Crowdsourced Testing Market Size, Share & Industry Analysis, By Testing Type (Performance Testing, Functional Testing, Payments Testing, Localization Testing, and Others), By Device Type (Mobile/Smartphones, Wearables/IoT Connected Devices, Desktops), By End-User (Retail and Consumer Goods, BFSI, Media and Entertainment, Healthcare and Life Sciences, Travel and Hospitality, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

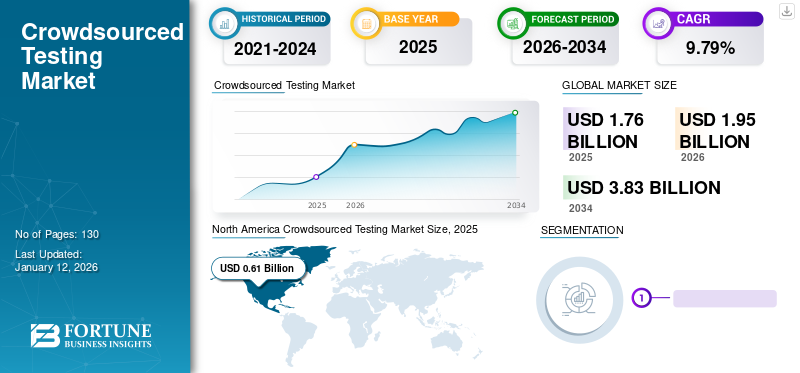

The global crowdsourced testing market size was valued at USD 1.76 billion in 2025. The market is projected to grow from USD 1.95 billion in 2026 to USD 3.83 billion by 2034, exhibiting a CAGR of 9.79% during the forecast period. North America dominated the global market with a share of 34.78% in 2025.

Crowdsourcing is a software test approach in which a large number of testers, commonly referred to as ‘the crowd’, are invited into the testing process. Crowdsourced testing makes use of the diverse skills and experiences of a distributed community of testers rather than relying solely on an internal testing team.

One of the key factors contributing to the crowdsourced testing market growth is the growing need to scale software quality assurance to create a better customer experience. Furthermore, the market growth is fueled by the global increase in digital transformation and regulatory compliance management of software developers. Organizations are using the shared power of a diverse group of testers to improve the quality and user experience of their software or applications. In addition, there is considerable market potential for developing business strategies through partnerships, collaborations, and product launches by key players in the market. For instance,

- In May 2023, Testlio, a crowdsourced software quality testing firm, and Bugcrowd, a crowdsourced cybersecurity company, announced their collaboration to provide businesses with security and quality testing services that capitalize on the sole efficiency features of crowd testing.

The COVID-19 pandemic made the role of crowdsourcing more important as an evolving model. Remote work also allowed crowdsourced testing to increase the testing process, while reducing the essential investment for businesses. Enterprises were rapidly evolving due to the adoption of cloud infrastructure, allowing them to react quickly to ever-evolving market conditions. In the course of the crisis, they used crowdsourcing tests to ensure that businesses were able to function and scale. For instance,

- In April 2020 - Medallia Inc., a player in experience management, announced that it was part of a U.K.-wide initiative to provide new and innovative solutions for rapidly scaling up coronavirus tests all over the country through its Crowdicity cloud platform.

Due to such an increase in cloud-based services to facilitate digitalization during the COVID-19 pandemic, there was an enormous need for crowdsourced testing services.

Crowdsourced Testing Market Trends

Rising Impact of Agile and DevOps Tools and Adoption of Innovative Technologies to Propel Market Growth

Organizations are using DevOps and agile tools to respond to the rapid changes in testing requirements. DevOps is a way to reduce the time taken from development to operations by using practices, rules, procedures, and tools that help the integration of development and operation activities. For organizations looking at ways to shorten the software life cycle from development to delivery and operation, DevOps and agile are becoming widely accepted solutions. According to Digital.ai, the rate of agile adoption among software teams went up from 37% in 2020 to 86% in 2021.

The rise of AI and ML technologies in crowdsourced testing, such as the use of AI algorithms to create test cases and ML methods to detect patterns and differences in testing data, can enhance testing processes. Organizations are significantly improving the speed and accuracy of testing, providing software with higher quality and reliability by using AI and ML algorithms. Additionally, generative AI has significantly impacted the market by enabling testers to automate repetitive tasks and generate test cases dynamically. This has increased the efficiency and speed of testing processes, allowing for quicker identification and resolution of issues.

Therefore, such factors enhanced the quality of testing by providing testers with advanced tools for scenario creation and test case generation.

Download Free sample to learn more about this report.

