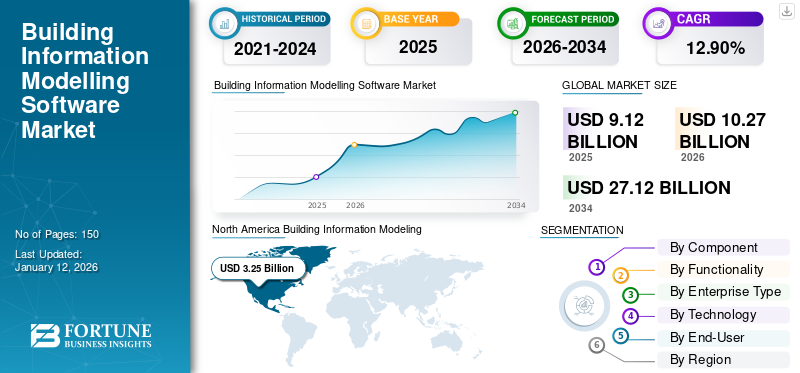

Building Information Modeling (BIM) Market Size, Share & Industry Analysis, By Component (Software & Services), By Functionality (3D Modeling, Visualization, Clash Detection, Conflict Resolution, Cost Estimation, Time Scheduling & Sequencing, Sustainability & Energy Analysis), By Enterprise Type (Large Enterprises, SMEs), By Technology (AI-Driven BIM Solutions, AR/VR-Integrated BIM, IoT-Enabled BIM), By End-user (Architect and Engineers, Facility or Construction Managers), Regional forecast, 2026-2034

BUILDING INFORMATION MODELING (BIM) MARKET OVERVIEW AND FUTURE OUTLOOK

The global Building Information Modeling (BIM) market size was valued at USD 9.12 billion in 2025. The market is projected to grow from USD 10.27 billion in 2026 to USD 27.12 billion by 2034, exhibiting a CAGR of 12.90% during the forecast period.North America dominated the building information modeling (bim) market with a market share of 35.60% in 2025.

The increasing development of residential and commercial structures is anticipated to enhance the market growth. With government backing, numerous public and private construction companies are utilizing the software to improve operational efficiency.

- For instance, in June 2024, the Malaysian government announced the implementation of Building Information Modelling (BIM) for both government and private sector projects, from August 2024. In this initiative, supported by the Construction Industry Development Board (CIDB), all designs of roads, bridges, and buildings are used in a digital method and 3D.

Major companies such as Dassault Systemes SA, Bentley Systems Inc., Nemetschek AG, Beck Technology Ltd., Autodesk Inc., AVEVA Group Plc., Hexagon AB, Pentagon Solution Ltd., Trimble Ltd., and Planon Group are significantly investing in improving their offerings. These firms are forming collaborations and merging different software solutions to provide seamless operations and assistance to their users.

The COVID-19 pandemic severely affected the construction and building industry. However, the pandemic also accelerated the shift toward remote working environments. Digital collaboration tools and software are enabling designers and structural engineers to work from remote locations to map future projects. This trend drove the growth of the global building information modeling (BIM) market.

For instance, between March and June 2020, Autodesk Inc. provided complimentary access to BIM 360 Docs, BIM 360 Design, Fusion 360, Fusion Team, and other tools. The initiative aimed to offer flexibility to project managers, employees, team members, and owners during this crisis. This support enabled project managers to maintain onsite work while ensuring high productivity.

IMPACT OF GENERATIVE AI

Rising Demand for Generative AI Capabilities to Minimize Repetitive and Labor-intensive Tasks in Design and Construction

Generative AI models have become essential for automating tedious and repetitive tasks in the Building Information Modeling process, greatly enhancing productivity in the architecture, engineering, and construction (AEC) industries. Generative AI utilizes algorithms to generate various design options based on established parameters and project limitations. In BIM, these limitations may include space utilization, energy effectiveness, material considerations, light exposure, and other factors.

