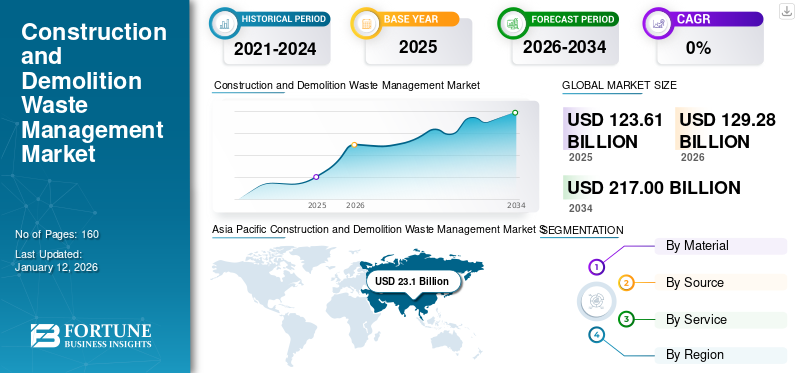

Construction and Demolition Waste Management Market Size, Share & COVID-19 Impact Analysis, By Material (Concrete & Gravel, Bricks & Ceramics, Asphalt & Tar, Timber & Wood Products, Metals, Others (conduit, pipes, etc.)), By Source (Demolition, Construction, and Renovation), By Service (Disposal and Collection), and Regional Forecast, 2026–2034

Construction and Demolition Waste Management Market Size

The global construction and demolition waste management market size was valued at USD 123.61 billion in 2025. The market is projected to grow from USD 129.28 billion in 2026 to USD 217 billion by 2034, exhibiting a CAGR of 5.8% during the forecast period. The Asia Pacific dominated global market with a share of 18.70% in 2025.

The use of recycled construction raw materials is gaining popularity among prominent builders and construction developers. These materials offer various benefits, including cost-effectiveness, eco-friendliness, easy availability, and better flexibility in raw material procurement. As per industry experts, recycled coarse concrete can significantly decrease the cost incurred for traditional construction. Thus, the benefit of recycled cost-effectiveness is luring in a notable customer base toward the market. Rapid urbanization has given rise to infrastructure activities to bridge the rising demand and supply gap. Many companies are trying to provide recycling machines and recycling plants at an affordable cost to customers in multiple regions to increase the recycling of waste in construction projects. The research report provides holistic information about the present and forecasts of the market.

COVID-19 IMPACT

COVID-19 to Impede Opportunities for New Construction Activities Owing to Volatility in International Market

COVID-19 has caused a substantial economic downturn and a sense of uncertainty in the market. The stringent lockdown imposed across prominent economies acted as a major downturn for the construction and development industry. The reduction in construction and real estate development activities and cash liquidity in the market is anticipated to obstruct the construction activities in the market. The International Labor Organization recently published a study that suggests a scarcity of labor on the construction sites in the Indian construction market has obstructed the pace of construction activities in the country. The considerable decrement in demand for residential and commercial buildings and subsequent decrement in ongoing activities also hampered the market growth considerably.

The disruption of supply chain operations in the market also dipped market activities across the globe. The restrictions and limitations on the transportation of non-essential goods and commodities obstructed the transportation of debris at recycling plants. Also, they restricted the flow of recycled products at construction sites. The breakdown of transportation medium and the unavailability of established supply channels have curbed the development prospects of construction and demolition waste management.

Construction and Demolition Waste Management Market Trends

Download Free sample to learn more about this report.

Integration of AI-powered Robots at Recycling Plants to Elevate Quality and Speed of Recycling Activities

The increasing impact of artificial intelligence integrated technology and IoT-based devices in the construction industry has encouraged most market players operating in the market to put substantial efforts into inculcating AI-based technology. The application of Artificial Intelligence (AI)-based robots to sort and segregate debris and demolition waste materials to provide high purity and high-value materials from mixed construction and demolition waste.

The applications of robotic technology, AI-integrated recycling facilities, and IoT- based devices are emerging as the latest trends in the global market. For instance, Switzerland-based company the Eberhard Group has decided to make massive investments in the development and installation of AI-based intelligent robots which can recover mixed construction waste at a staggering rate of 200 tons per hour.

