Cable Modem Termination System (CMTS) Market Size, Share & Industry Analysis, By Type (Integrated CMTS and Modular CMTS), By DOCSIS Standard (DOCSIS 3.0, DOCSIS 3.1, and Below System Standard), By Application (Residential and Commercial), and Regional Forecast, 2024 – 2032

Cable Modem Termination System Market Size & Forecast

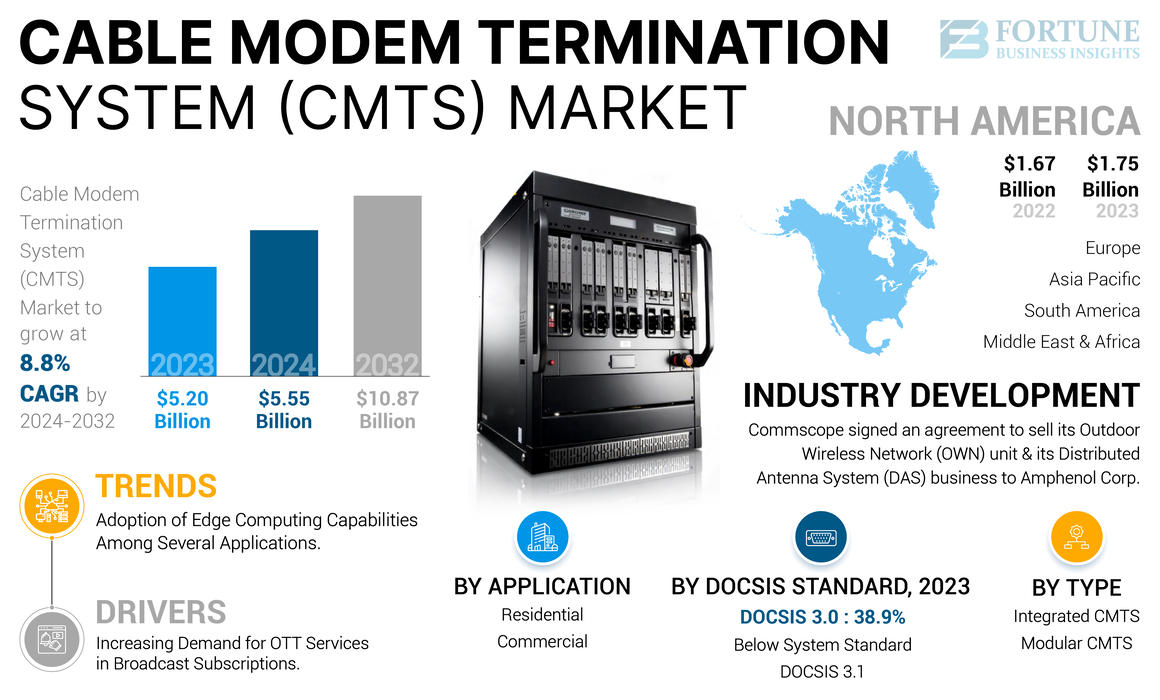

The global Cable Modem Termination System (CMTS) market size was valued at USD 5.20 billion in 2023 and is projected to grow from USD 5.55 billion in 2024 to USD 10.87 billion by 2032, exhibiting a CAGR of 8.8% during the forecast period. North America dominated the global market with a share of 33.65% in 2023.

A Cable Modem Termination System (CMTS) is a hardware device, usually placed in a cable corporation’s hubsite or headend, which is used to offer high-speed data services, such as Voice over Internet Protocol (VoIP) or cable Internet to cable subscribers. It provides functions of digital subscriber line access multiplexer in the digital subscriber line system. Cable operators generally use it to offer services over the HFC network.

The COVID-19 pandemic significantly impacted the semiconductor CMTS and related broadband infrastructure due to a surge in internet usage. With the shift to remote work, online education, and virtual entertainment during lockdowns, there was an unprecedented rise in the demand for high-speed internet. This drove cable operators to upgrade and expand their network capacity. CMTS, which manages data traffic in cable networks, practiced higher usage and demand to support this increased network load. Moreover, the pandemic caused supply chain issues, delaying the production and delivery of CMTS equipment. Manufacturing shutdowns, logistical disruptions, and component shortages created bottlenecks. These delays impacted cable operators’ ability to scale up their infrastructure quickly.

Generative AI Impact

Rise in Demand for Generative AI in CMTS Applications to Drive Market Growth

The rise of generative AI is expected to positively influence the Cable Modem Termination System (CMTS) market in several ways. Generative AI technologies can enhance network management, optimize operational efficiencies, and introduce new possibilities in the cable industry. These technologies can be used to personalize customer experiences by dynamically allocating bandwidth based on individual user needs. This can be particularly useful for managing varying loads due to increased streaming, gaming, or virtual reality applications. Therefore, this factor will boost the growth of the cable modem termination system market.