- In December 2024, The National Science Foundation (NSF) announced a grant of nearly USD 300,000 to enhance construction education at Western Michigan University and throughout the U.S. Upon completion, the platform will be integrated into WMU’s curriculum, equipping students with skills pertinent to the industry and preparing them for careers as future BIM professionals, researchers, and engineers.

Thus, by integrating generative AI into their BIM workflows, manufacturers are likely to experience a significant transformation in their operations. This integration will provide essential insights into market trends and possible improvements to products.

MARKET DYNAMICS

Building Information Modeling (MBI) Market Trends

Increasing Integration of BIM with Emerging Technologies to Enhance Design Visualization and Project Management

The incorporation of Augmented Reality (AR) and Virtual Reality (VR) into Building Information Modeling boosts project visualization. AI techniques can extract features from large amounts of data in BIM models and use them to make predictions. For example, it can predict structural problems or estimate the time required for a task based on design factors from previous projects completed or current environmental conditions.

- For instance, in January 2025, the Nemetschek Group unveiled a new technology known as AI Assistant, initially integrating it into two of its numerous brands—ALLPLAN and Archicad. This innovative AI Assistant from Nemetschek is a fundamental component of the group’s AI strategy. The purpose of this new AI technology is to streamline and automate processes while enhancing collaboration.

Market Drivers

Rising Urban Development to Amplify the Demand for BIM Solutions around the Globe

In recent years, urban areas have increasingly relied on precise data to enhance the efficiency of their structures and overall operations. Building owners utilize reliable BIM data to improve properties services by tracking foot traffic, managing access systems, identifying peak and downtime periods, monitoring energy consumption, analyzing public transportation, ensuring security, and optimizing food services. Additionally, nations such as the U.K., U.S., China, Singapore, UAE, Denmark, Germany, and France are at the forefront of BIM implementation, setting remarkable examples for the rest of the globe.

- A 2023 Global BIM survey indicates that more than 300 projects across the U.K., U.S., Germany, France, China, Japan, Korea, and Singapore are currently utilizing BIM technology. Projects such as New York City's One World Trade Center, Singapore's Marina Bay Sands, and the Shanghai Tower, China’s tallest skyscraper; BIM technology has significantly impacted the global architectural scene.

Technological advancements have facilitated the incorporation of various tools into pre-existing systems. For example, the NavVis IVION tool was initially created for the purpose of monitoring machinery in automotive manufacturing facilities across Europe. This tool allowed employees to navigate through their factories virtually to reach different areas and gather information on operational machines. Besides obtaining specifications and performance metrics, the tool also empowered workers to detect and address any issues that may arise. As a result, the rapid urban development globally has further increased the demand for BIM solutions.

Market Challenges

Lack of Standardized Mandates and Resistance to Change to Limit Market Growth

In contrast to certain developed countries that require BIM implementation for public projects through government policies, numerous regions lack standardized regulations. This lack of regulatory influence leads to varying rates of adoption worldwide, which obstructs collaboration and interoperability among projects. The absence of BIM mandates has resulted in both private and public organizations developing their own distinct BIM standards, complicating the adoption of BIM as construction professionals must adjust to these diverse standards.

Moreover, an increasing number of construction firms have begun using BIM into their projects. However, the adoption of BIM requires a transformation in the operations of the construction firm. Enhanced planning under BIM imposes a heightened responsibility for flawless execution, leaving less margin for error and increased pressure to deliver. These factors contribute to hesitancy in embracing technological innovations. Companies concerned about the cultural implications tend to stick to traditional methods rather than investing in the training of their current employees or hiring a new workforce that aligns better with the BIM-centered approach.

Market Opportunities

Sustainability Initiatives to Create Various Growth Avenues for BIM Solution Providers

Countries pursuing eco-friendly construction goals, such as Copenhagen's goal of achieving carbon neutrality by 2025, are leveraging BIM's data management features to improve efficiency. BIM is essential in the creation of smart cities, where its application in overseeing sustainable infrastructure initiatives is becoming increasingly common.

