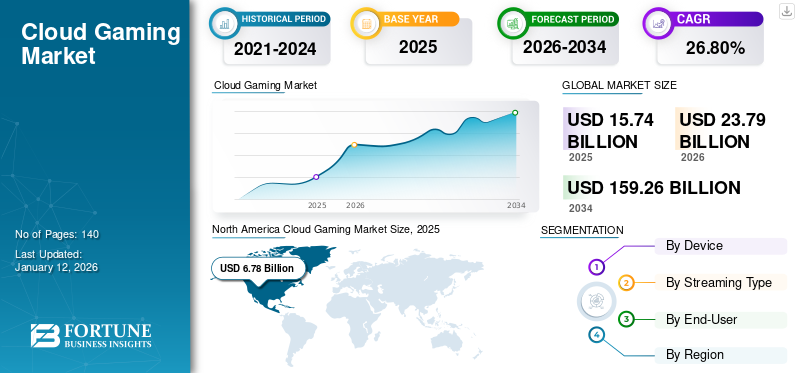

Cloud Gaming Market Size, Share & Industry Analysis, By Device (Smartphone, Laptop/Tablets, Personal Computer, Smart TV, and Consoles), By Streaming Type (Video Streaming and File Streaming), By End-User (Casual Gamers, Avid Gamers, and Hardcore Gamers), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cloud gaming market size was valued at USD 15.74 billion in 2025. The market is projected to grow from USD 23.79 billion in 2026 to USD 159.26 billion by 2034, exhibiting a CAGR of 26.80% during the forecast period. North America dominated the global market with a share of 43% in 2025. Additionally, the U.S. cloud gaming market is predicted to grow significantly, reaching an estimated value of USD 3.44 billion by 2032.

Cloud gaming is anticipated to be the future of the gaming industry. The cloud service plays a key role in delivering a smooth gaming experience to customers' entire devices without additional hardware configuration. The growing desire for a low-latency, inventive, and immersive gaming experience will fuel the market growth rate. Gamers may play games directly via an external cloud server without having to download the complete game. They can play these games on any device type, lowering the cost of storage space and hardware setup. For instance,

- In August 2021, Microsoft Corporation launched a gaming service on Xbox Consoles. The company aims to expand the offering to consoles such as Xbox Series S, Xbox Series X, and Xbox One machines. Similarly, according to a report by Snapt Inc. in July 2021, the market trends may reach a point where the cost of administering an ever-larger network makes expanding into new territories and reaching new audiences unprofitable.

The COVID-19 pandemic significantly impacted manufacturing and supply chain businesses. Manufacturing units had temporary shutdowns or working with half operating capacity, supply chain interruptions, material shortages, and international border closures. However, due to lockdown restrictions across regions, cloud-based gaming devices, services, and solutions saw a surge in demand during the pandemic. The demand for cloud-based games increased as they do not require additional hardware and can be played on any device.

Cloud Gaming Market Trends

Rising Mobile Cloud Gaming Trend Likely to Boost Market Growth

The rising mobile cloud gaming is poised to augment the cloud gaming market significantly. Mobile cloud gaming involves the streaming of high-fidelity gaming content directly to mobile devices, facilitated by cloud-based infrastructure, low-latency streaming protocols, and robust data center networks. This trend prevents the need for powerful local hardware, enabling users to access and play resource-intensive games on smartphones and tablets with minimal latency and without extensive downloads.

Moreover, the proliferation of subscription-based gaming platforms and the availability of vast game libraries on the cloud further drive the adoption of mobile cloud gaming, offering gamers unparalleled convenience and flexibility in their gaming experiences. Examples include services such as Google Stadia, Microsoft xCloud, and NVIDIA GeForce Now, which allow users to stream console-quality games on mobile devices with minimal latency. This trend offers unparalleled convenience and accessibility, driving increased adoption and expansion of the cloud gaming ecosystem.

According to the survey conducted by Ericsson, there are around 2.4 billion mobile gamers globally. As a result, the growing trend for cloud-based mobile gaming is expected to boost the market.

Download Free sample to learn more about this report.

Cloud Gaming Market Growth Factors

5G Technology’s Low-latency Capability to Drive the Cloud Gaming Market Growth

Market players such as Ericsson, Fibocom, and Verizon are attempting to reduce technological barriers and related high costs to attract all gamer types existing globally. It is critical to achieve low latency in gaming services to give an immersive and unique gaming experience. With its low-latency capability, 5G technology provides additional assistance to providers. Cloud-based gaming is being reinvented to provide a better gaming experience with the launch of 5G. As a result, the low-latency capabilities of 5G technology are expected to drive the market growth even further.

