Breast Pump Market Size, Share & Industry Analysis, By Type (Wearable and Non-wearable), By Application (Hospital Grade {Manual and Automatic} and Consumer Grade {Manual and Automatic}), By End User (Hospitals, Maternity Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

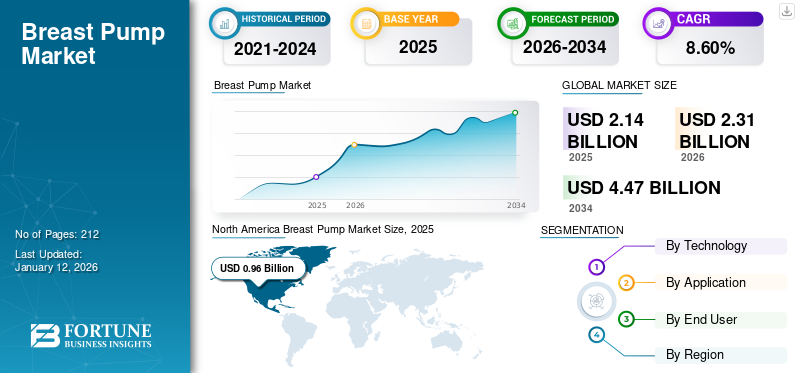

The global breast pump market size was valued at USD 2.14 billion in 2025. The market is projected to grow from USD 2.31 billion in 2026 to USD 4.47 billion by 2034, exhibiting a CAGR of 8.60% during the forecast period. North america dominated the breast pump market with a market share of 45.05% in 2025.

A breast pump is a medical device lactating women to extract milk from their breasts. Several types of devices are offered by major manufacturers, including manual, electric, battery-operated, and wearable pumps. Companies in the market are focused on consistent innovation to improve their product portfolio with new and proficient product offerings, such as wearable and double electric pumps, aimed at providing better outcomes for lactating women. Similarly, these companies are working to enhance product awareness in the market through various collaborations across the globe. Some of the major players operating in the global market include Medela, Chiaro Technology Ltd., Willow, among others.

- For instance, in January 2023, Medela collaborated with fitness trainer and global influencer Kayla Itsines to support and elevate the breastfeeding journey of new parents. The move was also aimed at highlighting the critical role that breast milk plays in maternal and infant health and development.

The market growth is credited to the rising demand for advanced products, such as wearable and double electric pumps, driven by the growing birth rate and the surging women's employment rate worldwide. The surge in consciousness concerning women's health devices in developing and developed nations propels market growth. Moreover, increased funding and investments by market players in research and development contributes to the global market growth.

Breast Pump Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 2.14 billion

- 2026 Market Size: USD 2.31 billion

- 2034 Forecast Market Size: USD 4.47 billion

- CAGR: 8.60% from 2026–2034

Market Share:

- North America dominated the global breast pump market with a 45.05% share in 2025, driven by the high adoption of wearable and electric pumps, well-established healthcare infrastructure, favorable reimbursement policies, and early product launches by major players such as Medela and Freemie.

- By type, non-wearable breast pumps are projected to retain the largest market share in 2025, supported by their stronger suction capabilities, time efficiency, and increasing innovation in automatic pump technologies. However, wearable pumps are gaining rapid popularity due to hands-free functionality and mobility, especially among working mothers.

Key Country Highlights:

- Japan: The market is expanding due to rising awareness around women’s health, growing employment among women, and product launches tailored for convenience in daily use. Local manufacturers and increasing e-commerce access are also contributing to demand.

- United States: Growth is driven by strong reimbursement policies, rising working women population, and the early adoption of technologically advanced products. Campaigns like “Pumping is Breastfeeding” by Willow have significantly boosted awareness.

- China: Market growth is fueled by increasing disposable income, improved access through e-commerce channels, and growing awareness around postpartum care. Manufacturers like Horigen are expanding their domestic presence.

- Europe: Growth is supported by corporate campaigns promoting breastfeeding, rising product awareness, and higher female workforce participation. Countries like Germany, U.K., and France are seeing rising demand for both hospital-grade and wearable pumps.

Market Drivers

Rising Number of Working Women Population to Increase the Adoption of Breast Pump

The rising attainment of womens and girls education has contributed to the growing number of working women globally over the last few years. The increase in women's employment is further resulting in a rising demand for these devices among working mothers in developed and emerging countries.

