Commercial Cooking Equipment Market Size, Share & Industry Analysis, By Type (Ovens, Cooktops and Ranges, Grills, Fryers, Cook-chill Systems, Broilers, Steamers, and Others), By Application (Full-Service Restaurants, Quick-Service Restaurants, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

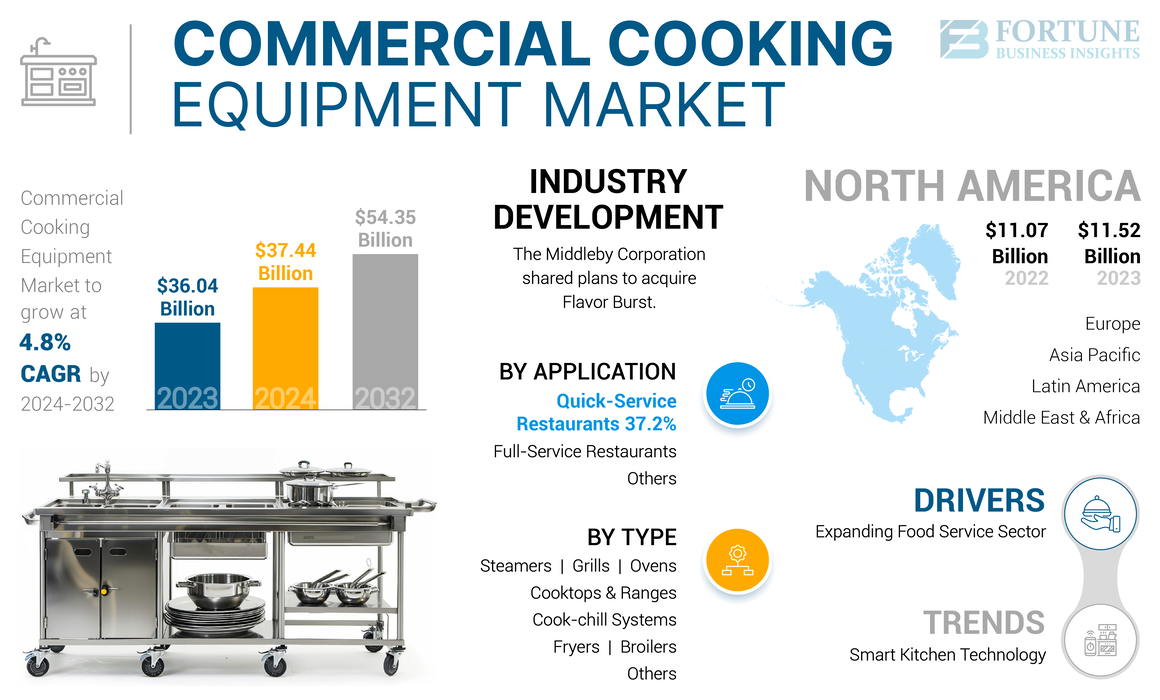

The global commercial cooking equipment market size was valued at USD 39.01 billion in 2025 and is projected to grow from USD 40.73 billion in 2026 to USD 60.48 billion by 2034, exhibiting a CAGR of 5.10% during the forecast period. The North America dominated the market with a market share of 32.20% in 2025. The market growth is driven by the rising demand for energy-efficient and technologically advanced cooking appliances in commercial kitchens. Additionally, the growing trend of dining out and the expansion of the food service industry, especially in emerging economies, are propelling the market growth.

This market encompasses a wide range of products, including ovens, grills, fryers, cooktops, and steamers, which are essential for food service establishments such as restaurants, hotels, and catering services. Innovations in cooking technologies, such as smart kitchen appliances and multifunctional equipment, are enhancing efficiency and productivity, thereby attracting more investments from industry players.

Environmental sustainability and health considerations are also influencing the commercial cooking equipment market. Manufacturers are increasingly focusing on developing eco-friendly appliances that reduce energy consumption and minimize emissions, aligning with global efforts to combat climate change. Furthermore, the adoption of equipment that supports healthier cooking methods, such as air fryers and steam ovens, is gaining traction. The market is also witnessing a shift toward modular and compact cooking equipment, catering to the rising number of small and medium-sized food service operations. Overall, the global commercial cooking appliances market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and a strong emphasis on sustainability.

