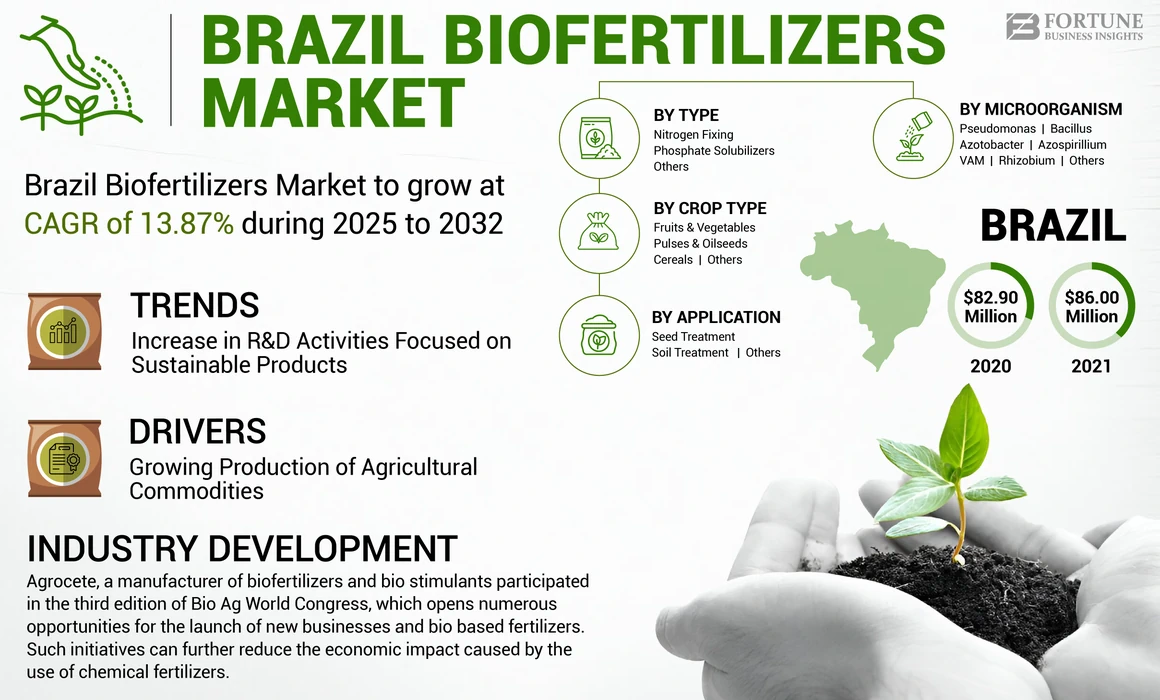

Brazil Biofertilizers Market Size, Share & Industry Analysis, By Type (Nitrogen Fixing, Phosphate Solubilizers, Others), By Microorganism (Rhizobium, Azotobacter, Azospirillum, Pseudomonas, Bacillus, VAM, Others), By Application (Seed Treatment, Soil Treatment, Others), By Crop Type (Cereals, Pulses & Oilseeds, Fruits & Vegetables, Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The Brazil biofertilizers market size is estimated to grow at a CAGR of 13.87% during the forecast period.

Brazil has a well-known research history about the role and effect of rhizobium and plant growth promoting Rhizobacteria across the agricultural field. Currently, the use of bio-based fertilizers in Brazil, containing microorganisms that are highly effective in improving plant’s growth and also helps to reduce greenhouse gas emissions. They also help to maintain the community of fungi, bacteria and other microorganisms present in the soil, thus improving the crop yield and soil health. Moreover, favorable government policies, easy registration process, and growing organic farms across the country are some of the main factors responsible for driving the Brazil biofertilizers market growth.

Brazil Biofertilizers Industry Landscape Overview

Market Size & Forecast:

- CAGR: 13.87% during the forecast period

Market Share:

- Brazil is the leading market for biofertilizers in South America, supported by favorable government policies, a streamlined registration process, and the expansion of organic farms. The country has a strong history of research into rhizobium and plant growth-promoting rhizobacteria, making biofertilizers a natural fit for its agricultural landscape. Soybeans are a major driver of market demand, with 80% of planted areas already utilizing biofertilizers, resulting in reduced nitrogen fertilizer costs and lowered greenhouse gas emissions.

Key Country Highlights:

- Brazil: Rapid growth in agricultural R&D, increased focus on sustainable practices, and rising production of crops like soybeans are promoting widespread adoption of biofertilizers. Government and research institutions such as Lactec and the State University of Campinas are actively developing microbial-based fertilizers, further supporting the market's expansion.

LATEST TRENDS

Increase in R&D Activities Focused on Sustainable Products to Promote the Brazil Biofertilizers Market Growth

Agriculture has been a key of success in terms of productivity growth in the last few decades compared to other sectors of the Brazilian economy or other country’s agricultural sector. Brazil is the major contributor in the South America market and witnesses a significant growth in its production as well as consumption pattern. The growth in agricultural productivity is mainly driven by investments in agriculture’s innovation, facilitation of financing sector, and trade liberalization. Moreover, the conflict between Ukraine and Russia has adversely affected the supply chain of fertilizers due to which the companies are planning to invest in the production of biofertilizers.

