Calcium Carbonate Market Size, Share & Industry Analysis, By Type (Ground Calcium Carbonate and Precipitated Calcium Carbonate), By End-Use Industry (Building & Construction, Pharmaceutical, Agriculture, Pulp & Paper, Paints & Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

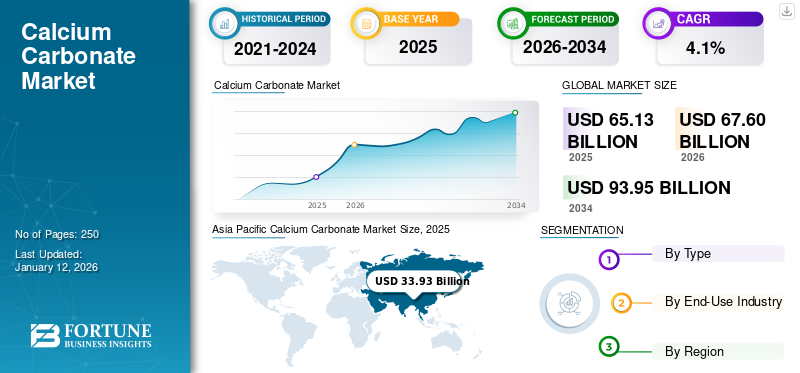

The global calcium carbonate market size was valued at USD 65.13 billion in 2025 and is projected to grow from USD 67.6 billion in 2026 to USD 93.95 billion by 2034 at a CAGR of 4.1% during the forecast period. Asia Pacific dominated the calcium carbonate market with a market share of 52% in 2025.

Calcium carbonate (CaCO3) is an abundant mineral found in rocks such as limestone, chalk, and marble. It is a versatile inorganic compound used in various industries. The market is driven by the usage of the product as a filler in paper, plastics, and rubber, as an additive in paints and adhesives, and as a dietary supplement in food and pharmaceuticals. Increasing demand from the construction, packaging, and consumer goods sectors, coupled with its cost-effectiveness and eco-friendly nature, further fuel the market growth.

The COVID-19 pandemic disrupted the market, primarily due to reduced industrial activity and supply chain interruptions. Key sectors such as paper, plastics, and construction faced slowdowns, decreasing demand. However, market recovery is underway, driven by resumed manufacturing, infrastructure projects, and increased demand in healthcare and packaging industries, gradually restoring the pre-pandemic consumption level.

Global Calcium Carbonate Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 65.13 billion

- 2026 Market Size: USD 67.6 billion

- 2034 Forecast Market Size: USD 93.95 billion

- CAGR: 4.1% from 2026–2034

Market Share:

- Asia Pacific dominated the calcium carbonate market with a 52% share in 2025, driven by rapid industrialization, urbanization, and demand from the construction, paper, and plastics industries across China, India, and Southeast Asia.

- By type, Ground Calcium Carbonate (GCC) is expected to retain the largest market share in 2025, supported by widespread use in paper, plastics, adhesives, and construction materials.

Key Country Highlights:

- China: The leading country in Asia Pacific, driven by high demand in pulp & paper and paints & coatings industries, supported by cost-effective production and abundant raw materials.

- United States: Growth is fueled by established paper, plastics, and construction sectors, with increasing adoption of sustainable practices and eco-friendly additives.

- India: Rapid infrastructure development and rising demand in packaging and construction sectors are supporting market expansion.

- Germany: Market growth is supported by advancements in nano-calcium carbonate applications in coatings, paints, and plastics, aligned with strong environmental regulations.

- Brazil: Urbanization and construction boom are driving demand for calcium carbonate in building materials and paints, backed by favorable government policies.

Calcium Carbonate Market Trends

Growth in the Use of Nano-Calcium Carbonate in Plastics, Paints, and Coatings to Present Market Opportunities

The growth in the use of nano-calcium carbonate in plastics, paints, and coatings is creating significant opportunities for the market. Nano-CaCO3, with particle sizes ranging from 10 to 100 nanometers, has unique features that improve the performance of these materials.

In plastics, nano-CaCO3 is used as a reinforcing filler to improve mechanical qualities such as tensile strength, impact resistance, and temperature stability. It also functions as a nucleating agent, facilitating better crystallization and increasing optical qualities such as transparency and gloss. This has resulted in its increased use in a variety of plastic applications, including packaging, automotive, and construction.

In paints & coatings, the product improves properties such as abrasion resistance, scratch resistance, and UV protection. It also improves paint dispersion and rheology, resulting in more effective application and coverage. Furthermore, nano-calcium carbonate has self-cleaning and anti-fouling qualities, making it suitable for architectural treatments.

