Commercial Drone Market Size, Industry Share & Industry Analysis By Weight (<2 Kg, 2 Kg - 25 Kg, and 25 Kg - 150 Kg), By System (Hardware (Airframe, Propulsion System, Payload, and Others) and Software), By Technology (Fully Autonomous, Semi-autonomous, and Remote Operated), By Application (Filming & Photography, Horticulture and Agriculture, Inspection and Maintenance, Mapping and Surveying, Surveillance & Monitoring, Delivery and Logistics, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

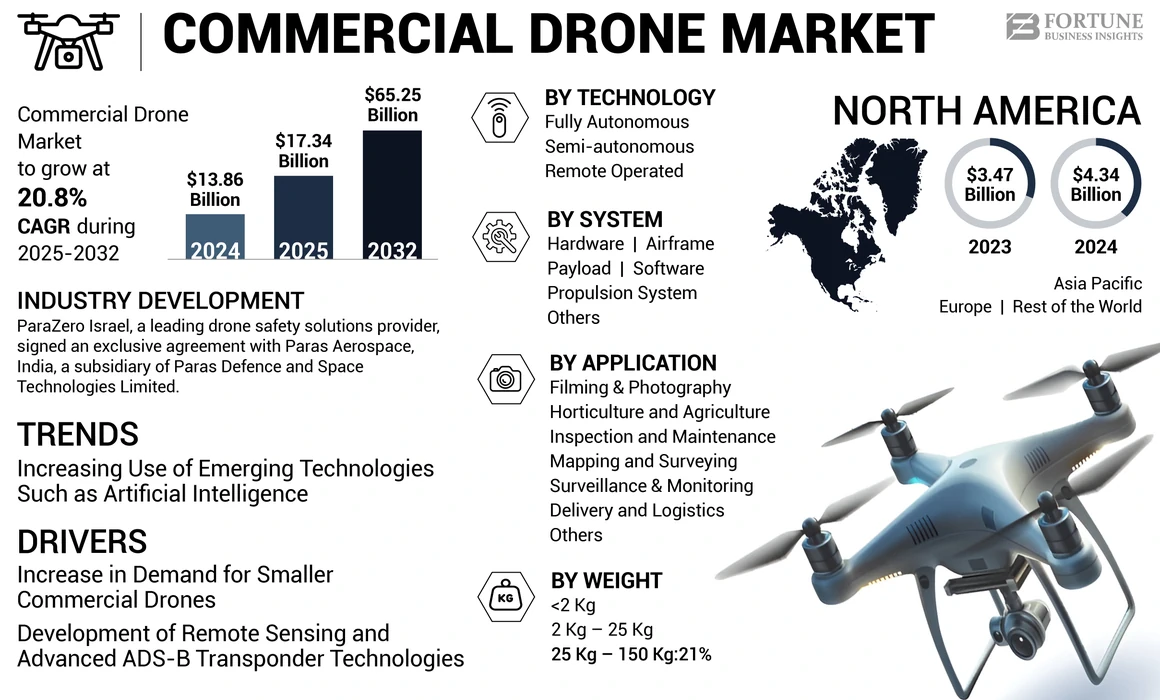

The global commercial drone market growth was valued at USD 13.86 billion in 2024 and is projected to grow from USD 17.34 billion in 2025 to USD 65.25 billion by 2032, exhibiting a CAGR of 20.8% during the forecast period. North America dominated the commercial drone market, accounting for 31.31% of the market share in 2024. Industry growth is driven by regulatory liberalization, demand for enterprise automation, adoption of aerial data analytics, infrastructure monitoring needs, and the expanding use of unmanned aerial systems across commercial sectors worldwide.

Moreover, the commercial drone market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 14.55 billion by 2030, driven by an increasing demand for commercial drones from media, agriculture, delivery, and inspection industries in the country.

The commercial drone market is transitioning from fragmented early adoption toward structured, enterprise-scale deployment across multiple industries. Commercial operators increasingly integrate unmanned aerial systems into core workflows for data acquisition, monitoring, and automated operations. This evolution reflects rising confidence in regulatory frameworks, maturing technology stacks, and demonstrable return on investment across use cases.

Commercial drone market size expansion is supported by growing demand from agriculture, infrastructure inspection, mapping, logistics, and public safety sectors. Enterprises deploy drones to improve operational visibility, reduce labor dependency, and enhance safety outcomes. Hardware sales remain significant, but value creation is progressively shifting toward software platforms, analytics, and service-based models.

