is projected to reach USD 0.16 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Latin America

Latin America dominated the global brain tumor drugs market with a share of 4.19% in 2025. The market value in Latin America is rising due to the increasing rate of diagnosis and treatment of brain tumor, which created a demand for brain tumor drugs in the region. This, along with the launch of new drugs in the region, is helping in the growth of the market in the region.

To know how our report can help streamline your business, Speak to Analyst

Middle East and Africa

Middle East and Africa dominated the global brain tumor drugs market with a share of 6.62% in 2025. The Middle East and Africa market will continue to expand at considerable CAGR during the forecast period. The growth is attributable to improving healthcare infrastructure and government initiatives for the awareness of brain tumor.

KEY INDUSTRY PLAYERS IN BRAIN TUMOR DRUGS MARKET

F. Hoffmann-La Roche AG is Leading the Market Owing to Strong Portfolio of Drugs

The market is consolidated, with a few brain tumor drugs players holding a major share in the market. The competitive landscape of the market includes leading pharmaceutical companies, F. Hoffmann-La Roche Ltd., Pfizer Inc., Novartis AG, Amgen Inc., and Merck & Co., Inc., which hold a dominating place with a strong portfolio in brain tumor drugs. Increasing approvals for the drugs by the U.S. FDA support the market growth.

- In April 2020, F. Hoffmann-La Roche Ltd. received Health Canada approval for its drug Rozlytrek (entrectinib) for adult patients with locally advanced or metastatic extracranial solid tumors, including brain metastases.

The other major players such as NextSource Pharmaceuticals, LLC., Amneal Pharmaceuticals LLC., and others mark a strong global presence. The strategic decisions taken by these players support the growth of these companies.

- For instance, in 2022, Amneal Pharmaceuticals LLC received the U.S. FDA approval for bevacizumab-maly, an Avastin biosimilar for the treatment of recurrent glioblastoma in adults.

LIST OF TOP BRAIN TUMOR DRUGS COMPANIES:

- F. Hoffmann-La Roche Ltd (U.S.)

- Novartis AG (Switzerland)

- Merck & Co. Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Amneal Pharmaceuticals LLC. (U.S.)

- Amgen Inc. (U.S.)

- NextSource Pharmaceuticals, LLC (U.S.)

- Emcure Pharmaceuticals (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2022- F. Hoffmann-La Roche Ltd. announced to acquire Good Therapeutics. Through this acquisition, the company aimed to gain rights to Good Therapeutics’ platform technology, which has application in a wide fields comprising cancer, metabolic diseases, autoimmune disease, and pain management.

- June 2022- Novartis AG received FDA clearance for Tafinlar + Mekinist for treating pediatric and adult patients suffering BRAF V600E mutation solid tumors. BRAF V600E mutation drives tumor growth in more than 20 tumor types, including brain, thyroid, and others.

- March 2022 – The Ivy Brain Tumor Center initiated the 0/1b phase clinical trial to study the efficacy of the drug AZD1390 developed by AstraZeneca in patients suffering with recurrent grade IV gliomas.

- December 2021 - Novartis AG entered a collaboration and licensing agreement with BeiGene for TIGIT inhibitor ociperlimab to strengthen its immunotherapy pipeline. The drug was then being evaluated for a wide range of solid tumors.

- November 2021 - Pfizer Inc. acquired Trillium Therapeutics, a clinical stage immuno-oncology company primarily focused on developing innovative therapies for the treatment of cancer.

REPORT COVERAGE

The research report provides a detailed global market analysis. It focuses on key aspects such as leading companies, therapy, indication, and distribution channel. Besides this, it offers insights into the market trends, impact of COVID-19, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Therapy

By Indication

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 2.55 billion in 2026 to USD 5.2 billion by 2034.

In 2025, the market value stood at USD 2.29 billion.

The market will exhibit steady growth at a CAGR of 9.30% during the forecast period (2026-2034).

By therapy, the chemotherapy segment will lead the market.

Surge in brain cancer prevalence, presence of potential pipeline candidates, and increasing demand for precision and personalized medicine are the key factors set to spur the market growth.

Pfizer Inc., F. Hoffmann-La Roche Ltd., Novartis AG, Emcure Pharmaceutical, and Merck & Co. Inc. are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us