Corporate Wellness Market Size, Share & Industry Analysis, By Services (Health Risk Assessment, Smoking Cessation, Fitness, Weight/Nutrition Management, Stress Management, and Others), By Delivery Model (Onsite and Virtual), By End User (Small-sized Organizations, Medium-sized Organizations, and Large Organizations), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

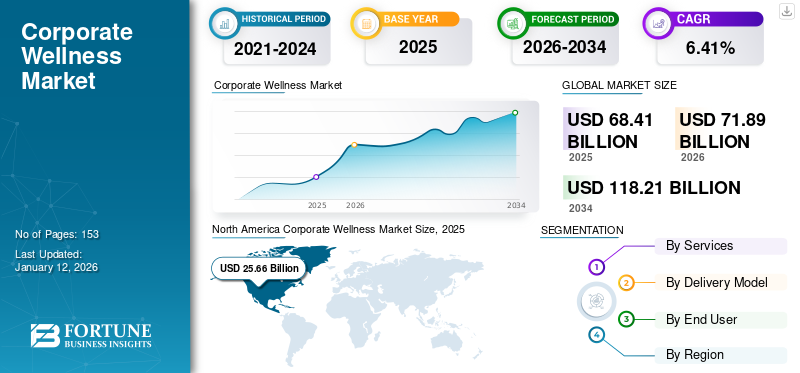

The global corporate wellness market size was valued at USD 68.41 billion in 2025. The market is projected to grow from USD 71.89 billion in 2026 to USD 118.21 billion by 2034, exhibiting a CAGR of 6.41% during the forecast period. North America dominated the corporate wellness market with a market share of 37.51% in 2025.

Corporate wellness or workplace wellness are the programs adopted by employers or an organization to improve the well-being of their employees. These programs are designed to help employees better understand their health risks and engage in healthy workplace behavior. Organizations are progressively implementing these programs to improve employees’ personal growth, improve their morale, reduce stress and absenteeism, and boost productivity at work.

According to the 2023 data published by the U.S. Department of Labor, about 23% of employees working in private organizations with 50 workers have access to wellness programs, and about 76% of employees have access to workplace wellness programs working in organizations with more than 500 workers. A similar trend is anticipated to be observed in other countries.

The rising prevalence of chronic diseases owing to unhealthy diet patterns, sedentary lifestyles, high-stress levels, and overexposure to digital screens caused due to long time working schedules is increasing the demand for wellness programs at the workplace.

- According to the World Health Organization 2023 statistics, lower back pain affected 619.0 million people across the globe in 2020, which is anticipated to increase to 843.0 million by 2050. According to the data, 90% of lower back pain cases are non-specific and are caused by high physical stress at work, obesity, low physical activity, and others.

Furthermore, growing awareness related to mental health issues in the workplace and the shifting focus of employers on employee engagement and retention are a few factors contributing to the global market growth.

The global market witnessed a decline during the COVID-19 pandemic. A noteworthy amount of expenditures is spent on traditional workplace wellness activities, such as fitness classes, gym membership, health screening activities, and others. During the pandemic, due to the implementation of stringent lockdown restrictions, many of these activities were curtailed. Moreover, due to the COVID-19 pandemic, companies shifted to low-cost online platforms for providing workplace wellness as a result of their cost-cutting measures.

- For instance, according to the 2021 data published by the Global Health & Fitness Association, approximately 17.0% of the gyms and fitness clubs were permanently closed during the pandemic.

However, the post-pandemic scenario exhibited a steady growth owing to the rising cases of mental health problems and anxiety among employees, growing awareness regarding workplace wellness, and the launches of various online platforms to promote these virtual programs.

Corporate Wellness Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 68.41 billion

- 2026 Market Size: USD 71.89 billion

- 2034 Forecast Market Size: USD 118.21 billion

- CAGR: 6.41% from 2026 to 2034

Market Share:

- North America dominated the global corporate wellness market with a 37.51% market share in 2025, driven by growing employer focus on employee engagement, rising adoption of wellness programs to reduce absenteeism, and increasing availability of diverse wellness offerings. The presence of major wellness program providers and favorable government policies in the region further strengthen its market leadership.

- By service, Health Risk Assessment held the largest share in 2024, supported by widespread adoption of biometric screenings and health monitoring programs aimed at identifying and mitigating workplace health risks. Virtual delivery models are increasingly favored, especially post-pandemic, to support distributed and remote workforces.

Key Country Highlights:

- United States: Strong government initiatives such as the Infrastructure Investment and Jobs Act encourage adoption of workplace wellness programs. Employers emphasize mental health and preventive care to reduce healthcare costs and improve productivity. The shift to virtual wellness platforms is growing rapidly due to the rising remote workforce.

- Europe: The region accounted for the second-largest market share in 2024. Regulatory initiatives like the European Green Deal and wellness-focused conferences (e.g., Wellbeing at Work Summit Europe) promote low-carbon, sustainable workplace wellness solutions and encourage wide adoption.

- Asia Pacific: Expected to register the highest CAGR during the forecast period, driven by rising awareness of workplace health issues, increasing chronic disease burden (e.g., lower back pain, stress), and growing employer investments in wellness programs. Countries like India, China, Japan, and Southeast Asia show significant market potential due to expanding corporate sectors and government support.

- Latin America & Middle East & Africa: Growth propelled by increasing corporate investments to address work-related health problems and launching of tailored wellness programs catering to diverse workforce needs.

Corporate Wellness Market Trends

Shifting Employers’ Focus Toward Holistic and Virtual Wellness of Employees

Organizations are shifting their focus from physical fitness toward a more holistic approach that includes the social as well as mental well-being of an individual. The rising number of working professionals suffering from work-related stress is a key factor behind this shifting preference.

Furthermore, with an increased remote work culture, organizations are adopting virtual wellness programs to cater to the distributed workforce. Virtual wellness programs mainly comprise fitness classes, mental health counseling, and others. Through virtual and holistic wellness programs, the employers ensure that the well-being of the employees working remotely is not compromised due to the lack of physical presence in onsite office space. To meet the growing demand for holistic and virtual wellness programs, companies operating in the market are launching various programs in developed and developing nations.

- For instance, in January 2021, the India-based organization HopeQure, whose service offerings include an online platform for counseling mental health, announced the launch of an automated online corporate mental health wellness program across the country.

Download Free sample to learn more about this report.

Corporate Wellness Market Growth Factors

Increasing Prevalence of Mental Stress and Growing Emphasis on Mental Health to Augment Market Growth

The rising mental health burden among working professionals due to poor working environments, including excessive workloads, job insecurity, discrimination, and inequality in the workspace, raises the demand for corporate wellness programs. According to the WHO 2022 report, an estimated 15% of working professionals suffered from mental disorders in 2019. Such factors are expected to promote preventive care and reduce treatment costs.

Moreover, the rising awareness of mental health problems in the workplace surged the adoption of corporate wellness programs by employers to increase work efficiency among workers.

- According to a survey published by the American Psychological Association in 2022, 81% of workers support mental health as an essential consideration in the workplace.

In addition, companies are launching new programs to cater to the rising mental health issues at corporate offices.

- For instance, in February 2024, United We Care introduced a range of stress relief and mental health initiatives. Utilizing generative AI and a human-centric approach, the company aims to provide affordable, accessible, and adaptable wellness solutions for people globally.

Rising Focus to Increase Employee Engagement and Cost Reduction Raises to Boost Market Expansion

The rising incidence of employees quitting their jobs owing to a poor work environment has led large-scale organizations to focus on implementing programs to increase employee engagement. Moreover, employers are investing heavily in adopting preventive health measures to mitigate the impact of absenteeism and increase work efficiency. This factor is increasing the adoption of workplace wellness programs, which is anticipated to lead to substantial cost savings.

- For instance, according to the statistics published by the Employee Wellness Industry Trends Reports in 2022, approximately 71% of U.S. employers plan to invest more in mindfulness and meditation benefits.

RESTRAINING FACTORS

Limited Awareness and Low Employee Engagement in Developing Countries to Limit Market Growth

Despite a rise in the adoption of workplace wellness programs, there are various challenges in implementing corporate wellness programs in low- and middle-income countries. Various factors, such as low awareness, budget constraints, concerns associated with privacy, lack of confidence, and others are hindering the acceptance of these programs by employers and employees.

- For instance, according to a study published by Wellness 360 in 2023, companies in India are facing significant challenges in implementing wellness programs. According to the survey, 52.0% of the difficulties were due to a lack of adoption of these services by employees, and about 40% of challenges were faced due to budget constraints. The need to provide personalized wellness programs to meet the needs of each employee is also a barrier to implementing an impactful wellness program.

A similar trend is anticipated to be observed in other developing countries, which is anticipated to hamper the market growth during the forecast period.

Some organizations might not recognize the potential advantages of wellness programs or may not view employee well-being as a strategic priority. Resistance from employees, particularly when wellness initiatives disrupt established routines and practices, can impede successful implementation. These are some of the factors that can restrict the corporate wellness market growth.