Cable Modem Termination System (CMTS) Market Trends

Adoption of Edge Computing Capabilities Among Several Applications to Drive Market Growth

Edge computing enables the processing of data closer to end-users or connected devices. This reduction in latency is crucial for real-time applications, such as online gambling, video conferencing, and augmented reality. By integrating edge computing at the network edge, cable operators can improve the quality of service and offload processing responsibilities from central data centers to the network edge. CMTS & CCAP systems with integrated edge computing capabilities can provide a more responsive and seamless customer experience. They can arrange and process critical data locally, improving bandwidth usage and offering a consistent and reliable consumer experience. Therefore, these trends are expected to drive the Cable Modem Termination System (CMTS) market growth.

Download Free sample to learn more about this report.

Cable Modem Termination System (CMTS) Market Growth Factors

Increasing Demand for OTT Services in Broadcast Subscriptions to Drive Market Growth

The growing demand for broadband services has led to increased investment and, thereby, driven the growth of the market. Additionally, the emergence of Over-the-Top (OTT) services, such as Netflix, Amazon Prime, and many others has contributed to the growth of the market. Furthermore, due to technological advancement, businesses are using IoT solutions. Moreover, the increasing demand for online streaming content such as live news, movies, TV shows, and sports among others is expected to increase the demand in CMTS. Therefore, this factor is projected to stimulate the Cable Modem Termination System (CMTS) market growth.

RESTRAINING FACTORS

Higher Deployment Costs and Complexity of Integrating Advanced Technologies to Restrain Market Growth

High development costs represent a significant restraint on the Cable Modem Termination System (CMTS) market growth. The deployment costs related to replacing or upgrading the existing infrastructure can be significant, and they incorporate numerous elements that contribute to the overall financial burden. Executing CMTS technologies involves a significant capital disbursement for cable operators. This includes the price of procuring new software, hardware, and other necessary equipment to advance the prevailing cable infrastructure. Acquiring the essential software licenses for advanced functionalities and safeguarding seamless integration with prevailing systems can contribute to deployment costs. The difficulty of integrating new technologies with legacy systems may require supplementary investments in software development and customization. Hence, these factors can impede market growth.

Cable Modem Termination System (CMTS) Market Segmentation Analysis

By Type Analysis

Expansion of Broadband Services Fueled Adoption of Integrated CMTS

On the basis of type, the market is categorized into integrated CMTS and modular CMTS.

The integrated CMTS segment held the largest market share in 2023. The segment’s growth is driven by the growth of broadband services and the need for more efficient network management. Integrated CMTS combines both downstream and upstream channels within a single platform, which contrasts with the traditional approach using separate CMTS and edge QAM services. Moreover, with the rise of video streaming, online gaming, and smart home technologies, there is a growing demand for faster and more reliable broadband services. Thus, these systems offer better scalability and support for DOCSIS 3.1 and 3.0, enabling higher data throughput.

The modular CMTS (mCMTS) segment is expected to record the highest CAGR during the forecast period. This type of CMTS provides flexibility by allowing cable operators to scale the system based on specific traffic needs. In addition, mCMTS can be more cost-effective for operators managing large and distributed networks. It allows selective scaling of downstream capacity without over-investing in upstream or control functions. This is beneficial for operators in areas with highly variable traffic patterns or where a phased upgrade strategy is preferred. Thus, these factors boost the growth of the segment.

By DOCSIS Standard Analysis

Adoption of DOCSIS 3.1 Increased Due to Rising Demand for High-speed Internet Services

On the basis of DOCSIS standard, the market is categorized into DOCSIS 3.0, DOCSIS 3.1, and below system standard.

The DOCSIS 3.1 segment held the largest global Cable Modem Termination System (CMTS) market share in 2023. DOCSIS 3.1, which stands for Data over Cable Service Interface Specification, has several key features that enhance network capacity, speed, and efficacy, allowing cable operators to meet growing consumer demand for high-speed internet services. Moreover, it significantly improves the bandwidth capacity of existing Hybrid Fiber-Coaxial (HFC) networks, allowing for speeds of up to 10 Gbps downstream and 1-2 Gbps upstream.

The DOCSIS 3.0 segment is expected to record the highest CAGR during the forecast period. It supports channel bonding, allowing operators to deliver internet speeds of up to 1 Gbps downstream and 200 Mbps upstream, which is a massive improvement over DOCSIS 2.0. This capability is vital in meeting the increasing demand for bandwidth-driven applications, such as streaming, gaming, and cloud services.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Demand for Reliable and Fast Connectivity Fueled Use of CMTS in Residential Applications

On the basis of application, the market is categorized into residential and commercial.

The residential application segment held the maximum market share in 2023. CMTS technology, which requires cable internet service, plays a crucial role in enabling residential applications gain access to fast and reliable connectivity. Residential users are increasingly demanding high-speed internet for streaming, online gaming, remote work, and smart home devices. The CMTS market has evolved to support these needs by deploying DOCSIS technologies, enabling gigabit speeds of internet in residential areas.

The commercial application segment is expected to record the highest CAGR during the forecast period. Traditionally, cable networks are focused on residential customers, but the growing demand for advanced services among Small and Medium Enterprises (SMEs), retail operations, and other commercial applications is expected to drive market growth. Businesses today require robust internet connections to support cloud services, unified communications, large-scale data transfers, and other bandwidth-intensive applications. This has driven cable operators to enhance their CMTS infrastructure to deliver business-grade services.