By simulating energy consumption, analyzing material usage, and evaluating environmental impact, BIM enables architects and engineers to design more energy-efficient and environmentally friendly buildings. This reduces the carbon footprint and helps in achieving sustainability goals and obtaining green building certifications. The data-driven approach of BIM is likely to become increasingly important as the construction industry embraces the principles of sustainability and seeks to minimize its environmental impact.

SEGMENTATION ANALYSIS

By Component

Software Segment to Lead Backed by High Demand from AEC Industry

Based on component, the market is bifurcated into software and services.

The software segment is likely to dominate the market during the forecast period. This segment held the 57.53% of the market share in 2025. The increasing need for digital solutions within the AEC sector is expected to enhance the demand for BIM software. Additionally, the software supplies BIM objects that deliver 3D CAD drawings, offering greater practicality and adaptability.

BIM services are expected to showcase high demand during the forecast period. The increasing need for services such as consultation, virtualization, documentation assistance, and cost planning is expected to drive overall global building information modeling (BIM) market growth. For example, Tesla Outsourcing Services led the way in developing innovative BIM solutions for the changing AEC sector in 2024, achieving outstanding results across various projects.

By Functionality

Rise of 3D Architectural Visualizations Encouraged the Demand for BIM 3D Modeling and Visualization Functions

By functionality, the market is divided into 3D modeling and visualization, clash detection and conflict resolution, cost estimation (5D BIM), Time Scheduling and Sequencing (4D BIM), and sustainability and energy analysis.

3D modeling and visualization held the largest market share in 2024. 3D architectural visualizations have evolved into an essential element of contemporary design and construction practices. These visualizations enable architects, designers, and clients to view and engage with projects prior to their actual construction, providing a vivid, realistic depiction of buildings, interiors, and surroundings. The strength of 3D visualization stems from its capacity to connect the ideas with tangible outcomes, helping stakeholders make educated choices, reduce mistakes, and enhance project results. 3D modeling and visualization is expected to attain 28.13% of the market share in 2026.

- In June 2024, Neilsoft, a provider of software solutions and engineering services, had revealed the launch of ConstructMonitor, a SaaS tool designed for overseeing construction quality and progress. Utilizing terrestrial 3D laser scanners monthly and LiDAR-equipped iPhones on either on a daily or weekly basis, ConstructMonitor enables users to remotely track design deviations at construction sites.

The cost estimation (5D BIM) functionality is likely to grow with the highest CAGR of 18.80% during the forecast period. 5D BIM incorporates comprehensive cost information within the BIM model. This financial data includes material expenses, labor charges, equipment costs, and various other financial metrics. As artificial intelligence and machine learning technologies evolve, the predictive features of 5D BIM are likely to become more advanced, enhancing cost estimations and the decision-making process.

By Enterprise Type

Rapid Adoption of the Product in Projects by Various Governments to Fuel the Expansion in Government and Public Sector Organizations

Based on enterprise type, the market is segmented into large enterprises, small and mid-sized enterprises (SMEs), and government & public sector organizations.

The government and public sector organizations are estimated to showcase the highest CAGR of 17.20% during the forecast period. Countries around the globe are significantly influencing the adoption of Building Information Modeling through a range of initiatives and regulations. Acknowledging the transformative benefits of BIM in improving efficiency, lowering expenses, and enhancing project results, numerous governments have established mandates that either require or encourage the utilization of BIM in public infrastructure projects.

- For instance, from 2021 to 2024, the Malaysian Public Works Department (JKR) adopted Building Information Modelling (BIM) in 455 projects at various phases of planning, design, and construction. This initiative is a part of the JKR Strategic Plan 2021-2025, which seeks to integrate BIM into 90% of projects in order to digitize and automate the construction sector and maintain competitiveness on the global front.

BIM solution adoption among large enterprises accounted for the largest market share in 2024. As a new technology, BIM has been gradually integrated into project and enterprise management systems. Large enterprises usually demand comprehensive BIM strategies, predictive analytics, and advanced visualization tools to support large-scale projects and enhance collaboration across diverse stakeholders. The large enterprises segment is projected to attain 40.84% of the market share in 2026.

