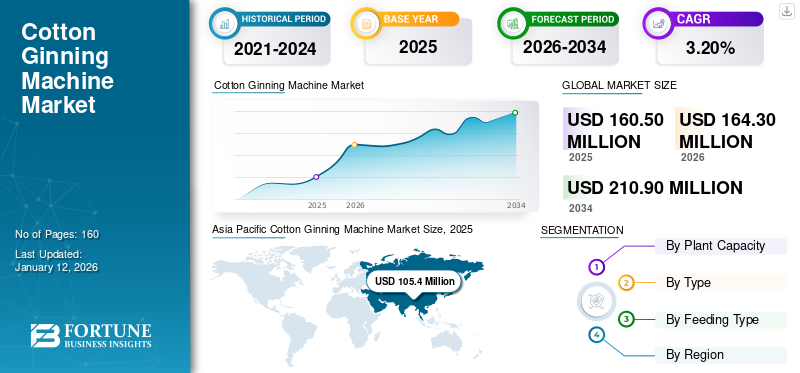

Cotton Ginning Machine Market Size, Share & Industry Analysis, By Plant Capacity (Small Scale, Medium Scale, and Large Scale), By Type (Single Roller, Double Roller, Saw Ginning, and Rotobar), By Feeding Type (Automatic and Manual), and Regional Forecast, 2026-2034

Cotton Ginning Machine Market Size

The global cotton ginning machine market size was valued at USD 160.5 million in 2025 and is projected to grow from USD 164.3 million in 2026 to USD 210.9

million by 2034, exhibiting a CAGR of 3.20% during the forecast period. Asia Pacific dominated the global market with a share of 65.60% in 2025.

A cotton ginning machine quickly and easily separates fibers and removes impurities from the seeds of cotton. It performs a vital job in cotton quality preservation, a job previously done by hand. Ginning is a crucial step in the cotton supply chain, as it has a substantial impact on quality and fiber-produced values. Presently, owing to the increasing mechanical picking of cotton, there is much waste along with cotton. Hence, modern ginning utilizes advanced machinery for removing impurities. After processing cotton on the ginning machine, it is sent to be spun into yarn and woven into fabric as well as various cotton products.

The market growth is mainly driven by rapid technological advancements, rising demand for textiles, government initiatives to support cotton farming, and the growing popularity of mechanized farming across the globe. As per the National Cotton Council of America, cotton production is expected to rise to 115.1 million bales in fiscal year 2024-25 on account of an increase in harvested acreage. The cotton mills in the U.S. are anticipated to consume 1.85 million cotton bales in 2024-25 in comparison with 1.75 million bales in 2023-24. Ginning acts as a bridge between cotton farmers and the textile industry. In most of the developed economies, ginning is executed on saw gins. However, there has been growing interest in roller ginning across the globe.

The COVID-19 outbreak had a mixed impact on the market. During the initial period of the pandemic, there was significant disruption in the global cotton supply chain on account of the stringent lockdowns and constraints on movement, impacting manufacturing and trade. A steep decline in cotton mill use was registered across all of the main cotton-spinning economies, including China, Pakistan, India, Bangladesh, and Turkey. According to the College of Agricultural & Environmental Sciences (CAES) U.S., cotton spinning in China dropped by upwards of 90% during the height of the pandemic. However, there was a gradual recovery in demand for ginning machines to sustain cotton production.

Cotton Ginning Machine Market Trends

Rapid Automation in Cotton Production to Augment the Market Growth

The increasing availability of autonomous machines in agriculture production shows that there are significant opportunities to augment automation in cotton production. Presently, advancements in cotton ginning are majorly driven by the increased focus on quality and the sustainability demands placed on cotton by a variety of stakeholders. There is an increasing adoption of automated ginning processes to enhance efficiency and reduce labor costs. In addition, the integration of robotics for tasks, such as feeding, ginning, and packaging enhances precision and speed. The quality of fiber obtained from these modernized and automated ginning plants is much better than the manual method. In recent years, most of the developments in cotton ginning have taken place in India, whereas in other major cotton-producing countries, no substantial developments except the development of high-capacity saw gins have taken place.

Download Free sample to learn more about this report.

Cotton Ginning Machine Market Growth Factors

Robust Government Initiatives to Support Cotton Farming to Drive the Market Growth

The cotton ginning machine market growth is growing significantly, primarily due to the increased government initiatives globally aimed at boosting cotton farming. Governments are increasingly offering subsidies and financial schemes to bolster support for cotton farmers and foster the growth of the cotton industry. These subsidies cover several aspects, including fertilizers, seeds, pesticides, and machinery. For instance, to promote the cotton industry, the Government of India (GOI) has introduced various schemes providing benefits on bank finance and credit guarantee facilities for infrastructure development activities in the agriculture sector. The International Cotton Advisory Committee (ICAC) has evaluated that total assistance to the cotton industry reached USD 8 million in 2022/23, increasing around 66% from USD 4.8 million in 2021/22.

The robust government support for the cotton industry results in increased demand for ginning machines, as farmers aim to capitalize on the financial support offered. This increased demand leads to robust sales volumes and revenue growth for ginning machine manufacturers.

RESTRAINING FACTORS

High Initial Investment Cost and Maintenance Expenses to Limit Market Growth

The major concern of cotton ginning and pressing facilities across the globe continues to be reducing costs, specifically the per unit power cost, operating expenses, and plant capital. Cotton growers also anticipate increased productivity per machine per time unit and the optimization of natural fiber parameters. A great deal of research and development work has been done recently to solve these issues, and numerous advancements in cotton handling, cotton ginning, and cotton pressing have been developed to reduce costs and increase output.

Cotton Ginning Machine Market Segmentation Analysis

By Plant Capacity Analysis

Rising Adoption of Mechanized Ginning by Large Industry-scale Gins to Fuel the Market Growth

Based on the plant capacity, the market is segmented into small scale, medium scale, and large scale.

The large-scale segment held the highest cotton ginning machine market share in 2026, driven by increased adoption of mechanized ginning by large industry-scale gins, accounting for 59.83% of the market with a size of USD 98.3 million. Ginning machines deliver higher processing speeds and throughput compared to manual techniques, enabling large-scale gins to manage larger volumes of cotton in a shorter time frame. Ginning machines significantly decrease the requirement for manual labor, resulting in cost savings for gin operators, mainly in regions where labor costs are significantly high.

The medium scale segment is anticipated to record the highest CAGR during the forecast period. Medium scale cotton gins are also increasingly benefiting from mechanized ginning technology. While their processing volumes are less than large scale cotton gins, medium scale operators still benefit from the labor-saving and efficiency-improving qualities of ginning machines.

By Type Analysis

Higher Ginning Percentage Offered by Double Roller Ginning to Increase their Adoption

Based on type, the market is divided into single roller, double roller, saw ginning, and rotobar.

The double roller segment is expected to grow with the highest CAGR during the forecast period due to its lower power consumption per unit of production compared to other methods. The use of roller cotton ginning machines is becoming increasingly popular in South Asia, including India, Africa, and other countries. Double roller ginning machines are increasingly preferred over saw ginning on account of their benefits in regards to higher ginning percentage and better retention of fiber length.

The saw ginning segment held the highest market share in 2026, accounting for 62.39% of the market with a size of USD 102.5 million. Most of the ginning is performed on saw gins in advanced countries. Saw gins are usually equipped with advanced technology for monitoring, leading to superior fiber quality and reduced wastage.

To know how our report can help streamline your business, Speak to Analyst

By Feeding Type Analysis

Strong Adoption of Automatic Machines to Improve Efficiency to Fuel Segment Growth

Based on the feeding type, the market is divided into automatic and manual.

The automatic segment dominated the market in 2026 and accounted for the highest share, representing 79.00% of the market with a size of USD 129.8 million. Automatic cotton ginning machines improve efficiency and reduce manual labor requirements by automating the feeding of raw cotton into the ginning system. They help to streamline the process of separating cotton fibers from their seeds. Due to all these factors, the adoption of automatic cotton ginning machines is expected to increase rapidly during the forecast period.

A manual cotton ginning machine is often used in traditional cotton processing settings. This type of machine is time-consuming as well as labor-intensive. In addition, their quality is low compared to automatic ginning machines. As a result, their adoption is expected to decline during the forecast period.

REGIONAL INSIGHTS

Geographically, the market is studied across five major regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

Asia Pacific Cotton Ginning Machine Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share in 2025, with a market size of USD 105.4 million, and showed the highest growth rate during the forecast period. Demand for cotton depends on the demand for textiles. Textile usage is increasing rapidly in this region owing to urban population and income growth. Cotton contributes greatly to the economy of Asian countries and the livelihoods of millions of rural smallholders. World's largest cotton-producing countries are China and India, followed by Brazil and the U.S. In the 2023/24 marketing season, China's cotton output was 24%, while Indian cotton production was 23% of global production. Higher cotton production results in an increased supply of raw cotton that needs to be processed, augmenting the greater need for cotton ginning machines to manage the larger volume.

