Building Automation Systems Market Size, Share & Industry Analysis, By Product Type (Hardware and Software), By Application (HVAC Systems, Safety and Security Systems, Energy Systems, Sanitization Systems, and Others), By End User (Residential, Commercial, and Industrial), By End User vs. Area Size (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Building Automation Systems Market Size

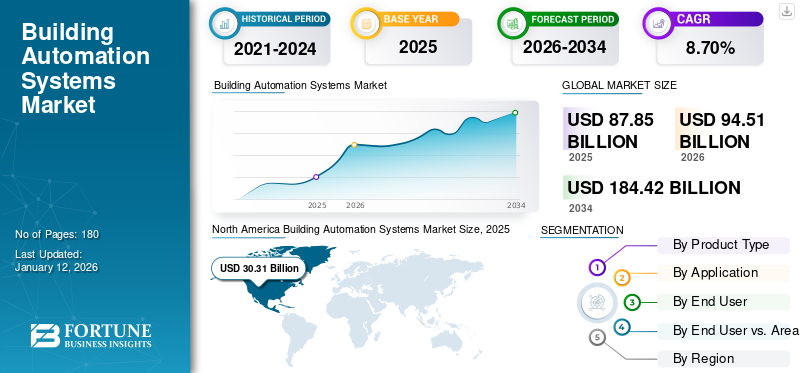

The global building automation systems market size was valued at USD 87.85 billion in 2025. The market is projected to grow from USD 94.5 billion in 2026 to USD 184.42 billion by 2034, exhibiting a CAGR of 8.70% during the forecast period. North America dominated the global market with a share of 34.50% in 2025.

Building automation systems, also known as BAS, are widely accepted across the construction industry owing to their several advantages. These systems are a set of components operated to gain control and access over electronic devices. This combination of software and hardware aids in controlling HVAC, lighting, safety, and other systems. The systems help minimize energy consumption by buildings, reduce operating costs, and enhance the devices' overall lifecycle. With rising technology growth and integrated systems with the help of IoT and 5G technology, the demand for automation systems is estimated to grow at a significant rate.

Global Building Automation Systems Market Overview

Market Size:

- 2025 Value: USD 87.85 billion

- 2026 Forecast Value: USD 94.51 billion

- 2034 Forecast Value: USD 184.42 billion

- CAGR: 8.70% (2026–2034)

Market Share:

- Regional Leader: North America dominated the market with a 34.50% share in 2025, driven by stringent energy efficiency regulations and high adoption in commercial construction.

- Leading Product Type: The hardware segment holds the highest revenue share, fueled by the growing demand for sensors, controllers, and other components in IoT-based automation systems.

- Leading Application: HVAC systems are the dominant application, driven by a focus on reducing building carbon footprints and the demand for smart, remote-controlled climate systems.

- Leading End-User: The commercial segment leads the market, propelled by the high demand for energy-efficient smart buildings in sectors like offices, healthcare, and retail.

Industry Trends:

- IoT Integration: The integration of IoT is a primary trend, enabling connected devices, real-time monitoring, remote operations, and condition-based maintenance for building systems.

- Focus on Sustainability: A major push toward energy-efficient, decarbonized buildings is driving the development of BAS that optimize energy consumption and reduce operating costs.

- Cloud-Based Control: Cloud-based platforms are gaining traction, allowing for centralized control and monitoring of HVAC, security, and other systems from any location.

- AI and Advanced Tech Adoption: The use of AI, Augmented Reality (AR), and Building Information Modeling (BIM) software is enhancing the entire construction and building management process.

Driving Factors:

- Growth in Construction Activities: Rapid urbanization and robust infrastructure development globally are creating a huge demand for modern buildings with advanced automation.

- Demand for Energy Efficiency: Rising energy costs and stringent government regulations for energy management are forcing building owners to adopt BAS to minimize consumption.

- Improved Building Operations: BAS provides significant advantages by optimizing the lifecycle of building equipment, reducing maintenance costs, and improving occupant comfort and safety.

- Demand for Smart Buildings: A growing desire for smart, connected commercial and residential buildings with remote monitoring capabilities is a key market driver.

Restraining Factors:

- Cybersecurity Threats: As BAS are internet-connected, they are vulnerable to cyberattacks and malware, which can disrupt operations and compromise building security.

- Lack of Awareness: A lack of awareness regarding the benefits and functionalities of building automation systems, particularly among residential end-users, can limit adoption.

Several domestic markets are focusing on energy-efficient buildings, which can be seen through a significant public and private investment directed toward building sustainability. With sustainable building investment and a focus on building de-carbonization, the demand for the product is expected to grow over the forecast period. IoT-powered building automation systems are further spurring the demand for the systems as a result of connected devices with seamless networks and improved building operations. Rapid urbanization is a major factor creating a huge demand for real estate assets, especially in the commercial and residential sectors.

The outbreak of the COVID-19 pandemic has slowed down the growth of automation systems, including other industries. The market has seen supply chain disruptions during the pandemic period. Strict restrictions over international trade and a shortage of semiconductor chips have further impacted the market demand.

The residential and commercial sectors are inclined toward building automation owing to the remote monitoring and optimal building operations. Thus, prior to the pandemic, the adoption of BAS system was likely to increase due to rising energy costs, increasing construction activities, growing awareness about the advantages of automation, and improved productivity. The usage of BAS helps to optimize building energy efficiency and reduction in operating costs for these industries is further creating worthwhile opportunities for manufacturing companies during the pandemic.

Building Automation Systems Market Trends

IoT-based Building Automation Systems to Show Lucrative Market Growth.

The Internet of Things is transforming the building automation industry by reducing energy consumption, providing real-time monitoring and support systems, and improving security systems. The IoT-based system provides automated building operations, which help in remote building operations and reduce operating costs. Internet of Things (IoT)-based building automation systems aid in condition-based maintenance for equipment such as HVAC, lighting, and other energy systems.

The automation system provides controlled home appliances, improved safety and security, and continuous monitoring of electrical appliances connected to the system. This further helps in easy maintenance and convenient repair of the appliances. IoT-integrated building automation system (BAS) automates building operations by generating a unified network to monitor potential hazards by optimizing energy usage. This factor helps to improve the sustainability of buildings by reducing the maintenance costs.

According to the International Energy Agency, by 2040, more than 1 billion households and 11 billion smart appliances will participate in interconnected systems, creating lucrative opportunities for the systems market. The rise in demand for interconnected devices and optimization of energy consumption is anticipated to create strong business opportunities for these systems, which is contributing to the building automation systems market growth.

Download Free sample to learn more about this report.

Building Automation Systems Market Growth Factors

Rising Construction Activities with Advanced Technology to Boost Market Prospects

With the help of construction industry growth and the increasing demand for modern buildings with advanced technology, the market is expected to gain huge popularity over the forecast period. The growth is influenced by several factors, including rapid urbanization, robust infrastructure development, energy management systems, and constant monitoring of electronic assets connected to the systems. The integration of artificial intelligence (AI), augmented reality & virtual reality techniques, growing usage of building information modeling (BIM) software and other advanced technologies with construction activities helps to enhance the entire construction process.

These systems allow efficient energy utilization for several appliances, including heating, ventilation, lighting, and enhanced security and safety systems. In addition, government regulations and energy management standards are bolstering the market for these systems.

RESTRAINING FACTORS

Technology Threats to the Systems Might Impact the Market Growth

Building automation systems are centrally operated and connected to the internet, which might increase the threat of cyberattacks on the system. Such kinds of malware attacks might allow access to important data leading to disruptions in operations. The malware attack on building systems might significantly threaten the building assets and people’s health. For instance, in smart building systems, HVAC systems are generally connected to other networked devices providing more chances for malware attackers to control energy systems and threaten human life. Furthermore, a lack of awareness among residential end users might further limit the global market’s growth.

Building Automation Systems Market Segmentation Analysis

By Product Type Analysis

Hardware segment to Account for Highest Revenue Market Share as a Result of Growing Demand.

Based on product type, the market is segmented into Hardware and Software. The hardware segment is further bifurcated into sensors, controllers, output devices, and user interfaces. The Hardware segment dominated the market accounting for 81.98% market share in 2026. Hardware to dominate the market throughout the forecast period because of increasing IoT-based automation systems across residential buildings. Modern building automation systems provide complete control of the building optimizing the operational cost for buildings, reducing maintenance costs, and improving energy savings. Software solutions to witness considerable growth during the forecast period owing to rising demand for automation across buildings.

By Application Analysis

HVAC Systems to have Substantial Growth Owing to Rising Awareness of Energy-efficient Building

Based on application, the market is segmented into HVAC systems, safety and security systems, energy systems, sanitization systems, and others. HVAC systems segment holds significant market share among other application segments.

These automation systems are expanding with smart technology offerings such as control of HVAC systems through mobile or remote devices. HVAC systems are contributing to the reduction of a building’s carbon footprint spurring the demand for HVAC automation systems, especially in commercial buildings. The systems help monitor building data through any remote devices at any given time. Automated HVAC systems optimally regulate the building's heat, airflow, and air-conditioning without human intervention, creating strong growth opportunities for automation systems for HVAC applications.

The need for safety and centralized lighting systems is projected to grow over the forecast period. Facility managers and building owners are focusing on reducing power requirements and optimizing energy consumption, positively affecting the operating cost for the stakeholders. Thereby, the demand for safety and security systems and energy systems is expected to observe steady growth over the projected period. The Safety and Security Systems segment is expected to lead the market, contributing 31.83% globally in 2026.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Commercial Industry to Show Significant Growth Due to Rising Demand in Smart Buildings

By end user, the market is classified into commercial, industrial, and residential.

The commercial segment holds a prominent share of 66.59% in 2026 and is anticipated to have strong market growth over the forecast period. The commercial segment is further divided into office buildings, institutional facilities, healthcare facilities, hotels and restaurants, retail stores, and others. Office buildings are expected to show lucrative market opportunities for automation systems for buildings among commercial spaces.

The demand for energy-efficient buildings surges across the commercial sector, including IT tech parks, hotels, offices, organized retail stores, hospitals, institutional facilities, and other buildings. Remote and centralized building automation offers several advantages, such as controlling firefighting, heating, ventilation, air conditioning, lighting, and other energy systems.

Several government investments and supportive policies are boosting the demand for building automation in public infrastructure and other facilities creating huge market opportunities for the market participants.

By End User vs. Area Size Analysis

Commercial Buildings Under 100,000 Sq. Ft. to Witness Strong Demand due to Changing Demographics

Based on end user vs. area size, the market is categorized into residential, commercial, and industrial.

The residential segment is further divided into up to 3,000 sq. ft., 3,000 to 10,000 sq. ft., and above 10,000 sq. ft. The commercial segment is further divided into less than 25,000 sq. ft., 25,000 to 100,000 sq. ft., and above 100,000 sq. ft. The industrial segment is further divided into below 50,000 sq. ft., 50,000 to 200,000 sq. ft., and above 200,000 sq. ft.

Increase in building operations, remote access to data, energy efficiency, and cost savings are a few of the prominent factors positively impacting the building automation systems installed in commercial buildings.

The majority of the commercial buildings lie under 50,000 sq. ft. area size. Energy consumption by commercial spaces has increased owing to changing demographics, rising infrastructure investment, and urbanization directing the demand for energy savings solutions. Furthermore, varying climatic conditions are boosting the demand for HVAC systems across regions, increasing the energy demand for automation systems in commercial spaces.

Building spaces with more than 25,000 sq. ft. are highly energy intensive, creating significant demand for the systems. Large building owners are concentrating on the reduction of operating costs owing to supportive government regulations spurring the market demand for building automation and control solutions.

REGIONAL INSIGHTS

The market is analyzed across five main regions, North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America Building Automation Systems Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America contributed the largest building automation systems market share over the forecast period, followed by Europe with rising awareness about energy-efficient buildings. The Asia Pacific region shows high growth prospects due to rapid urbanization and increasing infrastructure development across the region. The region dominated the demand for building automation due to increasingly stringent regulations and government policies on building energy efficiency. There has been a growing demand for facility management in public infrastructures and buildings, further bolstering the growth of automated solutions. North American countries, including Canada and Mexico, show strong economic growth over the forecast period, especially in the construction sector. Due to the increasing demand for energy-efficient buildings, building automation is witnessing potential growth from nonresidential construction activities such as office buildings and retail stores in the region.

According to statistics from the U.S. government, the market for non-residential construction, such as commercial spaces, offices, and recreational spaces, has grown by approximately 18% in March 2023 compared to 2022. Stringent government regulations and supportive policies for building energy efficiency are a few factors boosting the construction sector in the U.S., which is further expected to boost the demand for automated solutions in residential and commercial spaces. The rising awareness of the green building concept has seen immense growth in system demand and sales across the country. Additionally, global market participants such as Honeywell, Siemens AG, and others are heavily penetrating the U.S. market. The U.S. market is projected to reach USD 26.94 billion by 2026.

Asia Pacific

Asia Pacific is estimated to experience the highest CAGR due to rapid urbanization and increasing concerns about demand for integrated security systems. The rising urban population is boosting the demand for smart buildings across several emerging countries, which is projected to create lucrative market opportunities. For instance, India is set to register high growth for building automation systems as a result of increasing safety concerns among facility managers and building owners. The growing usage of automated systems while performing construction activities among China, India, and Japan and other countries in Asia Pacific has accelerated developments in the construction industry, which significantly helps to enhance the productivity of employees. The Japan market is projected to reach USD 3.95 billion by 2026, the China market is projected to reach USD 15.08 billion by 2026, and the India market is projected to reach USD 3.67 billion by 2026.

As the green and energy-efficient buildings concept is gaining more pace in emerging countries, manufacturing companies are likely to focus on catering to the rising demand from such countries. Several domestic governments are focusing on carbon-neutral goals, which allow building owners to install building energy-efficient systems creating strong growth opportunities in the Asia Pacific market.

Europe

The Europe market holds prominent market share owing to increasing investment in commercial construction activities and rapid adoption of automation systems. With the help of monitoring tools and automation systems, the rising demand for efficient resource utilization is further projected to create strong demand from European countries. The UK market is projected to reach USD 7.65 billion by 2026, while the Germany market is projected to reach USD 6.57 billion by 2026.

Middle East & African

Significant investment is growing across Middle East & African countries with upcoming massive commercial projects that are all estimated to boost the demand for building automation in the region. South America’s smart buildings adoption is rising in South America owing to the rising urban population and changing demographics.

KEY INDUSTRY PLAYERS

Key Players are Striving to Penetrate the Market through Collaborative Measures

Prominent market players are focusing on new product launches in high-growth markets to expand their presence across the globe. For instance, Siemens AG, Honeywell International Inc., and Schneider Electric are focusing on developing product portfolios for a wide range of applications, including HVAC systems and safety and security systems.

Schneider Electric Strives for New Product Launches to Improve Building Sustainability for Building Owners and Facility Managers

- In 2023, Schneider Electric expanded its product portfolio named as EcoStruxure Building Operation 2023, which is expected to reduce carbon emissions and enhance building efficiency.

LIST OF TOP BUILDING AUTOMATION SYSTEMS COMPANIES:

- Schneider Electric (France)

- Siemens AG (Germany)

- Cisco Systems (U.S.)

- Johnson Controls (U.S.)

- Robert Bosch (Germany)

- Hitachi (Japan)

- ABB (Switzerland)

- Carrier (U.S.)

- Legrand (France)

- Honeywell International (U.S.)

- General Electric (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Siemens launched Connect Box for smaller to medium-sized buildings. The IoT solution for small to medium-sized buildings is designed to monitor building energy efficiency and help in improving indoor air quality.

- July 2022: The SAUTER Group expanded its actuator product portfolio that enables autonomous or semi-autonomous control in HVAC systems. The IoT-capable actuators are designed with a wide range of applications and cloud connectivity.

- January 2022: Daikin Applied introduced Siteline Building Controls, a cloud-based technology that monitors and controls integrated HVAC systems and other electronic devices.

- January 2022: Bosch Building Technologies signed agreements with a German building automation specialist Hoerburger AG to expand its comprehensive product and services portfolio and penetrate the market.

- October 2020: Johnson Controls introduced the Johnson Controls OpenBlue digital technology service suite to remotely monitor HVAC, fire protection, and security services for Asia Pacific customers.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2024 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 8.70% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

By Application

By End User

By End User vs. Area Size

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market stood at USD 94.51 billion in 2026.

As per Fortune Business Insights, the market will reach USD 184.42 billion by 2034.

Growing at a CAGR of 8.70%, the market will exhibit strong growth during the forecast period.

Rapid urbanization and increasing investment in energy-efficient buildings to boost the market.

The top companies in the market are Schneider Electric, Siemens AG, Cisco Systems, Johnson Control, and Robert Bosch.

North America dominated the global market with a share of 34.50% in 2025.

The software segment is expected to hold the highest CAGR in the market.

The commercial sector is expected to grow at the highest CAGR over the forecast period.

IoT-based building automation systems to create lucrative product demand is the key market trend.

Related Reports

- Europe Indoor Air Quality (IAQ) Monitoring Solution Market

- Central Air Conditioning Market

- Heating-Ventilation-and-Cooling-HVAC-System-Market

- HVAC Control System Market

- Commercial Air Conditioner (AC) Market

- High-efficiency Particulate Air (HEPA) Filters Market

- Smart Building Market

- Energy Management System Market

- Machine Automation Controllers Market

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us