By Technology

AR/VR-integrated BIM Solutions Segment Dominated with Rising Demand for Enhanced Overall Building Construction Projects

By technology, the market is segmented into AI-driven BIM solutions, AR/VR-integrated BIM, and IoT-enabled BIM.

The AR/VR-integrated BIM held the largest market share in 2024. The combination of AR and VR within BIM solutions boosts visualization capabilities. AR projects digital information onto the physical environment, assisting with construction on-site, whereas VR offers immersive experiences for evaluating designs. Together, they enhance collaboration, support better decision-making, and facilitate a deeper understanding of intricate construction projects.

- In June 2023, Gamma AR, a tool that utilizes augmented reality to present BIM models at the construction site, is connected with BIMcollab, the software for managing issues and validating models. This integration enables users of BIMcollab to incorporate issues generated in Gamma AR into their current workflows.

As technology advances and costs decrease, AR and VR are poised to become even more accessible and integral to the construction process.

The AI-driven BIM solutions are estimated to capture 40.21% of the market share in 2026 and register the highest CAGR of 16.80% during the forecast period. The incorporation of AI into BIM could address challenges such as insufficient automation and optimization. AI can analyze extensive data sets, recognize trends, and forecast outcomes, allowing designers and contractors to enhance their plans and timelines.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Builders and Contractors Segment To Have Highest CAGR, Fueled by Need to Understand Future Challenges

Based on end-user, the market is segmented into architect and engineers, facility or construction managers, and builders and contractors.

Among these, the adoption of BIM solutions by builders and contractors are projected to grow with a highest CAGR of 16.70% over the forecast period as the software helps lower the cost of construction through its real-time insights. By gaining the information in advance, builders can improvise project operations. Builders and contractors are showing interest in advanced solutions that can enhance the quality of construction. This is likely to drive market growth.

Architect and engineers segment is expected to dominate the market by 43.60% in 2025, in terms of share. BIM solutions assist designers and engineers in anticipating potential future challenges of their projects ahead of time. By implementing the software, facility and construction managers can gain ongoing insights into the process.

BUILDING INFORMATION MODELING (BIM) MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

North America Building Information Modeling (BIM) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global building information modeling (BIM) market share in 2026. This region’s value was estimated to be USD 3.6 billion in 2026, and in 2025, the value stood at USD 3.25 billion.

North America, particularly the U.S., is at the forefront of BIM market growth, driven by rapid technological advancements and an increased focus on sustainable construction practices. Government investments in infrastructure and private-sector demand are fueling the adoption of BIM, which is becoming essential in projects ranging from architecture to engineering.

North America’s focus on sustainability and the advancement of energy-efficient structures is driving the growth of the market. The combination of BIM with geospatial information systems (GIS) and its involvement in smart city initiatives are propelling the market, establishing the region as an important contributor to global BIM development. The U.S. market size is estimated to be USD 2.04 billion in 2025.

Download Free sample to learn more about this report.

In recent years, Building Information Modeling has emerged as a crucial resource within the engineering and construction industries in the U.S. This development is attributed to a rise in private funding for construction projects and the federal government's efforts to enhance infrastructure growth. Companies focused on creating information models need sophisticated 3D model-based processes that are connected with spatial information sciences.

- The U.S. Census Bureau reported that private construction spending in the U.S. continued to rise in 2023, nearly quadrupling that of public sector construction expenditures. Texas and California led the rankings for construction spending among the 50 states. A forecast suggests that the total value of construction in the U.S. is projected to keep increasing in the coming years.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific region is accounted to be the third-largest market with a value of USD 2.28 billion in 2026. Asia Pacific building information modeling industry is likely to grow with the highest CAGR during the forecast period. The Asia Pacific region is rapidly adopting digital technologies, including BIM, as construction companies aim to enhance efficiency, productivity, and collaboration. This surge in adoption is driven by a construction boom in the region, fueled by population growth, urbanization, and economic development, which in turn, is increasing the demand for BIM solutions.