Corporate Wellness Market Segmentation Analysis

By Services Analysis

Growing Launch of Various Health Risk Assessment Programs by Companies to Foster Segment Growth

Based on services, the market is divided into smoking cessation, health risk assessment, stress management, fitness, weight/nutrition management, and others.

The health risk assessment segment dominated the market in 2024 but is projected to grow at a steady rate during the forecast period. Workplace wellness health programs mainly comprise screening activities for identifying risks associated with health, further implementing appropriate strategies, and promoting a healthy lifestyle among employees. Companies are launching various health risk assessment programs, which is a factor that drives the growth of the segment.

- In May 2022, Multiply Group, a UAE-based company, launched a workplace well-being program to promote the work-life balance and support the physical and mental well-being of its employees. The program will offer various health risk assessment services, such as biometric screening, blood tests, and others.

The stress management segment is projected to grow at a lucrative rate during the forecast period. The rising concerns of mental problems, such as depression, anxiety, and others among employees, are one of the key factors raising the demand for stress management services. In addition, employers are shifting their focus and adopting stress management programs to support employees in coping with stress experienced during work. Wellness companies are also launching various platforms and programs to cater to the rising demand.

- For instance, in January 2023, Roga, a neurotech and wellness company, launched corporate wellness programs to reduce stress and improve the well-being of workers.

Moreover, fitness, smoking cessation, and weight/nutrition management segments also account for a considerable share of the market. Increased smoking among the population, growing obesity among the employees, incorrect posture owing to prolonged sitting, and others are factors contributing to increased adoption of these services.

To know how our report can help streamline your business, Speak to Analyst

By Delivery Model Analysis

Growing Adoption of Virtual Workplace Wellness Programs to Augment the Segment Growth

Based on the delivery model, the global market is segmented into onsite and virtual.

The virtual segment held the largest market share in 2024 and is anticipated to expand at a substantial CAGR during the forecast period. The outbreak of the COVID-19 pandemic has shifted the preference toward virtual workplace wellness, thereby increasing the adoption among employers for improving the efficiency of employees. Furthermore, the increasing number of employees working from home is another factor contributing to the rising demand for virtual wellness programs.

- For instance, according to a 2020 report published by the International Association of Workforce Professionals, the number of Americans working remotely will grow to 36.2 million by the year 2025, an increase of 86.0% from the pre-pandemic levels.

In addition, virtual wellness programs provide employees easy access to the portal, allowing them to customize their diet plan and help track their health progress. Several companies are launching online platforms to support employees' health and fitness, which is leading to rising awareness about employee health.

- In July 2021, Embassy Group announced the launch of its virtual employee wellness program, 'Wellbeing on the Web.' The main objective behind the launch of this program is to support employee health and fitness through a holistic online platform.

The onsite segment is expected to witness significant growth during the forecast period. The reopening of office premises after the pandemic is one of the predominant factors contributing to the segment growth. In addition, companies are investing in various inorganic business activities to launch new onsite corporate wellness programs, increasing their adoption among employers.

By End User Analysis

Rising Adoption of Wellness Programs by Large Organizations to Fuel Segment Growth

On the basis of end user, the market is segmented into small-sized organizations, medium-sized organizations, and large organizations.

The large organizations segment dominated the global market in 2024. The rising investment by companies to implement wellness programs for their workers is one of the key factors supporting the segment growth. The rising awareness among large organizations and employers to incorporate wellness programs to increase the team members’ work efficiency and improve work culture also promotes segment growth.

- For instance, in March 2022, Walmart launched a new service through its wellness hub to improve access to wellness services among its employees.

Moreover, rising awareness regarding workplace wellness among the employees working in small and mid-sized organizations, rising adoption of these services by these organizations, and others contribute to the growth.

REGIONAL INSIGHTS

Based on region, the corporate wellness market is divided into Europe, Asia Pacific, North America, the Middle East & Africa, and Latin America.

North America Corporate Wellness Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market in North America was valued at USD 25.66 billion and dominated the global corporate wellness market share in 2025. The shifting preference of employees toward companies with workplace wellness programs, increasing adoption of these programs by the employers to improve employee engagement and reduce absenteeism, the launch of new workplace wellness programs by companies, and others are a few factors anticipated to augment the market growth in the region.The North America market is projected to reach USD 26.9 billion by 2026. The U.S. market is projected to reach USD 24.52 billion by 2026.

- For instance, in June 2021, Amazon Canada launched a program called “Working Well” across its Canadian operation to provide employees with mental & physical activities, wellness exercises, healthy eating support, and others. The program is designed to re-energize and recharge employees, ultimately lowering the risk of injury.