Commercial drone market share remains moderately concentrated among a small group of global manufacturers with vertically integrated capabilities. However, ecosystem diversification is accelerating. Specialized payload developers, software providers, and service operators are capturing incremental value as drone deployments scale. This dynamic is reshaping competitive positioning across the value chain.

Commercial drone market trends indicate increasing adoption of autonomous and semi-autonomous flight capabilities. Advances in navigation, obstacle avoidance, and fleet management software enable beyond-visual-line-of-sight operations in approved jurisdictions. These capabilities expand addressable applications, particularly in logistics and infrastructure inspection.

A drone is a flying device, including a camera and a sensor. It is also known as an Unmanned Aerial Vehicle (UAV). Different industries are investing in commercial drone technology and paying close attention to expanding their awareness of commercial applications, which is expected to boost the business outlook. Numerous firms are investing in new start-ups through well-funded strategic techniques to address the need for commercial drone portfolios such as surveying, air taxis, logistics, surveillance, monitoring, and mapping.

The market growth is attributed to the growing demand for commercial drones for cargo and logistics operations. The global COVID-19 pandemic has enabled the market to witness a higher-than-anticipated demand across all regions compared to pre-pandemic levels. Based on our analysis, the global market exhibited a higher growth percentage in 2022 compared to 2030.

COVID-19 IMPACT

COVID-19 Pandemic Caused a Rise in Demand for Drone Applications

The market experienced a surge in demand as soon as the lockdown was imposed following the spread of COVID-19. The pandemic prompted government agencies to make strenuous efforts to improve hospital infrastructure, basic medical facilities, and health facilities worldwide, simultaneously limiting transportation and movement to avoid spreading the virus further. Recently, numerous industries worldwide have started using drones to perform important operations successfully. Major companies are designing and developing lightweight commercial drones for various commercial applications such as medical emergency transportation, inspection & maintenance, filming & photography, mapping & surveying, surveillance & monitoring, and precision agriculture.

LATEST TRENDS

Download Free sample to learn more about this report.

Increasing Integration of Emerging Technologies Such as Artificial Intelligence to Bolster Market Growth

Technological breakthroughs in electronics, such as processors, microcontrollers, mobile hardware, modern computing, and cameras, have modernized the product line for commercial drones. Further advancements enable businesses to create and build in-house measurement and annotation tools for calculating distance, volume, and area.

As a result, enterprises worldwide increasingly demand machine learning and artificial intelligence solutions to extract accurate results from a pile of information and real-time data acquired from millions of data collection points. Artificial intelligence technology manages and stores vast amounts of data, allowing UAVs to function better. North America witnessed commercial drone market growth from USD 3.47 billion in 2023 to USD 4.34 billion in 2024.

Several other companies in the market use the most updated tools, such as Ground Control Point (GCP), based on 150,000 photos of selected GCPs. OEM businesses' upgrades are expected to play a prime role in driving the global market growth in the forthcoming years.

Commercial drone market trends increasingly emphasize automation and scalability. Autonomous flight planning, real-time obstacle avoidance, and intelligent fleet management are becoming standard capabilities. These features reduce pilot workload and enable higher utilization rates across fleets.

Software-centric value creation is another defining trend. Cloud-based platforms aggregate flight data, automate compliance reporting, and deliver analytics insights. Vendors increasingly differentiate through software ecosystems rather than airframe performance alone.

Payload diversification continues to expand the application scope. Multispectral, thermal, and light detection and ranging sensors enable advanced inspection and surveying use cases. This trend strengthens adoption in agriculture, mining, and infrastructure maintenance. Service-based operating models are gaining traction. Drone-as-a-service offerings allow enterprises to access capabilities without capital investment. This model supports rapid deployment and aligns costs with project requirements.

DRIVING FACTORS

Increase in Demand for Smaller Commercial Drones to Accentuate Market Growth

Growing adoption of small UAVs for different commercial applications such as filmmaking, relief & rescue operations, precision agriculture, law & enforcement, wildlife monitoring, disaster management, research & development, aerial photography, entertainment, logistics & transportation, and construction is expected to fuel the market growth.

