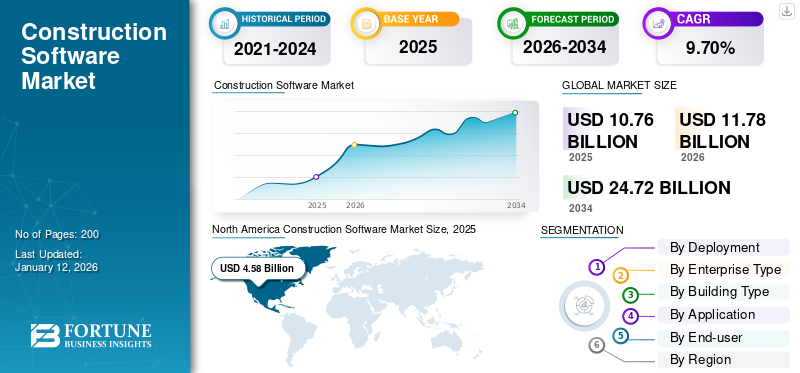

Construction Software Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Building Type (Commercial & Industrial Building and Residential Building), By Application (Project Management and Scheduling, Safety and Reporting, Project Design & Quality Management, Field Service Management, Cost Accounting, and Others (Reporting & Analytics)), By End User (Builders & Contractors, Construction Managers, and Engineers & Architects), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global construction software market size was valued at USD 10.76 billion in 2025. The market is projected to grow from USD 11.78 billion in 2026 to USD 24.72 billion by 2034, exhibiting a CAGR of 9.70% during the forecast period. North America dominated the construction software market with a market share of 42.50% in 2025.

A construction software is a digital solution designed to streamline planning, project management, budgeting, scheduling, and collaboration within the construction industry.

The market is growing rapidly due to the increasing adoption of cloud based platform services, high demand for real-time tracking of project progress, cost-saving measures, increased digital transformation in the construction sector, and automation of manual processes. Furthermore, the surge in the number of construction projects and the governments' focus on reducing delays are other factors for the growth in the market.

The main participants within the market include Oracle Corporation, Hexagon AB, Deltek Inc., Procore Technologies, Inc., Sage Group, plc, Trimble Inc., and Autodesk, Inc.

Impact of Gen AI

Generative AI Adoption Fuels Acceleration in Market Growth

Gen AI is rapidly driving growth within the market by embedding deep intelligence and automation at every stage of the project’s lifecycle. This technique reforms traditional design and management processes, making them more efficient and innovative. Integration of Gen AI enables rapid generation of architectural designs, supports rapid iteration, and enhances the predictive analytics for construction site analysis. Construction companies using these advanced AI-operated solutions achieve clever resource allocation, better risk management, and informed, data-powered decision making, which improves the project quality and cost savings. As a result, organizations that embrace Gen AI gain a competitive increase in productivity and stability within the construction ecosystem.

MARKET DYNAMICS

Market Drivers

Growing Inclination Toward of Cloud-based Construction Software Drives Market Expansion

The growing inclination toward cloud-based construction software is significantly propelling the growth of the market. Cloud-based solutions facilitate cost-effective installation, scalability and real-time communication benefits, driving its widespread adoption into the construction sector. These platforms provide project scheduling, budget management, resource allocation, and collaboration, as a result, improving the operational efficiency. The increasing demand for large-scale construction projects leads to this trend, as this technology enables better management of complex workflows.

According to industry experts,s regions such as North America, Asia Pacific, and Europe lead in adopting these technologies. North America is estimated to contribute 38% of the global market growth by 2029. The government data reveal the frequent increase in cloud SaaS adoption, especially to streamline construction processes, reduce costs and improve project delivery, acting as a major market driver.

Market Restraints

High Initial Costs and Budget Constraints Limit Market Adoption

The high costs for software licenses, implementation, and customization represent significant barriers for small and medium sized firms (SMEs) in the construction industry. Finances typically delay, or even prohibit, SMEs from considering modern construction software tools, even when its clear benefits are considered. The expensive nature of initial investments limits widespread deployment, especially among firms with tight financial parameters. Consequently, the construction software market growth is restrained due to limited accessibility for smaller players, who find the cost of transitioning to advanced software solutions prohibitive.