REGIONAL INSIGHTS

In terms of region, the global cable modem termination system market is studied across five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further divided into nations.

North America Cable Modem Termination System (CMTS) Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the largest share of the market. The region was an early adopter of DOCSIS technology, with cable operators swiftly moving from DOCSIS 2.0, DOCSIS 3.0, and DOCSIS 3.1. These upgrades enhanced network capacity, allowing operators to offer gigabit internet speeds. The push toward DOCSIS 4.0 is expected to further increase the capabilities of CMTS systems in the region. Moreover, major companies, such as Comcast, Charter Communications, and Rogers have been key players in the deployment and upgrading of the Cable Modem Termination System infrastructure. These organizations have significant footprints in both urban and suburban areas, making North America one of the most advanced regions for CMTS technology.

Asia Pacific is expected to exhibit maximum growth in terms of CAGR during the forecast period. The growth can be attributed to increasing urbanization across major economies in the region, such as China, Japan, India, and Southeast Asia. This factor has fueled the demand for high-speed internet. The growing middle-class population and increasing digital connectivity needs for entertainment, e-commerce, education, and work-from-home setups have pushed cable operators to invest in the CMTS infrastructure.

Europe is anticipated to exhibit steady growth in the global market over the forecast period. The need for faster and more reliable internet has accelerated the adoption of CMTS technology across the region. With consumers demanding higher internet speeds for streaming, remote work, and online gaming, cable operators have been upgrading their networks with advanced CMTS platforms, particularly leveraging DOCSIS 3.1. Moreover, many European operators have already transitioned to DOCSIS 3.1, enabling them to offer gigabit broadband services. Germany, the U.K., and the Netherlands are leading in this transition, with extensive deployments that allow for faster download and upload speeds. These factors will boost the global Cable Modem Termination System (CMTS) market growth.

South America is witnessing significant growth in the global market. The region is experiencing rapid urbanization, leading to increased demand for broadband services in growing cities. CMTS enables cable operators to meet these demands by optimizing their existing Hybrid Fiber-Coaxial (HFC) networks.

The Middle East & Africa (MEA) market is predicted to grow in the coming years owing to improved private and government funding for digitization.

KEY INDUSTRY PLAYERS

Leading Organization are Collaborating to Increase their Geographical Reach

Prominent firms are keenly focused on launching tailor made solutions to address sector-specific requirements. These companies are making acquisitions and joining forces to establish a strong position. Organizations are also developing and implementing plans to augment their market share in coming years. Thus, the rising demand for Cable Modem Termination System (CMTS) is expected to create a positive market outlook for key companies.

List of Top Cable Modem Termination System (CMTS) Companies:

- Cisco Systems, Inc. (U.S.)

- Axing AG (Switzerland)

- COMMSCOPE (U.S.)

- ATX Network Corp. (Canada)

- CASA Systems (U.S.)

- Harmonic Inc. (U.S.)

- Huawei Technologies, Ltd. (China)

- Broadcom (U.S.)

- Juniper Networks, Inc. (U.S.)

- Sumavision (China)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Commscope signed an agreement to sell its Outdoor Wireless Network (OWN) unit and its Distributed Antenna System (DAS) business to Amphenol Corp. for USD 2.1 billion. This transaction offers the business an increased focus and further fortifies its CommScope NEXT significance with its enduring segments and business units.

- May 2024: Vecima Networks Inc. acquired AXING AG to provide Entra DAA solutions to cable operatives in Germany. The partnership will significantly improve the offering of state-of-the-art broadband HFC access systems, and clients will benefit from leading products and strong support.

- May 2024: Comcast announced that it has reduced the electricity to distribute information across its network by 40% over the last few years. Thus, these cloud-based technologies drive efficiency via real-time performance visibility and provide a service that is better for both customers and the planet.

- October 2023: Harmonic Inc. revealed that its virtualized cOS broadband platform provides a wide array of next-generation capabilities that cement its unique market-leading position. The platform makes it easier for workers to address real environmental, economic, and technical necessities while offering greater versatility and agility to deliberately extend high-speed services to more subscribers.

- May 2023: CommScope introduced an innovative AI-based software - The ServAssure Profile Optimizer - to improve the broadband operatives' network efficiency, capacity, and quality. The solution aids operators in expanding their network capacity and performance, increasing customer satisfaction, and reducing Operational Expenditure (OPEX) via enhanced operational efficiency and less customer calls.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 8.8% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By DOCSIS Standard

By Application

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 10.87 billion by 2032.

In 2023, the market was valued at USD 5.20 billion.

The market is projected to record a CAGR of 8.8% during the forecast period.

By application, the residential segment captured the largest market share in 2023.

Increasing demand for OTT services in broadcast subscriptions across the globe is the key factor driving the market growth.

Cisco Systems, Inc., Axing AG, COMMSCOPE, ATX Network Corp., CASA Systems, Harmonics Inc., Huawei Technologies, Ltd., Broadcom, Juniper Networks, Inc., and Sumavision are the top players in the market.

North America holds the highest market share.

By DOCSIS standard, the DOCSIS 3.0 segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us