Several engineering and other companies extensively adopt small drones for numerous commercial projects. A few key commercial applications of drones include in-depth project maintenance, inspection, and oil pipeline & transmission cable inspection. A surge in demand for unmanned systems in the oil & gas, energy, and power generation sectors will likely fuel market growth in the coming years. Amazon Inc. and big logistics companies such as UPS, DHL, and FedEx are investing heavily in creating drone delivery platforms owing to the demand for home delivery services for food and e-commerce platforms. An increase in global demand for online food delivery services will propel the market for small drones during the forecast period.

Development of Remote Sensing and Advanced ADS-B Transponder Technologies to Aid Market Expansion

Drones are well-suited for the quasi-static positioning of advanced sensors in 3D space with high precision. Even in windy conditions, drones enable precise flight control and operations in cluttered environments due to their maneuverability and ability to fly at a low speed. There is a rising interest in drone deployment for photogrammetric surveys, infrastructure inspection, and forest monitoring based on remote sensing tasks.

ADS-B uses a transponder and GPS to transmit highly accurate positional information to the ground-based controllers and directly to another drone. This transmission is known as ADS-B Out, and its accuracy is greater than conventional radar surveillance. This gives air traffic controllers the potential to reduce the required separation distance between drones that are ADS-B equipped.

The High Eye Airboxer is a long-range unmanned aerial vehicle (UAV) powered by an air-cooled boxer engine with fuel injection. With a payload capacity of 5kg, multiple payloads, sensors, and other additional hardware can be integrated into the UAVs, making it a highly flexible platform suitable for combat missions.

Regulatory liberalization is a primary driver of the commercial drone market. Aviation authorities are progressively enabling expanded operational envelopes, including higher altitude limits, night operations, and beyond-visual-line-of-sight approvals. These regulatory changes unlock scalable commercial use cases and improve investment certainty for operators.

Enterprise demand for operational efficiency further accelerates adoption. Drones reduce inspection time, lower labor exposure to hazardous environments, and improve data accuracy. Industries such as energy, construction, and agriculture increasingly rely on aerial data to optimize asset performance and resource allocation.

Technological advancements reinforce market momentum. Improvements in battery energy density, sensor miniaturization, and flight control systems extend mission duration and reliability. Integrated software platforms support mission planning, data processing, and compliance management, reducing operational complexity.

Cost dynamics also favor growth. Declining hardware prices and flexible service-based deployment models lower entry barriers for small and medium-sized enterprises. This broadens the addressable customer base beyond large industrial operators. Data-centric business models drive sustained demand. Commercial drones generate high-resolution geospatial and visual data that feed analytics, artificial intelligence models, and digital twins. This data integration capability positions drones as strategic assets within enterprise digital transformation initiatives, reinforcing long-term commercial drone market growth.

RESTRAINING FACTORS

Lack of Uniform Air Traffic Management, Appropriate Infrastructure, and Skilled Operators to Limit Market Growth

Drones are widely used worldwide for commercial, military & defense, and civil applications. The drone industry and end-users have witnessed severe limitations on drone flying in numerous countries for the past few years. A few countries allow commercial flights for small drones Beyond Visual Line Of Sight (BVLOS); some have a mandatory flight license.

The challenges faced by the industry are due to a lack of appropriate infrastructure for air traffic controllers responsible for safe flight operations. The presence of uniform air traffic management can create drone-related safety as well as reduce challenges. These primary factors are projected to support drone operations in various regions; at the same time, they will protect against environmental damage and property losses.

Despite strong momentum, the commercial drone market faces several structural restraints. Regulatory inconsistency across jurisdictions remains a significant barrier. Differing certification requirements, airspace access rules, and operational limitations complicate cross-border deployments and slow scaling for multinational operators.

Operational risk management also constrains adoption. Concerns around collision avoidance, cybersecurity vulnerabilities, and system reliability require robust mitigation frameworks. These requirements increase compliance costs and lengthen deployment timelines, particularly for critical infrastructure applications.

Airspace integration challenges further limit growth. The coexistence of manned and unmanned aircraft demands advanced traffic management systems. Limited availability of unified unmanned traffic management frameworks restricts high-density drone operations in urban environments. Economic constraints affect adoption behavior. While hardware costs decline, total ownership costs remain significant when training, insurance, maintenance, and software subscriptions are considered. Price sensitivity is pronounced among small operators and emerging market customers.

Market Opportunities

Logistics and delivery applications represent a significant opportunity within the commercial drone market. As regulatory frameworks evolve, last-mile delivery and inter-facility transport gain viability. These use cases offer scalability and recurring revenue potential for operators and platform providers.