China is anticipated to lead the region due to its extensive array of planned infrastructure initiatives. The nation has scheduled three major construction endeavors utilizing BIM software, including the Shanghai Tower, Beijing Phoenix Media Center, and Shanghai Disneyland Resort, enhancing the growth of the market. The market size in China is expected to hit USD 0.49 billion in 2026.

The Indian government is considering the adoption of BIM to expedite the construction process in the country. According to Niti Aayog, utilizing building information modeling can decrease construction time and result in a 20% reduction in costs. The market in India is set to reach USD 0.49 billion in 2026, whereas Japan is projected to show USD 0.45 billion in 2026.

South America

South America is in a development phase due to growing government investments aimed at digitalizing the construction industry. This growth is further attributed to an increase in awareness toward the usage of BIM solutions in Brazil and Argentina, boosting the adoption of construction solutions during the forecast period.

In Brazil, the government has taken a major step by mandating the implementation of Building Information Modeling in projects and services undertaken by federal agencies and entities. This initiative has laid the foundation for creating a detailed BIM roadmap for the country. Consequently, many government organizations and federal agencies have enacted regulations and normative documents, establishing management committees tasked with executing BIM initiatives.

Europe

Europe is to be anticipated the second-largest market with USD 2.33 billion in 2026, recording the second-largest CAGR of 23% during the forecast period in 2025. Nations such as the U.K., Germany, Sweden, and France have enforced the use of BIM in public projects. Moreover, the substantial presence of key players in the region is expected to stimulate growth.

Additionally, the rate of BIM adoption differs greatly from one nation to another. For instance, the U.K. adopted BIM relatively early but experienced a slower rate of adoption in the subsequent years. In contrast, France experienced a gradual early adoption followed by a rapid increase in BIM users in recent times. The integration of 4D and 5D BIM functionalities remains restricted among European architects, indicating an opportunity for more technological advancement and innovation. The market in U.K. is estimated to be USD 0.35 billion in 2026.

The Germany’s market size is foreseen to be valued at USD 0.43 billion in 2026 and France’s likely to be USD 0.40 billion in 2025.

Middle East and Africa

The Middle East & Africa region is anticipated to be the fourth-largest market with a value of USD 1.19 billion in 2026. The Middle East market is rapidly growing due to the increasing use of digital technologies in the construction industry and the need for improved collaboration and communication between stakeholders in the construction process.

- In February 2023, Bechtel and Abu Dhabi National Oil Company (ADNOC) signed a collaboration agreement to explore the use of BIM technology in the design and construction of ADNOC’s oil and gas projects.

Furthermore, as the UAE's economy continues to grow rapidly, Building Information Modelling (BIM) is increasingly being incorporated into the construction industry, which now requires the use of the model for large-scale projects. The GCC market is expected to hit USD 0.39 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Offer Advanced Building and Designing Solutions to Expand their Product Portfolios

Various companies are dedicating resources to creating and enhancing products to meet the evolving needs of builders, designers, project managers, and owners. They are partnering with other innovative solutions and software companies to broaden their product range according to customer needs.

List of Key Building Information Modeling (BIM) Companies Profiled:

- Autodesk Inc. (U.S.)

- Nemetschek Group (Germany)

- Bentley Systems Inc. (U.S.)

- Trimble Inc. (U.S.)

- Dassault Systemes (France)

- Asite Solutions Ltd. (U.K.)

- Procore Technologies Inc. (U.S.)

- Hexagon AB (Sweden)

- Archidata Inc. (Canada)

- Pentagon Solution Ltd. (Ireland)

- AVEVA Group plc (U.K.)

- Synchro Software Ltd. (U.K.)

- Pinnacle Infotech (India)

- Planon Group B.V. (Netherlands)

- Vectorworks Inc. (U.S.)

- Beck Technology Ltd. (U.S.)

- LOD Planner Inc. (U.S.)

- Bimeye Inc. (U.S.)

- Topcon Positioning Systems Inc. (U.S.)

- ACCA software S.p.A. (Italy)

..and more

KEY INDUSTRY DEVELOPMENTS

- July 2024: Esri and Autodesk have strengthened their collaboration to improve data interoperability between Geographic Information Systems (GIS) and Building Information Modeling (BIM). With ArcGIS Pro now providing direct-read functionality for BIM and CAD components from Autodesk's software, this partnership seeks to create a more seamless integration of GIS and BIM workflows. This advancement could revolutionize the way architects, engineers, and construction professionals handle geospatial and design data in the AEC sector.

- June 2024: Hexagon, the Swedish technology company, acquired Voyansi, a company based in Spain that specializes in Building Information Modelling (BIM), in order to enhance its range of BIM offerings. This acquisition bolsters Hexagon's standing in the worldwide BIM industry and highlights the expertise present in Argentina's tech landscape, especially in Córdoba, where Voyansi has been providing design, architecture, and engineering services to the global construction sector for the last 15 years.

- April 2024: Hyundai Engineering partnered with Trimble Solution Korea to collaboratively develop a process management program for Building Information Modeling (BIM), with the goal of improving productivity at construction sites through sophisticated 3D modeling technology. This partnership underscores the increasing significance of BIM within the construction sector, with the opportunity to enhance management of steel structures and precast concrete, expedite project timelines, and lower expenses in comparison to conventional construction approaches.

- March 2024: Autodesk unveiled a range of new functionalities in Autodesk Construction Cloud (ACC) aimed at assisting project leaders and their teams in avoiding expensive errors. These functionalities, such as specifications, work planning tools, and model-based progress monitoring, offer teams essential project insights derived from data, allowing them to make well-informed choices.

- January 2024: ALLPLAN, a global provider of BIM solutions for the architecture, engineering, and construction (AEC) sector, announced that subscribers to Allplan can benefit from improved capabilities for connecting 2D and 3D workflows. A notable feature of Allplan Subscription is Allplan Cloud, an all-encompassing solution that integrates Allplan's desktop and cloud applications, allowing users to optimize their data usage.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The building information modelling (BIM) market is experiencing rapid growth and transformation, driven by technological advancements and the increasing demand for efficient and sustainable construction practices. For investors, the BIM market presents a wealth of opportunities, supported by several key drivers and emerging trends. The focus on sustainable construction practices is driving the adoption of BIM for green building projects. Investments in BIM solutions that support sustainability goals align with global environmental trends and regulations.

- For instance, in October 2024, BIM Ventures, a venture studio firm based in Saudi Arabia, partnered with Japan’s SBI Holding to create BIM Capital, a joint venture aimed at fostering growth opportunities throughout Saudi Arabia and the wider Middle East. BIM Capital’s objective is to secure over USD 200 million in foreign direct investment (FDI) and to manage total assets exceeding USD 2 billion. The focus of BIM Capital will encompass a variety of investments, such as private equity, venture capital, debt funds, and real estate development funds.

Report Coverage

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Functionality, Enterprise Type, Technology, End-user, and Region |

|

Segmentation |

By Component

By Functionality

By Enterprise Type

By Technology

By End-user

By Region

|

|

Companies Profiled in the Report |

Autodesk Inc. (U.S.), Nemetschek Group (Germany), Bentley Systems Inc. (U.S.), Trimble Inc. (U.S.), Dassault Systemes (France), Asite Solutions Ltd. (U.K.), Procore Technologies Inc. (U.S.), Hexagon AB (Sweden), AVEVA Group plc (U.K.), and Synchro Software Ltd. (U.K.) |

Frequently Asked Questions

The market is projected to reach USD 27.12 billion by 2034.

In 2025, the market was valued at USD 9.12 billion.

The market is projected to grow at a CAGR of 12.90% during the forecast period.

The software component is expected to lead the market.

Rising development of smart cities to amplify the demand for BIM solutions around the globe.

Autodesk Inc., Nemetschek Group, Bentley Systems Inc., Trimble Inc., Dassault Systemes, Asite Solutions Ltd., Procore Technologies Inc., and Hexagon AB are the top players in the market.

North America dominated the building information modeling (bim) market with a market share of 35.60% in 2025.

By functionality, the cost estimation (5D BIM) is expected to grow with a highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us