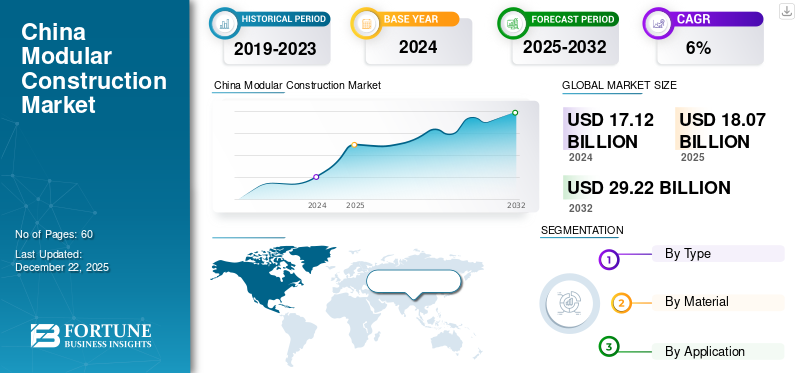

China Modular Construction Market Size, Share & COVID-19 Impact Analysis, By Type (Permanent (PMC) and Relocatable), By Material (Concrete, Steel, and Wood), By Application (Commercial, Healthcare, Education & Institutional, Hospitality, and Others (Residential and Religious buildings)), 2025-2032

China Modular Construction Market Size

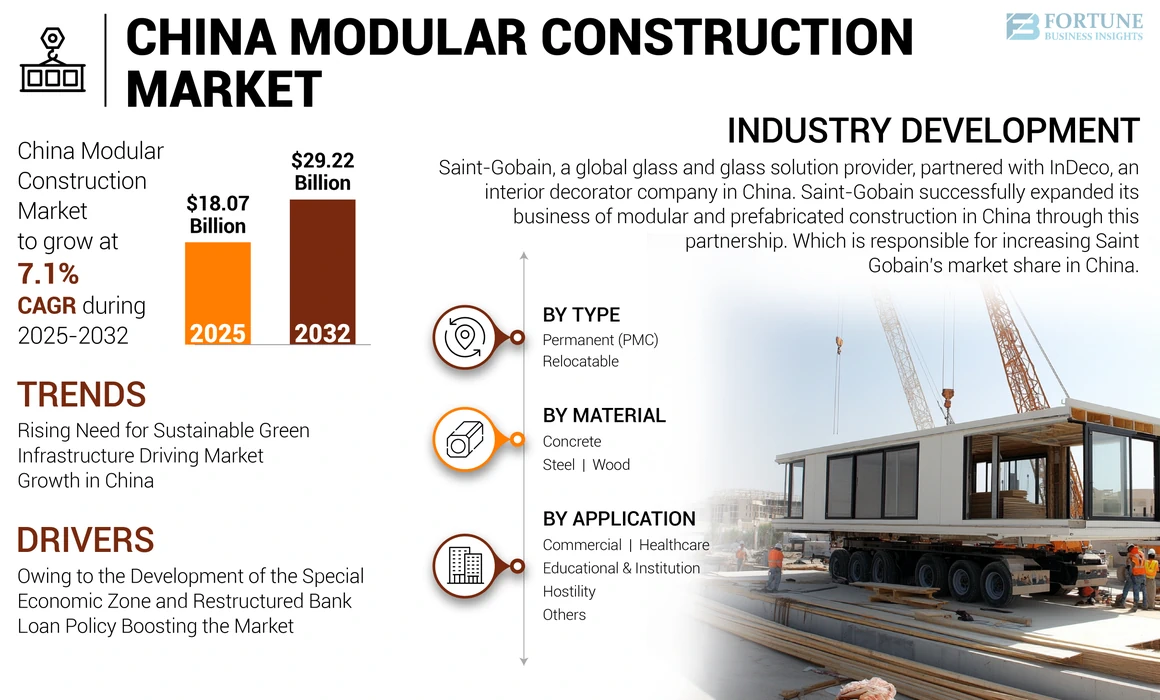

The China modular construction market size was valued at USD 17.12 billion in 2024. The market is projected to grow from USD 18.07 billion in 2025 to USD 29.22 billion by 2032, exhibiting a CAGR of 7.1% during the forecast period.

In the past few decades, the Chinese economy has been rapidly growing, and the government of China is heavily investing in the building and construction business. Along with the growing Chinese construction industry, China's labor and operational cost is also increasing. To tackle the problem of high labor cost and more construction building time, the concept of prefabricated construction has been gaining popularity in China for the last two decades. Furthermore, the government of China continuously invests in the construction industry to promote the country's economy. For instance, in August 2022, the Government of China decided to pump more than USD 1 trillion (6.8 trillion yuan) into the building and construction industry of the country. This investment is expected to create lucrative growth opportunities in the Chinese modular and prefabricated construction market during the forecast period.

COVID-19 IMPACT

During COVID-19 Pandemic, the Shortage of Skilled Labor Slowed Down the Growth of Market

The COVID-19 pandemic had a significant impact on the Chinese prefabricated construction market. The industry has experienced a shortage of skilled labor. Due to lockdowns and travel restrictions, many workers could not travel to construction sites. Also, the pandemic has delayed project approvals as local authorities prioritize pandemic control measures. However, after the COVID-19 pandemic, the demand for prefabricated housing is increasing, which will boost market growth.