Infrastructure inspection remains a high-growth opportunity. Aging energy, transportation, and utility assets require frequent monitoring. Drones provide cost-effective, high-resolution inspection capabilities that improve maintenance planning and reduce downtime.

Agriculture continues to offer expansion potential. Precision farming applications leverage drones for crop health assessment, spraying optimization, and yield forecasting. Adoption is accelerating as analytics tools demonstrate measurable productivity gains.

Market Segmentation Analysis

By Weight Analysis

Download Free sample to learn more about this report.

25Kg – 150Kg Segment to Grow at a Higher CAGR Backed by Increasing Development of eVTOL Aircraft

Based on weight, the market is segmented into <2Kg, 2Kg – 25Kg, and 25Kg – 150Kg.

The <2Kg segment held the highest market share in 2021, owing to increasing adoption of small drones for various applications such as filming, photography, mapping, surveying, and inspection. Drones under two kilograms represent the most widely deployed weight category due to regulatory flexibility and ease of operation.

Many jurisdictions impose fewer certification and licensing requirements for lightweight platforms, accelerating adoption among small enterprises and service providers. These drones are extensively used for aerial photography, basic surveying, and localized monitoring tasks. Their lower payload capacity limits advanced sensor integration, but rapid innovation in miniaturized cameras and navigation systems sustains relevance. This segment contributes significantly to unit volumes but captures a smaller share of the commercial drone market revenue due to lower average selling prices.

The two to twenty-five kilogram segment forms the commercial core of the market. These drones balance payload capacity, endurance, and regulatory accessibility, making them suitable for agriculture, inspection, mapping, and surveillance. Most professional-grade sensors, including multispectral cameras and light detection and ranging systems, are optimized for this class. Enterprises favor this segment for its versatility and scalability. As a result, it accounts for a substantial portion of the commercial drone market size and ongoing investment. Growth remains strong as applications diversify and regulatory clarity improves.

The 25Kg – 150Kg segment is anticipated to grow at a higher CAGR during the forecast period, owing to the growing development of Electric-Vertical Takeoff Landing (eVTOL) aircraft for passengers. Additionally, subsequent technological advancement in the 25Kg – 150 Kg segment is anticipated to boost the growth of the segment over the forecast period.

Heavier drones serve specialized, high-value missions requiring extended range, endurance, or payload capacity. Applications include long-distance inspection, cargo transport, and advanced surveillance. Regulatory barriers are higher, requiring stringent certification and airspace coordination. Consequently, adoption volumes are limited, but revenue contribution per unit is significant. This segment is strategically important for logistics and infrastructure use cases and represents long-term growth.

- The 25Kg – 150Kg segment is expected to hold a 21% share in 2024.

By Technology Analysis

Remote Operated Segment is Expected to Hold the Largest Market Share Owing to the After Effects of the Pandemic

As per technology, the market is segmented into fully autonomous, semi-autonomous, and remotely operated.

The fully autonomous segment is predicted to experience higher growth during the forecast period. The increasing demand for drones that can fly BVLOS is anticipated to fuel the development of the fully autonomous segment. Fully autonomous drones represent an emerging but strategically critical segment. These platforms execute missions with minimal human intervention, relying on advanced navigation, obstacle avoidance, and artificial intelligence-driven decision-making.

Adoption remains limited by regulatory constraints, but pilot programs demonstrate strong efficiency gains. Logistics, large-scale inspection, and surveillance applications are early adopters. As regulatory acceptance expands, fully autonomous systems are expected to drive step-change commercial drone market growth.

Semi-autonomous drones dominate current commercial deployments. These systems combine automated flight functions with human oversight, balancing efficiency and regulatory compliance. Semi-autonomous platforms support waypoint navigation, automated data capture, and assisted landing. This segment benefits from strong enterprise trust and regulatory acceptance, making it the primary revenue contributor today. Continued software enhancement sustains adoption across industries.

The remotely operated segment is anticipated to have a dominant market share during the forecast period. Comparatively low cost and ease of use are primary factors that have increased the adoption of remotely operated drones for a wide range of commercial applications. Remote-operated drones rely heavily on pilot control and are prevalent in early-stage or highly regulated environments. While offering flexibility, they are less scalable due to labor dependency. Adoption persists in filming, emergency response, and specialized inspections. Over time, this segment’s relative market share declines as automation increases, although it remains relevant where human judgment is essential.