Similarly, key market players and telecom providers are forming alliances and collaborations to give gamers a 5G gaming experience. For instance, in 2021, S K Telecom and SingTel worked together to entice gamers using technologies such as multi-access edge computing (MEC) and 5G. According to a May 2022 report by VentureBeat, Activision Blizzard beat analyst earnings projections by 50%, owing to the mobile version of its Call of Duty game.

RESTRAINING FACTORS

Latency and Responsiveness Issues to Hinder Market Potential

Streaming games on a cloud platform need a low latency network with high bitrates and adequate bandwidth. However, the expense of establishing a connection to the internet with the required performance may be too expensive in some countries. Latency and responsiveness can be an issue if the appropriate network and bandwidth requirements are not satisfied. However, as telecom companies begin to deliver high-speed connectivity and key organizations, such as Microsoft Corporation and Google LLC, invest in data servers, market growth could be revived.

Cloud Gaming Market Segmentation Analysis

By Device Analysis

Smartphone Segment to Grow Rapidly Backed by Investment in 5G Technology

Based on devices, the market is categorized into smartphones, laptops/tablets, personal computers (PCs), smart TVs, and consoles. The laptop/tablets and personal computer segments are expected to lead the market during the forecast period. Early adoption of gaming laptops and PCs and the availability of high-end computers are encouraging the acceptance of innovative games. The laptop/tablets segment is projected to dominate the market with a share of 32.14% in 2026.

However, the increased availability of low-cost internet subscriptions and investments in 5G technology is likely to increase the possibilities for gaming on smartphones and smart TVs. The growing use of smartphones is expected to improve the potential of cloud-based gaming solutions. As a result, the smartphone and smart TV segments are expected to increase rapidly throughout the projection period.

By Streaming Type Analysis

Minimum Requirement of Hardware to Propel the Video Streaming Segment

Based on streaming type, the market is bifurcated into video streaming and file streaming. The file streaming segment is expected to lead the market due to its capability to download a small portion of the file. As a result, gamers give game file patches and assist the developer in lowering the cost of developing media material. The file streaming segment is expected to lead the market, contributing 52.54% globally in 2026.

The video streaming segment is expected to increase rapidly throughout the cloud gaming forecast period as it can be played on any device without requiring any technology. It has also significantly decreased the latency issue for cloud gamers. In addition, several players, including Shadow, GeForce Now, Vortex, LiquidSky, and others, enable video games.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

High-Quality Streaming Games to Boost the Hardcore Gamers Segment

By end-users, the market is segmented into casual gamers, avid gamers, and hardcore gamers. Due to increased investment in advanced and creative gaming solutions, the hardcore gamers segment is expected to rise rapidly throughout the projection period. Market participants are heavily investing in rich media content to provide high-quality streaming games on devices such as smart TVs, laptop computers, smartphones, and others. Hardcore gamers are expected to increase the use of cloud-based gaming solutions, which is further anticipated to drive the market's growth in the near future. The casual games segment is expected to account for 41.47% of the market in 2026.

The casual gamers segment is likely to lead the market during the projected period. The increased efficiency of internet facilities and the widespread availability of smartphones are expected to fuel the demand in the casual gaming market. Similarly, 5G and low-cost cloud-based technologies will promote the gaming trend among the avid gamers segment.

REGIONAL INSIGHTS

Geographically, this market is fragmented into five major regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. They are further categorized into countries.

North America

North America Cloud Gaming Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is anticipated to gain considerable market share. Early acceptance of cloud technology, rising demand for online gaming, and widespread availability of efficient internet infrastructure are projected to boost market expansion in North America. The U.S. market is expected to reach USD 8.24 billion by 2026.

Europe

The expanding gaming sector in Europe is projected to enhance the region's cloud gaming business. This expansion propels the massive collaboration, investment, and acquisition in the Europe gaming sector. For instance, in March 2021, the European Commission approved Microsoft Corporation's acquisition of ZeniMax Media, a game developer and publisher. The UK market is anticipated to reach USD 2.15 billion by 2026, while the Germany market is estimated to reach USD 1.54 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is likely to dominate the market. The region's growth is driven by rising demand for gaming content from Japan, India, China, and South Korea. Also, the increased smartphone penetration in these nations is likely to drive the worldwide gaming industry. Owing to increased telecom and 5G infrastructure investments, China is expected to lead the market throughout the forecast period. Japan will see quick growth throughout the predicted period due to the existence of key market participants in cloud gaming. The Japan market is forecast to reach USD 1.16 billion by 2026, the China market is set to reach USD 1.78 billion by 2026, and the India market is poised to reach USD 0.6 billion by 2026.

Rest of The World

Latin America and the Middle East & Africa are anticipated to grow. The growing popularity of smartphones is likely to fuel the potential for cloud-based gaming in Latin America. Similarly, increased investment by major market players in the MEA region will surge the demand for gaming. For instance, in June 2020, Blacknut introduced its cloud-based 400 family-friendly premium games in Israel with collaboration with Partner TV.

Key Industry Players

Key Players are Entering into Strategic Partnerships to Expand Business Potential

Prominent key market players of cloud gaming collaborate with several other gaming platform providers to build and utilize the platform to reach out to more target customers. These players work together to provide users with high-performance cloud-based games. In addition, several major players are investing in developing new and unique games to increase their portfolios. Also, players focus on the worldwide market by simultaneously launching new games in all countries, owing to cloud-based deployment.

- February 2023 – Xsolla, a U.S.-based video game commerce company, is ready to launch a new venture of tools to bring game developers into the world of cloud gaming and also help developers monetize from the game.

- September 2021 – NVIDIA Corporation collaborated with Electronic Arts Inc. to expand the game portfolio on GeForce NOW's gaming platform. Through this partnership, Electronic Arts brought its hit games to NVIDIA’s GeForce NOW. The company added games such as Mirror's Edge Catalyst, Battlefield 1 Revolution, Dragon Age: Inquisition and Apex Legends, and Unravel Two to the NVIDIA gaming service.

- April 2021 – Blacknut partnered with the communications and entertainment group NOS to provide the gaming experience with 5G across Portugal. The collaboration aims to offer 500+ games to play over the 5G network. After the launch of 5G technology, NOS delivered Backnut’s gaming service directly to customers.

List of Top Cloud Gaming Companies:

- Google Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Amazon Inc. (U.S.)

- Tencent (China)

- Sony Corporation (Japan)

- Electronic Arts, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- Broadmedia Corporation (Japan)

- Intel Corporation (U.S.)

- Blacknut (France)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - Meta's VR headsets support Xbox Cloud Gaming, with a beta version of the app available for Meta Quest 2, 3, or Pro. Users can stream numerous Xbox games via an Xbox Game Pass Ultimate subscription, a Bluetooth controller, and a Quest headset. The beta app is accessible from the Meta Quest Store, and various Bluetooth controllers, including Xbox, PS4, and Switch Pro, are compatible. Support for PS5 controllers is expected in the future.

- October 2023 - Samsung Electronics Co., a leading smartphone manufacturer, introduced a cloud gaming service for mobile devices. This initiative aims to explore new revenue streams from its vast user base of 1 billion Galaxy users, given the sluggish growth in global mobile phone sales.

- October 2023 - Netflix trialled its cloud gaming service in the U.S., enabling members to play games on TV-connected devices and smart TVs using their smartphones as controllers. This beta phase, similar to previous tests in Canada and the U.K., offers a limited game selection and requires downloading a dedicated controller app.

- March 2023 - Ubitus K.K. entered into a partnership with Google, Inc. to bring advancement in the development of cloud-based game streaming. In contrast, Google Cloud is chosen as a cloud provider for Ubitus' GameCloud solution.

- March 2023 – Microsoft Corporation partnered with Boosteroid, a cloud gaming platform provider, to involve more gamers worldwide and aims to develop gaming operations in Ukraine and Russia.

- January 2023 - Ubitus K.K, a Japan-based cloud gaming provider, collaborated with JioGames to enhance the cloud gaming platform on 5G in India and help to improve the performance of cloud gaming in the local gaming market.

- October 2021 – NVIDIA Corporation launched an advanced gaming platform on GeForce NOW, GeForce RTX 3080. The GeForce RTX 3080 subscription offers gamers the fastest frame rates, high resolutions, and lowest latency.

- September 2021 – Amazon Web Services, Inc., expanded its service offerings with the launch of a family-oriented subscription plan. Through these new updates, users get 36 child-friendly games such as Wandersong, Overcooked, Adventure Pals, and Spongebob Squarepants for an extra USD 2.99 per month to Luna+.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, it provides insights into the latest industry trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 26.8% from 2026 to 2034 |

|

Segmentation |

By Device

By Streaming Type

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 159.26 billion by 2034.

In 2025, the market stood at USD 15.74 billion.

The market is projected to grow at a CAGR of 26.8% over the forecast period (2026-2034).

The casual gamer end-user segment is likely to lead the market.

5G technologys low-latency capability is the key factor driving the market growth.

Microsoft Corporation, NVIDIA Corporation, Ubitus Inc., Vortex, Google Inc., Amazon Inc., and Intel Corporation are the top players in the market.

North America is expected to hold the highest market with a share of 43% in 2025.

The smartphone segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us