Besides this, the growing awareness regarding the harmful effects of synthetic fertilizers also necessitates the manufacturers and agricultural research corporations to develop organic matter-based bio inputs, which will further boost the demand for agrifood systems. For instance, in April 2022, Lactec, one of the largest research and innovation centers in Brazil, develop biofertilizers from organic matter such as algae, microalgae biomass, and living organisms. Thus, the field of microbiome research has evolved rapidly and is expected to augment Brazil biofertilizers market share. Similarly, in 2022, State University of Campinas at the Genomics for climate change developed a biological fertilizer which is applied on crops to make them healthier. Researcher named Rafael de Souza named this fertilizer as ‘biological yogurt’. Such microbiome research acts as an effective driver of success stories in agrifood systems.

DRIVING FACTORS

Growing Production of Agricultural Commodities to Promote the Product Usage

Brazil is a major exporter of various tropical agricultural products (coffee, sugar, and cacao) and is set to become a major global supplier of corn, cotton, soybeans, orange juice, and meat since the early 21st century. Over the last few decades, Brazil has been strengthening its position as the fifth largest country in area and population and the largest in terms of arable land base (approx. 1 million hectares), along with the prominent producer of agricultural commodities.

Out of all crop yields, soybeans have emerged as a crucial crop responsible for the expansion of Brazil’s farm sector, which in turn boosts the use of biofertilizers. According to a study published by the Centre for Research in Genomics Applied to Climate Change (Brazil) and the Joint Genome Institute (U.S.) in 2022, around 80% of the soybean planted area in Brazil includes the usage of biofertilizers in their agricultural production. In addition, this represents savings of around USD 10 billion in nitrogen fertilizers and reduced carbon emission by 430 million tons of co2-equivalent. This further influences the farmers to opt for sustainable solutions and hence the market is estimated to grow significantly in the upcoming period.

RESTRAINING FACTORS

Download Free sample to learn more about this report.

Changes in Environment Can Hamper the Agricultural Production Across the Country

Crop cultivation is vulnerable to climate change owing to its vast size and sensitivity to weather parameters. Several climate-driven factors, such as drought, heat waves, intense rainfall patterns, and emerging insect pests, have adversely affected the production and quality of yield. As influenced by climatic variables, Brazil witnessed a sharp decline in the growth of its agricultural production. According to the report published by “Woodwell Climate Research Centre,” in 2021, 28% of agricultural lands have become hot and dry and the percentage of such land is expected to increase by 74%. As 90% of Brazil’s agricultural land is rainfed, changes in climate conditions can damage to such lands and affect the efficacy of biofertilizers.

As per data provided by the Food and Agriculture Organization (FAO), the export of soybeans increased by 3.74% from the year 2020 to 2021.

KEY INDUSTRY PLAYERS

Brazil holds several established and emerging market players, such as Novozymes, Valagro, and Rizobacter Argentina SA, amongst others. In addition, as Brazil is the largest producer and exporter of agricultural crops, it is expected that the country will witness the growth of new market entrants, engaged in replacing the use of fertilizers with eco-friendly methods. Moreover, the rising demand for organic products and environmental concerns will further propel the Brazil biofertilizers market growth.

LIST OF KEY COMPANIES PROFILED:

- Novozymes (Denmark)

- Valagro (Italy)

- Rizobacter Argentina SA (Argentine Republic)

- Nutrien Ltd (Canada)

- Microquimica Industrias Quimicas Ltda (Brazil)

- Chr. Hansen Holding A/S (Denmark)

- Groundwork BioAg Ltd. (U.S.)

- UPL Limited (India)

KEY INDUSTRY DEVELOPMENTS:

- June 2022 – Agrocete, a manufacturer of biofertilizers and bio stimulants participated in the third edition of Bio Ag World Congress, which opens numerous opportunities for the launch of new businesses and bio based fertilizers. Such initiatives can further reduce the economic impact caused by the use of chemical fertilizers.

- April 2022 – Biotrop, a Brazilian company, announced its plan to introduce new inoculants and fertilizers by the year 2025. In order to reach this goal, the company is expanding its manufacturing plant from a production capacity of 4.3 million liters per year to 7 million liters by 2022 and 9 million liters by 2023. Thus, such latest additions will further boost the growth of biofertilizers, as it is one of the fastest growing segments in the agricultural industry.

- December 2020 - KrillTech, a Brazilian company, launched its new nanotechnology, which consists of a combination of biofertilizers and biostimulants. This new technology acts as an effective driver, which will encourage the plant’s growth and will help to reduce the greenhouse gas emissions produced across the country.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The Brazil biofertilizers market research report includes quantitative and qualitative insights into the market. It also offers a detailed analysis of the market size and growth rate for all possible segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.87% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Microorganism

|

|

|

By Application

|

|

|

By Crop Type

|

Frequently Asked Questions

The market is projected to grow at a CAGR of 13.87% during the forecast period (2025-2032).

The nitrogen-fixing segment is expected to be the leading type segment in Brazil.

Growing production of agricultural commodities is expected to drive the market growth.

Novozymes, Valagro, and Rizobacter Argentina SA are some of the top players in the Brazilian market.

Environmental changes can hamper agricultural production across the country, impeding market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us