By System Analysis

Hardware Segment to Hold Primary Market Share Due to Increased Demand for UAVs

In terms of the system, the market is segmented into hardware and software.

The hardware segment is further divided into propulsion system, payload, airframe, and others. The hardware segment held the largest market share in 2022. The rising adoption of drones for numerous commercial applications, such as pipeline inspection, aerial photography, surveillance, and wildlife monitoring, is anticipated to drive the segment growth during the forecast period. In addition, the market witnessed great demand for medical drones during the COVID-19 pandemic to deliver vaccines and medicines in rural areas.

Hardware remains foundational to the commercial drone market and encompasses airframes, propulsion systems, payloads, and supporting components. Airframe design prioritizes durability, aerodynamics, and modularity to support diverse missions. Propulsion systems increasingly emphasize efficiency and reliability to extend flight duration. Payload innovation drives differentiation, with sensor quality and integration capability influencing purchasing decisions. Hardware competition is intense, with pricing pressure offset by performance improvements and customization.

The software segment is projected to be the fastest-growing segment during the forecast period. The segment growth is due to the increasing utilization of drone mapping software to analyze and represent collected data and enhance operational efficiency. In addition, the rising adoption of advanced technology-enabled fully autonomous drones across the world is supporting the segment's growth.

Software is the fastest-growing system segment and a primary driver of value creation. Flight control, mission planning, fleet management, and data analytics platforms increasingly define competitive positioning. Enterprises prioritize software that simplifies regulatory compliance, automates workflows, and integrates with existing information systems. Software platforms support recurring revenue models and enhance customer retention. As deployments scale, software accounts for a growing share of the commercial drone market value, reshaping market share dynamics away from hardware-centric competition.

By Application Analysis

High Growth of Filming & Photography Segment Attributed to Increase in Demand for Cinematography and Photography Drones

Based on application, the market is bifurcated into filming & photography, mapping and surveying, horticulture and agriculture, inspection and maintenance, delivery and logistics, surveillance & monitoring, and others.

The filming & photography segment accounted for the largest market share in 2022. The growth in procurement of drones such as Autel EVO II (With 8K video), PowerVision PowerEgg X Wizard, DJI Mavic 2 Zoom, Parrot Anafi FPV, and many others for aerial cinematography and photography is anticipated to drive the segment growth over the forecast period.

Filming and photography remain foundational applications for commercial drones. Media, advertising, and entertainment sectors utilize drones for cost-effective aerial content creation. While this segment drove early adoption, growth rates have moderated as markets mature. Differentiation now depends on image quality, stabilization, and post-processing integration rather than basic flight capability.

Mapping and surveying applications benefit from drones’ ability to capture high-resolution geospatial data rapidly. Construction, mining, and urban planning sectors increasingly rely on drone-based surveys for planning and monitoring. Adoption is driven by accuracy, speed, and cost advantages. Integration with geographic information systems and digital twins enhances long-term value.

Agriculture is a high-growth application area driven by precision farming practices. Drones support crop health monitoring, spraying optimization, and yield estimation. Adoption is strongest where farm consolidation and technology adoption are advanced. Analytics integration enhances value by translating imagery into actionable insights. This segment contributes meaningfully to commercial drone market growth due to recurring seasonal demand.

Inspection and maintenance represent one of the most commercially significant applications. Energy, utilities, and industrial operators deploy drones to inspect assets efficiently and safely. Drones reduce downtime and improve data accuracy compared to manual methods. This application commands higher margins and drives demand for advanced sensors and analytics platforms, reinforcing its importance within the commercial drone market.

Surveillance and monitoring applications span public safety, environmental monitoring, and infrastructure security. Drones provide persistent visibility and rapid deployment capabilities. Regulatory oversight influences adoption, but demand remains strong for border security, disaster response, and site monitoring. This segment prioritizes endurance, reliability, and secure communications.

The delivery and logistics segment is anticipated to rise at a higher CAGR throughout the forecast period. The increasing development of VTOL drones for delivering food, medicines, cargo, and passengers is expected to boost the market growth. Additionally, the increasing use of drones in delivery for e-commerce sites such as Amazon is expected to drive the market over the forecast period.