Europe

Europe accounted for the second largest market share in 2024. The growing number of initiatives launched in the region to promote workplace wellness is a key factor augmenting the market growth. The Europe market is projected to reach USD 26.33 billion by 2026. The UK market is projected to reach USD 5.83 billion by 2026.

- For instance, the 7th Wellbeing at Work Summit Europe took place from 14th -16th May 2024 live and in-person in Amsterdam, Zurich, and Stockholm. This conference appealed to senior HR and business leaders from all over the region who are seeking to enhance their well-being and mental health strategies.

Moreover, the rising adoption of these services by companies to improve workplace efficiency also supports the growth of the market in the region.

Asia Pacific

Asia Pacific market is anticipated to exhibit the highest CAGR during the forecast period. The growing number of companies in the region, rising awareness among employees regarding workplace wellness, and growing adoption of these services by employers to reduce work-related health problems are some of the factors contributing to regional growth. The Asia Pacific market is projected to reach USD 14.66 billion by 2026.

Middle East & Africa and Latin America

The rising incidence of chronic disorders, such as lower back pain, stress, and others, increase in investments by companies to adopt corporate wellness programs for their employees, the launch of new programs designed to cater to the needs of every employee, and others promote the market growth in Latin America and the Middle East & Africa. The Middle East & Africa market is projected to reach USD 2.27 billion by 2026.

The Latin America market is projected to reach USD 1.73 billion by 2026.

List of Key Companies in Corporate Wellness Market

Companies Have Strong Focus Toward Market Expansion Strategies to Hold a Key Share

The global market reflects a fragmented nature due to the presence of many players, such as ComPsych, Virgin Pulse, EXOS, and others. The growing initiatives by key players to expand their market presence by entering into strategic business activities, such as mergers and acquisitions, collaborations, and others, are the prominent factors behind their growth.

- For instance, in September 2023, Virgin Pulse announced its intent to merge with the company HealthComp. Through this merger, the company aimed to create a comprehensive employer health platform.

The market also has a presence of other players, such as Marino Wellness, Privia Health, Vitality, and others. A strong presence across the globe, an increase in collaboration, partnerships, and growing launches of new services contribute to their market share.

LIST OF KEY COMPANIES PROFILED:

- ComPsych Corporation (U.S.)

- Privia Health (U.S.)

- Personify Health (U.S.)

- EXOS (U.S.)

- Marino Wellness (U.S.)

- Vitality (U.S.)

- Wellsource, Inc. (U.S.)

- Central Corporate Wellness (Singapore)

- Truworth Wellness (India)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Virgin Pulse and HealthComp unveiled a new company brand: Personify Health. These two companies merged in November 2023 and have since introduced the first and only personalized health platform to provide health plan administration, holistic well-being solutions, and comprehensive health navigation all in one place.

- August 2023: Cigna Healthcare partnered with Virgin Pulse (Personify Health) to launch a personalized digital experience for individuals to improve health and vitality.

- June 2023: Virgin Pulse (Personify Health) extended its partnership with Headspace to provide employers and employees with affordable mental health services.

- February 2023: OneCare Solutions announced the launch of corporate wellness programs to safeguard employee health.

- October 2022: Exos launched a new digital application called “The Game Changer” to reduce stress and boost employees’ passion for work.

REPORT COVERAGE

An Infographic Representation of Corporate Wellness Market

To get information on various segments, share your queries with us

The global corporate wellness market report delivers a detailed market analysis and size. It focuses on key aspects such as new service launches and technological advancements. In addition, it includes an overview of all the segments and key industry developments such as mergers, partnerships, and acquisitions. Moreover, it covers regional analysis of different segments, key trends, and profiles of key market players. Besides these, the report offers an overview of market trends, market opportunities, and the impact of the services on the stakeholders. It also encompasses qualitative and quantitative insights that contribute to the growth of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

|

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

|

|

Growth Rate |

CAGR of 6.41% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Services

|

|

By Delivery Model

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 68.41 billion in 2025.

In 2025, North America stood at USD 25.66 billion.

The market is projected to expand at a CAGR of 6.41% during the forecast period.

Based on services, the health risk assessment segment held a dominating share of the market in 2025.

The key factors driving the market growth are the growing awareness related to mental health issues in the workplace, the shifting focus of employers on employee engagement and retention, the rising prevalence of chronic disease, and the launch of various services.

ComPsych, Virgin Pulse, and EXOS are some of the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic