Ceramic Tiles Market Size, Share & Industry Analysis, By Application (Floor, Walls, and Others), By End-Use Industry (Residential and Non-Residential {Food Industry, Chemical Industry and Laboratories, Automotive and Truck Workshops, Emergency and Fire Stations, Retail and Wholesale, General Production and Commercial Enterprises, and Others}), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

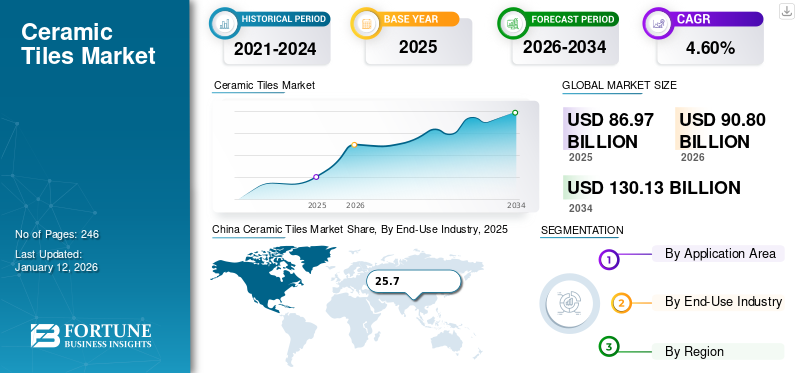

The global ceramic tiles market size was valued at USD 86.97 billion in 2025. The market is projected to grow from USD 90.8 billion in 2026 to USD 130.13 billion by 2034, exhibiting a CAGR of 4.60% during the forecast period. Asia Pacific dominated the ceramic tiles market with a market share of 54% in 2025. Mohawk Industries Inc., Grupo Lamosa, RAK Ceramics, and Kajaria Ceramics Limited are key players operating in the industry.

The growth of the market is driven by the increase in construction activities, combined with the growing investment by countries in infrastructure development. The properties, such as high durability, water resistance, cracking resistance, ad aesthetic appeal, are increasing the product demand. These features make them a preferred choice for the renovation and restructuring of houses, shops, malls, and other facilities. Furthermore, factors such as the rising population and increasing disposable income are further supporting market growth.

Ceramic Tiles Market Trends

Rising Demand for Digitally Printed Ceramic Tiles to Boost Market Growth

Digitally printed ceramic tiles are emerging as a key trend in the market, gaining popularity due to their intricate designs, which help in improving the aesthetic appeal. Additionally, developments in digital printing technology have helped manufacturers to maintain uniformity in designs. Increased expenditure by consumers and the emerging need for innovative interior decor have led to a rise in the consumption of digitally printed tiles.

Digitally printed tiles are versatile and create new and unique aesthetics. Digitally printed tiles are stylish and are often called ceramic artwork for walls. They can create a spectacular effect in interior spaces. Digital printing technology can replicate images easily and precisely to create high-definition, immaculate designs on the tiles. These tiles are available in a variety of colors, such as copper, gold, silver, steel, and bronze colors, finishes, and textures, offering versatile tile options. The growing interest of consumers in well-coordinated and unique colored interior designs in houses and even outdoor venues has created significant growth opportunities for printed tiles. Moreover, these tiles are exceptionally strong, durable, anti-bacterial, easy to clean, and resistant to moisture, weather, stains, and fire.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Construction Industry in Developing Countries to Fuel Market Demand

The growing construction industry in emerging economies is a key driver of demand for these tiles, fueled by rapid urbanization, population growth, and increasing infrastructure investments. Countries such as China, India, Brazil, and those across Southeast Asia and Africa are experiencing a construction boom, particularly in residential, commercial, and public infrastructure projects.

Ceramic tiles are favored for their durability, water resistance, low maintenance, and aesthetic appeal. These characteristics make them ideal for flooring and wall applications in homes, offices, malls, hospitals, and other commercial spaces. China, a major hub for ceramic tile production, benefits from abundant raw materials and cost-effective manufacturing processes.

The combination of urbanization, infrastructure development, and rising consumer preference for durable, customizable design solutions positions developing economies as strong market prospects.

Rising Population and Urbanization to Boost Market Demand

Rising population and urbanization will significantly boost the demand for the product. As more people move to urban areas, the need for housing and infrastructure grows, driving growth in the construction industry. This, in turn, drives demand for the product, which is favored for its durability, aesthetic appeal, and versatility across various applications.

Additionally, factors such as rising disposable income, changes in consumer preferences toward advanced and sustainable building materials and advancements in manufacturing technologies further contribute to the expanding market. As smart cities continue to grow and evolve, the market is poised for considerable growth.

Population growth positively impacts the market by increasing the need for residential construction, renovations, and public infrastructure, requiring flooring and wall solutions due to their durability, affordability, and aesthetic versatility. Consumers are increasingly opting for ceramic tiles as they are aesthetically pleasing and durable. They are also readily available in a wide variety of colors, designs, and finishes, catering to different tastes and budgets.

Market Restraint

Stringent Environmental Regulations to Restrict Market Growth

Stringent environmental regulations are significantly impacting the market by increasing production costs and restricting growth. The ceramic tile industry is energy-intensive, due to its high-temperature kiln firing process, contributing to significant carbon emissions and air pollution from dust, smoke, and glaze particles.

Regulatory bodies, such as the European Commission, the U.S. EPA, and China’s Ministry of Environmental Protection, have enforced strict limits on carbon emissions, raw material use, and waste disposal. These regulations push manufacturers to adopt costlier, eco-friendly technologies and processes. These include anti-pollution equipment, post-industrial recycling, and low-emission production methods, which raise operational expenses. For instance, compliance with environmental standards such as ISO 14001 and EMAS in Europe requires measures such as recycling wastewater and using sustainable materials.

Market Opportunities

Rising Renovation and Replacement Activities to Accelerate Product Demand

Rising renovation and replacement activities are significantly driving demand for ceramic tiles globally. Increasing disposable incomes and a growing focus on home improvement, particularly in developed regions such as North America and Europe, are boosting these trends. Consumers are increasingly investing in upgrading walls and floors with ceramic tiles due to their durability, low maintenance, and aesthetic versatility.

Advancements in technologies such as digital printing have expanded the range of available designs, colors, and textures, allowing for greater customization and alignment with modern interior design preferences. In addition to their visual appeal, these tiles offer functional benefits, such as slip resistance, scratch resistance, and water resistance, making them ideal for high-traffic areas such as kitchens, bathrooms, and commercial spaces.

Market Challenges

Raw Material Constraints and Supply Chain Issues Posing a Challenge to Market Expansion

The global ceramic tile market, despite its steady growth, faces a number of challenges that could impact its trajectory. Economic uncertainties, including inflation and the risk of recessions in key markets, are dampening consumer spending on renovation and construction projects, impacting demand.

Geopolitical instability and trade barriers continue to disrupt supply chains, increasing material costs and creating pricing pressures for manufacturing. In addition, fluctuating energy prices pose a significant challenge for energy-intensive production processes, hindering the ceramic tiles market growth.

Additionally, environmental regulations are becoming increasingly stricter, demanding greater investment in sustainable manufacturing practices and eco-friendly products. This necessitates innovation and adaptation to remain competitive, further straining resources, especially for smaller players.

Impact of COVID-19

The COVID-19 pandemic impacted major economies such as China, the U.S, and Germany, prompting governments to implement strict measures to contain the virus. Since the spread of Coronavirus in late 2019, many countries announced restrictions on the distribution and transportation of materials, affecting the supply chain for ceramic tile manufacturers.

The pandemic led to lockdowns, travel restrictions, and business shutdowns worldwide, disrupting global supply chains and manufacturing activities. This resulted in delays in product deliveries and a slump in sales for manufacturers. Many manufacturing facilities and construction activities were shut down or operated at reduced capacity, leading to decreased consumption.

However, as people spent more time at home during lockdowns, there was an increased interest in home improvement projects, including flooring and tiling. This trend led to a surge in demand, particularly for residential applications.

Trade Protectionism & Tariff Landscape

In April 2024, the U.S. filed anti-dumping and countervailing duty (CVD) petitions against Indian imports, citing concerns over unfair pricing and subsidies. In September 2024, the U.S. Department of Commerce identified countervailing subsidies of about 3%. A final determination was scheduled in April 2025 to decide whether to impose CVD orders, resulting in higher duties on Indian goods if it is concluded that these subsidies have harmed U.S. industries.

Various groups, including the Tile Council of North America, have advocated for steep duties on Indian tile imports, ranging from 328–828%. This would significantly affect trade, especially in industries such as ceramics and tiles.

The U.S.-China trade war has led to tariffs between 30% and 35% on a range of Chinese goods, alongside additional countervailing duties (CVDs) as part of broader protectionist measures aimed at addressing the trade deficit and counteracting perceived unfair trade practices by China. The European Union and other global economies are closely monitoring the U.S.-India situation, as it could set a precedent for future trade disputes and tariff policies, particularly concerning anti-dumping and countervailing measures.

Countries such as Indonesia are increasingly using non-tariff measures (NTMs) such as strict product standards to control imports. These NTMs can be as effective as tariffs in limiting trade, though they are not always perceived as protectionist, becoming more common tools in global trade disputes.

Segmentation Analysis

By Application

Floor Segment Dominated Owing to Rising Urbanization

In terms of application, the global ceramic tiles market is segmented into floor, walls, and others.

The floor segment accounted for the largest ceramic tiles market with a share of 49.03% in 2026. Urbanization, government initiatives, and rising consumer demand for low-maintenance, aesthetically pleasing surfaces are a few of the major factors contributing to the segment's expansion.

The walls segment accounted for the second-largest share in 2024. The shifting preference of consumers toward visually appealing interiors is driving the growth of the segment. Ceramic tiles offer numerous advantages over conventional materials such as paint and wood, making them popular for wall covering. Their durability, easy maintenance, versatility, and aesthetic appeal make them a practical and stylish choice.

Other segments include tiles for backsplash, countertops, fireplaces, patios, and swimming pools, and are expected to grow with a significant CAGR.

By End-Use Industry

To know how our report can help streamline your business, Speak to Analyst

Residential Segment Led the Market Due to Increasing Construction Projects

In terms of end-use industry, the global market is segmented into residential and non-residential.

The residential segment dominated by contributing 73.24% globally in 2026. Residential ceramic tiles are a popular choice for home flooring and wall decoration due to their durability, versatility, and ease of maintenance. They are made from clay and other natural materials, which are fired at high temperatures to create a hard, durable surface. The tiles are strong and can withstand heavy foot traffic, making them suitable for high-use areas such as hallways and living rooms. The growing demand from both new construction and renovation projects is expected to drive the growth.

The non-residential segment is further sub-segmented into the food industry, chemical industry and laboratories, automotive and truck workshops, emergency and fire stations, retail and wholesale, general production and commercial enterprises, and others.

The retail and wholesale segment is accounted to be the fastest growing sub-segment. The retail and wholesale shops are designed to be aesthetically appealing to attract customers and clients. The use of these tiles enhances the visual appeal of the area and adds to the aesthetics.

Ceramic Tiles Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Ceramic Tiles Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share, accounting for USD 49.01 billion in 2026. The region is the world’s largest producer and consumer of ceramic tiles.

Fueled by rapid urbanization and infrastructure development, the demand for residential and commercial construction materials, including tiles, continues to soar in countries such as India, Indonesia, and Thailand. However, increasing environmental regulations are pushing manufacturers toward sustainable and high-quality production methods, which, in turn, are affecting pricing and product availability.

With a rapidly expanding middle class and ambitious housing programs, India presents significant growth opportunities. The market is characterized by a mix of organized and unorganized players, with increasing demand for value-added products such as vitrified tiles. Additionally, government initiatives promoting infrastructure development further contribute to the growth of the ceramic tile industry. The Japan market is projected to reach USD 0.59 billion by 2026, the China market is projected to reach USD 34.99 billion by 2026, and the India market is projected to reach USD 4.03 billion by 2026.

China Ceramic Tiles Market Share, By End-Use Industry, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

The North America market is a dynamic landscape driven by construction activity, renovation projects, and evolving design preferences. While the market is mature, it continues to experience consistent growth, fueled by the durability, versatility, and aesthetic appeal of ceramic tiles.

The U.S. leads the regional market, generating a value of USD 4.28 billion in 2026. Demand is primarily driven by the strong residential construction sector, coupled with a robust home renovation market. Lower interest rates in recent years further fueled housing demand, directly contributing to increased tile consumption for flooring, walls, and backsplashes.

Canada's ceramic tile market is steadily expanding, supported by expansion in the residential and commercial construction sectors. A growing population, particularly in urban centers, is fueling demand for new housing, creating opportunities for tile manufacturers.

Europe

Europe's ceramic tile market presents a diverse landscape, with varying demands and driving factors across its constituent countries. While overall trends such as increasing urbanization and renovation activities play a significant role, each nation's unique economic conditions, cultural preferences, and building regulations shape specific market dynamics.

As a leading producer, Italy boasts a robust domestic market driven by both new construction and refurbishment projects. Italian consumers appreciate stylish and aesthetically pleasing designs, influencing demand for intricately patterned and high-end tiles.

Spain is a prominent ceramic tile exporter with a significant domestic market. Recovering from past economic challenges, the Spanish construction sector is witnessing renewed growth, boosting tile demand.

Germany represents a mature market with a steady demand for high-quality ceramic tiles. The emphasis on durability and functionality, coupled with a strong home renovation culture, fuels the product demand. The market favors larger formats and minimalist designs, reflecting a preference for contemporary aesthetics. The UK market is projected to reach USD 1.17 billion by 2026, while the Germany market is projected to reach USD 1.34 billion by 2026.

Latin America

The Latin America market is experiencing robust growth, fueled by urban projects, infrastructure development, and a growing preference for aesthetically pleasing and durable flooring and wall solutions. The rising disposable income within the region also contributes significantly to the demand for higher-quality tiles.

Brazil is one of the largest markets in Latin America, driven by the country's vast population and growing construction industry. The market is expected to continue to grow, driven by government investments in infrastructure development and the increasing popularity of ceramic tiles as a flooring option in residential and commercial buildings.

Middle East & Africa

The GCC market is experiencing robust growth, fueled by booming construction activity across the residential, commercial, and infrastructure sectors. The burgeoning tourism industry, particularly in countries such as Saudi Arabia and the UAE, is further driving demand for aesthetic and durable tiling solutions. Imports remain a significant source, with China, India, and Spain being key suppliers. However, local manufacturers are increasingly focusing on producing high-quality, innovative designs to capture a larger market share.

The market in South Africa is relatively mature, exhibiting a moderate growth rate. Demand is largely driven by residential renovations and new construction projects, particularly in the affordable housing segment.

Key Market Players in the Ceramic Tiles Market

To know how our report can help streamline your business, Speak to Analyst

Key Players Adopted Acquisition Strategy to Solidify Their Positions

Mohawk Industries Inc., Grupo Lamosa, RAK Ceramics, and Kajaria Ceramics Limited are among the leading companies in the industry. To improve their competitive stance and lessen the threats of new market entrants, manufacturers are actively expanding their operations. The market is characterized by moderate competition between both international and regional players, utilizing their vast distribution networks, regulatory expertise, and supplier connections to gain a competitive edge.

Additionally, companies are pursuing strategic alliances, including contract agreements, acquisitions, and collaborations with other major players in the industry to expand their market presence and solidify their position. The global market is partially consolidated, with the top 4 players accounting for around 40% of the market share.

LIST OF KEY CERAMIC TILES COMPANIES PROFILED

- MOHAWK INDUSTRIES INC. (U.S.)

- SCG CERAMICS (Thailand)

- Grupo Lamosa (Mexico)

- Grupo Cedasa (Brazil)

- RAK CERAMICS (UAE)

- Cerâmica Carmelo Fior (Brazil)

- PAMESA CERÁMICA SL (Spain)

- Kajaria Ceramics Limited (India)

- STN Cerámica (Spain)

- Porcelanosa Group (Spain)

KEY INDUSTRY DEVELOPMENTS

- October 2024 -RAK Ceramics partnered with Sobha Constructions LLC to supply premium ceramics and porcelain tiles for Sobha's upcoming projects. With this partnership, RAK Ceramics increases its customer base in the construction industry.

- June 2024- RAK Ceramics PJSC completed the full acquisition of RAK Porcelain LLC. With this acquisition, the company made it a wholly owned subsidiary. Such a development strategy helps a company to strengthen its market presence and capture significant market share across the globe.

- May 2024- Kajaria Ceramics Limited acquired a 90% stake in Kajaria Ceramics Limited. The acquired company has an annual capacity of 6 MSM of glazed vitrified tiles. Such an acquisition helps Kajaria Ceramics Limited to gain more market share in the tiles industry.

- February 2023 - Mohawk Industries, Inc. acquired Elizabeth Revestimentos in Brazil. This acquisition added four new production facilities, geographically complementing existing operations and creating opportunities for sales and operational synergies—such development solidifying Mohawk's position as the leading ceramic tile supplier in Brazil.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and end-use industries. Additionally, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years.

This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion); Volume (Billion Sq. Meters) |

|

Segmentation |

By Application

|

|

By End-Use Industry

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 90.8 billion in 2026 and is projected to reach USD 130.13 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 46.77 billion.

Growing at a CAGR of 4.60%, the market will exhibit steady growth during the forecast period.

The residential segment led the market in 2025.

The growing construction industry in developing countries is a key factor driving market growth.

Mohawk Industries Inc., Grupo Lamosa, RAK Ceramics, and Kajaria Ceramics Limited are key players operating in the industry.

Asia Pacific dominated the market in 2025.

Rising renovation and replacement activities are expected to drive the adoption of ceramic tile products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us