Construction and Demolition Waste Management Market Growth Factors

Environmental Benefits and Development of Circular Economy to Promote Market Growth

Many environmental organizations encouraged constructors and developers to operate as per waste framework directives and prioritize construction and demolition waste management strategies. For instance, the European Commission has issued an objective to increase the re-use, material recovery, and recycling of construction and demolition waste (excluding hazardous materials) by up to 70%. The constant and keen efforts of governments across the globe on the recycling and reuse of waste debris from demolition and renovation sites have been a critical factor that prompted the development of a circular economy in the waste management sector. The progressive waste solutions and application of the existing demolition waste in the foundation of new infrastructure are expected to provide an optimistic scenario for the construction and demolition waste management market growth in the years to come.

Hefty Investments by Governmental Authorities to Increase Construction and Demolition Waste Management

Government and infrastructure authorities across the globe are currently emphasizing investment in the development of waste recycling plants. These investments aim to ensure better and more effective management of construction debris and minimize the consumption of natural resources. The establishment and inauguration of such setups are expected to provide new growth horizons for the market. For instance, in November 2020, the state government of Telangana, India launched a 500 metric ton construction and demolition waste recycling plant to boost the implementation of a comprehensive policy for construction and demolition waste management.

The Asia Pacific countries have very minimal capacity for the recycling and reuse of construction debris. The governments in the region are trying to address the issue of this waste and increase the construction and demolition waste recycling across their countries. There is a subsequent increase in landfills due to waste dumping and ecological problems associated with improper disposal in Asia Pacific. This offers the region abundant opportunities and makes it a promising region with the scope of development for the established and emerging players.

RESTRAINING FACTORS

Limited Capability to Recover and Recycle Construction and Demolition Waste

Construction, demolition, and waste management activities depend on the ability of an established ecosystem to perform quantification and segregation of construction and demolition waste. In the present condition, many countries lack the means of recycling and reusing the construction and demolition waste generated. The lack of recycling capacity and continued landfill operations in these economies is anticipated to curb the construction and demolition waste management practice during the forecast period. Although to effectively exercise waste recycling operations, government and project pre-planning authorities need to develop recycling facilities and a competent value chain to augment recycling operations in the market.

Construction and Demolition Waste Management Market Segmentation Analysis

By Material Analysis

Concrete & Gravel Segment is Estimated to Govern a Considerable Chunk of the Market Pie

By material, the market is further classified into concrete & gravel, bricks and ceramics, asphalt and tar, timber and wood products, metals, and others (conduit, pipes, etc.).

According to the European Cement Association, the concrete & gravel segment constitutes a dominant portion of the total waste salvaged from demolition and construction sites across the globe. The substantial output of concrete & gravel in the total recycled waste contributes to being a major segment in the global market. The increasing use of recycled and collected concrete & gravel debris at new construction sites and renovation sites reinforces the dominance of the concrete & gravel segment during the forecast period.

The stringent norms and environmental regulations about landfill disposal and incineration of construction and demolition waste encourage real estate developers and builders to emphasize recycling and recycled materials. Furthermore, the cost-effective application of Recycled Coarse Aggregate (RCA) concrete and its classification as a green construction material attract numerous customers to the market.

The bricks and ceramics segment is projected to hold a significant share of 29.52% in the global market in 2026. Direct application of salvaged bricks in new construction sites increased their demand across new infrastructure sites. The use of ceramic debris as raw material for coarse aggregate and demand for ceramic debris at manufacturing facilities, pavers, and tiles can be considered other factors contributing to the development of the segment.

Most metal salvage shares from the foundation, slab, and piping system of old construction need to be discarded as scrap. The metals segment constitutes a modest market share. Asphalt and tar debris can be efficiently used in the reconstruction of roads and the construction of pavements. Therefore, the asphalt and tar segment holds a moderate share.

By Source Analysis

To know how our report can help streamline your business, Speak to Analyst

Demolition Segment is Projected to Procure Noteworthy Development Prospects in the Market

By source, the market is further segmented into demolition, construction, and renovation.