The COVID-19 pandemic had a significant impact on the commercial kitchen equipment market. The disruptions in supply chains, temporary shutdowns of manufacturing facilities, and reduced demand from the foodservice industry due to lockdowns and restrictions led to a decline in market growth. However, the market showed resilience as businesses increased their investments in advanced cooking technologies and contactless equipment to ensure safety and efficiency. The shift toward home delivery and takeout services also spurred the demand for specific types of cooking equipment tailored for these operations

Commercial Cooking Equipment Market Trends

Smart Kitchen Technology is a Significant Trend in the Global Market

Smart kitchen technology is revolutionizing the global market for commercial cooking equipment through the integration of advanced digital capabilities such as the Internet of Things (IoT) and Artificial Intelligence (AI) into everyday kitchen appliances. These technologies enable remote monitoring and control of equipment, allowing kitchen managers to oversee operations from anywhere, enhancing efficiency and convenience. Smart appliances can provide real-time data on performance, energy consumption, and maintenance needs, allowing for predictive maintenance that minimizes downtime and extends the lifespan of the equipment. This results in significant cost savings and operational efficiencies for food service establishments.

Moreover, smart kitchen technology enhances food safety and quality. With precise control and monitoring, smart appliances ensure consistent cooking results and reduce the risk of human error. Features such as automated cooking processes, recipe storage, and programmable settings allow chefs to maintain high standards even during peak hours. The ability to integrate and streamline various kitchen operations through a central system also facilitates better inventory management and reduces waste. As the demand for efficient, reliable, and technologically advanced kitchen solutions grows, the adoption of smart kitchen technology is becoming a prominent trend in the commercial kitchen equipment market growth.

Download Free sample to learn more about this report.

Commercial Cooking Equipment Market Growth Factors

Expanding Food Service Industry to Drive the Market Growth

The growth of the food service industry is a significant driver of the global commercial kitchen equipment market due to several interconnected factors. Firstly, as more people dine out frequently, there is an increased demand for diverse dining options, leading to the proliferation of new restaurants, cafes, and food trucks. This expansion necessitates the purchase of commercial kitchen equipment to establish and efficiently run these new food service establishments.

Additionally, established restaurants and hotel chains are continually upgrading their kitchens to enhance operational efficiency and meet the rising expectations of consumers for high-quality food and quick service. The catering and hospitality industry are also growing, fueled by events, corporate functions, and the tourism industry, all of which require advanced and reliable kitchen equipment. This constant need to equip or upgrade kitchens with the latest technology to stay competitive directly boosts the demand for commercial cooking equipment, driving the global market growth.

RESTRAINING FACTORS

High Initial Investment and Maintenance Costs to Hamper Market Growth

High initial investments and maintenance costs are significant restraints in the global commercial cooking appliances market, primarily due to the substantial financial outlay required to acquire advanced and modern equipment. State-of-the-art commercial cooking equipment, especially those featuring smart technology and energy-efficient components, come with a high price tag. This can be a considerable barrier for small and medium-sized food service businesses that may not have the capital resources to invest in such expensive equipment. The cost factor can deter new entrants and slow down the expansion plans of existing players in the food service industry.

Additionally, the maintenance and repair costs associated with high-tech commercial cooking equipment can be substantial. Advanced appliances often require specialized parts and expertise for repairs, leading to higher service costs. Regular maintenance is necessary to ensure the longevity and efficient operation of these appliances, adding to the overall operational expenses. For many food service establishments, these ongoing costs can strain budgets, making it challenging to maintain profitability. Consequently, the high initial investment and maintenance costs pose a significant restraint on the widespread adoption and growth of the global market.

Commercial Cooking Equipment Market Segmentation Analysis

By Type Analysis

Ovens Segment to Dominate the Global Market Due to Their Versatility

Based on type, the market is divided into cooktops and ranges, ovens, grills, broilers, fryers, cook-chill systems, steamers, and others.

The ovens segment holds the highest commercial cooking equipment market share and is set to expand at the highest CAGR over the forecast period due to their versatility and essential role in various cooking applications. They are indispensable in commercial kitchens for baking, roasting, and even grilling, catering to diverse menu requirements.with a share of 29.32% in 2026

The cooktops and ranges segment also holds a substantial market share. The equipment plays a crucial in direct heat cooking methods, such as sautéing and boiling. They are favored for their flexibility and ability to accommodate various cooking techniques, which makes them essential in most commercial kitchens.

Grills are popular for their ability to impart unique flavors and textures to food. They are widely used in restaurants, particularly those specializing in barbecue and grilled dishes, contributing to their steady demand.

Fryers are vital for preparing fried foods, a staple in many fast-food and casual dining establishments. The increasing popularity of fried snacks and appetizers drives the demand for commercial fryers.

Cook-chill systems are integral to large-scale food service operations, such as hospitals and catering services, for their efficiency in preserving food quality and extending shelf life. Their usage ensures consistency and safety in food preparation.

Broilers are essential for high-heat cooking methods, such as broiling and browning. They are commonly used in steakhouses and restaurants that require quick cooking and high-temperature food preparation.

Furthermore, steamers are preferred for healthy cooking methods that preserve nutrients and flavor. They are extensively used in health-conscious food service establishments and institutions, such as schools and hospitals.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Full-Service Restaurants Segment to Constitute Majority Share due to Higher Budget

On the basis of application, the market for commercial cooking equipment is subdivided into full-service restaurants, quick-service restaurants, and others.

The full-service restaurants (FSRs) segment holds the highest share in the global market due to the extensive and diverse culinary operations of these establishments. These settings typically offer a broad menu, requiring a wide range of cooking equipment, from ovens and grills to steamers and fryers. FSRs emphasize quality and presentation, necessitating sophisticated and versatile kitchen equipment to meet customer expectations for various cooking styles and cuisines. Additionally, the higher average spending per customer in full services restaurants allows these establishments to invest more in advanced and specialized cooking equipment.with a share of 50.21% in 2026

The quick-service restaurants (QSRs) segment is poised to exhibit the highest CAGR over the forecast period, driven by the increasing consumer preference for fast, convenient, and affordable dining options. QSRs require equipment that can handle high-volume cooking with speed and efficiency, making fryers, grills, and cooktops essential in their kitchens. The rising trend of fast food and casual dining, coupled with the expansion of QSR chains globally, fuels the rapid growth in the demand for commercial cooking appliances.

REGIONAL INSIGHTS

The market has been studied across five major regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South America.

North America Commercial Cooking Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America is a dominant region in the global market for commercial cooking equipment, driven by the well-established food service industry and the presence of major market players. The region has a high demand for advanced and energy-efficient cooking equipment due to stringent environmental regulations and a strong focus on sustainability. The U.S., in particular, contributes significantly to the market share, with a large number of full-service and quick-service restaurants continuously upgrading their kitchen equipment to enhance operational efficiency and meet consumer expectations.

The U.S. holds a significant share in the global market owing to the country's large and diverse food service industry. The high number of full-service and quick-service restaurants, along with the presence of major global market players, drives the demand for a wide range of commercial cooking equipment. Technological advancements and the adoption of smart kitchen appliances are prevalent trends in the U.S., enhancing operational efficiency and catering to consumer preferences for high-quality, diverse culinary experiences. Additionally, the focus on sustainability and energy efficiency in commercial kitchens is pushing the adoption of eco-friendly and energy-saving cooking equipment across the country.The U.S. market is projected to reach USD 9.2 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe holds a substantial share in the global market, fueled by the thriving hospitality and food service sectors. The region is characterized by a high demand for technologically advanced and eco-friendly cooking appliances owing to stringent energy efficiency standards and a growing emphasis on reducing carbon footprints. Countries such as Germany, France, and the U.K. are key contributors, with a significant number of upscale restaurants and catering services investing in modern kitchen equipment.The UK market is projected to reach USD 2.1 billion by 2026, while the Germany market is projected to reach USD 3.72 billion by 2026.

Asia Pacific

The Asia Pacific region is experiencing rapid growth in the commercial cooking appliances market, driven by increasing urbanization, rising disposable incomes, and a growing food service industry. Countries such as China, India, and Japan are major markets, with a high demand for both traditional and modern cooking equipment. The expanding quick-service restaurant chains and the proliferation of new food service outlets in urban areas are significant factors propelling the market growth in this region.The Japan market is projected to reach USD 1.16 billion by 2026, the China market is projected to reach USD 4.68 billion by 2026, and the India market is projected to reach USD 2.02 billion by 2026.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth, supported by the expanding tourism and hospitality sectors. Countries such as the UAE and Saudi Arabia are key markets, with significant investments in high-end hotels and restaurants driving the demand for advanced cooking equipment. The region's focus on enhancing food safety and hygiene standards is also contributing to the adoption of modern kitchen appliances.

South America

South America is emerging as a promising market for commercial cooking equipment, driven by the growing food service industry and increasing investments in the hospitality sector. Brazil and Argentina are major contributors, with a rising number of restaurants and food service establishments adopting advanced cooking equipment to cater to diverse culinary preferences. The trend toward modernization and improved efficiency in commercial kitchens is fueling market growth in this region.

KEY INDUSTRY PLAYERS

Key Manufacturers Offer Extensive Product Portfolio to Strengthen their Industry Foothold

The key players in the global market for commercial cooking equipment are characterized by their extensive product portfolios, which cater to a wide range of cooking needs, including ovens, ranges, fryers, and steamers. These companies are known for their strong focus on research and development, leading to continuous innovation and the introduction of advanced cooking technologies. They prioritize energy efficiency and sustainability, ensuring that their products meet modern environmental standards. Additionally, they offer robust customer support and after-sales services, enhancing their reputation and customer loyalty. Their global reach and strategic partnerships enable them to effectively penetrate various regional markets, maintaining a strong competitive edge.

List of Top Commercial Cooking Equipment Companies:

- The Middleby Corporation (U.S.)

- ITW Food Equipment (U.S.)

- Welbilt Inc (Ali Group) (U.S.)

- RATIONAL (Germany)

- Alto-Shaam, Inc. (U.S.)

- Henny Penny Corporation (U.S.)

- Duke Manufacturing Co. (U.S.)

- MKN Maschinenfabrik Kurt Neubauer GmbH & Co. KG (Germany)

- Electrolux Professional (Sweden)

- Garland Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: The Middleby Corporation announced the acquisition of Flavor Burst, an innovative technology company specializing in flavored beverage and soft serve products. Based in Danville, Indiana, Flavor Burst generates annual revenues of USD 5 million.

- February 2023: The Middleby Corporation announced the acquisition of Escher Mixers, a designer and manufacturer of advanced spiral and planetary mixers for the industrial baking industry.

- December 2022: Hillenbrand Inc. announced the completion of its acquisition of the Peerless Food Equipment division from Illinois Tool Works Inc. for approximately USD 59 million.

- July 2022: Ali Group successfully completed a USD 4.8 billion acquisition of Welbilt. This cross-border deal enhances Ali Group's position in the commercial foodservice equipment sector, combining Welbilt's strong market presence and innovative solutions with Ali Group's extensive portfolio and global reach. The acquisition is a strategic move aimed at expanding Ali Group's footprint and capabilities in the industry.

- November 2021: Tech24, backed by HCI Equity Partners, announced the acquisition of Commercial Kitchens, Inc. This takeover marks Tech24's sixth add-on in the fragmented foodservice repair market. Commercial Kitchens, based in Milford, Connecticut, provides repair services, preventative maintenance, and installation for foodservice equipment, primarily serving healthcare and educational institutions.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 60.48 billion by 2034.

In 2025, the market was valued at USD 39.01 billion.

The market is projected to grow at a CAGR of 5.10% during the forecast period.

By type, the ovens segment leads the global market in terms of share.

Growing food service industry is a key factor driving the global market.

The Middleby Corporation, ITW Food Equipment, Welbilt Inc (Ali Group), RATIONAL, Alto-Shaam, Inc., Henny Penny Corporation, Duke Manufacturing Co., MKN Maschinenfabrik Kurt Neubauer GmbH & Co. KG, Electrolux Professional, and Garland Group are some of the top players in the market.

North America holds the maximum market revenue.

The quick-service restaurants segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us