China Point-of-Care Sepsis Diagnostics Market Size, Share & Industry Analysis, By Product Type (Instruments and Reagents & Kits), By Technology (Molecular Diagnostics and Immunoassays), By Pathogen (Bacterial Sepsis and Fungal Sepsis), By End User (Hospitals & Clinics and Standalone Laboratories), and Country Forecast, 2024-2032

KEY MARKET INSIGHTS

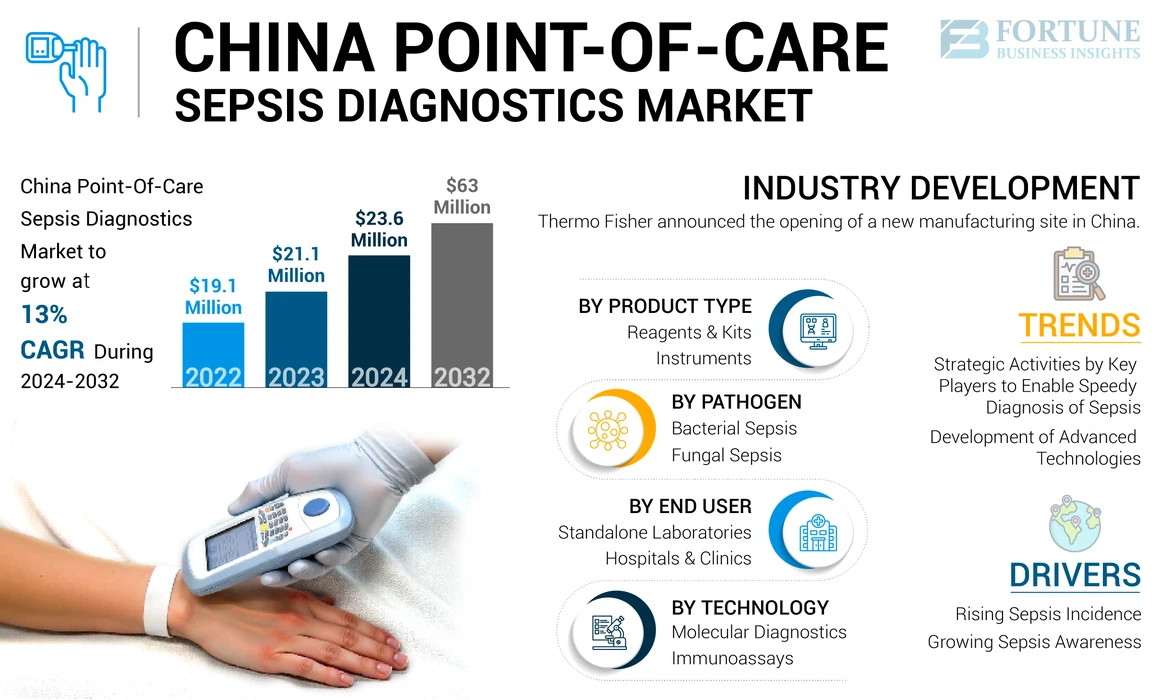

The China point-of-care sepsis diagnostics market size was valued at USD 21.1 million in 2023. The market is expected to grow from USD 23.6 million in 2024 to USD 63 million by 2032, exhibiting a CAGR of 13% during the forecast period.

Sepsis refers to the body's severe and excessive reaction to an infection. It represents a critical health crisis where, without prompt medical intervention, this medical condition can harm the tissues, cause failure of organs, and even death. Bacterial infections are some of the leading causes, but other forms of infection can also trigger it. These infections frequently affect the kidneys, stomach, lungs, or bladder. Sepsis can start from a minor cut that becomes infected or from an infection that develops after a surgical procedure. In some cases, it can develop in individuals who were unaware that they had an infection.

Point-of-care sepsis diagnostics refers to the diagnostics that can enable the rapid detection of sepsis. The presence of such point-of-care diagnostics results in improved outcomes that may save a patient’s life. The rising prevalence of sepsis, increase in the number of Hospital-Acquired Infections (HAIs), and emerging utilization of sophisticated point-of-care devices for early detection are driving the expansion of the market.

- As per an article by BMC Infectious Diseases in 2022, a systematic review was carried out to track the frequency and mortality of sepsis, severe sepsis, and septic shock in China through various sources. The total frequency of sepsis was estimated at 33.6%, and the total mortality of sepsis, severe sepsis, and septic shock was estimated to be 29%. As China is one of the most densely populated countries in the world, it has a significant patient burden due to sepsis. While it has witnessed a declining trend of age-standardized mortality in terms of sepsis, there is a need for efficient and rapid diagnostics to improve patient outcomes.

Certain additional factors, such as the increased incidence of chronic diseases, such as lung disease, diabetes, and cancers, coupled with improvements in the Chinese healthcare infrastructure, are contributing to the country’s market growth. Furthermore, the aim of the major and local players to better their market position through innovative product launches and strategic initiatives will also supplement the country’s market growth.

During the COVID-19 pandemic, the Chinese market witnessed a positive impact. The COVID-19-positive patients were more prone to developing sepsis. This fact led to increased sepsis cases. Moreover, point-of-care sepsis diagnostic test sales in China also increased in 2020. The market returned to its pre-pandemic growth levels in 2021 from its elevated growth levels witnessed in 2020, and with the market undergoing complete normalization during the years of 2022 and 2023. The market is expected to accomplish robust growth during the forecast period.

China Point-of-Care Sepsis Diagnostics Market Trends

Strategic Activities by Key Players to Enable Speedy Diagnosis of Sepsis to Emerge as Remarkable Market Trend

Increasing strategic initiatives by key players to boost the development of new sepsis testing technologies for the Chinese market is a prominent trend. Many companies are increasingly engaging in collaborations to introduce new biomarkers for early sepsis diagnoses in China.

- For instance, in November 2023, Abionic partnered with Lascco and entered an exclusive licensing agreement with Fapon. This collaboration granted Fapon an exclusive licence to utilize the Pancreatic Stone Protein (PSP) biomarker for diagnosing sepsis in China. Such innovations will bolster the growth of the China market in the coming years.

These new testing technologies will provide more improved patient outcomes in the forecast period as they are more efficient and accurate.

Other Trends:

Development of Advanced Technologies to Foster Product Adoption

One of the most prominent trends is the integration of advanced technologies in the Chinese market. The growing need for advanced care has propelled the usage of micro- and nanosensors for detecting blood pathogens and biomarkers.

- For instance, according to an article released by Springer Nature in 2022, nano- and micro-structured materials can be used for solving issues related to sepsis diagnosis and identify new challenges for future development. Such factors will promote the market growth.

The growing number of sepsis cases, government support for efficient diagnostic methods, demand for improved patient outcomes, and increasing awareness are enhancing the product adoption in the market.

Download Free sample to learn more about this report.

China Point-of-Care Sepsis Diagnostics Market Growth Factors

Rising Sepsis Incidence to Propel Market Growth

One of the most critical drivers for the China market is the rising incidence of sepsis. This, coupled with the increasing number of sepsis tests, is further augmenting the market growth. Also, the rapid and more accurate diagnosis provided by these devices are driving their adoption.

- For instance, as per the statistics by BioMed Central Ltd. (2022), the frequency and mortality of sepsis and septic shock in China is much higher than those found in North American and European countries. The rising sepsis incidence rate will require efficient diagnostic procedures, which is a significant factor contributing to the market’s growth.

Furthermore, while there was a notable decrease in the sepsis mortality rates in the rural areas and small and medium-sized cities in China, it was noted that there was an increase in the sepsis mortality rates in major cities. Such factors will also drive the adoption of these diagnostics in the rural and urban healthcare settings of China.

Moreover, the increasing incidence of hospital-acquired infections is another factor that will contribute to the China point-of-care sepsis diagnostics market growth during the forecast period.

Growing Sepsis Awareness to Impel Market Expansion

In the current scenario, several government and private agencies are working toward boosting the sepsis awareness among the Chinese population through the launch of awareness programs and diagnostic campaigns. The development of these awareness campaigns are also contributing to the market growth.

- For instance, collaborations between various government and non-government bodies have increased to provide information and training to healthcare providers regarding sepsis. For instance, in September 2023, Sepsis Alliance partnered with the National Minority Health Association (NMHA) to share the newly launched Spanish, Chinese, and Tagalog sepsis resources. The NMHA revealed that it would also be sharing information about Sepsis Alliance's new live site translation feature, which makes the valuable information on sepsis.org accessible to a larger population.

Thus, an increase in the number of initiatives by various government organizations and foundations to boost awareness and offer support is anticipated to fuel the market’s growth.

RESTRAINING FACTORS

Dearth of Trained Healthcare Professionals in China to Hinder Market Expansion

The growing demand for sepsis diagnostic tools may encounter obstacles that could potentially impede the expansion of the point-of-care sepsis diagnostics market in the years to come. Timely identification and immediate care play a vital role in saving the lives of patients suffering from sepsis. However, challenges, such as insufficient equipment and shortage of skilled healthcare providers could hinder the market growth.

These challenges are further intensified in settings with limited resources, particularly in developing countries. They include the restricted availability of bedside monitoring devices, inadequate staffing, insufficient laboratory resources & personnel, and absence of a sepsis management protocol. Since, the focus on sepsis diagnosis and treatment is growing, it is anticipated to boost the need for diagnostic devices. Nevertheless, the growth of the market is constrained by the lack of well-trained healthcare professionals to conduct diagnostic procedures for sepsis.

Other Restraints:

Regulatory Hurdles and Impact on Introduction of Approved Products:

The stringent regulatory policies for the approval of point-of-care diagnostic devices to detect sepsis can hinder the market’s growth in China.

High Costs Associated with Advanced Diagnostic Tools:

The high costs associated with advanced diagnostic tools, such as analyzers can restrict the market growth in sub-urban regions of the country.

Limited Access to POC Diagnostics in Remote Areas of China:

Developing countries suffer more due to limited access to advanced technologies. The high cost and limited infrastructure in hospitals will restrict the market’s growth in China.

Competition from Traditional Laboratory-Based Diagnostics:

The population in developing countries is more comfortable with conventional diagnostic methodologies despite their longer turnaround time. This creates strong competition for advanced technologies, such as point-of-care products. The existing players with strong penetration are the potential competitors for point-of-care manufactures in the China market.

Market Opportunities

Potential for Technological Advancements to Provide Opportunities for Growth:

The growing demand for early sepsis diagnosis has created numerous growth opportunities for the market. Strong initiatives by key players to launch new biomarkers for early sepsis diagnosis will also propel the market growth.

- In October 2023, Fapon entered a strategic cooperation agreement with two Swiss biotech companies, LASCCO SA and Abionic SA. Under this agreement, Fapon received an exclusive license to utilize the Pancreatic Stone Protein (PSP) biomarker for sepsis diagnosis in China.

Opportunities Arising from Government Healthcare Reforms:

The government plays a major role in implementing healthcare reforms for particular disease diagnoses. In China, the growing efforts of the government in fundraising for sepsis awareness and campaigns will contribute to the growth opportunities in the market.

China Point-of-Care Sepsis Diagnostics Market Segmentation Analysis

By Product Type Analysis

Increasing Awareness of Early Sepsis Diagnosis Enabled Reagents & Kits Segment Dominance

In terms of product type, the China point-of-care sepsis diagnostics market is segmented into instruments and reagents & kits.

The reagents & kits segment held the maximum market share due to the growing volume of sepsis cases and early diagnosis awareness among the Chinese population. Moreover, the rising number of clinical laboratories is increasing the number of diagnostic procedures. Such cases require huge quantities of reagents and kits, which eventually propels the segment’s growth.

- According to an article published by the National Institutes of Health (NIH) in 2022, nine observational studies involving 324,020 Chinese patients (9,587 patients with sepsis) were analyzed. The study found that 301,272 patients showed total prevalence and mortality rates of 3.8% and 26%, respectively. Such a substantial number of sepsis cases will enhance the demand for reagents and consumables for diagnostic procedures.

The instruments segment also held a prominent market share in 2023. The increasing adoption of point-of-care devices and collaborations between various organizations to expand their business in China will propel the segment’s growth.

By Technology Analysis

Immunoassays Held Dominant Market Share Due to Strategic Initiatives by Key Players

In terms of technology, the market is segmented into molecular diagnostics and immunoassays.

The immunoassays segment held the largest China point-of-care sepsis diagnostics market share. Progress in the field of immunoassay studies is expected to fuel the growth of the segment. The rise in the segment’s growth can be attributed to important collaborations among major companies to introduce sophisticated immunoassay products.

- In June 2024, T2 Biosystems, Inc. executed a territory-exclusive distribution agreement in Hong Kong and Macau. Under the terms of the agreement, T2 Biosystems will sell the T2Dx Instrument, T2Bacteria Panel, T2Candida Panel, and T2Resistance Panel through the newly appointed distributor.

The molecular diagnostics segment is anticipated to experience growth over the forecast timeframe. Molecular diagnostic tests are more accurate and take lesser time, which will contribute to the growth of this segment. Point-of-care molecular solutions are being created for numerous types of bacterial and viral infections. These factors are expected to aid in the growth of the segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Pathogen Analysis

High Number of Bacterial Sepsis Cases Augmented Segment’s Dominance

Based on pathogen, the market is segmented into fungal and bacterial sepsis.

The bacterial sepsis segment maintained its dominating position in terms of market share. The segment's growth is linked to the rising prevalence of bacterial sepsis and growing efforts to raise awareness about detecting the bacteria responsible for sepsis.

The fungal sepsis segment accounted for a decent portion of the China point-of-care sepsis diagnostics market and is projected to grow further in the coming years. Numerous patients experience sepsis resulting from fungal infections. This factor is driving the growth of the segment.

- For instance, according to an article published in the International Journal of Infectious Diseases in 2020, a study was conducted to describe the incidence, case-fatality rate, and pathogen distribution of Late-Onset Sepsis (LOS) among pre-term infants in China. A total of 1,199 episodes of culture-positive LOS were identified in 1,133 infants, with an incidence rate of 4.4%. It was found that fungal sepsis was alarmingly high at 17.1%. Such substantial cases of fungal sepsis will promote the segment’s growth in the future.

By End User Analysis

Significant Number of Patient Visits Aided Hospitals & Clinics Segment’s Market Dominance

Based on end user, the market is segmented into hospitals & clinics and standalone laboratories.

In 2023, the hospitals & clinics segment dominated the market in China. The segment's strong performance is due to the high prevalence of sepsis among hospitalized patients. The expansion of hospital facilities and widespread use of point-of-care devices are driving the growth of this segment in the market.

The standalone laboratories segment hold the second-largest share of the China point-of-care sepsis diagnostics market. The increasing amount of laboratories and growing need for affordable sepsis care are expected to drive the growth of this segment.

- In June 2023, Aignostics and Virchow Laboratories collaborated to advance the use of AI-powered pathology in China in both research and clinical routines. Under the collaboration, Aignostics will deploy its platform in China at Virchow Laboratories’ sites to enable the local AI-powered testing of samples in accordance with Chinese regulations. The initial focus of the collaboration is on providing biopharma research services, such as supporting prevalence studies, quality control, and biomarker research.

KEY INDUSTRY PLAYERS

Robust Brand Presence and Product Offerings to Help Shenzhen Mindray Bio-Medical Electronics Co., Ltd. Dominate Market

The competitive landscape of the Chinese market reflects a semi-consolidated structure. Shenzhen Mindray Bio-Medical Electronics Co., Ltd. accounts for a major share of the China point-of-care sepsis diagnostics market. A strong distribution network, robust product portfolios, and innovations contribute to the company’s dominance in the China market.

bioMérieux, Inc., Wondfu, and Abbott are also some of the other major companies in the China market. Moreover, recent mergers, acquisitions, and partnerships among the industry players are likely to aid in their penetration in developing countries, thereby fostering their growth.

- In May 2021, Abbott and Generic Pharmasec announced an agreement to distribute, market, and promote the entire range of products by Abbott Point of Care (APOC) in China. Such initiatives are projected to help these companies foster a strong market share.

FUTURE OUTLOOK

In terms of the future outlook of the China point-of-care sepsis diagnostics market, it is projected to witness strong growth trends throughout the forecast period. The strong research & development scenario in the country, coupled with active government support for domestic players, is anticipated to lead to the launch of low-cost and efficient alternatives for point-of-care sepsis testing.

However, the presence of China’s trade protectionism practices may hinder the entry of more innovative multinational players. This, in turn, may limit the market’s growth in the country during the forecast period. In recent times, the Chinese government has sought to address these issues.

The reforms in terms of policies, coupled with greater awareness regarding the adoption of point of care sepsis diagnostics in China, will contribute to a strong and sustained market growth in the country.

List of Top China Point-of-Care Sepsis Diagnostics Companies:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Radiometer Medical ApS (Danaher) (U.S.)

- bioMérieux, Inc. (France)

- T2 Biosystems, Inc. (U.S)

- DiaSorin S.p.A. (Italy)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Wondfu (China)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Boditech Med Inc. (South Korea)

- Lepu Medical Technology(Beijing)Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Danaher partnered with Chongqing-Chongqing's Liangjiang to launch the Danaher Western Innovation Center to boost medical innovation in the Chengdu-Chongqing region.

- November 2022: Thermo Fisher announced the opening of a new manufacturing site in China.

- November 2018: bioMérieux SA completed the acquisition of a majority holding in Suzhou Hybiome Biomedical Engineering Co. Ltd. With the acquisition, bioMérieux aims to strengthen its presence in China and the immunoassay market.

- July 2015: DiaSorin S.p.A. and Beckman Coulter Diagnostics announced a distribution partnership agreement for the commercialization of infectious disease tests in China to target the larger hospitals in the country.

REPORT COVERAGE

The report focuses on market analysis and forecast, highlighting key aspects, such as leading players, product types, technologies, pathogens, and end users. It also provides insights into the market dynamics, prevalence of sepsis in China, regulatory scenario, product launches, industry developments, and technological advancements. Additionally, the impact of COVID-19 has also been highlighted in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 13% from 2024-2032 |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Pathogen

|

|

|

By End User

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 21.1 million in 2023 and is projected to reach USD 63 million by 2032.

The market is expected to exhibit a CAGR of 13% during the forecast period of 2024-2032.

By technology, the immunoassays segment led the market in 2023.

The key driving factors include growing sepsis prevalence, rising awareness, and adoption of point-of-care sepsis diagnostic products.

Increasing adoption of point-of-care sepsis diagnostics products is the key trend in the market.

Shenzhen Mindray Bio-Medical Electronics Co., Ltd., bioMérieux, Inc. and Abbott are the prominent players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us