Crowdsourced Testing Market Growth Factors

Increasing Need to Scale Software Quality Assurance to Create Better Customer Experience will Enhance Market Growth

The use of software has grown significantly in recent years, while users' expectations for its quality are growing with the increasing adoption of digital platforms. Before a software application is published in the market, crowdsourced testing can provide tangible customer feedback. The role of Quality Assurance (QA) professionals in delivering the best customer experiences has been sharply highlighted by fierce competition on the internet market, driven by the rapid deployment of various software.

Enterprises are working toward a comprehensive assurance of customer experience that would significantly reduce the costs and risks of exposing them to customer experience limitations. Organizations are developing a more effective innovation process to monitor customers' experiences and ensuring complete control over consumer experience testing. For instance,

- According to a report by CX Index in 2022, more than 90% of businesses, regardless of the sector they operate in, stated that their primary focus was on customer experience.

Thus, such factors act as driving forces for the growth of the market.

RESTRAINING FACTORS

Lack of Confidentiality, Security, and Management to Hamper Market Growth

Crowdsourced testing, while advantageous for its scalability and diverse insights, introduces major challenges in confidentiality, security, and management. Ensuring the confidentiality and security of proprietary information shared with external crowd testers is paramount. Failure to do so results in data breaches and data compromise. Additionally, effectively managing and coordinating a large number of crowd testers can be challenging. Communication gaps and delays occur due to the diverse nature of crowd testers, who may be located in different time zones or having varying levels of availability. This impacts the overall efficiency and effectiveness of the testing processes. These factors may hamper the growth of the market.

Crowdsourced Testing Market Segmentation Analysis

By Testing Type Analysis

Rising Need for Efficient Digital Payment Processing to Increase Demand for Payment Testing

The Performance Testing segment is projected to dominate the market with a share of 27.84% in 2026.Based on testing type, the market is segmented into performance testing, functional testing, payments testing, localization testing, and others. The payments testing segment is estimated to record the highest CAGR during the forecast period due to rise in online payments. Digital payments have become an important aspect of the overall customer service as a result of large-scale digitalization. The pressure to provide secure, efficient, and flawless online payment software and gateways is increasing for firms that develop them due to a marked increase in acceptance and use of online payments. For instance,

- As per Testbird’s survey in 2022, 94.3% of consumers made online payments twice per month.

Additionally, key players have incorporated best practices to create scalable solutions and are helping companies with payment testing to implement those best practices.

By Device Type Analysis

Rising Need for Healthier Lifestyle to Boost the Use of Wearable and IoT Devices

Based on device type, the market is segmented into mobile/smartphones, wearables/IoT connected devices, and desktops.

The Mobile/Smartphones segment is expected to lead the market, contributing 55.04% globally in 2026. The wearables/IoT connected devices segment is expected to register the highest growth rate during the forecast period. Due to the rising popularity of healthy lifestyles, sports, and other tracking activities, the market for wearable and internet of things (IoT) connected devices has increased significantly. Companies have set up testing strategies covering the entire ecosystem of wearable devices from hardware to software, and all related third-party services. The value of crowdsourced testing is evident from the increase in the number of wearable devices and the dependency of other entities on them. For instance,

- The number of connected wearables/IoT devices is projected to grow by 16% to 16.7 billion active users in 2023, according to IoT Analytics.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapid Deployment of Test Automation Services to Increase Product Adoption in Healthcare & Life Sciences Sector

Based on end-user, the market is categorized into retail and consumer goods, BFSI, media and entertainment, healthcare and life sciences, travel and hospitality, and others, which are adopting crowdsourced testing for improving their business. Among these, the healthcare and life sciences segment is expected to display the highest CAGR during the forecast period. The Retail and Consumer Goods segment will account for 24.91% market share in 2026.

The crowd testing industry in the healthcare sector is largely driven by increasing demand for automation that enables rapid deployment of services. Moreover, the significant expansion of crowd testing in healthcare is due to the adoption of agile and DevOps methodologies and use of test automation to perform repetitive tasks, more precise testing, and continuous feedback loops required by healthcare IT. Additionally, government initiatives are helping deliver the latest technologies in healthcare. For instance,

- June 2023 - A major step has been taken by the National Health Authority of India for promoting digital health records in the country's healthcare system. The government has set aside USD 6 million to promote the adoption of electronic medical records by healthcare providers to make them more accessible to Indian citizens.

REGIONAL INSIGHTS

Regionally, this market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Crowdsourced Testing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.61 billion in 2025 and USD 0.65 billion in 2026. As per the analysis, rapid adoption of advanced technologies, such as Artificial Intelligence and automation tests to facilitate the implementation of effective solutions by crowd testing providers gave North America a maximum share in the global market in 2022. North America is a technology hub, and therefore rules on security while availing crowd testing services are strictly laid down by the federal government. In addition, compliance with performance and payment testing is mandatory for sectors such as BFSI, retail, and healthcare. Also, the rapid development of new technologies that can take advantage of the growing internet penetration and increasing customer demand is a key factor in driving the region's crowdsourced testing market share. The U.S. market is expected to reach USD 0.39 billion by 2026.