The unprecedented pace of urbanization in developing and emerging economies, constant investments, and subsequent efforts made by governments across prominent countries to establish and modernize the existing public infrastructure are the crucial factors propelling the market development prospects for the demolition segment at a commanding pace and accounting for majority market share. Moreover, the development of commercial facilities, corporate buildings, and industrial manufacturing clusters across different geographies has increased the demolition waste generation and subsequent recycling prospects.

The rapid rate of urbanization in developing regions and the development of commercial complexes and corporate buildings in numerous high-tech cities are increasing the trend of demolition of old buildings across different parts of the globe. The government projects and favorable policies to provide a considerable push for the transformation of tier 2 and tier 3 cities into smart cities and infrastructure development in tier-1 and metropolitan cities is encouraging developers and builders to demolish the old infrastructures and develop modular, robust, and enhanced infrastructure to ensure sustainable economic development in these regions. The demolition segment witnesses a noteworthy share due to the rapid rate of building demolition in multiple prominent economies.

Many real estate developers are trying to capitalize on the old and vacated infrastructure to develop modern buildings as per the current standards and regulations to augment the renovation segment, dominated in the market with a share of 16.78% in 2026, in waste recycling over time. Additionally, many customers demand renovation and modernization of the existing buildings to have a cost-effective solution to enhance the facilities and aesthetics of the structure. Thus, increasing the demand for renovation and repairs of structures that require minor structural and technical restoration.

By Service Analysis

Development of Easy and Secured Collection Services is Estimated to Hold a Major Market Share

By service, the market is categorized into collection and disposal. The collection segment is anticipated to govern a major share of 83.32% in the global market in 2026, although the disposal segment will be growing at a CAGR of 5.0% over the forecast period in the global market, outpacing its counterpart.

The availability of easy collection and waste and debris transportation solutions is providing a considerable share for the collection segment in the global market. Many manufacturers are keen to offer hassle-free, reliable, and safe collection services that ensure easy and secure lifting and transportation of nonhazardous debris for recycling. For instance, Advanced Disposal Services, Inc. provides roll off containers in varied sizes of 30, 40, and 50 cubic yards for reliable collection and easy recycling or disposal of construction waste.

REGIONAL INSIGHTS

Asia Pacific Construction and Demolition Waste Management Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 23.1 billion in 2025 and USD 24.49 billion in 2026. The growth is mainly attributed to the extensive emphasis of the central government on infrastructure development and the rise in demand for residential buildings. Furthermore, stringent restrictions on the use of landfill operations and regulations by environmental authorities to promote eco-friendly housing are likely to boost regional growth. The Japan market is projected to reach USD 4.03 billion by 2026, the China market is projected to reach USD 16.67 billion by 2026, and the India market is projected to reach USD 1.2 billion by 2026.

India to Witness Noteworthy CAGR with Increasing Development in Recycling Facilities

India is estimated to register the fastest CAGR due to establishing new and enhanced recycling facilities in the country. The Ministry of Housing and Urban Affairs (MoHUA) is keen to increase construction and demolition waste management growth in the country. The massive debris waste generation in the country is already capable of providing sufficient raw material to these recycling facilities, which can effectively augment the pace of the market. Moreover, increased awareness regarding the development of green buildings and eco-friendly constructions is attracting India's prominent builders and investors. The construction, renovation, and demolition projects in a developing country, such as India, are fostering the promising development landscape of the market.

The increasing demand for eco-friendly construction operations and the increasing need for builders and developers to reduce the cost incurred in the procurement of raw materials propel the market growth in North America. Additionally, the development in the market is spearheaded by the U.S. due to the hefty investments made by many market players in the country to establish and operate new recycling plants in the region. Republic services can be termed as prominent players operating in the market of North America with a noteworthy presence across the region. The U.S. market is projected to reach USD 40.71 billion by 2026.

In Europe, supportive government initiatives by the European Commission are anticipated to provide an optimistic market forecast within the region. For instance, the European Commission accelerated the recycling and utilization of recycled products in the ongoing construction projects. The commission has moreover striving to develop a circular economy of construction and demolition waste management products. The UK market is projected to reach USD 11.17 billion by 2026, while the German market is projected to reach USD 8.6 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

The Middle East & Africa market is projected to progress with sluggish growth over the forecast period owing to the slower adoption of recycled construction materials in the construction industry. South America is estimated to observe modest growth due to lack of favorable government policies and limited operations of tier 1 key players in the region.