The unique feature of nano-CaCO3, together with its eco-friendliness and cost-effectiveness, has fueled its popularity in these high-growth sectors. As manufacturers seek sophisticated materials with improved performance, the demand for nano-CaCO3 is likely to increase, opening up new opportunities for suppliers and manufacturers.

Download Free sample to learn more about this report.

Calcium Carbonate Market Growth Factors

Increasing Adoption in Paper Industry Due to Low Cost and Environmentally-friendly Nature to Drive Market Growth

The product is widely used in the paper industry due to its low cost. It is an inexpensive and abundantly available material, making it an excellent filler material for the paper market. Its low cost helps lower overall production expenses while preserving desirable paper qualities, which is an important component in the increasingly competitive paper market.

It improves the opacity and brightness of paper, which is necessary for printing and writing applications. Its high refractive index improves opacity, allowing for higher print quality and less show-through of text or graphics. This feature makes it an essential component in the manufacturing of high-quality printing and writing papers.

The product usage in paper coating improves surface smoothness and ink receptivity, resulting in higher print quality and clearer images. This is especially crucial for high-quality orienting applications such as magazines, catalogs, and advertising materials, which require both visual appeal and print quality. The improved printability has contributed to its widespread adoption in the paper industry.

In recent years, the paper industry has been moving toward more sustainable practices, and CaCO3 aligns well with this trend. As a naturally occurring, abundant, and environmentally friendly material, it is a preferred choice over synthetic fillers. This has further boosted its demand in the paper industry, which is under increasing pressure to adopt sustainable and eco-friendly practices.

The growth in demand for paperboard packaging, coated papers, and high-quality printing papers has driven the consumption of CaCO3 in the paper industry. Furthermore, the development of new grades, such as precipitated calcium carbonate (PCC) and nano-calcium carbonate, has opened up new opportunities.

RESTRAINING FACTORS

Environmental Regulations, Substitutes, and Raw Material Costs Restraint the Market Growth

The market is facing several restraints that are hindering its growth. One of the major factors is the availability of substitutes such as calcium silicate, which is used in various applications, including paper, plastics, and paints. In addition, the stringent environmental regulations imposed by governments, particularly in developed countries, have led to increased production costs for manufacturers, affecting their profit margins.

Furthermore, the fluctuating prices of raw materials and energy costs have created challenges for producers. The market is also impacted by the cyclical nature of downstream industries such as construction and automotive, which can lead to fluctuations in demand. In addition, the market faces competition from alternative materials and fillers such as kaolin and talc, which can substitute the product in certain applications, particularly when cost considerations and specific performance characteristics are prioritized.

Calcium Carbonate Market Segmentation Analysis

By Type Analysis

Ground Calcium Carbonate Segment Led Due to High Demand from Paper, Plastics, Adhesives, and Construction Materials

Based on type, the market is segmented into ground calcium carbonate and precipitated calcium carbonate.

The ground calcium carbonate segment held the largest with a share of 77.6% in 2026 due to its widespread applications in various industries, such as paper, plastics, adhesives, and construction. The growth of this segment is primarily driven by the increasing demand from the construction industry, particularly in emerging economies. In addition, the use of GCC as a filler in polymers and coatings is expected to fuel its demand further.

The precipitated calcium carbonate segment is anticipated to grow at a faster rate compared to ground calcium carbonate during the forecast period. The key growth factor for this segment is its increasing usage in paper manufacturing, where it enhances the brightness and opacity of paper products. Moreover, the rising demand for PCC from the plastics industry, owing to its superior properties such as high purity and controlled particle size distribution, is expected to drive the segment growth.

By End-Use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Pulp & Paper Segment Held a Leading Position Owing to Demand for High-Quality Paper Products

Based on end-use industry, the market is segmented into building & construction, pharmaceutical, agriculture, pulp & paper, paints & coatings, and others.

The pulp & paper segment held the largest share of 43.34% in 2026. The growth in this segment is driven by the increasing demand for high-quality paper products and the use of CaCO3 as a filler and coating pigment in paper manufacturing. It enhances the opacity, brightness, and printability of paper products.

The building & construction segment is another significant contributor to the market growth. The product is used as a filler in cement, concrete, and other construction materials, improving their strength and durability. The growth of this segment is driven by the increasing construction activities, particularly in developing economies, and the growing demand for sustainable and eco-friendly construction materials.

REGIONAL INSIGHTS

By region, the market is divided into Asia Pacific, North America, Europe, the Middle East & Africa, and Latin America.