DRIVING FACTORS

Owing to the Development of the Special Economic Zone and Restructured Bank Loan Policy Boosting the Market

The development of Special Economic Zones (SEZs) and restructured bank loan policies have contributed significantly to the growth of the modular prefabricated construction market. SEZs are designated areas within a country that offer special economic incentives to businesses, such as tax breaks and relaxed regulations. These zones promote foreign investment, boost economic growth, and create employment opportunities. In China, SEZs have contributed to the development of prefabricated construction market by providing a conducive environment for the growth of prefabrication-based construction companies. Furthermore, the Chinese government has also restructured bank loan policies to support the growth of the prefabricated construction market. Bank loans are now more accessible to prefabrication-based construction companies with favourable terms and conditions. This has made it easier for companies to invest in developing prefabrication technology, production facilities, and distribution networks, driving China modular construction market growth.

LATEST TRENDS

Rising Need for Sustainable Green Infrastructure Driving Market Growth in China

As China is one of the largest polluters globally, the demand for sustainable green infrastructure in China is continuously increasing to tackle various environmental concerns. Green infrastructure refers to the network of natural and semi-natural areas, such as forests, wetlands, parks, and green roofs, that provide society with ecological, economic, and social benefits. These benefits include biodiversity conservation, climate regulation, water management, air purification, recreation, and human well-being. Green infrastructure can also help mitigate climate change's impacts, such as urban heat islands, flooding, and drought. This increasing need for green infrastructure creates the country's demand for modular prefabricated construction.

RESTRAINING FACTORS

High Construction Cost Led to Restrain Market Growth

The high construction cost in China is a major factor restraining the growth of the modular construction industry in the country. The cost of construction materials, labor, and land has increased significantly in recent years, making it more expensive to build new homes and infrastructure. One of the reasons for the high cost of construction in China is the shortage of skilled labor in the industry. This shortage has led to higher wages for construction workers, increasing the cost of construction. Additionally, the rising cost of land in China has made it more expensive for developers to acquire land for new construction projects, contributing to the high cost of housing construction. These factors are restraining the growth of the market.

SEGMENTATION

China modular construction market share is segmented by type, material, and application segment.

The market is bifurcated by type into Permanent (PMC) and Relocatable. The permanent segment generated prominent revenue in 2022. It is due to the country's heavy demand for residential housing construction. However, the permanent segment shows the highest CAGR during the forecast period. Owing to the increasing investment of key players in the permanent construction market.

The material segment is divided into concrete, wood, and steel. Due to increasing housing construction development, the concrete segment had generated prominent revenue in the market. However, the wood segment shows the highest growth with a prominent CAGR during the forecast period. It is due to the increasing demand for antique wood structures in China.

Based on application, the commercial segment generates the highest revenue and shows the highest CAGR during the forecast period due to heavy demand for rapid construction from complex commercial owners driving the market growth. Furthermore, the healthcare and education segments are following the growth trends of the commercial segment. Owing to the rising demand for huge building construction for the educational institute and hospitals in China.

KEY INDUSTRY PLAYERS

Ark Prefab Co., Ltd. holds the major share in the prefabricated construction market in China. It is due to the country's strong production facility and fabrication casting yards. Furthermore, Atlantic Modular System, China State Construction, CIMC Modular Building Systems, GS Housing, Hangxiao Steel Structure, Kong Sing Building Co., Ltd., Ningbo Deepblue Smart House Co., Ltd., Shanghai Haisheng Special Metal Box Co., Ltd., Zhejiang Putian Integrated Housing Co., Ltd. And other companies are adopting business strategies such as partnership, product launch and collaboration to strengthen their footprints in the market.

LIST OF TOP CHINA MODULAR CONSTRUCTION COMPANIES:

- Ark Prefab Co., Ltd.

- Atlantic Modular System

- China State Construction

- CIMC Modular Building Systems

- GS Housing

- Hangxiao Steel Structure

- Kong Sing Building Co., Ltd.

- Ningbo Deepblue Smart House Co., Ltd.

- Shanghai Haisheng Special Metal Box Co., Ltd.

- Zhejiang Putian Integrated Housing Co., Ltd.

KEY INDUSTRY DEVELOPMENTS:

- May 2021 – Saint-Gobain, a global glass and glass solution provider, partnered with InDeco, an interior decorator company in China. Saint-Bobain successfully expanded its business of modular and prefabricated construction in China through this partnership. Which is responsible for increasing Saint Gobain’s market share in China.

- March 2022 – Finland based Peikko Group acquired a major share in China-based prefabricated construction company Shanghai Shucko Construction Technology Co. Ltd. By this acquisition, Peikko Group had expanded their business in China.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The modular construction market report provides an in-depth analysis of the China market dynamics and competitive landscape. It provides key insights, including recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

Frequently Asked Questions

Growing at a CAGR of 7.1%, the market will exhibit steady growth in the forecast period (2025-2032).

Owing to the Development of the Special Economic Zone and Restructured Bank Loan Policy Driving the Market

Atlantic Modular System, China State Construction, CIMC Modular Building Systems, GS Housing, Hangxiao Steel Structure, Kong Sing Building Co., Ltd., Ningbo Deepblue Smart House Co., Ltd., Shanghai Haisheng Special Metal Box Co., Ltd., Zhejiang Putian Integrated Housing Co., Ltd. And other are the major market players in the Asia Pacific market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us