India is expected to show the highest growth rate in Asia Pacific. There is a strong presence of manufacturers of automatic cotton ginning machines in India that cater to the demand of domestic as well as overseas markets. As per the “OECD-FAO Agricultural Outlook 2021-2030”, India is expected to dominate the global cotton production due to the higher yields. In 2030, the country is anticipated to hold around 25% share of global cotton production. The Japan market is projected to reach USD 7.5 million by 2026, the China market is projected to reach USD 42.6 million by 2026, and the India market is projected to reach USD 42.7 million by 2026.

The market in South America is majorly augmented by increased cotton production in Brazil in recent years. Countries in this region are increasing the adoption of mechanized farming practices to enhance efficiency and productivity.

The market in North America is driven by rapid technological advancements, modernization of agriculture, strict quality standards, shortage of labor, and robust government support. The U.S. Department of Agriculture (USDA) has 25 official color grades for American upland cotton and five categories of below-grade color. Cotton ginning machines help ensure that quality cotton fibers are processed to address these quality standards. The United States market is projected to reach USD 20.1 million by 2026.

In the Middle East & Africa region, the gradual shift toward automation in farming offers ample opportunities.

In Europe, the processing of imported cotton augments the demand for ginning machines to address the needs of the textile sector. The UK market is projected to reach USD 4.8 million by 2026, while the Germany market is projected to reach USD 1.3 million by 2026.

KEY INDUSTRY PLAYERS

Key Players Focused on Strengthening their Market Positions with Continuous Developments

The global market for cotton ginning is consolidated by leading players, such as Bajaj Steel Industries Limited, Lummus Corporation, Apple Electroniks, Balkan Cotton Gin Machinery, Handan Golden Lion Cotton Machinery Co., Ltd., and Mitsun Engineering, among others. These companies in the market are expanding their operations by adopting strategies, such as mergers, acquisitions, product launches, collaborations, and partnerships.

List of Top Cotton Ginning Machine Companies:

- Bajaj Steel Industries Limited (India)

- Lummus Corporation (U.S.)

- Apple Electroniks (India)

- Balkan Cotton Gin Machinery (Turkey)

- Jadhao Gears Pvt. Ltd. (India)

- Pramukh Steel Industries. (India)

- Nipha Exports Private Limited (India)

- Handan Golden Lion Cotton Machinery Co., Ltd. (China)

- Mitsun Engineering (India)

- Bhagvati Engineering Works (India)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: The U.S. Agricultural Research Services (ARS) announced the publishing of a study that demonstrates the capability of gin waste to synthesize and produce silver nanoparticles in the presence of silver ions.

- March 2024: Kirinyaga University, a public university in Kenya, announced the development of a portable cotton gin machine that can help farmers process their cotton on their farms and determine their prices.

- January 2024: Shandong Swan Cotton Industrial Machinery, a China-based company offering cotton processing machinery, including cotton ginning machines and lint cleaning machines, announced the plan to introduce cotton picking machines as well as develop assembly, training, and service facilities in Uzbekistan.

- October 2023: Module Truck Systems Inc. announced the purchase of Kimbell Gin Machinery Company’s assets to combine their teams and their product lines. Both companies have been offering essential equipment, parts, and services to cotton gins for the past several years.

- March 2021: The Egyptian Ministry of Public Enterprise Sector affiliated holding company announced the deal to import cotton ginning machines worth USD 7 million from Bajaj Steel Industries Limited.

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 3.20% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Plant Capacity

By Type

By Feeding Type

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 210.9 million by 2034.

In 2025, the market value stood at USD 160.5 million.

The market is projected to record a CAGR of 3.20% during the forecast period.

The saw ginning is the leading type segment in the market.

Robust government initiatives to support cotton farming to aid the market growth.

Some of the top players in the market are Bajaj Steel Industries Limited, Lummus Corporation, Apple Electroniks, Balkan Cotton Gin Machinery, and Others.

Asia Pacific is expected to show the highest CAGR over the forecast period.

By feeding type, the automatic feeding segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us