Asia Pacific

Asia Pacific Calcium Carbonate Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 35.32 billion in 2026. The region held the dominant calcium carbonate market share in 2024 and is projected to maintain its prominent position during the forecast period due to the rapid industrialization and urbanization in countries including China, India, and Southeast Asian nations. The growing construction and infrastructure development activities, along with increasing demand from the paper and plastics industries, are driving the calcium carbonate market growth in this region. The availability of low-cost labor and raw materials in certain Asian countries further contributes to the market’s growth in this region. China is the leading country in Asia Pacific owing to the presence of pulp & paper and paints & coatings industries. The Japan market is valued at USD 3.4 billion by 2026, the China market is valued at USD 17.9 billion by 2026, and the India market is valued at USD 4.9 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is another significant market driven by the well-established paper, plastics, and construction industries. The region’s stringent environmental regulations and focus on sustainable practices have led to an increased demand for eco-friendly fillers and additives. The presence of major market players and their continuous investments in research and development also support the market’s growth in this region. The U.S. market is valued at USD 15.02 billion by 2026.

Europe

The European market is propelled by the increased product demand from automotive, construction, and paper industries. The region’s emphasis on environmental regulations and sustainable practices also contributes to the market’s growth. The adoption of advanced technologies and the development of innovative products further drive the market growth in Europe. The UK market is valued at USD 0.9 billion by 2026, while the Germany market is valued at USD 2 billion by 2026.

The Latin America market is anticipated to witness significant growth during the forecast period due to rapid urbanization and infrastructure development in countries such as Brazil and Mexico. The region’s thriving construction and automotive industries are expected to drive the product demand. The availability of natural resources and favorable government policies also support market growth.

In comparison, the Middle East & Africa region is expected to exhibit moderate growth during the forecast period, primarily driven by the construction and infrastructure development activities in countries such as GCC, UAE, and South Africa.

KEY INDUSTRY PLAYERS

Key Market Players Ramp Up Capacity and Product Innovation to Fortify Market Dominance

The global market is fragmented, with a mix of both large manufacturers and specialized companies. Key manufacturers are focusing on expanding their production capacities, developing new product grades, and exploring new application areas. They are also investing in research and development to improve product quality and performance. In addition, strategic acquisitions and partnerships are being pursued to strengthen their market position and global reach.

List of Top Calcium Carbonate Companies:

- Minerals Technologies Inc (U.S.)

- Imerys S.A. (France)

- Mississippi Lime Company (U.S.)

- Huber Engineered Materials (U.S.)

- SCHAEFER KALK GmbH & Co. KG (Germany)

- Carmeuse (Belgium)

- Graymont Limited (Canada)

- Nordkalk (Finland)

- CIMBAR RESOURCES, INC. (U.S.)

- Omya AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- July 2024 – Mineral Technologies Inc. signed an agreement with leading global paper company to upgrade a precipitated calcium carbonate plant in Brazil with its NewYield LO PCC technology. This technology converts paper mill waste into functional filler pigment, reducing disposal costs and raw material consumption while enhancing paper quality.

- April 2024 – Mineral Technologies Inc. expanded its presence in the Chinese and Indian paper markets by entering three long-term precipitated calcium carbonate supply agreements. These agreements involve building on-site PCC plants in India and Nine Dragons Paper in China, adding over 180,000 metric tons of PCC annually.

- August 2022 – Cimbar Resources acquired Imerys Carbonates USA’s manufacturing assets. This acquisition enhances Cimbar’s portfolio, ensuring superior product availability and business continuity from multiple locations.

REPORT COVERAGE

The research report provides a comprehensive market analysis and emphasizes crucial aspects such as leading companies, types, and end-use industries. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends and highlights vital industry developments and competitive landscape. In addition to the abovementioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) Volume (Million Ton) |

|

Growth Rate |

CAGR of 4.1% during 2026-2034 |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 65.13 billion in 2025 and is projected to reach USD 93.95 billion by 2034.

Asia Pacific held the highest share of the market in 2026.

Growing at a CAGR of 4.1% the market is slated to exhibit rapid growth during the forecast period.

By end-use industry, the pulp & paper segment led in 2026.

The increasing product adoption in the paper industry due to low cost and environmentally-friendly nature is the key driving factor.

China held the highest share of the market in 2026.

Omya AG, Minerals Technologies Inc, Imerys S.A., Huber Engineered Materials, and SCHAEFER KALK GmbH & Co. KG are the leading players in the market.

Growth in the use of nano-calcium carbonate in plastics, paints, and coatings to enhance properties is anticipated to boost product consumption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us