South America and the Middle East & Africa are set to show moderate growth due to a rise in the number of digital payments and increasing internet penetration.

Europe

The U.K. market is projected to reach USD 0.06 billion by 2026, while the Germany market is anticipated to reach USD 0.07 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow exponentially, with a strong demand for professional testers that could promote the adoption of crowd testing in the region. Across the region, the number of crowdsourced testing companies is increasing. Developing economies, such as India, Japan, and China have made significant contributions in aiding the region's adoption of crowd testing platforms. The Japan market is expected to reach USD 0.11 billion by 2026, the China market is projected to reach USD 0.16 billion by 2026, and the India market is anticipated to reach USD 0.15 billion by 2026. For instance,

- January 2024 – Grab launched KartaCam 2, an advanced crowdsourced mapping solution that combined AI capabilities and high-end imagery, to improve navigation in Asia. The company aims to enhance data collection efficiency and quality while reducing operational costs through crowdsourced testing.

List of Key Companies in Crowdsourced Testing Market

Market Players Announce Merger & Acquisition and Partnership Strategies to Expand Reach

The market players are projected to increase their customer base by acquiring various growth strategies, such as R&D development, mergers, acquisitions, and others. These companies are focusing on acquiring small and local firms to expand their business presence. Moreover, strategic partnerships and leading investments in software testing technologies will help them increase their market reach.

List of Key Companies Profiled:

- Infosys Limited (India)

- Cigniti Technologies Ltd. (India)

- Testlio (U.S.)

- APPLAUSE (U.S.)

- Global App Testing (Spa Worldwide Limited) (U.K.)

- Test IO (U.S.)

- Digivante Limited (U.K.)

- Testbirds B.V. (Germany)

- KiwiQA (India)

- Crowdsprint (Australia)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: EDX Medical Group acquired Hutano Diagnostics to augment lateral flow devices through crowdsourced testing. Their platform aided in translating proteomics research into multiflex LFD’s, resulting in personalized treatment for several diseases.

- September 2023: Battery Ventures acquired GrammaTech’s software products division, including the CodeSentry and CodeSonar product lines to form a new entity, CodeSecure, Inc. This acquisition enhanced CodeSecure’s capabilities in providing cybersecurity research, testing tools, and development services to the U.S. intelligence and defense.

- August 2023: Qase, a platform company for managing software and solutions quality assurance reporting and testing, raised USD 7.2 million in a Series A round led by Chrome Capital, S16VC, and FinSight Ventures. The funding was used for product development, including a plug-ins marketplace and workforce expansion of the company.

- August 2023: Zuci Systems partnered with BrowserStack, a leading cross-browser cloud native testing platform. The partnership enabled the company to test its solutions across thousands of operating systems, devices and browsers, ensuring optimal functionality.

- April 2023: Sofy launched SofySense, a no-code mobile application testing platform powered by generative AI. The platform enhanced testing efficiency with its intelligent AI chatbot, aimed to accelerate product release times by 95%.

- April 2023: Bugcrowd announced new features for its Penetration Testing as a Service (PTaaS) solution. These features make it possible for customers to set up, manage, and buy pen tests online without having to wait for long sales calls or meet with a scoping expert.

- January 2023: Cigniti Technologies entered a partnership with LambdaTest, a cloud testing platform for developers and testers, to speed up the delivery of code. The partnership allows Cigniti to use LambdaTest's innovative HyperExecute platform, which provides customers with secure, scalable, and sophisticated test orchestration at each stage of their DevOpsCICD lifecycle.

REPORT COVERAGE

The research report provides a detailed market analysis. It focuses on key aspects such as leading companies, software types, and leading software & service applications. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

An Infographic Representation of Crowdsourced Testing Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.79% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Testing Type

By Device Type

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 3.83 billion by 2034.

In 2025, the market value stood at USD 1.76 billion.

The market is projected to record a CAGR of 9.79% during the forecast period.

The healthcare and life sciences segment is likely to lead the market.

Rising need to scale software quality assurance to create better customer experience is the key factor driving the market growth.

Infosys Limited, Cigniti Technologies Ltd., Testlio, APPLAUSE, Global App Testing (Spa Worldwide Limited), Test IO, Digivante Limited, Testbirds B.V., KiwiQA, and Crowdsprint are the top players in the global market.

North America is expected to hold the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic