Chromatic Confocal Sensors Market Size, Share & Industry Analysis, By Product (Point Chromatic Confocal Sensors and Line Chromatic Confocal Sensors), By Application (Semiconductor, 3C Electronics, Glass Industry, Precision Machine Parts, Battery, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

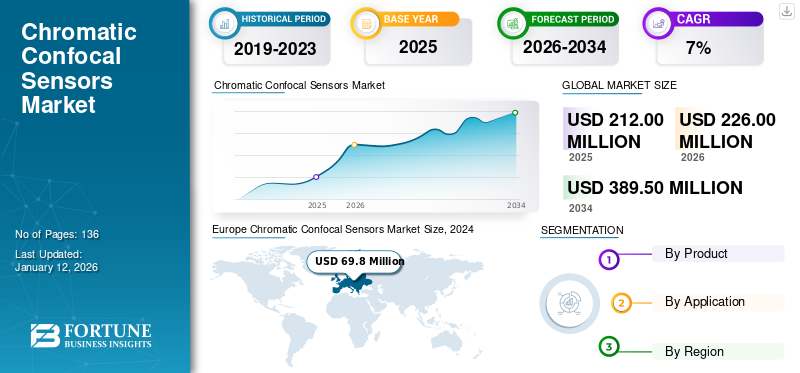

The global chromatic confocal sensors market size is valued at USD 199.1 million in 2024 and is projected to grow from USD 212.0 million in 2025 to USD 343.1 million by 2032, exhibiting a CAGR of 7.1% during the forecast period. Europe dominated the global chromatic confocal sensors market with a share of 35.06% in 2024.

Chromatic confocal sensors are advanced optical measurement devices used for non-contact surface measurement, inspection, and profilometry. They utilize the principles of confocal microscopy and chromatic aberration to precisely measure the distance to a surface and capture detailed surface profiles with high resolution. Industry 4.0 emphasizes the importance of flexibility and adaptability in manufacturing processes to meet the changing market demands and customer preferences.

Chromatic confocal sensors allow high precision and accurate measurement of surface profiles and find applications across various industries, including automotive, aerospace, medical devices, and semiconductors. Several sectors are recording a rising demand for the precise measurement of surface roughness, shape, and thickness for inspection and control processes, generating a solid market demand.

Precision measurement is essential across various industries to ensure quality control, improve manufacturing processes, and meet regulatory standards. In addition, these sensors enable manufacturers to inspect components, surfaces, and assemblies with accuracy. These sensors are crucial in addressing the need for high-accuracy and non-contract measurement solutions. Many industries prefer non-contact and non-destructive testing methods to inspect and measure components without causing any damage to the continuous part. Furthermore, several benefits, such as non-contact, high-precision measurements, make them ideal for non-destructive testing applications.

Increasing demand for industrial automation and artificial intelligence is further propelling the market growth that offers high-resolution measurements, enhancing product quality and minimizing defects across diverse industry applications. Sensors demanded in the manufacturing environment are required to perform high-speed measurements and offer precise results in order to obtain reliable quality products. The continuous feedback from machines and robots that produce parts, as well as the status of their components, is required to control production processes on production lines. In these applications, distance measurement sensors play a crucial role in positively impacting the growth of chromatic confocal sensors market share.

Several prominent market participants are offering innovative technology-based high-quality sensors and comprehensive metrology solutions to a diverse range of industries. The companies are focusing on penetrating the market through new product launches and creating strong brand awareness at trade shows and exhibitions. High-precision product launches specific to industries might further boost the market sales of the companies.

The COVID-19 pandemic had a relatively low impact on the market owing to supply chain disruptions and global impact on industrial facilities. However, the market is anticipated to experience steady growth during the forecast period.

Download Free sample to learn more about this report.

Chromatic Confocal Sensors Market Trends

Real-Time Monitoring Applications are Influencing the Demand for Miniaturized Chromatic Confocal Sensors

Advancements in industries, adoption of automation, increased connectivity, and data-driven decision-making are all responsible for solid market demand. Integrated smart solutions in manufacturing environments are seamlessly propelling the industry growth, enabling real-time monitoring and control of manufacturing processes, contributing to increased quality, productivity, and efficiency. Manufacturers are developing compact, lightweight sensors with enhanced performance characteristics to meet the evolving needs of industries such as microelectronics, MEMS (Micro-Electro-Mechanical Systems), and biomedical engineering, propelling a notable trend toward miniaturization and customization in chromatic confocal sensor design.

Rising growth toward data-driven metrology solutions is driving innovation in the chromatic confocal sensors market and enabling manufacturers to stay ahead in an increasingly competitive landscape. The trend toward miniaturization in electronics and the growing complexity of microengineering applications require measurement tools capable of analyzing small-scale features with high precision. Chromatic confocal sensors offer sub-micron level accuracy and high spatial resolution, making them well-suited for measuring microstructures, MEMS devices, electronic components, and other miniature features.

Chromatic Confocal Sensors Market Growth Factors

Changing Industry Practices and Growth toward Automation to Boost Market Growth

Due to rising automation and the adoption of Industry 4.0 principles, there is an increasing demand for advanced sensing technologies that can seamlessly integrate into automated production lines. Chromatic confocal sensors are designed to be robust and reliable, minimizing downtime and maintenance requirements in automated production environments. Their non-contact measurement method resulted in longer service life and reduced maintenance costs compared to traditional contact-based measurement tools. This reliability is particularly beneficial in high-volume manufacturing settings where uptime is critical.

In automated production environments, these sensors can provide real-time feedback to control systems, enabling precise adjustments and ensuring consistent product quality. Manufacturers can improve efficiency and productivity by incorporating confocal sensors into automated production lines.

RESTRAINING FACTORS

Low Adoption Rate and High Capital Investment across Developing Regions May Create Challenges for Market Expansion

Chromatic confocal sensors often have a higher initial investment than traditional measurement techniques. In developing regions where cost-consciousness is prevalent, this higher upfront cost may be a barrier to adoption. This cost range differs from industry to industry and depends on the application across various industries. Such costs are not bearable by Small and Medium-Scale Enterprises (SMEs), which limits the growth of the global market. With a clear understanding of the long-term benefits and return on investment, businesses may be able to invest in these advanced measurement technologies. The sensors often involve significant upfront investment costs, including the purchase of specialized equipment and the implementation of supporting infrastructure. For some businesses, especially Small and Medium-Sized Enterprises (SMEs), the initial capital outlay may be prohibitive, leading to reluctance to adopt these sensors.

Chromatic Confocal Sensors Market Segmentation Analysis

By Product Analysis

Point Confocal Sensors Demand to Rise Driven by Benefit of High-Resolution Measurements

Based on product, the market is categorized into point chromatic confocal sensors and line chromatic confocal sensors.

The point confocal sensors segment is estimated to dominate the market throughout the forecast period. Technological advancements across industrial manufacturing are generating a high demand for cost-effective dimensional measuring equipment surging point chromatic confocal sensors market growth. These types of confocal sensors offer several benefits, such as non-contact and high-resolution measurements with rising adoption in inspection, quality control, and measurement applications. Point confocal sensors primarily find their application in several end-use industries such as semiconductor, automotive, and electronics manufacturing. Owing to these factors, the segment is slated to showcase the highest growth rate during the forecast period.

The line confocal sensors segment is anticipated to experience steady growth during the forecast period as they provide accurate and reliable dimensional measurements. Industry-wide demand for high-precision measurement solutions is further expected to boost the market for line confocal sensors.

By Application

To know how our report can help streamline your business, Speak to Analyst

Semiconductor Segment to Lead Owing to Product Assistance in the Quality Inspection of Microstructures

Based on application, the market is classified into semiconductor, 3C electronics, glass industry, precision machine parts, battery, and others (plastics and medical).

The semiconductor segment dominates the market. The sensors find applications across various industries, such as electronics and semiconductor manufacturing, for quality control, dimensional analysis, surface profiling, and defect detection. Semiconductor manufacturing is showcasing significant double-digit growth across diverse regions. According to the Worldwide Semiconductor Industry Association, the semiconductor industry has experienced a year-on-year growth of 16.3% in February 2024 as compared to February 2023.

Moreover, with the increasing emphasis on non-contact measurement solutions to avoid surface damage and contamination, chromatic confocal sensors are gaining traction due to their non-contact measurement principle. They offer precise measurement capabilities without physically touching the object, making them suitable for delicate and sensitive surfaces. Confocal sensors find their application in micro-structuring electronic components in the semiconductor industry, experiencing the highest growth over the forecast period. The manufacturing process of semiconductor and electronic devices is complex and requires advanced measurement solutions such as chromatic confocal sensors. It reduces the complexity of manufacturing and increases the accuracy of the manufacturing process.

Increasing high-precision geometric measurement and the high demand for innovative confocal sensors provide real-time measurement of thickness, roundness, planarity, and wall strength. According to industry experts, the global electronics industry market revenue stood at USD 2,494.0 billion in 2021 and is anticipated to reach USD 3,168.0 billion by 2026, having a CAGR of 4.9% from 2021 to 2026.

Applications such as 3C electronics, precision machine parts, batteries and glass are demanding superior product quality by monitoring several parameters with the help of innovative sensors. Emphasis on non-contact measurement solutions across several industrial applications, such as the glass industry, precision machine parts, and battery is propelling the chromatic confocal sensors market growth.

REGIONAL INSIGHTS

Based on region, the market is further segmented into North America, Europe, Asia Pacific, South America, and the Middle East and Africa.

Europe Chromatic Confocal Sensors Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe dominates the market for confocal sensors and accounts for over one-third of the market revenue share, followed by Asia Pacific and North America.

Europe is embracing Industry 4.0 principles and smart manufacturing technologies to enhance productivity, efficiency, and competitiveness. Confocal sensors are integrated into digital manufacturing platforms, robotics systems, and automated production lines for real-time quality control, process monitoring, and adaptive manufacturing. Furthermore, integration with Industry 4.0 enables data-driven decision-making, predictive maintenance, and optimization of production processes. These factors are driving the adoption of chromatic confocal sensors in smart factories across Europe.

The regional market expansion is fueled by technological innovation, industrial automation, compliance with quality standards, adoption in medical and life sciences, and partnerships. As industries continue to evolve and embrace advanced optical measurement technologies, the demand is expected to grow, driven by innovation in the region.

Precise industrial application ensures high product quality and minimizes the risk of damaging sensitive materials, making it the preferred choice for end users. These sensors enable researchers and healthcare professionals to perform detailed 3D imaging, cell morphology analysis, and surface characterization for applications such as cancer research, regenerative medicine, and drug development. The growing demand for advanced imaging solutions drives the adoption of chromatic confocal sensors in medical and life sciences applications across Europe.

Asia Pacific is home to a rapidly growing manufacturing sector, encompassing industries such as automotive, electronics, semiconductor, aerospace, and medical devices. Chromatic confocal sensors are increasingly being adopted in these industries for applications such as quality control, dimensional analysis, surface profiling, and defect detection. The expansion of manufacturing facilities and the need for high-precision measurement solutions to ensure product quality and process efficiency drive the demand for chromatic confocal sensors in the region.

North America hosts numerous research institutions, universities, and technology companies engaged in cutting-edge research and development across various disciplines. Chromatic confocal sensors are utilized in research laboratories and academic institutions for material science, biomedical engineering, microelectronics, and nanotechnology research. They enable researchers to perform detailed surface characterization, 3D imaging, and non-destructive testing for a wide range of applications.

The Middle East & Africa and South America markets are anticipated to experience steady growth over the forecast period. This can be attributed to rising investments in research and development and diverse applications across industries, including biotechnology, automotive, electronics, and optics.

KEY INDUSTRY PLAYERS

Key Players Undertake New Product Launches and Investment Initiatives to Strengthen Market Presence

Key players in the market are focusing on penetrating across diverse industry applications. The market's competitive dynamics are driven by factors such as technological advancements, product performance, industry expertise, and customer satisfaction. These key players continue to push the boundaries of innovation, driving growth and shaping the future of the chromatic confocal sensor industry.

Key market participants are leveraging their extensive experience and technological capabilities that offer advanced sensing solutions to a wide range of industries. Market players are diversifying their product portfolio through new product launches. High-precision product launches specific to industries might further boost the sales of the companies.

Continuous advancements in chromatic confocal sensor technology are driving improved performance, accuracy, and reliability. Manufacturers are focusing on enhancing sensor resolution, measurement speed, and software capabilities to meet the evolving demands of industrial applications and enable new use cases. These confocal sensors are finding applications beyond traditional manufacturing industries. They are being used in research and development, materials science, biomedical engineering, and cultural heritage preservation for diverse measurement and analysis tasks.

List of Top Chromatic Confocal Sensors Companies:

- OMRON Corporation (Japan)

- Dongguan Pomeas Precision Instrument Co., Ltd. (China)

- Hypersen Technologies Co., Ltd. (China)

- Keyence Corporation (Japan)

- MICRO-EPSILON MESSTECHNIK GmbH & Co. KG (U.S.)

- Precitec GmbH & Co. KG (Germany)

- Schmitt Industries. Inc (U.S.)

- Shenzhen Light E-Technology Co., Ltd. (China)

- SICK AG (Germany)

- TKH Group (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Micro-Epsilon expanded its confocal chromatic sensors by adding a new precision sensor confocalDT IFS2407-1.5 explicitly designed for curved and structured surfaces.

- January 2024: Hypersen Technologies Inc., developed a new confocal chromatic sensor model, HPS-CFL043, with ultra-high limit resolution and high-speed precision measuring for a wide range of industries, including the semiconductor, electronics, and battery manufacturing sector.

- November 2022: Hypersen launched its new 3D line confocal sensor named HPS-LCX1000 for measurement and inspection in several end-use sectors, such as semiconductor, electronic components, metal, automotive, and aerospace.

- October 2021: Micro-Epsilon introduced three new models of high-speed and precision measurement sensors with a measuring range of 0.8mm. The IFS2407-0.8 is a new chromatic confocal sensor introduced for varied fields of application.

- August 2020: Pomeas Group inaugurated a new company headquarters and research and development base in China. The new research and development center would benefit the company through new product launches.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. These include growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2019 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019 – 2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025 – 2032 |

|

Historical Period |

2019 – 2023 |

|

Growth Rate |

CAGR of 7.1% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size stood at USD 199.1 million in 2024.

Fortune Business Insights says that the market will reach USD 343.1 million by 2032.

Growing at a CAGR of 7.1%, the market will exhibit strong growth during the forecast period.

Increasing automation and the adoption of Industry 4.0 practices are the key factors driving the market growth.

Keyence Corporation, Micro-Epsilon, SICK AG, and Omron Corporation are a few of the top players in the market.

Europe accounts for the highest market share, followed by Asia Pacific and North America owing to rising product application across various industries.

Based on product, the point confocal sensors segment is projected to record the highest CAGR over the forecast period.

By application, the semiconductor segment holds the highest market share.

The rising demand for miniaturized confocal sensors owing to benefits such as real-time monitoring is a critical trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us