KEY INDUSTRY PLAYERS

Key Companies Focus on Working to Collaborations and Joint Ventures across Diverse Regions

Most manufacturers operating in the global market are trying to execute organic and inorganic market growth strategies to strengthen their position across the region. All these strategies are aimed to increase their reach within the end users. The manufacturers are trying to understand the current competitive landscape across geographies and are approaching the markets according to the local scenario.

In regions where the market is developed and flourishing with the presence of numerous players, manufacturers in this market focus on collaborating and working in joint ventures with other key players to increase their recycling capacity and enhance the current market reach in different regions. The presence of established and global market players in diverse regions in collaboration with the regional market players is augmenting the fierce competitive landscape in multiple regions. For instance, Kiverco is working in a joint venture with the Mick George Group to provide the first Rentec triple shaft shredder in the U.K.

Furthermore, many manufacturers are trying to provide cost-effective recycling solutions to customers. Besides, many companies are also looking for a strategic acquisition or merger of smaller firms to lower the risk of market competition and gain the lion’s share of respective regional markets. Additionally, Clean Harbors announced the acquisition of the assets from Vertex Energy by signing a definitive document. The acquisition is aimed at developing its Safety-Kleen Sustainability Solutions (SKSS) segment and utilizing the operational efficiency of the acquired entity.

LIST OF TOP CONSTRUCTION AND DEMOLITION WASTE MANAGEMENT COMPANIES:

- Veolia Environnement S.A. (France)

- Waste Connections (U.S.)

- Clean Harbors, Inc. (U.S.)

- Remondis (Germany)

- Republic Services (U.S.)

- FCC Environment Limited (U.K.)

- WM Intellectual Property Holdings, L.L.C. (U.S.)

- Kiverco (Northern Ireland)

- Daiseki Co., Ltd. (Japan)

- Windsor Waste (U.K.)

- Casella Waste Systems, Inc. (U.S.)

- Renewi plc (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- March 2025: Frontier Waste Solutions, a U.S.-based company engaged in waste disposal and recycling, announced the acquisition of Absolute Waste Services Inc. (AWS). The acquisition aided the company in increasing its customer base for commercial, residential, and roll-off waste collection services.

- March 2025: Comprehensive waste management service provider WM has finalized the acquisition of Specialized Environmental Technologies, Inc.

- March 2025: Kinderhook Industries LLC’s portfolio company Capital Waste Services has recently completed the acquisition of U.S.-based Sandlands, which is engaged in construction and demolition landfill operations across the market.

- February 2024: SSN Innovative Infra LLP, a Pune-the based infrastructure-related organization, has recently commissioned a construction and demolition waste management processing plant in Maharashtra, India. The action by the company will encourage eco-friendly disposal of construction and demolition waste across the geography.

- October 2024: Wiltshire Heavy Building Materials (Wiltshire), which is a recycler of construction and demolition waste, has been acquired by Holcim, one of the prominent providers of concrete, cement, and aggregates across Europe.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides an in-depth analysis of the market dynamics and competitive landscape. It offers key insights, including recent industry developments in the market such as mergers & acquisitions, macro, and microeconomic factors, SWOT analysis, and company profiles.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Source

|

|

|

By Service

|

|

|

By Region

|

Frequently Asked Questions

According to a Fortune Business Insights study, the market size was valued at USD 123.61 billion in 2025.

The market is likely to grow at a CAGR of 6.70% during the forecast period of 2026-2034.

The demolition segment is expected to lead the market owing to the increasing trend of the reestablishment of old buildings with modern and robust facilities.

The Asia Pacific market size stood at USD 23.1 billion in 2025.

Favorable government initiatives and cost-effective raw material procurement are crucial factors boosting the market growth.

Some of the top players in the market include Veolia Environement S.A, Waste Connections, Clean Harbors, Inc., and Remondis.

The U.S. dominated the market in terms of revenue generation in 2025.

Limited capability to recover and recycle construction and demolition waste is anticipate to restrain the market over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us