REGIONAL INSIGHTS

North America Commercial Drone Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global market is segmented, based on region, into North America, Europe, Asia Pacific, and the Rest of the World.

North America Commercial Drone Market Analysis:

North America held the dominant commercial drone market share in 2024, and stood at USD 4.34 billion in 2024, and is expected to dominate the global market during the forecast period. The rise in the adoption of commercial drones and the presence of key drone manufacturers in the U.S. are anticipated to fuel market growth in the region. Additionally, according to the Federal Aviation Administration FAA, 872,694 drones were registered in the U.S. in May 2021, while the numbers are expected to grow during 2022-2030, owing to rising demand.

The North America commercial drone market is supported by regulatory progress, enterprise adoption, and service-led business models. Energy, construction, and agriculture drive demand for inspection and data analytics. Advanced airspace management initiatives enable scalable operations. Strong software ecosystems and professional service providers sustain commercial drone market growth and reinforce regional leadership in high-value applications.

United States Commercial Drone Market:

The United States dominates regional demand due to regulatory experimentation, enterprise-scale deployments, and strong innovation ecosystems. Commercial operators focus on inspection, mapping, and logistics pilots. Federal Aviation Administration frameworks shape the adoption pace. High software penetration and service-based operating models support steady commercial drone market size expansion across industrial and public-sector applications.

Europe Commercial Drone Market Analysis:

Europe exhibits compliance-driven commercial drone adoption influenced by harmonized aviation regulations. Infrastructure inspection, environmental monitoring, and public safety applications dominate demand. Operators prioritize safety certification and interoperability. While deployment scale is moderate, regulatory clarity supports long-term commercial drone market growth and encourages cross-border operational consistency.

The growing use of drones for various commercial applications across Germany, France, and the U.K. is predicted to support market growth in Europe during the forecast period. Additionally, the presence of major existing and emerging market leaders in the region is expected to accentuate market growth over the forecast period.

Germany Commercial Drone Market:

Germany’s commercial drone market is shaped by industrial inspection demand and strong engineering standards. Energy, manufacturing, and transportation sectors drive adoption. Regulatory rigor influences deployment planning and certification timelines. Integration with industrial digitalization initiatives supports sustained commercial drone market share expansion within enterprise and infrastructure-focused applications.

United Kingdom Commercial Drone Market:

The United Kingdom commercial drone market emphasizes infrastructure monitoring, surveying, and public-sector applications. Regulatory sandboxes support innovation while maintaining safety oversight. Demand growth is steady across construction and utilities. Service providers play a central role, enabling adoption without heavy capital investment and supporting consistent commercial drone market growth.

Asia-Pacific Commercial Drone Market Analysis:

The market in the Asia Pacific is anticipated to showcase exponential growth owing to the rising number of drone production and operation companies across the region. The increase is attributed to the government and OEMs' large investments in drone technology. The countries in the Asia Pacific, such as Japan and China, have the presence of large drone manufacturers such as TerraDrone and DJI.

Asia-Pacific is the fastest-growing commercial drone market due to scale, manufacturing strength, and government support. Agriculture, logistics, and infrastructure monitoring dominate applications. Cost-competitive platforms accelerate adoption. Regional supply chains and domestic innovation ecosystems contribute to rapid commercial drone market size expansion across emerging and developed economies.

Japan Commercial Drone Market:

Japan’s commercial drone market prioritizes precision, automation, and disaster resilience. Applications include infrastructure inspection, agriculture, and emergency response. Regulatory frameworks encourage safe integration while supporting innovation. High technology readiness and strong domestic manufacturers sustain steady commercial drone market growth within specialized use cases.

China Commercial Drone Market:

China holds a significant share of the global commercial drone market, driven by manufacturing scale and domestic demand. Applications span agriculture, surveillance, and industrial inspection. Regulatory structures support controlled expansion. Local vendors dominate hardware production, reinforcing China’s influence on the global commercial drone market share and pricing dynamics.

Latin America Commercial Drone Market Analysis:

Latin America shows emerging commercial drone adoption driven by agriculture, mining, and infrastructure inspection. Regulatory development varies by country, influencing deployment pace. Cost sensitivity shapes purchasing behavior. As regulatory clarity improves, the region offers long-term commercial drone market growth potential supported by expanding industrial use cases.