Market Opportunities

Surge in Demand for Integration of Emerging Technologies Creates New Market Opportunities

The integration of emerging technologies such as AI, machine learning, BIM, and IoT in construction software solutions is opening up new opportunities for the market participants. These technologies facilitate advanced analytics, automation and predictive capabilities to help improve efficiency, safety and cost control for related projects. Construction software solutions that combine these technologies offer greater value proposals to companies that aim to improve their operations. This convergence fosters product differentiation and expands the aspect of technology-based development in the construction software sector.

CONSTRUCTION SOFTWARE MARKET TRENDS

Growing Adoption of BIM and Digital Twins Boosts the Market Growth

The increasing use of Building Information Modeling (BIM) and Digital Twins is driving substantial growth in the market. BIM has specialized 3D/4D/5D modeling capabilities that improve design collaboration and enable clash detection, reducing project rework and delays, particularly for larger and more intricate construction projects. For example, BIM's adoption rates, demonstrate its growing importance in the U.S. As per reports from buildingSMART International survey, nearly half of surveyed professionals use BIM on 76% to 100% of their projects, with 23% applying it across all projects. In India, BIM adoption remains low at about 10-18%, but its awareness and interest is growing.

Additionally, digital twins complement the BIM by providing real-time, data-operated project simulation that improve decision making and operational efficiency. This synergy is propelling the market forward by supporting more effective project management and innovation in construction technology.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Deployment

Increasing Adoption of Cloud Technologies to Boost Cloud Deployment

Based on the deployment, the market is segmented into on-premise and cloud.

Cloud deployment emerges as the leading segment accounting for 54.17% market share in 2026, capturing a substantial market size of USD 5.17 billion in 2024. Its dominance is attributed to the ability to significantly reduce high up-front investments in hardware, data center setup, and infrastructure. The cloud-based construction management software is also predicted to have a high CAGR of 13.00% because of the increased adoption of cloud technologies within construction management processes. The usage of cloud deployment within tools used for construction management also makes workflows easier, helps to facilitate automation, and keeps maintenance costs low for the product, which is a strong influencing factor on the willingness to adopt technologies with cloud deployments.

By Building Type

Large Enterprises Segment Dominates Market Owing to Widespread Adoption of the Software

Based on building type, the market is divided into Small & Medium Enterprises (SMEs) and large enterprises.

Large enterprises represent a significant construction software market share of 55.40% in 2026, estimated at USD 5.51 billion for 2024. This dominance stems from their financial capacity enabling them to spend on comprehensive on-premise or hybrid infrastructure, advanced solutions, and customized solutions. This ability positions them ahead in adopting scalable and enterprise-grade technologies needed for complex business processes.

The Small & Medium Enterprises (SMEs) segment is forecasted to be the fastest growing and achieve the highest CAGR of 11.06%. The segment’s growth is owing to the focus on cost-effective cloud-based and subscription models which helps minimize heavy capital expenditures. This flexibility enables SME to scale operations easily while accessing cutting-edge enterprise solutions.

By Building Type

Higher Investment Capacity Augments the Commercial & Industrial Building Segment Growth

Based on the building type, the market is divided into commercial & industrial building and residential building.

The commercial & industrial segment is the largest and accounted for a USD 5.77 billion in 2024, largely due to the higher investment capacity of commercial and industrial buildings, as they generally have larger budgets and a higher willingness to accept significant capital expenditures. The Commercial & Industrial Building segment is expected to account for 57.70% of the market in 2026. Consequently, they are more inclined to adopt comprehensive, full-featured software solutions to support operations.

The residential segment is expected to grow at the highest CAGR, 11.78%, and will emerge as the fastest-growing segment. This is mainly due to increased demand for lightweight, low-cost digital solutions among residential builders. Cloud- and SaaS-based platforms featuring mobile accessibility and simplified usability are becoming more popular to reduce complexity while advancing flexibility and adoption.

By Application

Centralized Frameworks for Various Tasks Augments The Project Management And Scheduling Segment Growth

Based on the application, the market is divided into project management and scheduling, safety and reporting, project design & quality management, field service management, cost accounting, and others (reporting & analytics).

Project management and scheduling segment occupied a significant market share of USD 3.43 billion in 2024. This growth is owing to its ability to offer centralized frameworks for planning, scheduling, and real-time monitoring of project tasks, resources, and timelines, as well as improving coordination across teams.

Field service management is projected to record the highest CAGR of 11.96% and is emerging as the fastest-growing application segment. Its rapid growth is driven by the increasing need for real-time responsiveness in the field, enabling streamlined communication, faster issue resolution, and improved customer satisfaction, which collectively enhance operational efficiency and service excellence.

To know how our report can help streamline your business, Speak to Analyst

By End User

Widespread Adoption Of Construction Software To Augments The Builders & Contractors Segment Growth

Based on the end user, the market is divided into builders & contractors, construction managers, and engineers & architects.

The builders & contractors segment accounted for the majority share of USD 4.88 billion in 2024. Their dominance is mainly owing to the widespread adoption of construction software tools. These tools allow the builders & contractors for faster take-offs, accurate automated estimating, and real time cost monitoring, thereby enhancing efficiency and profitability in project execution.

Engineers & architects is projected to be the fastest-growing end user segment, recording the highest CAGR of 12.09%. The growth is driven by the growing use of digital modeling tools, which allow for fast design iterations, facilitated collaboration with peer reviews, and change made early in the design process. This efficiency makes sure that design outputs remain closely tied to changing client requirements.

CONSTRUCTION SOFTWARE MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America Construction Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market holds the majority share with a valuation of USD 4.19 billion in 2025. This growth of the region is supported by robust demand for digital technologies in a variety of construction segments. In addition, the increased adoption of Building Information Modeling (BIM), cloud-based project management platforms, and advanced analytics for increased efficiencies, reduced costs, and improvement collaboration, is driving regional growth. The U.S. leads the North American market with a projected valuation of USD 2.72 billion in 2026. Large-scale infrastructure spending, smart city programs, and modernization of residential and commercial projects drives the demand for digital construction technologies in the country.

Europe

The Europe market is growing substantially with a valuation of USD 2.74 billion in 2025. The region’s growth is driven by the rising adoption of digital solutions for project planning, cost management, and compliance with stringent building regulations. U.K., Germany, and France are some of the leading contributors to the growth in the market, with the revenue stake of USD 0.53 billion, USD 0.65 billion in 2026, and USD 0.33 billion respectively by 2025.

Asia Pacific

The Asia Pacific region is projected to witness the highest growth. This is mainly owing to the increased adoption of new construction technologies to help solve industry challenges. Increasing complexities in projects, ongoing labor shortages, and mounting cost pressures are driving construction firms in this region to use digital products such as cloud platforms, Building Information Modeling (BIM), Artificial Intelligence (AI) and data analytics.

Among the contributing Asia Pacific countries to this growth, China has the leading market at USD 0.47 billion, with India following closely behind at USD 0.28 billion. Both countries are investing heavily in modernization and smart construction practices.

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 0.61 billion and USD 1.33 billion respectively in 2025. The market growth in South America is driven by investments in infrastructure and urban development. High requirement for effective tool management to improve cost efficiency and profit margins is driving the growth in Middle East & Africa. GCC countries are predicted to have a market valuation of USD 0.50 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Top Players Adopt Innovative Digital Technologies to Lead the Market

The global market is led by important players such as Bentley Systems, Incorporated, Buildertrend Solutions, Inc., Nextcon, Kahua, Jonas Construction Software, CoConstruct, RedTeam Software, and Buildxact, and other significant companies. The majority of these companies operate via a widespread global network, use innovative digital technologies such as Building Information Modeling (BIM) and digital twins, regulatory compliance, and engage into strategic partnerships or acquisitions to compete in the marketplace. Other notable companies such as Autodesk, Oracle, Trimble, Sage Group, and Procore Technologies also emphasize innovation via the cloud-based solutions, acquisitions, and partnerships.

LIST OF KEY CONSTRUCTION SOFTWARE COMPANIES PROFILED

- Oracle Corporation (U.S.)

- Hexagon AB (Sweden)

- Deltek Inc. (U.S.)

- Procore Technologies, Inc. (U.S.)

- Sage Group, plc (U.K.)

- Trimble Inc. (U.S.)

- Autodesk, Inc. (U.S.)

- Bentley Systems, Incorporated (U.S.)

- Buildertrend Solutions, Inc. (U.S.)

- Nextcon (Brazil)

- Kahua (Georgia)

- Jonas Construction Software (Canada)

- CoConstruct (U.S.)

- RedTeam Software (U.S.)

- Buildxact (Australia)

KEY INDUSTRY DEVELOPMENTS

- January 2025- Sage and Tractics have partnered to integrate Sage Intacct Construction with Tractics' cloud-native platform, providing comprehensive operational and financial management solutions for heavy civil contractors. The integration enhances visibility across construction operations, enabling real-time updates for timesheets and access to critical data, thereby streamlining accounting and operational workflows.

- October 2024- Nemetschek Group, a globally leading software solutions provider for the AEC industry, has announced a strategic partnership with MicroGenesis CADSoft, a premier software and service provider with expertise in CAD/CAM/CAE and Building Information Modelling (BIM). This collaboration aims to accelerate the adoption of digital solutions in India's architecture, engineering, and construction sectors.

- March 2025- Procore emphasized enhanced integrations with ERP and BIM partners, and launched new modules aimed at improving infrastructure construction handovers, project tracking, and collaboration with external solution providers.

- March 2024- Ontraccr Technologies, a Canada-based construction solution provider, raised USD 0.88 million in seed funding to expand their business into different industrial segments and across the U.S.

- May 2022- Autodesk expanded its Construction Cloud (including Autodesk Build and Takeoff) in Japan and broadened global partnerships to consolidate field reporting, RFI tracking, and interoperability for estimating and design teams.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the construction software industry trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 9.70% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment · On-premise · Cloud |

|

By Enterprise Type · Small & Medium Enterprises (SMEs) · Large Enterprises |

|

|

By Building Type · Commercial & Industrial Building · Residential Building |

|

|

By Application · Project Management and Scheduling · Safety and Reporting · Project Design & Quality Management · Field Service Management · Cost Accounting · Others (Reporting & Analytics) |

|

|

By End User · Builders & Contractors · Construction Managers · Engineers & Architects |

|

|

By Region · North America (By Deployment, Enterprise Type, Building Type, Application, End User and Country/Sub-region) o U.S. o Canada o Mexico · Europe (By Deployment, Enterprise Type, Building Type, Application, End User and Country/Sub-region) o U.K. o Germany o France o Italy o Spain o Russia o Benelux o Nordics o Rest of Europe · Asia Pacific (By Deployment, Enterprise Type, Building Type, Application, End User, and Country/Sub-region) o China o Japan o India o South Korea o ASEAN o Oceania o Rest of Asia Pacific · South America (By Deployment, Enterprise Type, Building Type, Application, End User, and Country/Sub-region) o Argentina o Brazil o Rest of South America · Middle East & Africa (By Deployment, Enterprise Type, Building Type, Application, End User, and Country/Sub-region) o Turkey o Israel o GCC o North Africa o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 11.78 billion in 2026 and is projected to reach USD 24.72 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 9.70% during the forecast period.

The growing inclination toward cloud-based construction software is speeding up the market growth.

Oracle Corporation, Hexagon AB, Deltek Inc., Procore Technologies, Inc., Sage Group, plc, Trimble Inc., and Autodesk, Inc. are some of the top players in the market.

North America dominated the construction software market with a market share of 42.50% in 2025.

North America was valued at USD 4.58 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us