- According to 2024 data presented by the national survey conducted by the Indian Ministry of Statistics (IMS), the labor force participation rate (LFPR) for females aged 15 years and above increased from 37.0% during July 2022-2023 to 41.7% during July 2023-June 2024.

The rising use of these products among working women with hectic work schedules in developed and emerging countries is a key factor driving market growth. These devices allow mothers to store breast milk and conveniently feed their babies, aligning with the demands of their busy lifestyles.

Various benefits associated with these devices, such as accessibility, portability, and convenience of carrying pumped milk in a bottle in advance for comfortable feeding, are expected to increase the adoption of these devices in the near future. Moreover, it is also helpful for mothers who have undergone breast surgery and cannot nurse their babies directly.

Furthermore, the introduction of wearable pumps by market players has further increased adoption among working women due to their portability features, allowing women to multitask.

- For instance, in September 2021, Chiaro Technology Limited (Elvie) launched Elvie Stride, a wearable pump that is broadly covered by insurance in the U.S.

Such developments in these pumps and the rising women's employment rate are expected to reflect a positive global breast pump market growth trajectory over the forecast period.

Rapid Launch of Breast Pumps to Propel Market Growth

The growing demand for breast pumps is driving increased efforts by market players to develop and introduce technologically advanced products with enhanced features to support adoption.

- In June 2022, Imani USA launched the Imani i1, a double breast pump, in the U.S. market. The product offers hospital-grade strength and advanced motor efficiency, catering to the needs of mothers in the country.

Rising initiatives by companies and government bodies to increase awareness regarding the benefits and availability of these devices are expected to boost adoption among working women.

- In August 2024, Willow Innovations, Inc. launched a campaign, ‘Pumping is Breastfeeding,’ to promote breastfeeding and increase the use of these pumps among mothers and working women.

Furthermore, companies operating in the market have increased their focus on developing and launching advanced pumps for lactating women.

- For instance, in August 2023, Lansinoh launched the Lansinoh Wearable Pump to support new moms with innovative products and resources designed to make their breastfeeding journey easier.

Moreover, the increasing clinical research on these devices is expected to drive significant advancements in product development and innovations, supporting strong growth in the market in future.

- For instance, according to an article published by the International Conference on Harmonization GCP Guideline (ICH GCP), initiated in 2020 to determine the feasibility and potential benefits of a mHealth The study aimed to increase breast milk pumping frequency and production among mothers of critically ill infants admitted to the neonatal intensive care units.

Such development and launches of these devices by manufacturers are expected to increase product adoption, thereby propelling market growth during the forecast period.

Market Restraints

Association of Adverse Effects with Breast Pumps to Hinder Market Growth

There are certain limitations associated with the use of breast pumps among women, which can hamper the adoption of these devices in the market. Some potential adverse effects include pain, soreness, injuries, and infections, which can discourage women form using these devices in the market. The other side effects can include nipple damage, painful engorgement of breasts, and risk of contamination of bottles and milk.

- According to a 2023 news article published by Health News Florida, an infant was infected with Cronobacter sakazakii bacteria, with genetic sequencing linking the infection to bacteria isolated from the breast pumps used by the mother.

These devices can harm the growth of the baby as bottle feeding can decay the baby's teeth, reduce the nutritional quality of breast milk, and increase the chances of milk contamination.

- For instance, according to an article published by Elsevier B.V. in 2022, in the Manufacturer and User Facility Device Experience (MAUDE) dataset, 66.0% of pump devices had malfunctioned. Thus, these issues potentially cause infection and damage, reducing the quality of life.

Such potential adverse effects associated with these products are expected to limit the growth of the market in the near future.

Market Opportunities

Growing Awareness on Breastfeeding and Rising Support from Healthcare Organizations to Create Favorable Market Opportunities

The rising awareness and support for breastfeeding is one of the significant opportunities for manufacturers to develop patient-centric breast pump devices. The rising collaborations and focus of healthcare organizations, companies, and others to create awareness regarding the benefits of breastfeeding for a growing child are expected to spur the market opportunity for breast pump manufacturers.

- In August 2024, the World Health Organization (WHO), UNICEF, and various Health Ministries supported World Breastfeeding Week, an initiave aimed at encouraging breastfeeding among mothers.

Market Challenges

High Cost of Devices

The rising technological advancements in the devices by manufacturers have also increased their cost, posing a challenge to customers in low- and middle-income countries, including China, India, and Brazil. The high cost of these devices can deter adoption, especially among cost-sensitive populations.

- According to Star and Daisy, an e-commerce website in India, the average cost of an electric pump ranges around USD 50-60 in the country.

Along with this, the lack of reimbursement coverage for these devices in emerging countries further hinders their adoption .

Regulatory Issues and Standards

The lack of regulatory standardization for pumps globally and the rising number of product recalls are crucial factors that affects customer loyalty and trust, thereby hindering the adoption of these products in the market.

- For instance, in February 2024, the Momcozy breast pump were sold in Canada without the proper authorization, highlighting the challenges associated with compliance and regulation.

Lack of Product Awareness in Emerging Countries

Limited awareness regarding the devices, including their usability, and convenience, along with the advanced technologies integrated into these devices, remains a significant barrier to market growth in emerging countries such as India, Brazil, and Southeast Asian countries.

Market Trends

Technological Advancements in Breast Pumps

The growing adoption of these devices among women is driving manufacturers to focus on developing and introducing innovative products with the latest technology. One notable advancement is the availability of wearable pumps, which offers hands-free usability, making them more convenient for working mothers.

- According to a cross-sectional survey published by the National Institutes of Health (NIH) in 2022, women who used wearable pumps reported significantly shorter lactation breaks and were more likely to provide breast milk to their infants for their entire intended duration compared to those using traditional pumps.

Additionally, the rising focus of companies on integrating artificial intelligence, machine learning, and mobile apps for tracking pumping sessions and other meterics. These innovations are shaping major trends in the industry.

- For instance, in April 2023, Medela launched a hands-free smart breast pump that uses Nordic’s Bluetooth LE System-on-Chip to monitor and track pumping sessions. The device can be connected with the user’s smartphone, enhancing convenience and usability.

Rising Use of Eco-friendly and Sustainable Materials

The rising importance of sustainability in baby products for improving longevity and imparting minimal health risks to babies and mothers is one of the crucial trends followed in the industry. There are several players operating in the market that are adopting sustainable materials for the manufacturing of these pumps.

- Olivia Wearable Breast Pump is one of the companies focused on manufacturing eco-friendly pumps made with sustainable materials.

Growth of Online Sales Channels

The rising focus of companies to increase the accessibility and availability of products to customers, along with the growing use of smartphones and online platforms for shopping, is resulting in the increasing adoption of online sales channels.

Download Free sample to learn more about this report.

Impact of COVID-19

The impact of COVID-19 resulted in a low demand for breast pumps in 2020. This was attributed to the increase in direct breastfeeding during the pandemic, leading to a decline in the adoption of these devices.

Other prominent factors that negatively affected market growth included the decline in the number of maternity services and breastfeeding support services, manufacturing and supply chain issues, and the preference for direct breastfeeding over pumping. These challenges hindered the demand for these devices in the market on a global level.

However, in 2021, the market began to recover, with companies reporting increased revenues due to an increase in product adoption. The rising product awareness and the resumption of normal healthcare services contributed to this demand, setting the stage for sustained market growth during the forecast period.

- Pigeon Corporation, which has a strong presence in the global market, witnessed a 6.8% revenue increase in its Lansinoh business segment in 2021 compared to 2020.

In 2022, the market returned to pre-pandemic levels and is expected to grow during the forecast period due to the rising awareness about pumps, technologically advanced product launches, and growth in women's employment rates.

Segmentation Analysis

By Type

Non-wearable Segment Held a Major Market Share due to Rapid Introduction of Advanced Automatic Pumps

Based on type, the market is segmented into wearable and non-wearable.

In 2024, the non-wearable segment held the largest market share of 89.7% and is predicted to grow at the highest CAGR during the forecast period. The benefits of these devices, such as stronger suction power, the ability to express more breast milk, and reduced time for the process are major factors supporting the growth of the segment.

Furthermore, the growing number of working women and increasing launches of advanced automatic pumps, such as silent wearable pumps, are anticipated to propel the segment in the forecast timeframe.

- For instance, in April 2023, Medela launched a hands-free smart pump that uses Nordic’s nRF52832 Bluetooth Low Energy (Bluetooth L.E.) system-on-chip (SoC) to track pumping sessions.

The introduction of such advanced automatic pumps is expected to strengthen the growth of the segment during the forecast period.

The wearable segment is expected to grow at a substantial CAGR during the forecast timeframe. The shifting preference of women toward wearable pumps owing to their mobility, convenience, and user-friendly features are some of the major factors supporting the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Application

Consumer Grade Segment Held a Major Market Share due to the Increasing Adoption of Portable Pumps

Based on application, the market is segmented into hospital grade and consumer grade.

The consumer grade segment accounted for the highest market share in 2024 and is anticipated to grow at the highest CAGR during the forecast period. The segment’s dominance is due to the increasing demand for portable devices coupled with increasing launches of advanced pumps. Furthermore, the growing focus of market players to expand their footprint in the market through campaigns is expected to boost the growth of the consumer grade segment. The segment is expected to dominate the market share of 75.00% in 2026.

- In May 2022, Medela partnered with Expectful to offer breastfeeding and pumping education and discounted access to wellness support for new moms. Such initiatives to increase product awareness among the population contribute to the segment’s growth.

The hospital grade segment is predicted to grow at a substantial CAGR of 7.50% during the forecast period. The growth is attributed to the increasing issues related to milk lactation among women combined with surging launches of these devices by market players in developed and developing countries.

By End User

Growing Adoption of Pumps Among the Women for Homecare Use Led to the Dominance of the Homecare Settings Segment

Based on end-users, the market is segmented into hospitals, maternity clinics, homecare settings, and others.

The homecare settings segment dominated the market in 2024. The increased convenience of using these devices at home and the growing focus of companies to develop and introduce innovative products for homecare settings are some of the important factors contributing to the growth of the segment. The segment is expected to dominate the market share of 61.48% in 2026.

- In October 2022, Momcozy launched the new S9 Pro wearable pump, which offers long-lasting battery life and hands-free convenience, providing comfort for moms on the go.

The hospital segment is expected to grow with a CAGR of 7.20% during the forecast period attributable to the rising childbirths in hospitals, which is increasing the demand for hospital-grade pumps for mothers.

The maternity clinics and other segments are projected to grow at a nominal growth rate. The rising preference for maternity clinics owing to customized care and tailored solutions that enhance healthcare quality, is a major factor contributing to the growth of the segment.

BREAST PUMP MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America Breast Pump Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market in 2024 with USD 0.89 billion and the market size stood at USD 0.96 billion in 2025 and is anticipated to expand at a moderate CAGR during the forecast period. The growth is due to the quick introduction of wearable pumps, the growing adoption of electric pumps, the well-established healthcare infrastructure, and the introduction of advanced products by leading players.

The U.S. is likely to dominate the North America market in 2026 with USD 0.98 billion , supported by its developed healthcare infrastructure, along with improved reimbursement scenarios for devices, including breast pumps. Additionally, the growing number of product launches in the country by the companies is another factor boosting the adoption.

- In January 2022, Freemie launched a slim breast pump in the U.S., featuring a compact design and a highly efficient motor.

Europe

Europe is anticipated to account for the second-highest market size of USD 0.61 billion in 2025, exhibiting the second-fastest growing CAGR of 7.90% during the forecast period. The growth is due to the growing population of working women coupled with surging demand for advanced products. Furthermore, the surging number of campaigns by companies to enhance awareness of the product are contributing to market growth. The market value in U.K. is expected to be USD 0.11 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.16 billion in 2026. France is likely to hold USD 0.12 billion in 2025.

- For instance, in September 2020, Tommee Tippee (Mayborn Group Limited) collaborated with Manifest to deliver a global communications campaign in 2021. The creative partner Manifest highlighted the innovative product lines of these devices to their target audience of mothers.

Asia Pacific

Asia Pacific region is to be anticipated the third-largest market with USD 0.47 billion in 2026. The Asia Pacific breast pump market is expected to grow at the highest CAGR during the forecast period. The rising disposable income in emerging countries, including India, China, and others, along with growing awareness regarding the benefits of these devices among mothers and working women, are some of the crucial factors helping the growth of the market. Furthermore, the increasing focus of key companies on establishing their presence in the region by launching new products are expected to boost the market during the forecast period. The market value in China is expected to be USD 0.13 billion in 2026.

On the other hand, India is projecting to hit USD 0.08 billion and Japan is likely to hold USD 0.11 billion in 2026.

- In December 2021, Chicco (Artsana S.p.A) launched its e-commerce website in India, making its products more accessible to Indian Consumers.

Latin America and the Middle East & Africa

Latin America region is to be anticipated the fourth-largest market with USD 0.09 billion in 2026. Markets in Latin America and the Middle East & Africa regions are expected to expand at a lower CAGR in comparison with other regions during the forecast period. Growth in these regions is attributable to factors such as campaigns by non-profit organization and market players for women's health, the increasing number of births, improved healthcare infrastructure in emerging economies, and the increasing adoption of these devices. The GCC market is expecting to hit USD 0.20 billion in 2025.

Competitive Landscape

Key Market PLayers

Presentation of Advanced Electric Products by Companies to Reinforce their Market Position

The market is consolidated, with a signififcant market share held by key companies operating such as Medela AG, Koninklijke Philips N.V., and Pigeon Corporation. In 2024, these three companies together accounted for a major breast pump market share.

Medela AG's has maintained its strong market position with its hospital-grade products, which continue to perform well even amidst the introduction of competiting products. The highest share of the company is due to its robust product portfolio and ongoing emphasis on new advanced launches.

- In June 2024, Medela launched Swing Maxi Hands-free, a smart double electric breast pump offers users mobility, anatomically design, ultra-lightweight and easy to clean options.

Koninklijke Philips N.V. and Pigeon Corporation are focusing of these companies to expand their product portfolio and customer base through strategic mergers and acquisitions has bolstered their market shares.

Additional companies including Momcozy, Chiaro Technology Ltd., Willow, and others are also contributing to market growth. The increasing efforts of these companies to develop and introduce technologically advanced products in the market to cater to the rising demand has contributed to their growing market shares.

LIST OF KEY COMPANIES PROFILED:

- Ameda (U.S.)

- Medela (Switzerland)

- Chiaro Technology Ltd. (U.K.)

- Willow (U.S.)

- Ardo medical AG (Switzerland)

- Freemie (U.S.)

- Spectra Baby USA (U.S.)

- Evenflo Feeding (U.S.)

- Tommee Tippie (U.K.)

- Canpol Sp. z o.o (Poland)

- Koninklijke Philips N.V. (Netherlands)

- Pigeon Corporation (Japan)

- NUK USA LLC (U.S.)

- Chicco (Italy)

- Horigen (China)

- Handi-Craft Company (U.S.)

- iAPOY (U.S.)

- Momcozy (U.S.)

- Hygeia (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024- Momcozy launched the Mobile Flow(TM) Hands-Free Breast Pump. This product features a powerful third-generation motor and the Momcozy DoubleFit Flange for easy milk extraction and spill-free results.

- February 2024 - Medela launched its first-ever Medela Family smartwatch app, designed for seamless tracking for Medela pump users.

- April 2022: Ardo medical A.G. launched its latest addition, the Ardo Alyssa pump, a double pumping device targeted at the consumer-grade market.

- March 2021: Ardo Medical AG.'s subsidiary, Ardo Medical, Inc., partnered with VGM Group to supply pumps and breastfeeding support products.

- September 2021: Chiaro Technology Limited (Elvie) launched Elvie Stride, a smart, ultra-quiet, hands-free pump. It is the first Elvie products to receive broad insurance coverage in the U.S.

FUTURE OUTLOOK

The market is expected to grow at a nominal growth rate of 8.4% during the forecast period. Untapped markets in emerging countries, including India, Brazil, and Mexico, present lucrative opportunities for companies to increase their market share and foster the growth of the market globally.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides a detailed competitive landscape. The report provides information related to key industry developments and new product launches. In addition, the report includes the global market analysis for the period 2019-2032, along with the assessment of the impact of COVID-19 on the market. Moreover, it covers the market dynamics such as market drivers, restraints, opportunities, and trends shaping the industry.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period |

2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD billion) |

| Growth Rate | CAGR of 8.60% from 2026-2034 |

| Segmentation | By Type, Application, End User, and Region |

| By Type |

|

| By Application |

|

| By End User |

|

| By Geography |

|

Frequently Asked Questions

According to the Fortune Business Insights the global market stood at USD 2.14 billion in 2025 and is expected to reach USD 4.47 billion by 2034.

The market is expected to expand at a CAGR of 8.60% during the forecast period (2026-2034).

The consumer grade segment is set to lead the market by application.

The increasing introduction of advanced pumps, rising population of working women, and growing awareness of womens health devices are expected to drive the market growth.

Medela AG, Koninklijke Philips N.V., and Pigeon Corporation are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us