Middle East & Africa Commercial Drone Market Analysis:

The Middle East and Africa commercial drone market remains early-stage but strategically focused. Applications include infrastructure inspection, security monitoring, and surveying. Government-led projects drive adoption. Market growth depends on regulatory development and technology transfer, supporting gradual commercial drone market expansion across targeted sectors.

Commercial Drone Industry Competitive Landscape:

Key Players are Focused on Building a Strong Portfolio, Resulting in Market Dominance

The market is fragmented, with several major companies. These important players focus on improving their product portfolios, pricing strategies, and marketing efforts to increase revenue share in the next few years. With a dominant revenue share in 2022, DJI (China), Yuneec (China), and Parrot Drone (France) are now leading the market.

Domestic participants are expected to grow due to the lack of substantial obstacles and high domestic demand. New development, innovative product launch, acquisition, partnership, and collaboration are major strategies adopted by players operating in the market. In March 2021, a leading drone manufacturer, DJI, introduced its novel First-Person View (FPV) drone for entertainment and media end-use applications.

The commercial drone industry's competitive landscape is defined by a combination of dominant global manufacturers, vertically integrated technology providers, and a growing set of specialized software and service companies. Market leadership is influenced by product reliability, regulatory readiness, and ecosystem depth rather than airframe performance alone.

Leading vendors maintain strong commercial drone market share through end-to-end offerings that combine hardware, payloads, flight control software, and analytics platforms. These players benefit from scale, global distribution, and established relationships with enterprise customers and public agencies. Continuous investment in autonomy, safety systems, and compliance technology reinforces their competitive positioning.

Emerging players focus on differentiation within specific value-chain segments. Some concentrate on advanced sensors, data analytics, or artificial intelligence-driven flight management, while others specialize in industry-specific service delivery. These companies capture value by addressing niche requirements and accelerating deployment timelines for customers unwilling to manage in-house drone operations.

Strategic partnerships are central to competition. Collaborations with cloud providers, geospatial analytics firms, and infrastructure operators enhance solution completeness. Joint ventures with logistics companies and energy utilities support application-specific scaling and early revenue validation.

LIST OF KEY COMPANIES PROFILED:

- 3D Robotics, Inc. (U.S.)

- Aeronavics Ltd. (New Zealand)

- AeroVironment Inc. (U.S.)

- Autel Robotics (China)

- Ehang Holdings Limited (China)

- FLIR Systems, Inc. (U.S.)

- Teal Drones (U.S.)

- Holy Stone (China)

- Intel Corporation (U.S.)

- AgEagle Aerial Systems Inc. (U.S.)

- Parrot Group (France)

- PrecisionHawk, Inc. (U.S.)

- Skydio, Inc. (U.S.)

- SZ DJI Technology Co., Ltd. (China)

- Yuneec Holding Ltd (China)

Latest Commercial Drone Industry Developments:

- January 2024: DJI expanded its enterprise drone portfolio with enhanced inspection-focused platforms, aiming to strengthen commercial adoption through improved sensor integration and advanced flight safety technologies.

- April 2024: Parrot announced a strategic shift toward software and data analytics offerings, targeting higher-margin enterprise applications using secure cloud-based drone management capabilities.

- August 2024: Skydio secured a major enterprise contract to deploy autonomous inspection drones, supporting operational efficiency through advanced artificial intelligence-based navigation and obstacle avoidance systems.

- February 2025: Zipline expanded its commercial drone delivery operations into new regions, advancing logistics scalability using autonomous flight systems and precision delivery technology.

- June 2025: Wing partnered with a national logistics provider to pilot expanded drone delivery services, aiming to validate last-mile delivery models through integrated fleet management and airspace coordination capabilities.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on key aspects such as product types, technology, hardware, and software systems. Moreover, the research report offers insights into market trends, competitive landscape, market competition, product pricing, market status, and key industry developments. In addition to the factors mentioned above, the report encompasses several direct and indirect factors that have contributed to the sizing of the global market in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2021 |

|

Growth Rate |

CAGR of 20.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Weight

|

|

By Technology

|

|

|

By System

|

|

|

By Application

|

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was USD 13.86 billion in 2024 and is projected to reach USD 65.25 billion by 2032.

Registering a CAGR of 20.8%, the market will exhibit rapid growth during the forecast period (2025-2032).

SZ DJI Technology Co., Ltd., Yuneec Holding Ltd., and 3D Robotics, Inc. are the leading players in the global market.

North America topped the market in terms of shares in 2024.

U.S. dominated the market in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us